Breathtaking Tips About Pro Forma Balance Sheet Format What Is The Main Purpose Of A

Capital budgeting techniques unit 7:

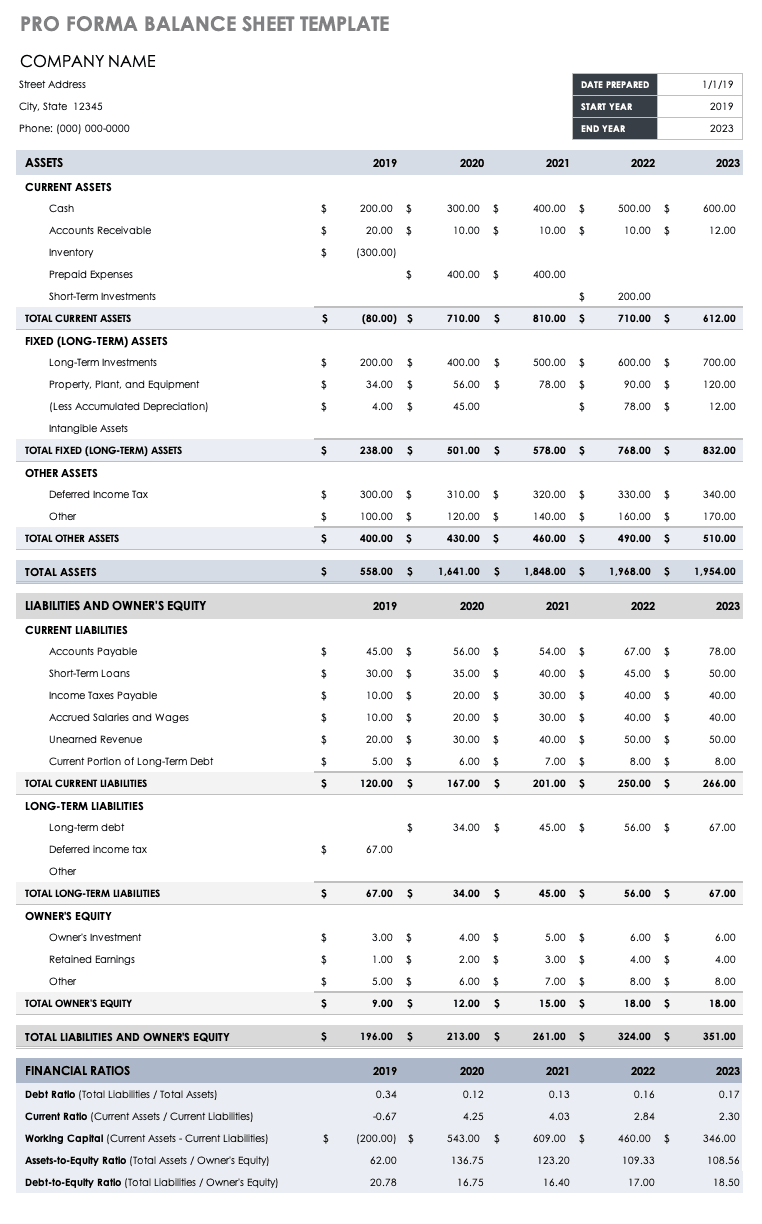

