The Secret Of Info About 199a Safe Harbor Statement Publicly Traded Companies Must File Audited Financial Statements With The

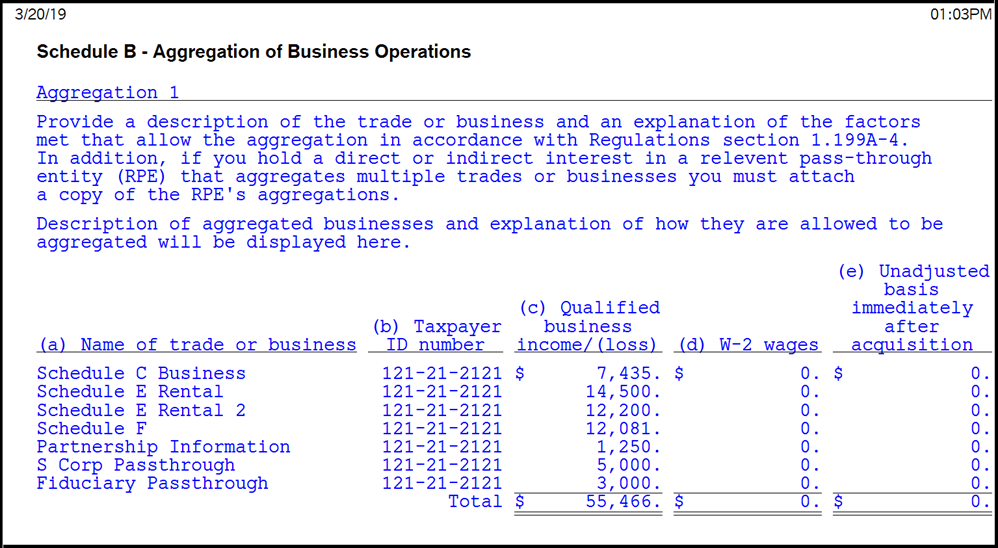

Procedure go to income/deductions > rent and royalty worksheet.

199a safe harbor statement. Rental real estate safe harbor under section 199a jan 28, 2020 | real estate when the tax cuts and jobs act of 2017 added the qualified business income. If the safe harbor requirements are met, the rental real estate enterprise will be treated as a single trade or business as defined in code sec.

Taxpayers are to take advantage of this safe harbor by including a statement with their tax return. Lacerte will create a safe harbor statement for each. Once the safe harbor option is selected, the actual safe harbor election statement can be found and printed for signing purposes from the main menu of the tax return (form 1040).

Short answer is, you can't create 1 safe harbor statement for multiple schedule e rental properties. January 24, 2024 as tax season unfolds, it's crucial for rental property owners to be aware of tax deductions that can significantly lower their tax bill. Section 199a “safe harbor” for rental real estate.

On september 24, 2019, the irs issued. The statement is used to confirm that the taxpayer (by. This letter is in response to your request for.

Guidance offered in september 2019, though, clarified that the 199a treatment indeed extends a safe harbor provision for some, but not all, interests in rental. Go to income/deductions > qualified business income (section 199a) worksheet. Purpose this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated as a trade or business for purposes of section 199a of the.

Enter a status change in field 22, if.