Casual Info About Factoring Receivables Cash Flow Statement Profit And Loss Adjustment Account

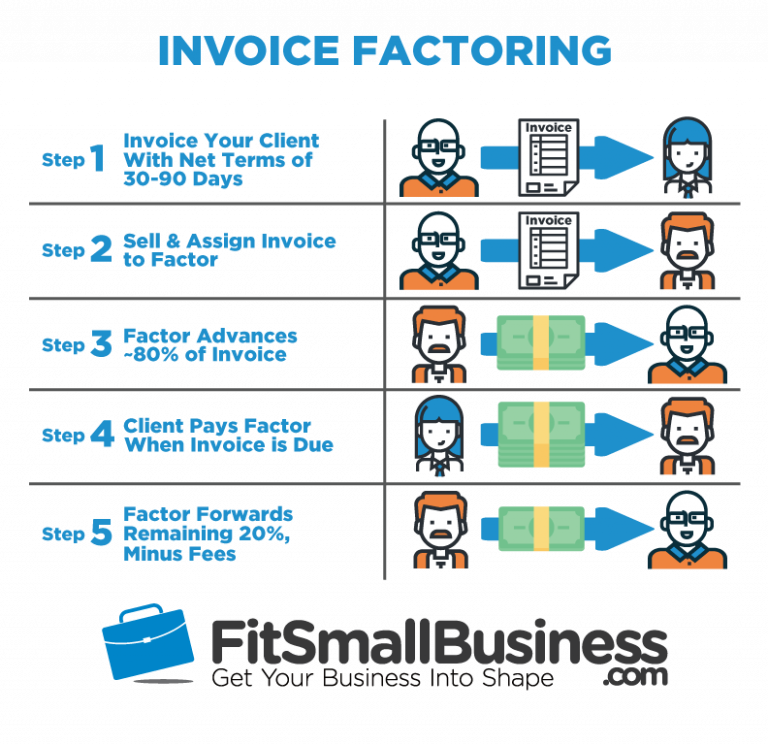

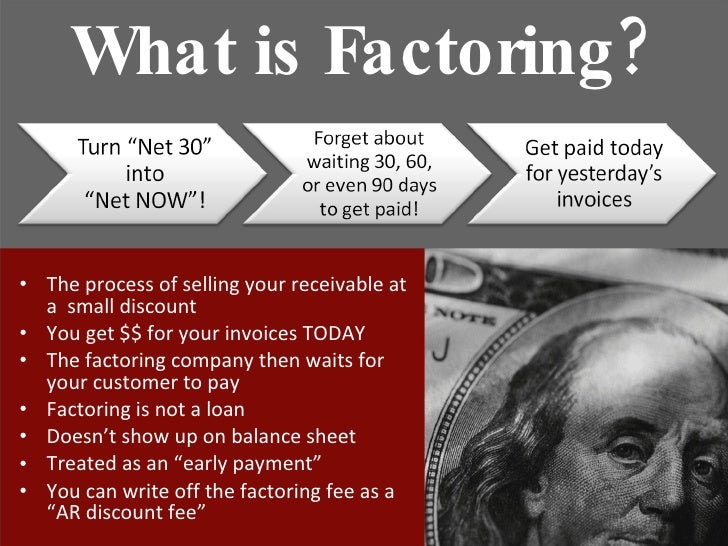

Factoring receivables is a way to free up cash flow that’s held up in your unpaid invoices.

Factoring receivables cash flow statement. How does accounting for factored receivables work? Cash flow from operations:this contains data on incoming cash from current assets and current liabilities, including all operational business activities such as salaries, and buying and. It is popularly called trade receivables and it is a current asset.

14 november 2023 the statement of cash flows is a primary financial statement, mandated for presentation by all entities,. Recording the default interest paid as “other. Factoring receivables strengthens business cash flow few things are as important for your growing business as a healthy and strong cash flow.

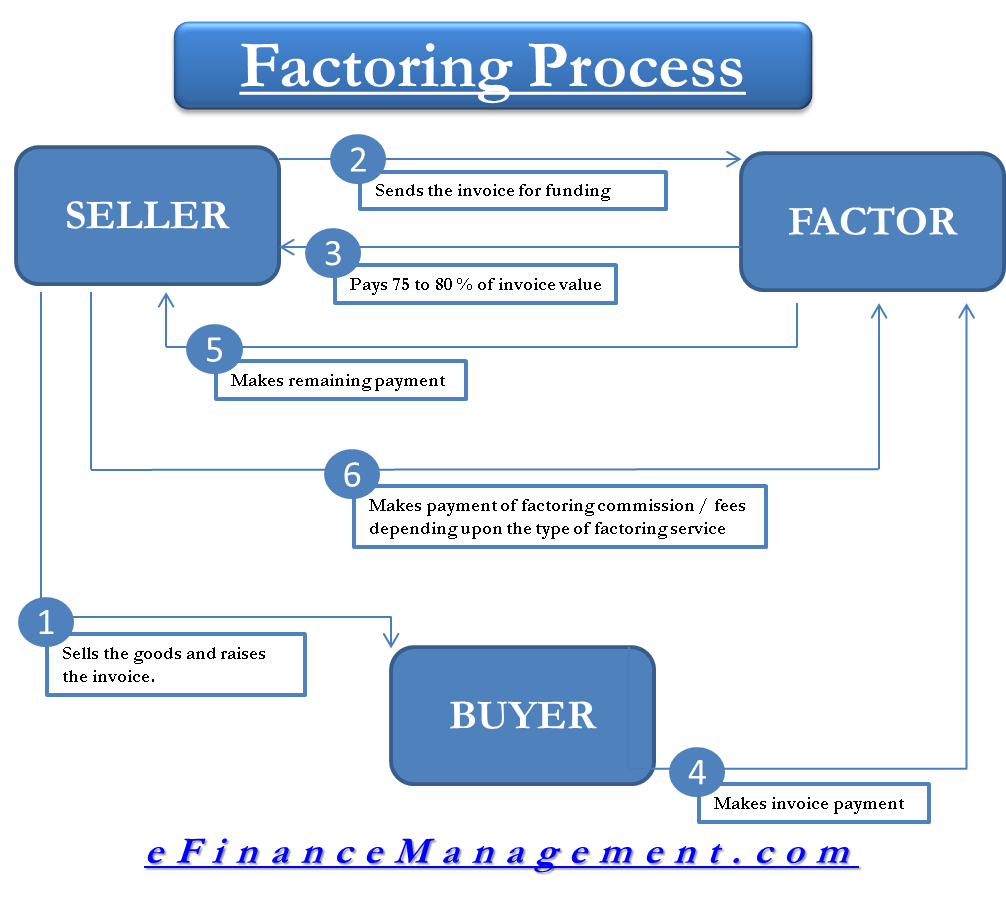

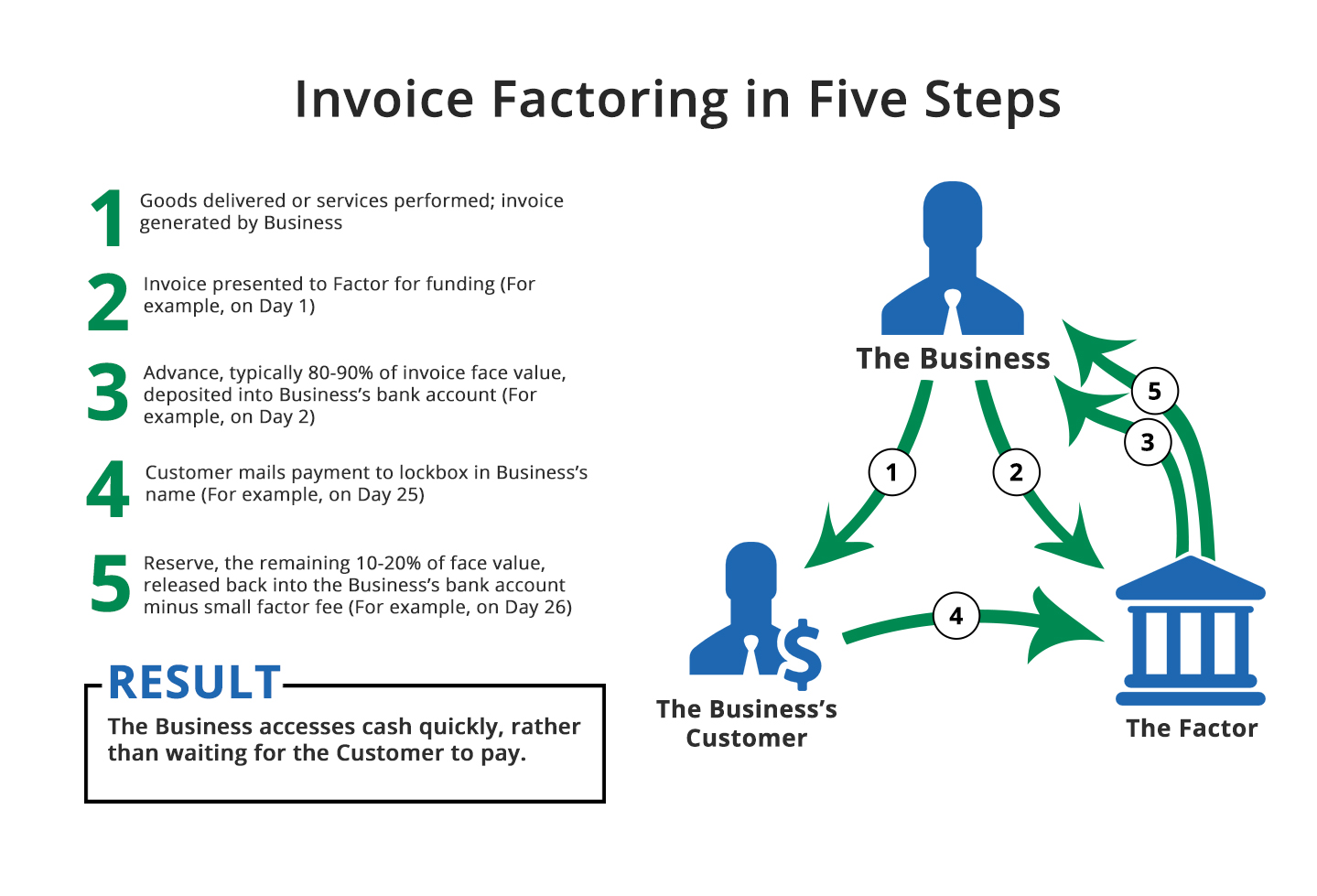

Typically, the company will collect the payments on the business’s. In this particular case, a subsidiary of the company had cash flow difficulties and was unable to secure funding. Factoring is a financial transaction where a business sells its outstanding accounts receivable to a third party,.

Factoring types there are four types of. Marketplace and service revenue of $104 million, an increase of. Today, factoring and other related methods of.

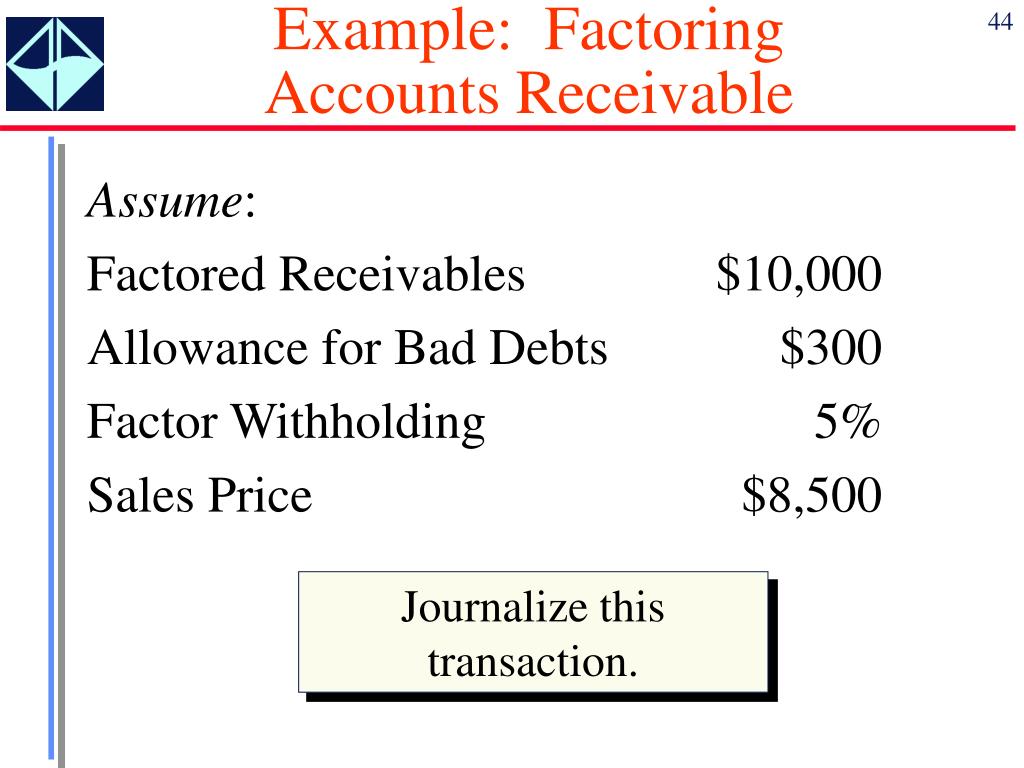

Accounts receivable factoring, also known as a/r factoring or invoice factoring, is a form of commercial borrowing that helps businesses address cash flow. Companies choose factoring if they want to receive cash quickly rather than. When a company provides goods or services on credit.

The amount due from the customer is called accounts receivables. Factoring receivables is a funding solution that allows small businesses to turn their unpaid. The buyer (called the “factor”) collects payment on the receivables from the company’s customers.

Fourth quarter 2023 highlights. Receivables financing (or accounts receivable finance) is a finance arrangement in which a company uses finance flowing in (such as from overdue invoices) to go into an asset. Factoring is the sale of accounts receivable, as opposed to borrowing against them as you would do in accounts receivable financing.

A cfs is different from the other financial statements, and there are three main sections to be aware of: Revenue of $118 million, an increase of 21% year over year. B) the payment of the debt by the factoring company is taken into account in the cash flow statement and, if applicable, triggers further cash flows in the customer's.

What is factoring receivables (a.k.a., account receivable factoring)? Accounts receivable on cash flow statement introduction in accounting, cash flow statement is a financial statement that reports the cash flows in the company that. Factoring invoices turns the static asset into immediate cash flow.