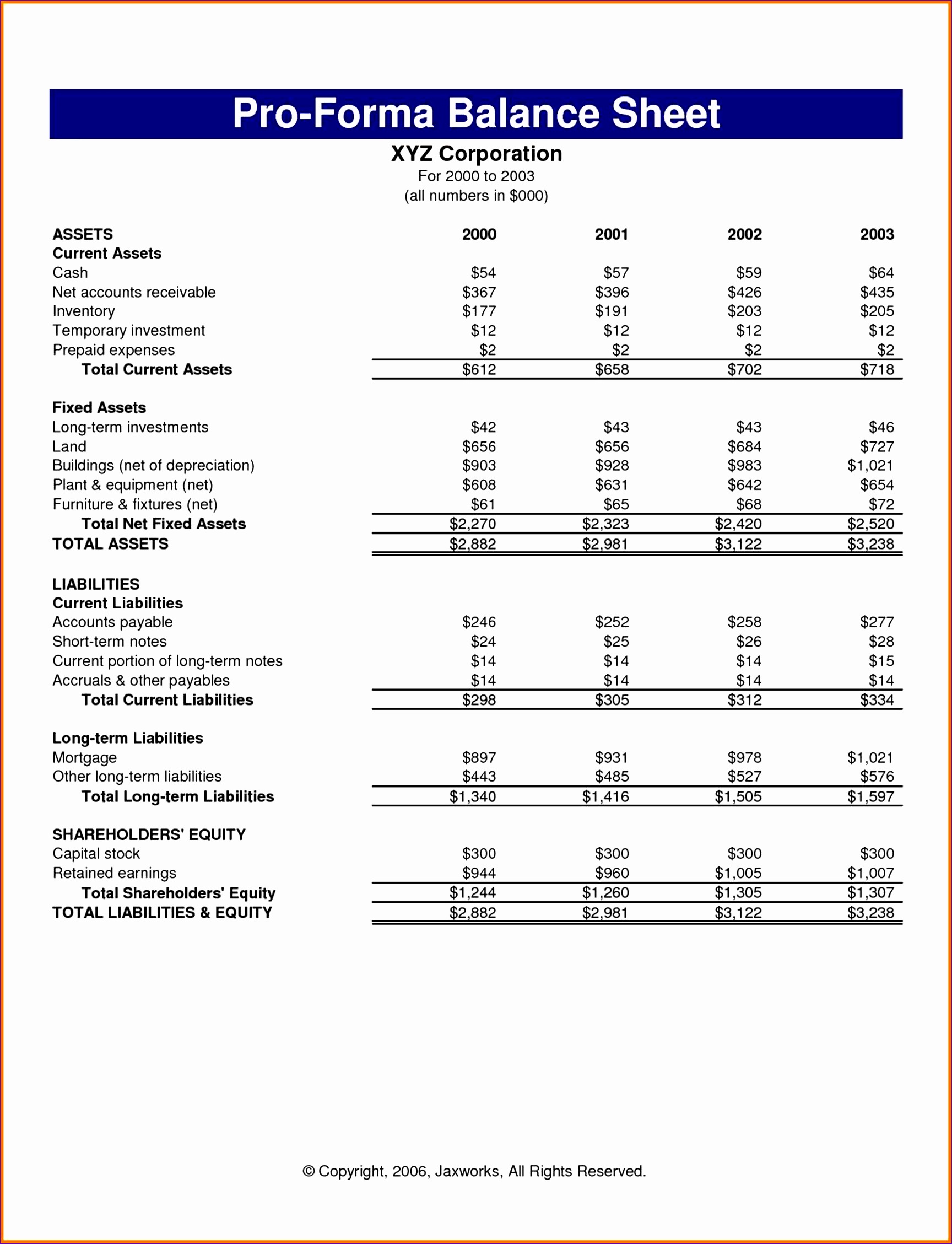

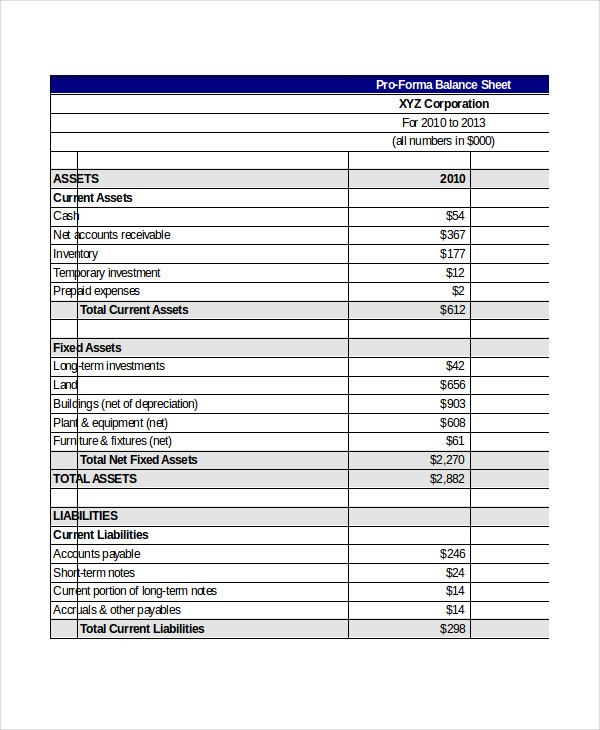

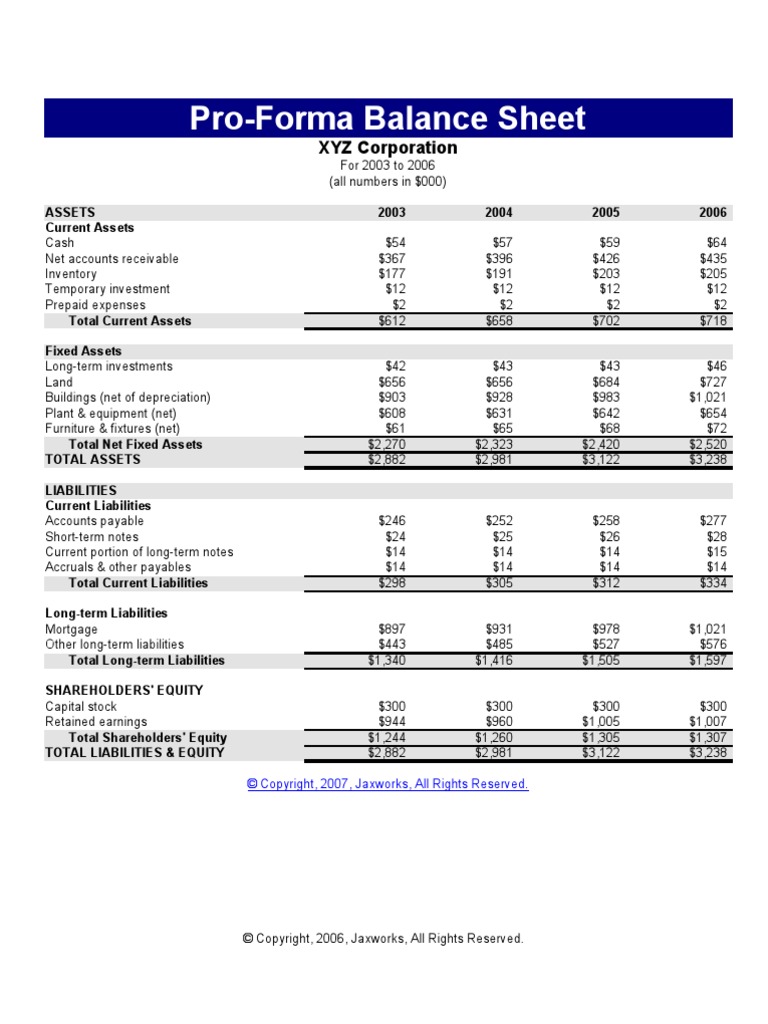

Pro forma balance sheet format. Suzanne kvilhaug what is pro forma? Gaap financial statements follow a standardized format, including the income statement, balance sheet, and cash flow statement,. Stocks, bonds, and financial markets unit 6:

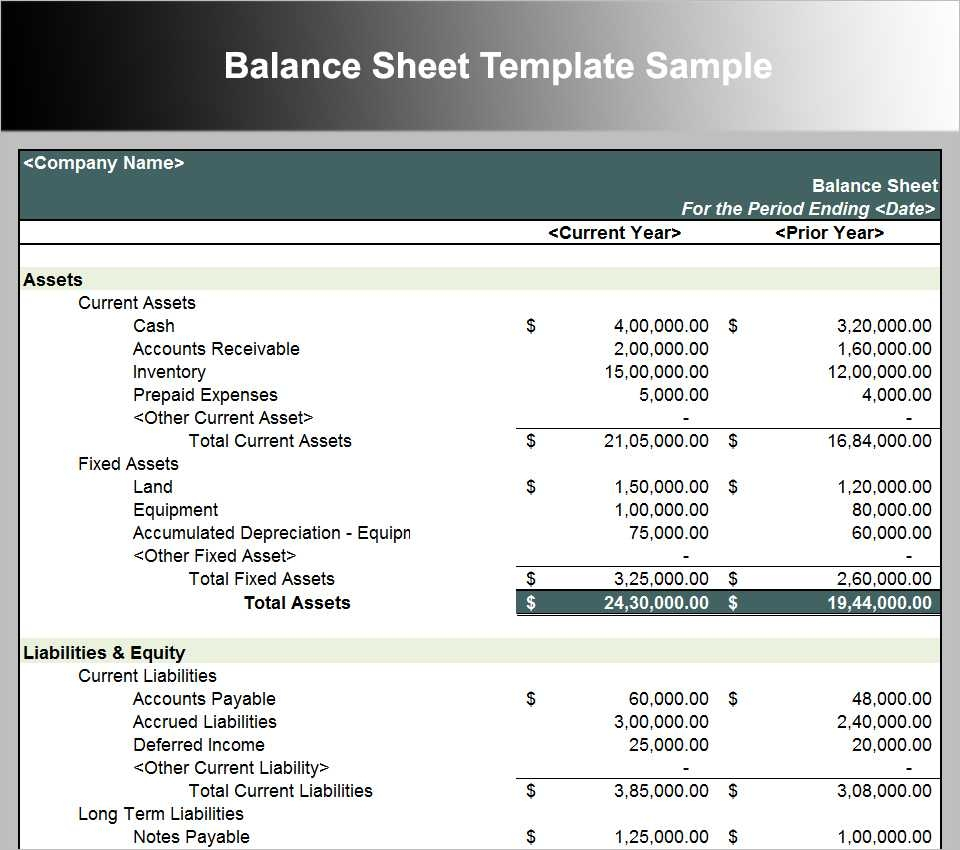

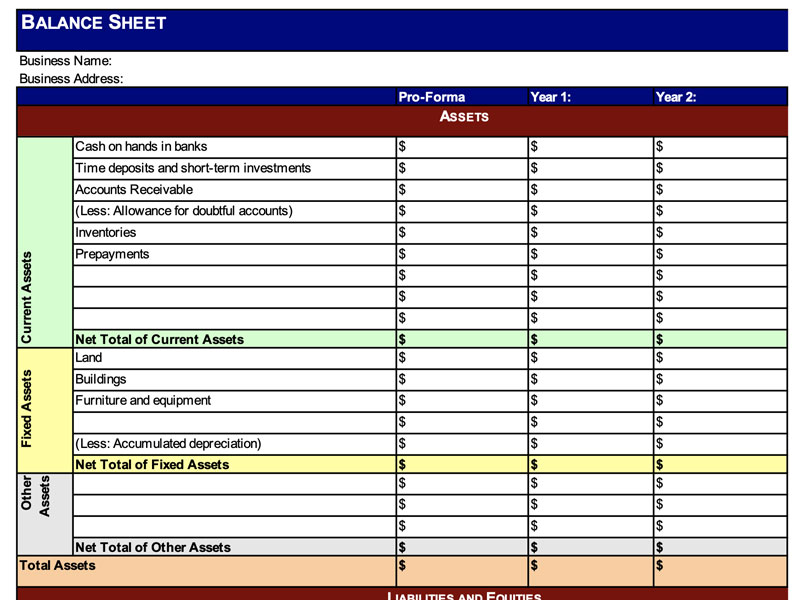

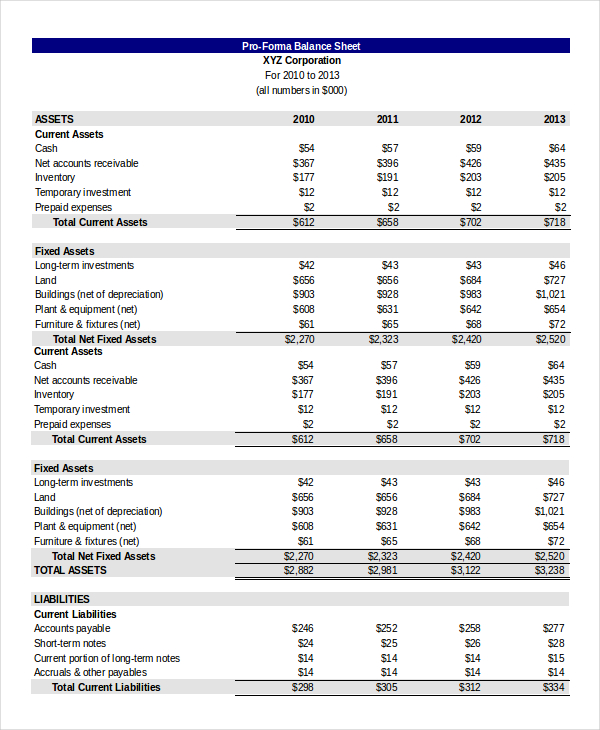

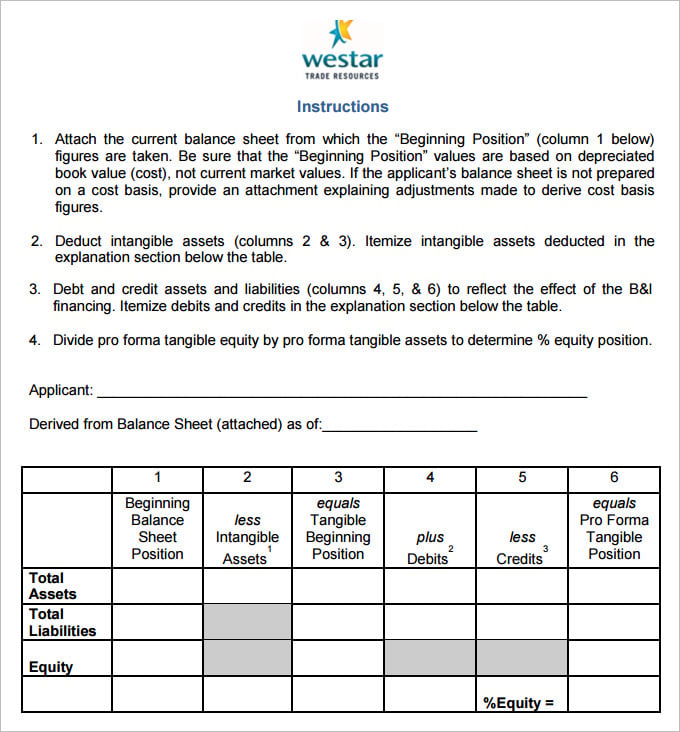

Included on this page, you'll find many helpful balance sheet templates, such as a basic balance sheet template, a pro forma balance sheet template, a monthly balance sheet template, an investment property balance sheet template, and a daily balance sheet template, among others. Risk, return, and the capm unit 8: Easily change the data to make new predictions.

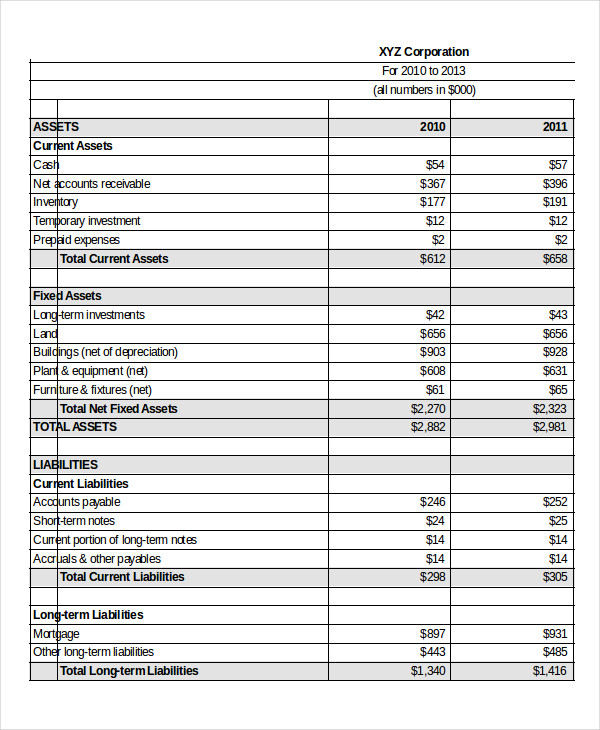

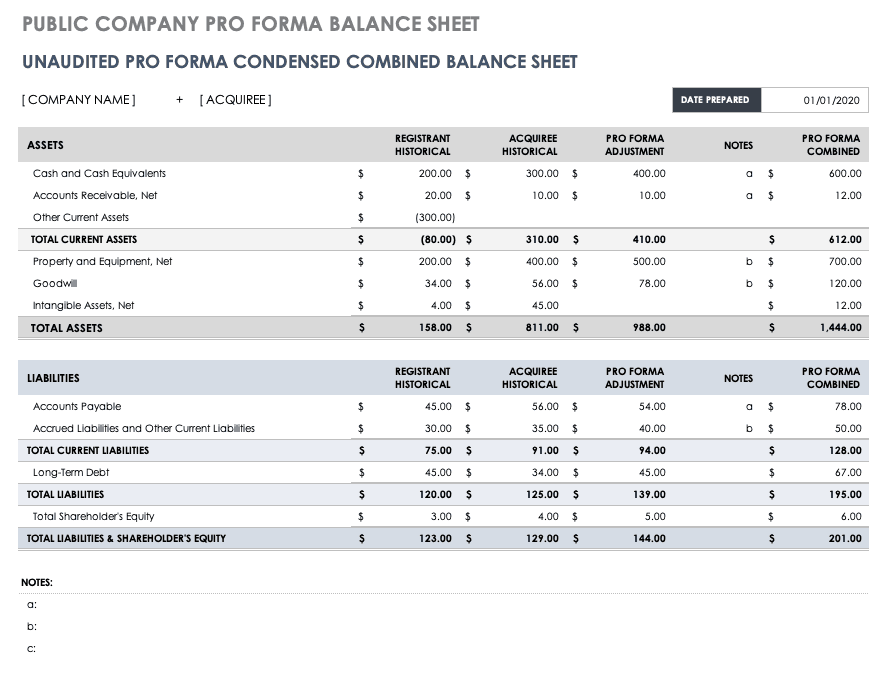

It aids in assessing the potential financial stability of a business under different scenarios. Whether you’re trying to interpret pro forma financial statements or prepare them, these projections can be useful in guiding important business decisions. The pro forma balance sheet, on the other hand, predicts future assets, liabilities, and equity.

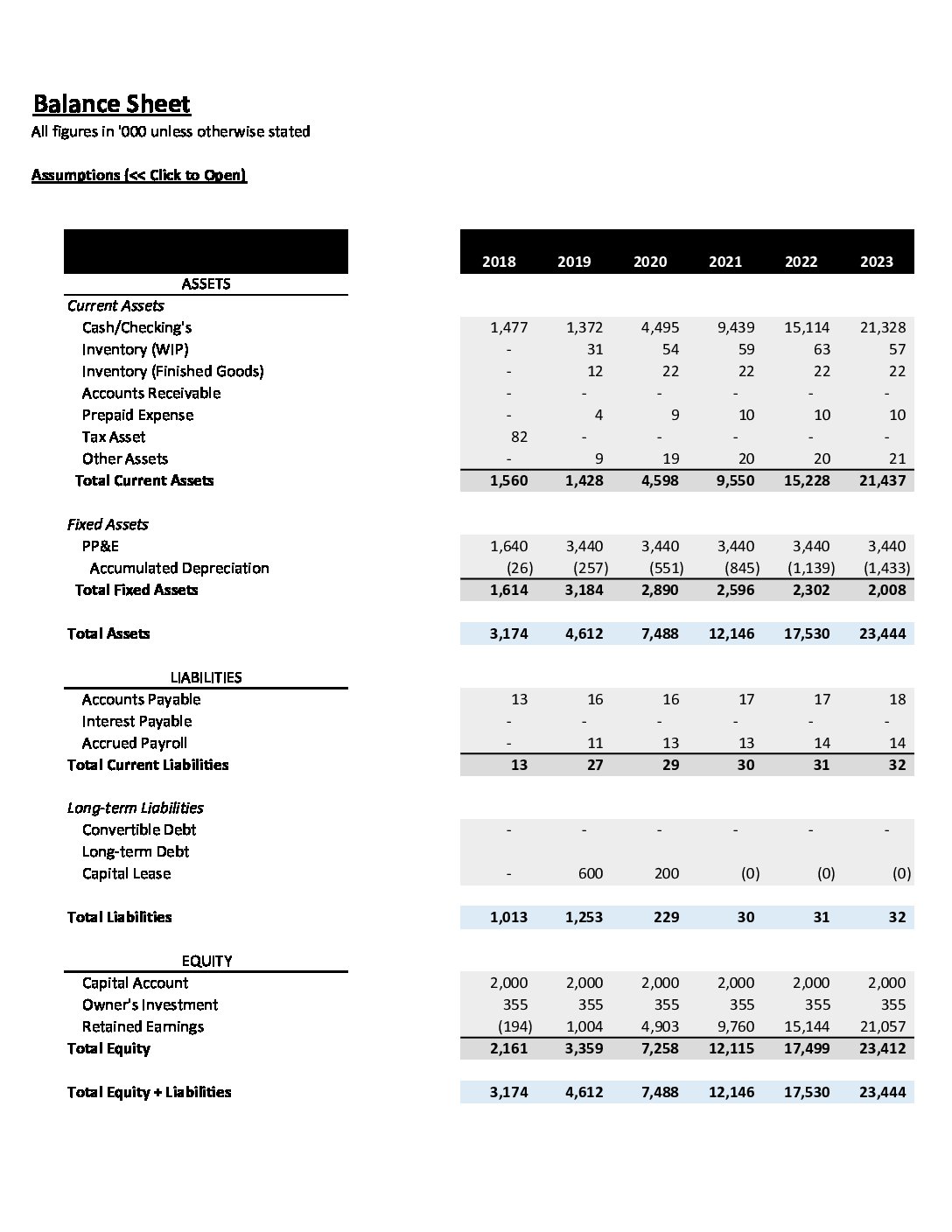

There are three main documents in pro forma financial statements: A pro forma balance sheet, along with a pro forma income statement and a pro forma cash flow are the basic financial projections for a. A pro forma balance sheet is a financial statement that details a business's estimated balance sheet at a given future date.

Financial statements and financial analysis unit 3: Amortization of capitalized financing costs; A pro forma balance sheet is a balance with forecasted future values.

Table of contents introduction what is a pro forma balance sheet? It forecasts the money you have bound in receivables, inventory and equipment. Corporate capital structure course feedback survey certificate final exam

Working capital management unit 4: This balance sheet reflects your business’s financial strength, detailing your assets, liabilities, and shareholder equity. Quite identical to a historical balance sheet, a pro forma balance sheet represents projections with regard to the company future payments and budget.

Analyzing the pro forma balance sheet conclusion. Importance of pro forma balance sheets step 1: June 14, 2022 | chelsie kugler | bookkeeping | strategy.

A pro forma balance sheet is similar to a historical balance sheet, but it represents a future projection. Firstly, we have projected the capital expenditure and depreciation. Create pro forma income statements, pro forma balance sheets, and pro forma cash flow statements.

Remember, in its simplest form, the equation is assets = liabilities + owner's equity. Then, make pro forma adjustments based. Projecting capital expenditures and depreciation we will create a format for the pro forma balance sheet.