Casual Tips About Cpa Certified Profit And Loss Statement An Adjusted Trial Balance

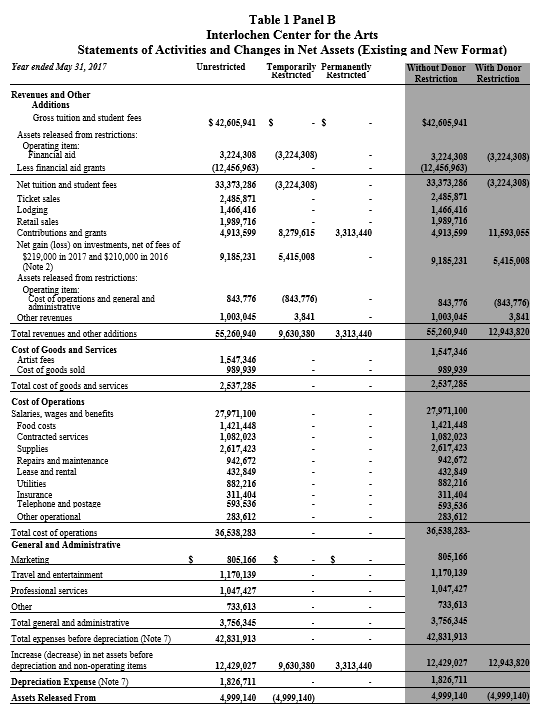

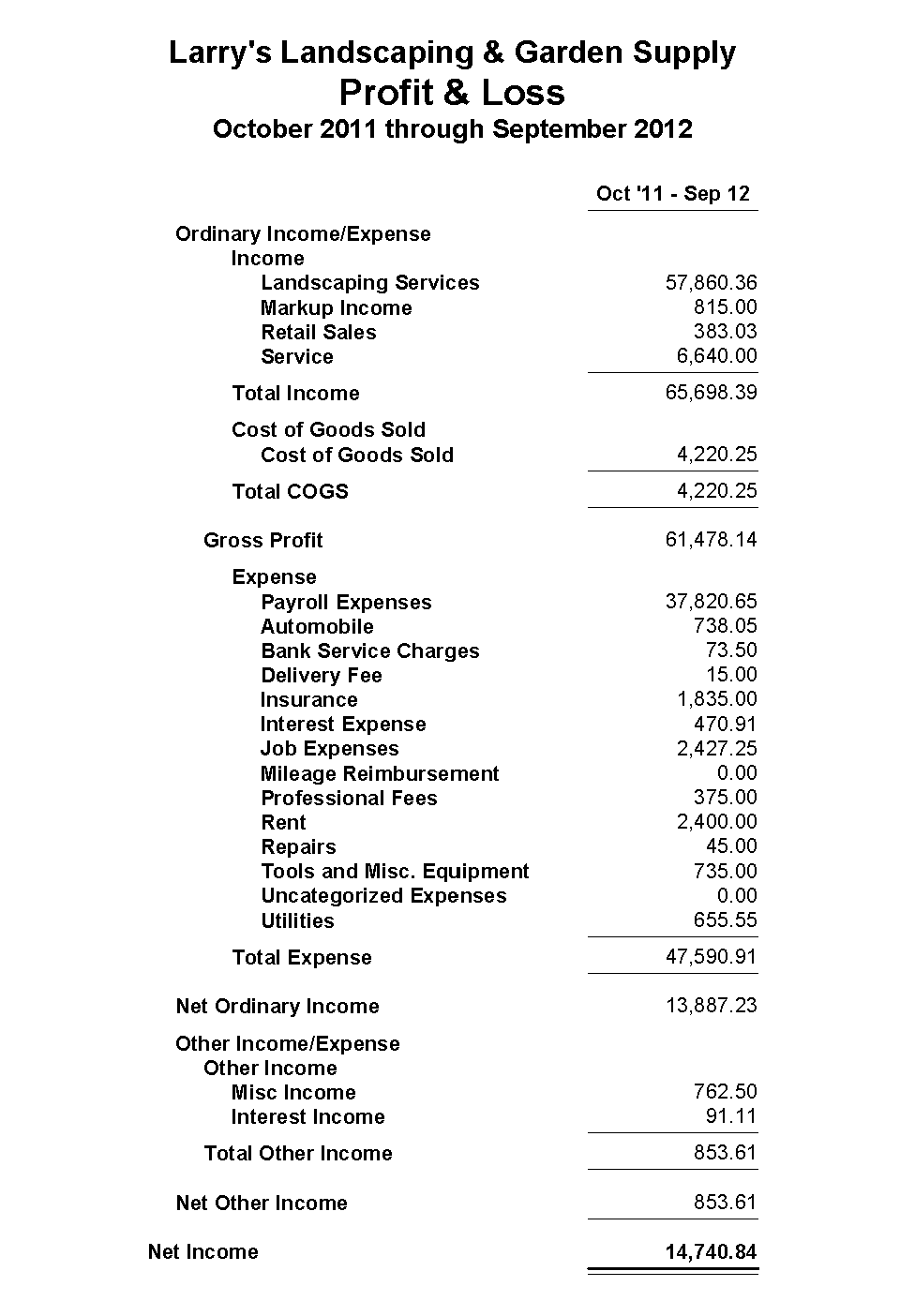

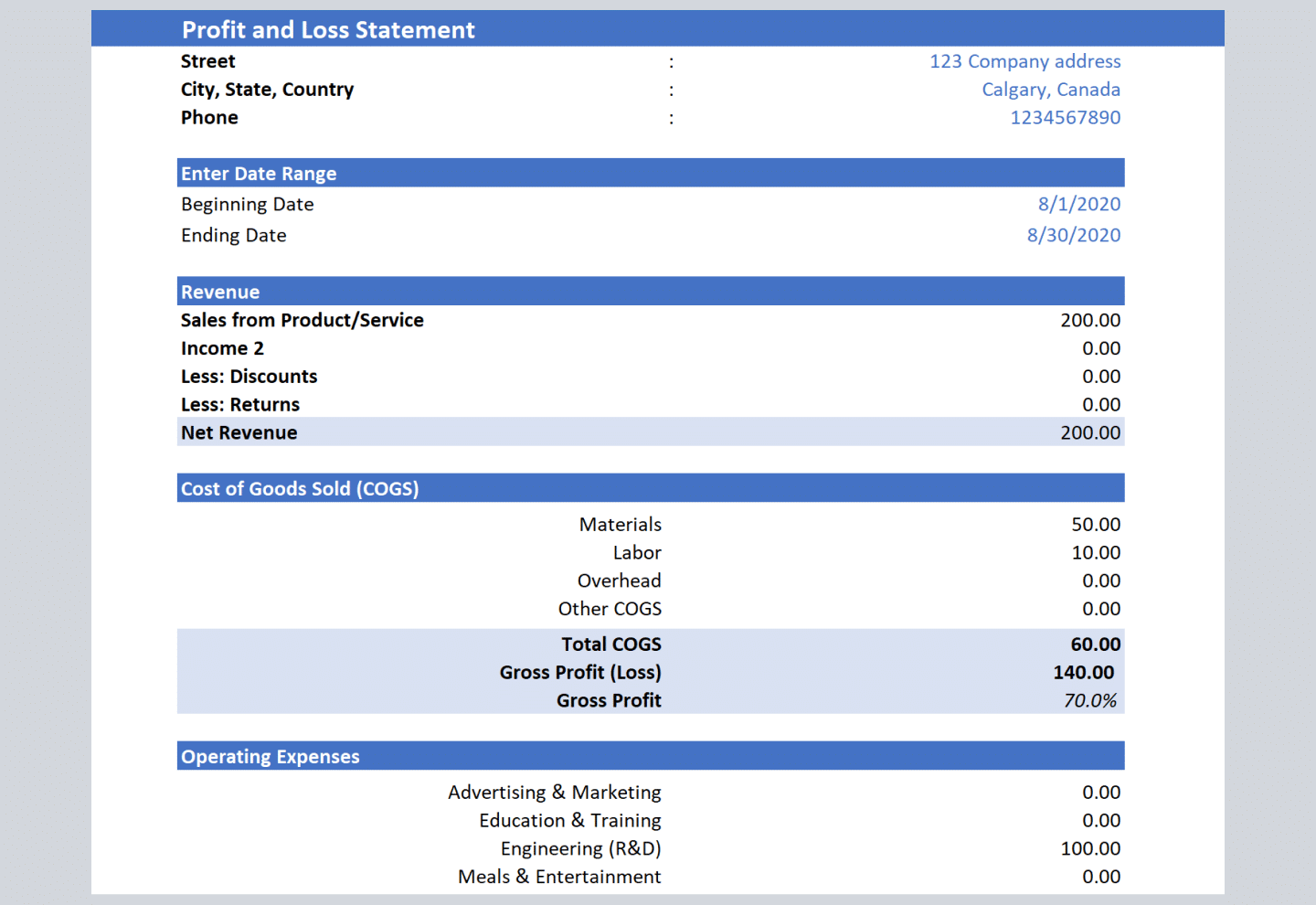

The p&l statement, also called the income statement is one of the three main financial statements, along with the balance sheet and the cash flow statement.

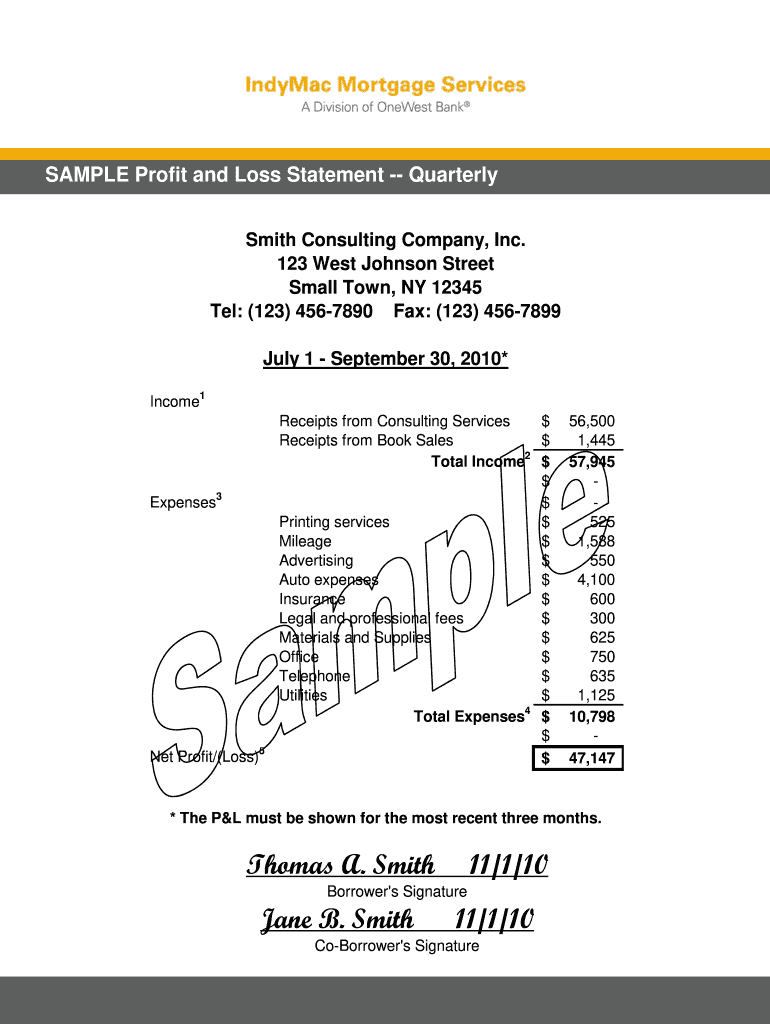

Cpa certified profit and loss statement. Our workflow streamlines the preparation of a cpa. The first step in creating a profit and loss statement is to calculate all the revenue your business has received. It takes a certified public accountant to give you a certified income statement, aka a profit and loss statement.

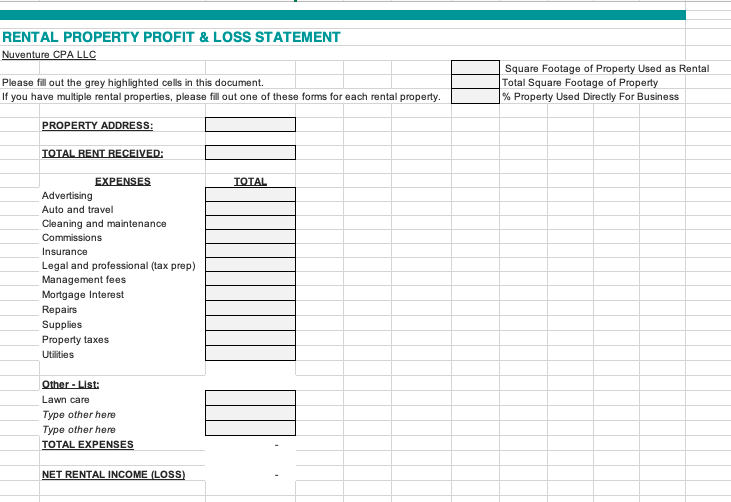

Rebecca casarez, cpa the profit and loss statement (income statement) is a tool to explain the performance of an entity. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A profit and loss statement, or income statement, is the report that shows you an overview of your business's income, expenses, and profits or losses over a period.

Having your p&l statement audited by a licensed cpa helps ensure accuracy. The lean profit and loss statement is designed to be understood by everyone. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period,.

The quick answer is yes, a cpa can create a certified financial statement, but there are a number of things to be aware of. Oftentimes, the certified public accountant (cpa) who performs your general accounting and/or bookkeeping and prepares your annual tax return can also prepare your financial. Certifying your financial statements requires the cpa to audit your.

Prepare a cpa letter profit and loss statement template. Unaudited profit and loss statement. Even if you have a certified public accountant (cpa), it’s good to know what reports and statements are prepared for your business.

Obtain cpa certified letter at the culmination of a. Because compiled sets no standard of evidence for the cpa, a cpa can solely compile an income statement. The p&l statement shows revenues, expenses, gains, and losses over a specific period of time such as a month, quarter, or year.

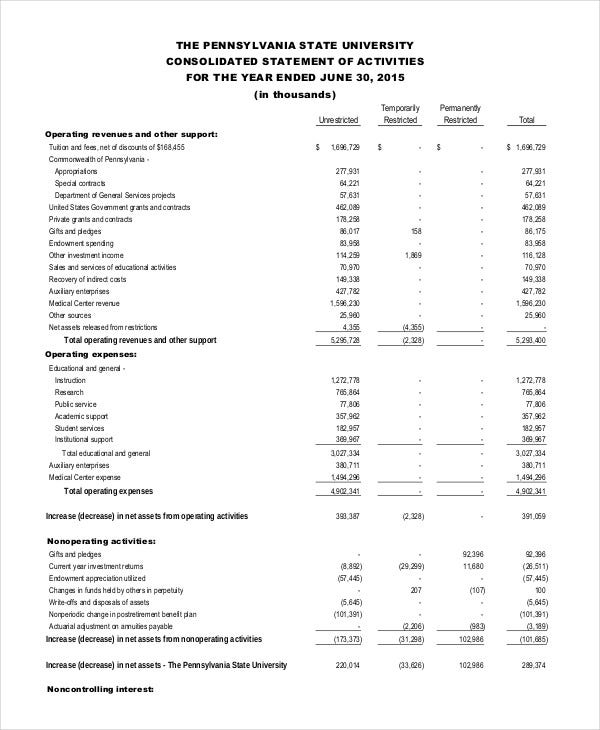

Such statements are considered more reliable than unaudited. A profit and loss statement, also known as. Quarterly and annual company reports fall into this category.

Certified financial statements are the documents that all publicly traded companies must publish. It provides quick, understandable and timely information to all line personnel.

A profit and loss statement may also be called a p&l or an income statement. A certified financial statement is one that has been reviewed and approved by a certified, independent auditor. The following are the main types of audited financial statements:

In this article, we will explore the role of.