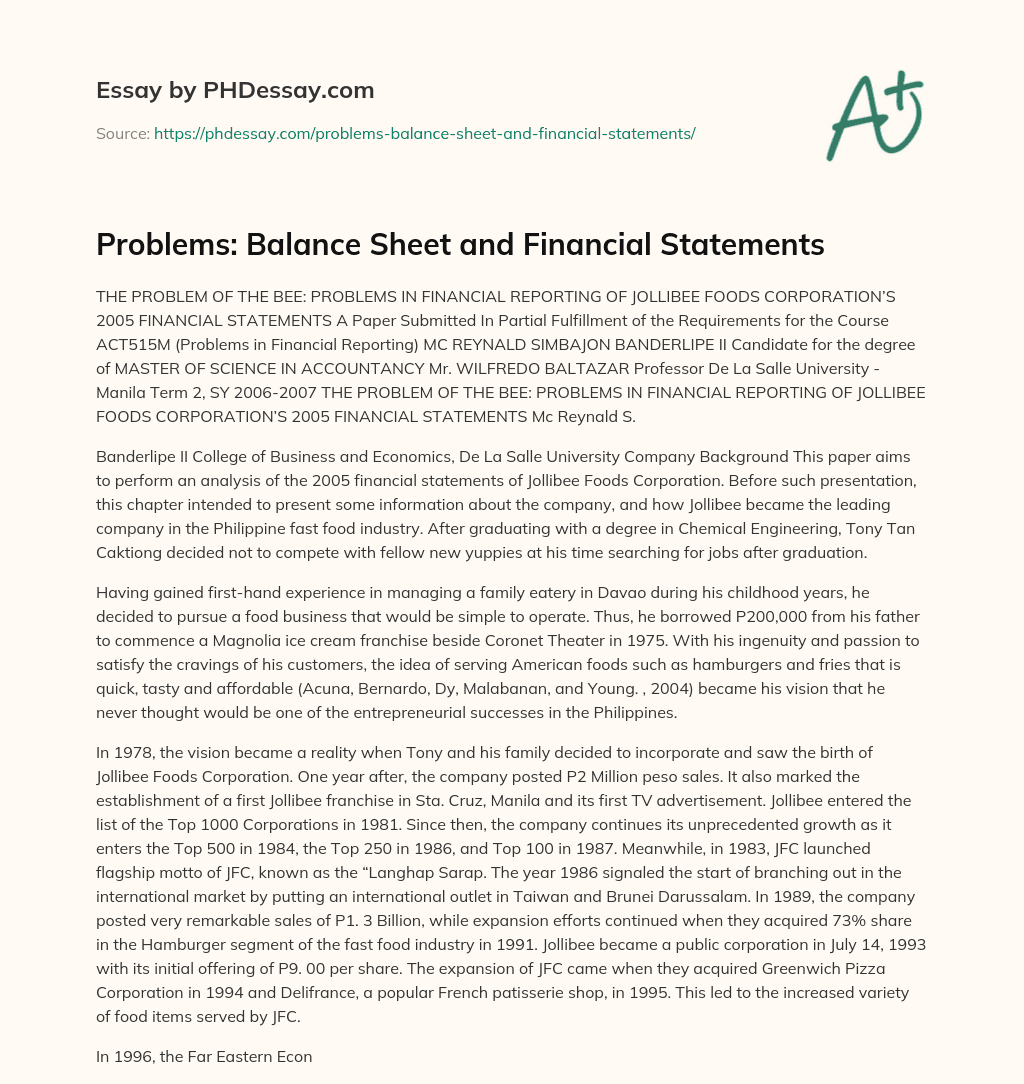

Build A Tips About Problems On Balance Sheet Deferred Tax In Income Statement

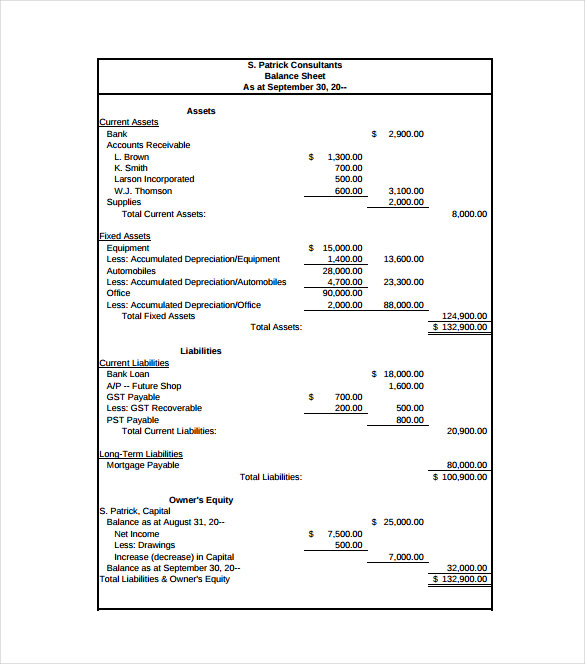

In the account form (shown above) its presentation mirrors the accounting equation.

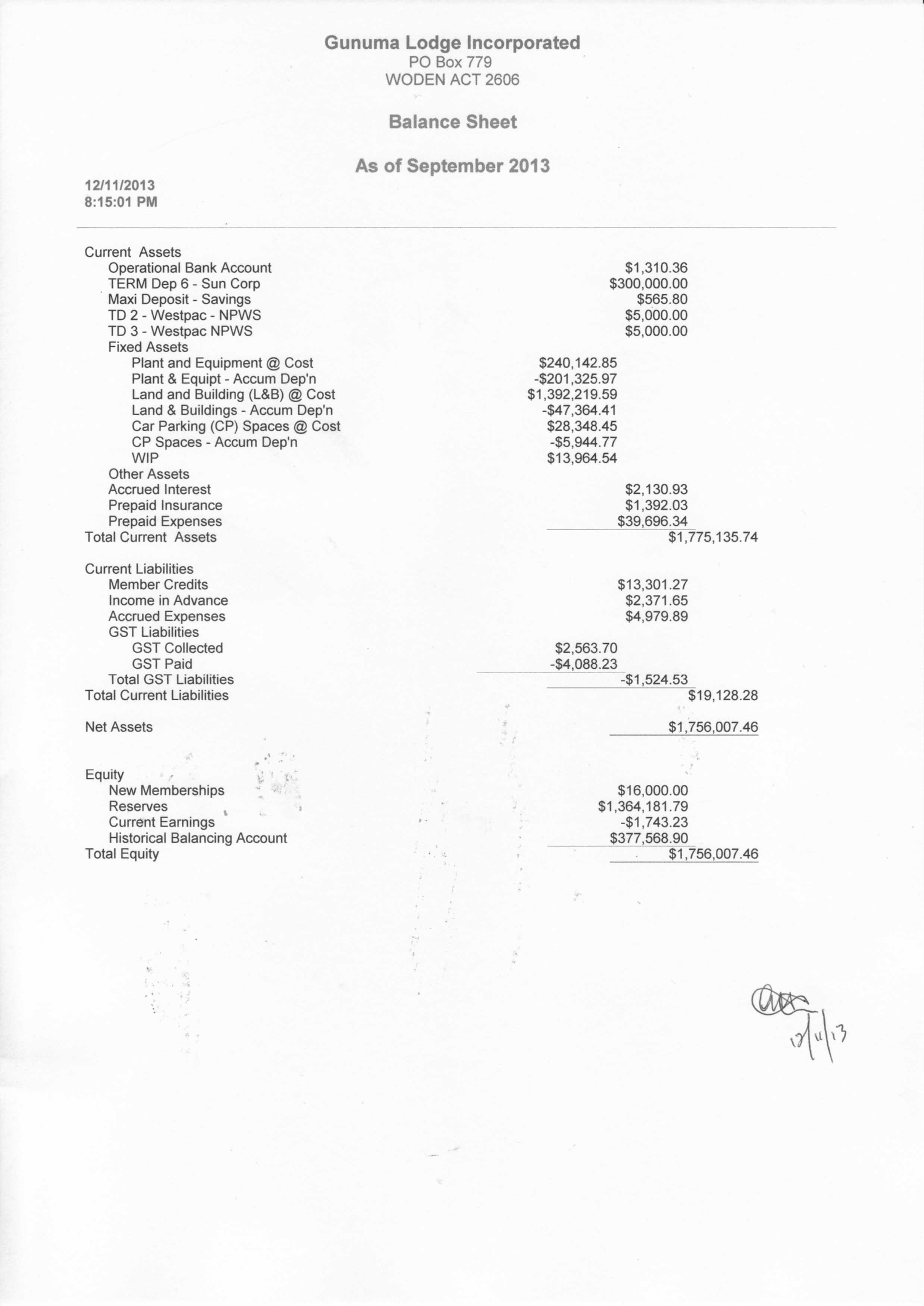

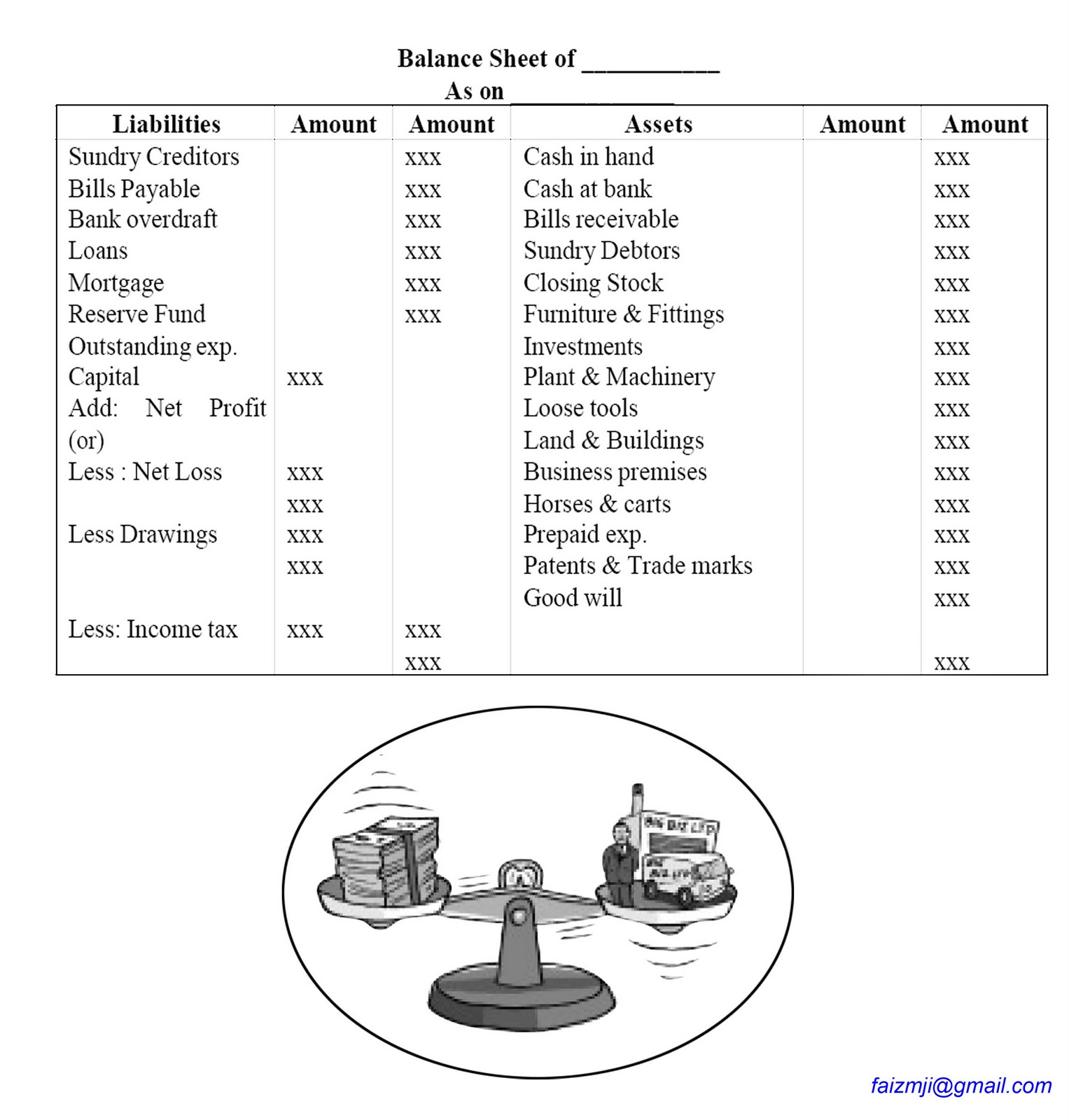

Problems on balance sheet. Now, it is paying dearly for that. Example of a balance