Nice Info About Purpose Of Financial Ratios Define Pro Forma Statement

Instead of opening account of an individual.

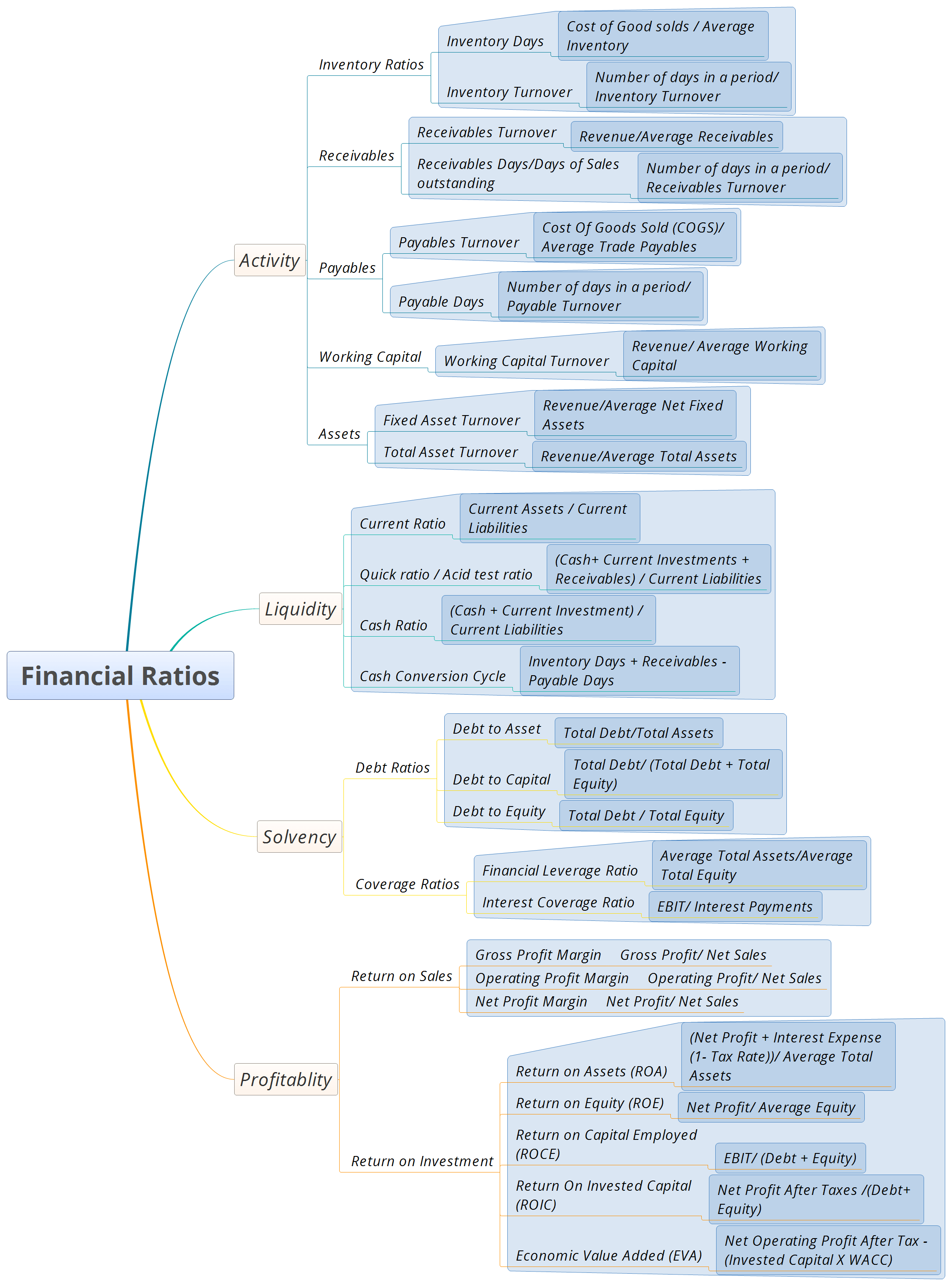

Purpose of financial ratios. Common financial ratios come from a company’s balance sheet, income statement, and cash flow statement. Tamilnad mercantile bank has seen the biggest rise of 200 basis points in its casa ratio while punjab & sind bank has improved the same by 158 bps. Financial ratios are grouped into the following categories:

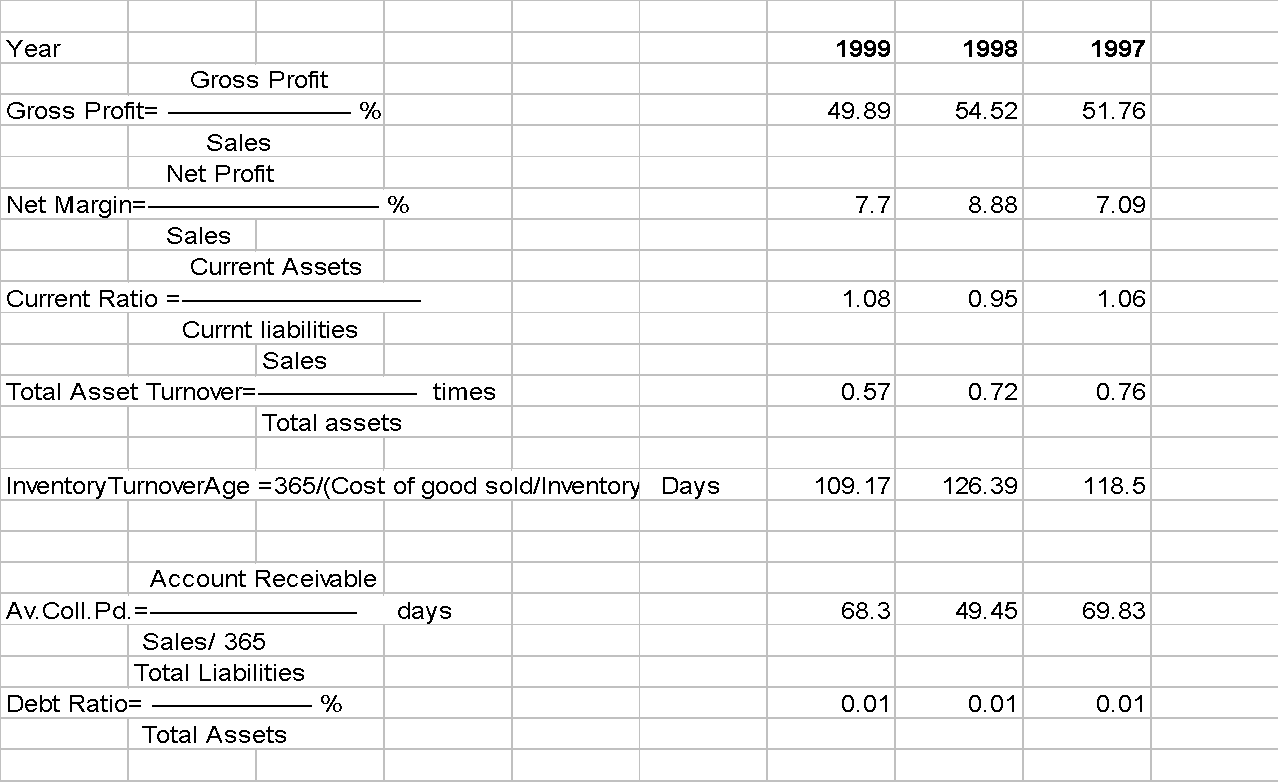

Learning the importance and uses of financial ratios is an essential skill for a small business owner. Financial ratios are always calculated as per a specified period or point in time. Analysis of financial ratios serves two.

