Beautiful Work Info About Balance Sheet With Retained Earnings Kpmg Big Four Accounting Firms

An increase in retained earnings increases.

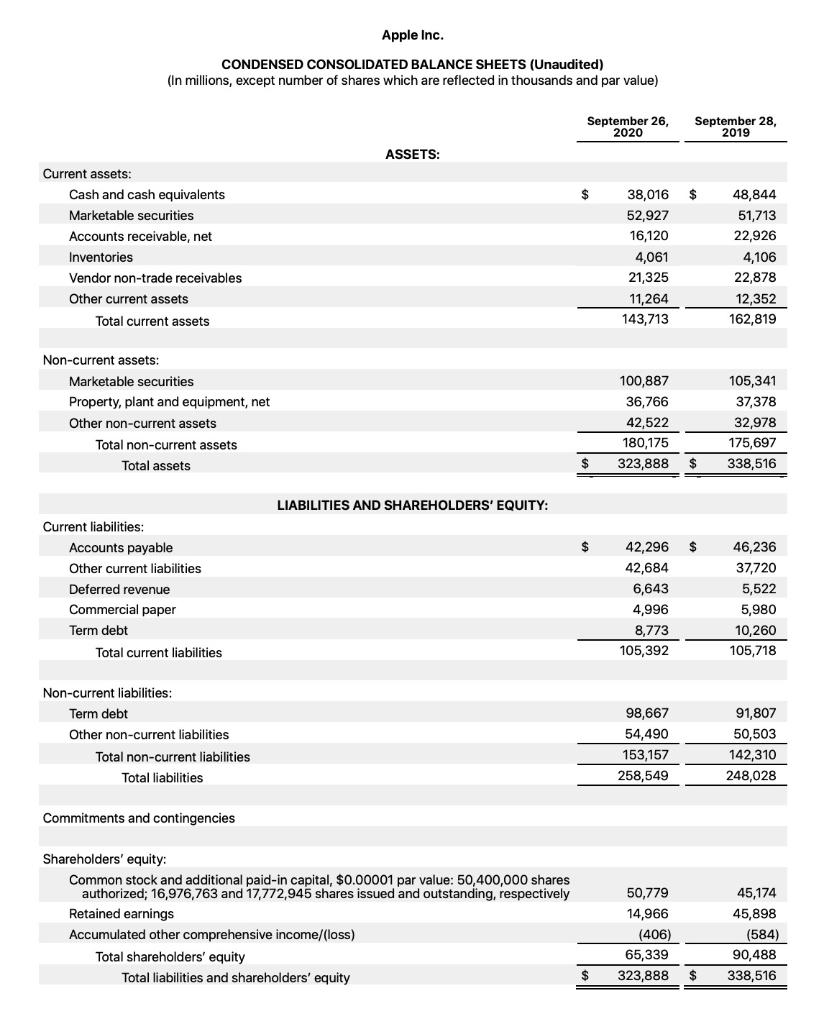

Balance sheet with retained earnings. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends paid to shareholders. Retained earnings on a balance sheet are the net income that a company has decided to keep or ‘retain’ after distributing dividends to its shareholders. Finally, calculate the amount of retained earnings for the period by adding net income and subtracting the amount of dividends.

Financial reporting includes collecting and documenting your finances to monitor your business’. How are the retained earnings calculated on the balance sheet? On a company’s balance sheet, owners’ equity shows what the owners of the business (or shareholders) would have if the company paid off all its debt with its.

In the next accounting cycle, the re ending balance from the previous. Without them, your balance sheet would fall out of equilibrium with every sale you make, and expense you incur. Definition, formula and use cases take your business ambitions and make them reality sole traders and individuals expense tracking and.

This amount gives companies clarity on how much money their business. Retained earnings refer to a company’s net profit after paying out dividends to shareholders. Net income can be found near the end of a company’s income statement.

In fact, they are so critical to accounting entries that we could. Once retained earnings are reported on the balance sheet, it becomes a part of a company’s total book value. Retained earnings can be found on the right side of a balance sheet, alongside liabilities and shareholder’s equity.

A statement of retained earnings shows changes in retained earnings over time, typically one year. The recording of retained earnings is done on the balance sheet of a company. Typically, retained earnings are judged based on their relationship to a company’s total assets.

Retained earnings, also known as accumulated earnings, is a company’s total earnings or profit that have been retained since the business first began. Sometimes a separate statement for the recording of retained earnings is also. Retained earnings debit or credit can.

The ideal ratio between retained earnings and total assets is. On the balance sheet, the retained earnings. Retained earnings on a balance sheet.

Retained earnings represent the portion of net profit on a company's income statement that is not paid out as dividends. 4 rows how do you calculate retained earnings on a balance sheet? Retained earnings can be found in the shareholders’ equity section of a company’s balance sheet.

These retained earnings are often. Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its shareholders. What is a statement of retained earnings?