sheet using the account form. Assets = liabilities + equity.

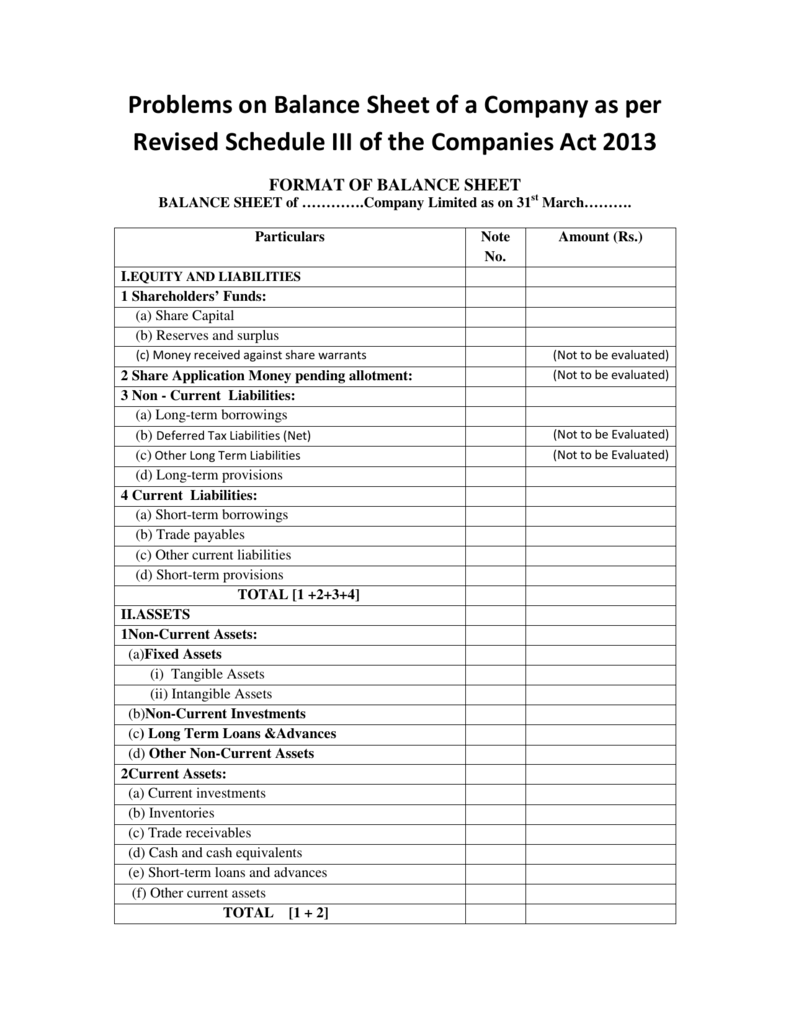

You pay for your company’s assets by either borrowing money (i.e. One major mistake business owners make with their books is incorrectly recording. The balance sheet heading will specify a period of time point in time 3.

At some point, recording a transaction on your balance sheet might slip your mind. Reports the following assets and liabilities. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

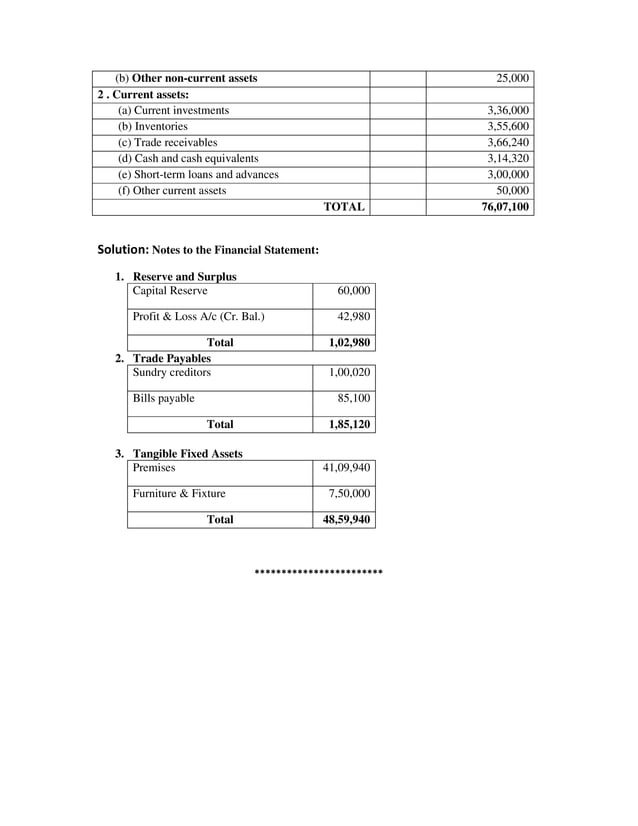

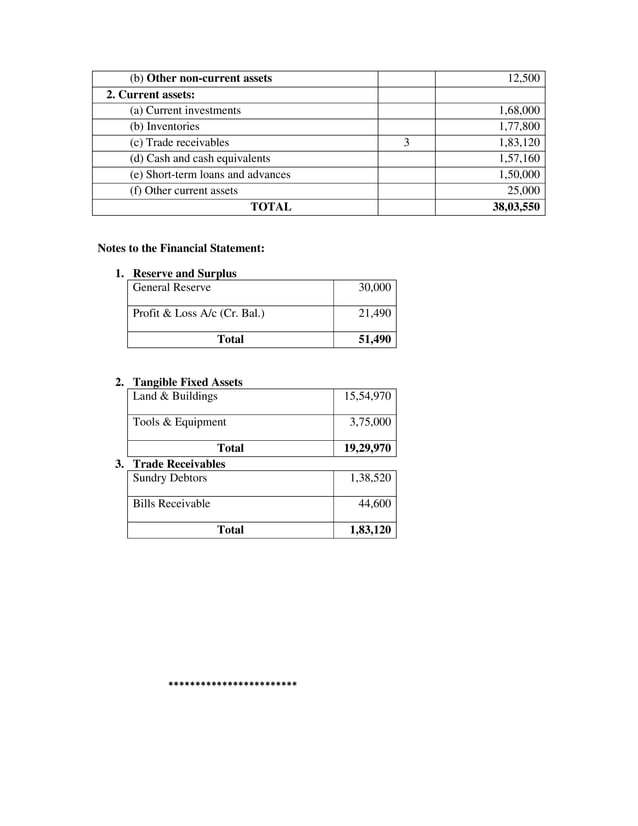

Key takeaways a balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. From the following particulars are given after preparation of income statement, prepare a balance sheet of jks as at 31st march 2021. Items appearing under the head equity and liabilities in the balance sheet (1) shareholders funds (a) share capital:

Identify the three main components of the statement of cash flows. The balance sheet is one of the three core financial statements that. The formula can also be rearranged like so:

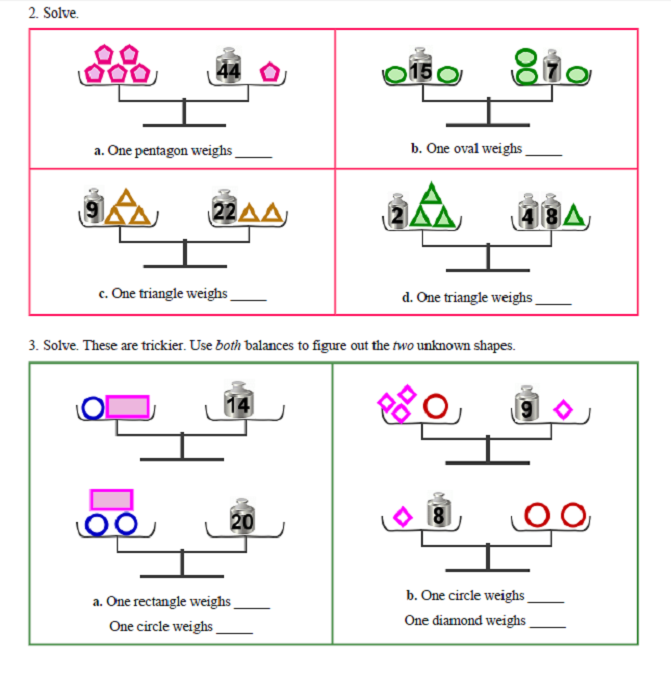

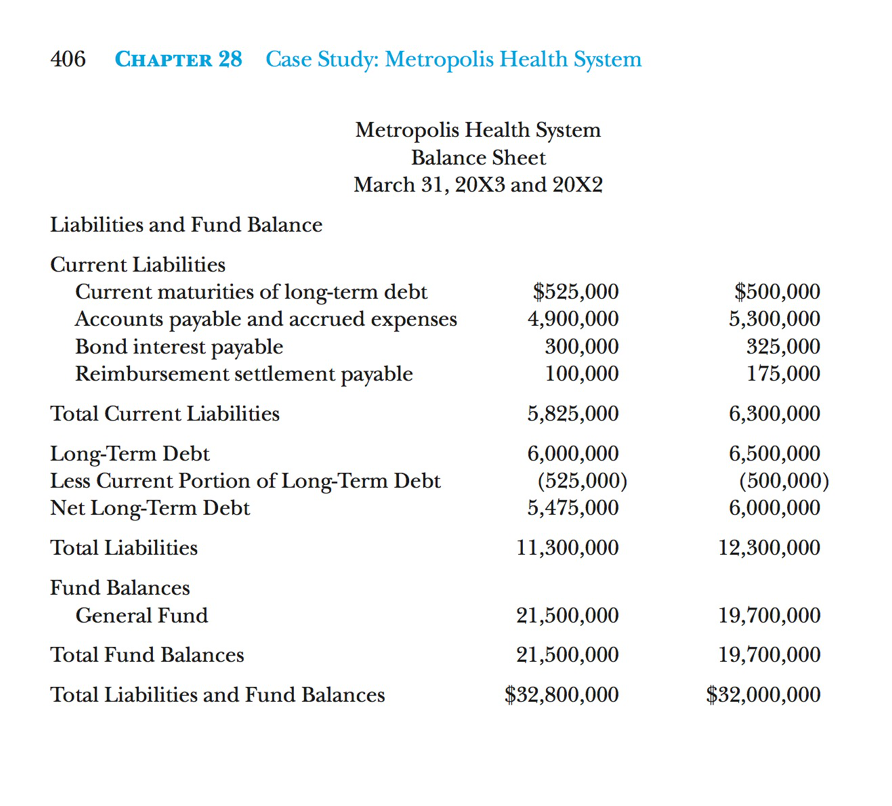

The primary reasons balance sheets are important to analyze are for mergers, asset liquidations, a potential investment in the company, or whether a company is stable enough to expand or pay down. Equity share capital and preference share capital are to be shown separately. 4 balance sheet problems 1.

The two sides must balance—hence the name “balance sheet.”. Expenses gains liabilities losses 4. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.

That is, assets are on the left; However, banks still grapple with two issues in particular right now: 10 balance sheet questions for practice.

The btfp has allowed banks to get cash from the fed window without declaring a loss in their balance sheet. Asset categories would include all of the following except: A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time.

The balance sheet reports a company's assets, liabilities, and equity as of a specific date. Compute the totals that would appear in the corporation’s basic accounting equation (assets = liabilities + stockholders’ equity (capital stock)). Assets = liabilities + owner’s equity.