These ratios can be used to evaluate a company’s fundamentals and provide information about the performance of the company over the last quarter or fiscal year. Financial ratios are calculations used to measure and analyse various aspects of a company’s financial performance. Uses of financial ratios financial ratios have the following uses:

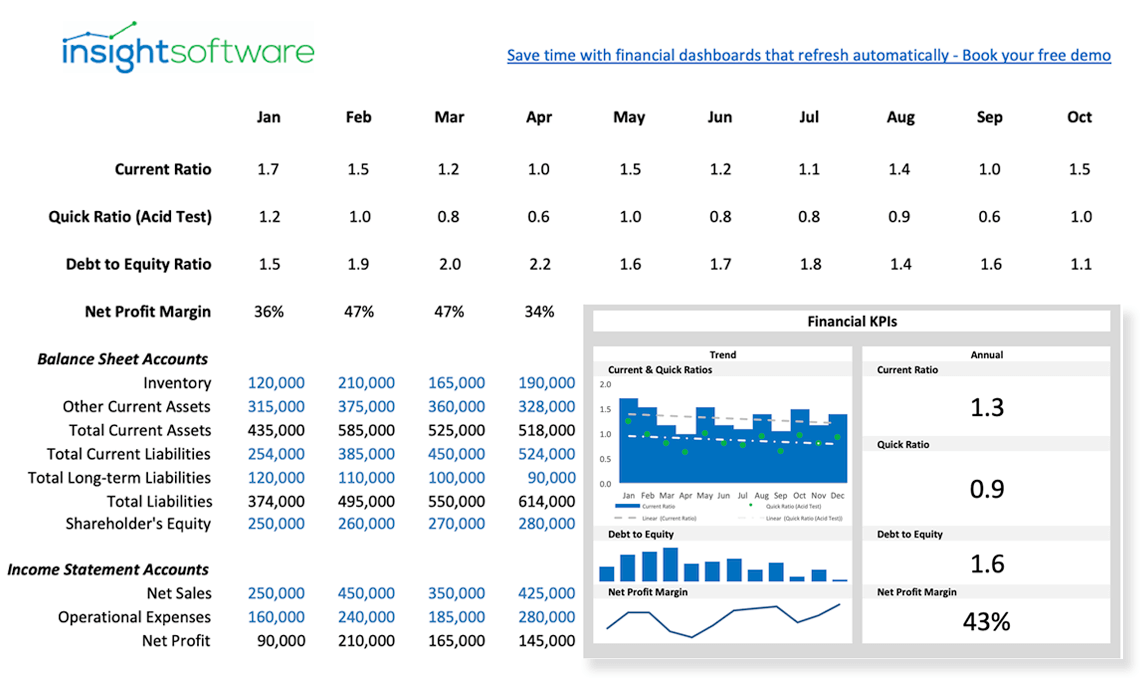

Financial ratios can help you pick the best stocks for your portfolio and build your wealth. Ratios are also used to determine profitability, liquidity, and solvency. Ratios for profits, liquidity, solvency and operational ratios are important.

Financial ratios analysis is an invaluable tool in analyzing the financial statements of a company, assessing its financial situation, evaluating business performance which normally quickly results in identifying the real problems of a business. They are used most effectively when results over several periods are compared. The use of financial ratios is often central to a quantitative or fundamental analysis approach, though they can also be used for technical analysis.

List of financial ratios, their formula, and explanation. Dozens of financial ratios are used in fundamental analysis. We've briefly highlighted six of the most.

Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization. Financial ratios are powerful tools to help summarize financial statements and the health of a company or enterprise. Typically, ratios are not examined alone, but are looked at in combination with other performance indicators.

They are one tool that makes financial analysis possible across a firm's history, an industry, or a business sector. A financial ratio or accounting ratio states the relative magnitude of two selected numerical values taken from an enterprise's financial statements. Learn the most useful financial ratios here.

Liquidity is the firm's ability to pay off short term debts, and solvency is the ability to pay off long term debts. Financial ratios can be classified into ratios that measure: One of the most common ways to analyze financial data is to calculate ratios from the data in the financial statements to compare against those of other companies or against the company's own.

The purpose of financial ratios is to enhance one's understanding of a company's operations, use of debt, etc. Evaluate performance compare companies and industries conduct fundamental analysis This information is used to used to: