Sensational Info About Size Of Balance Sheet Cfi Cash Flow Statement

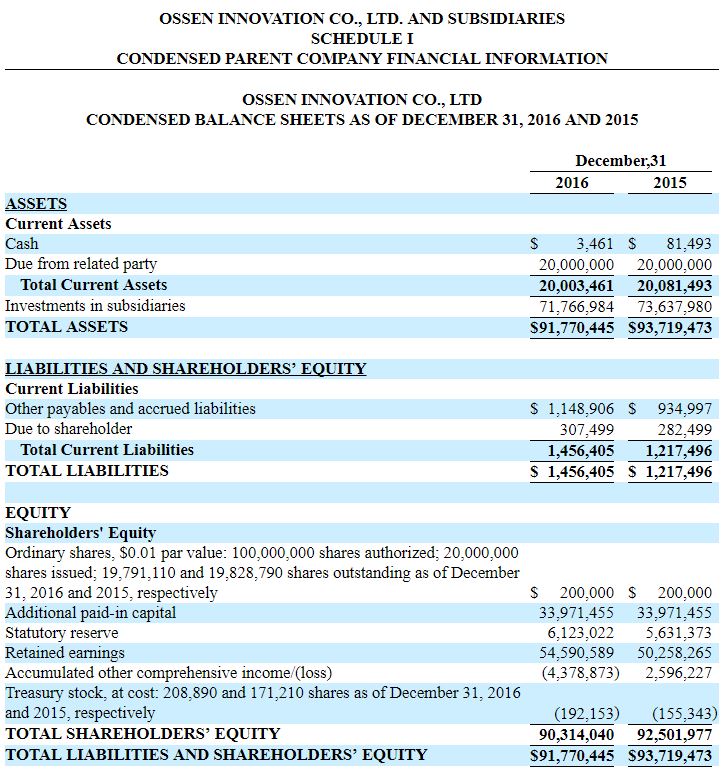

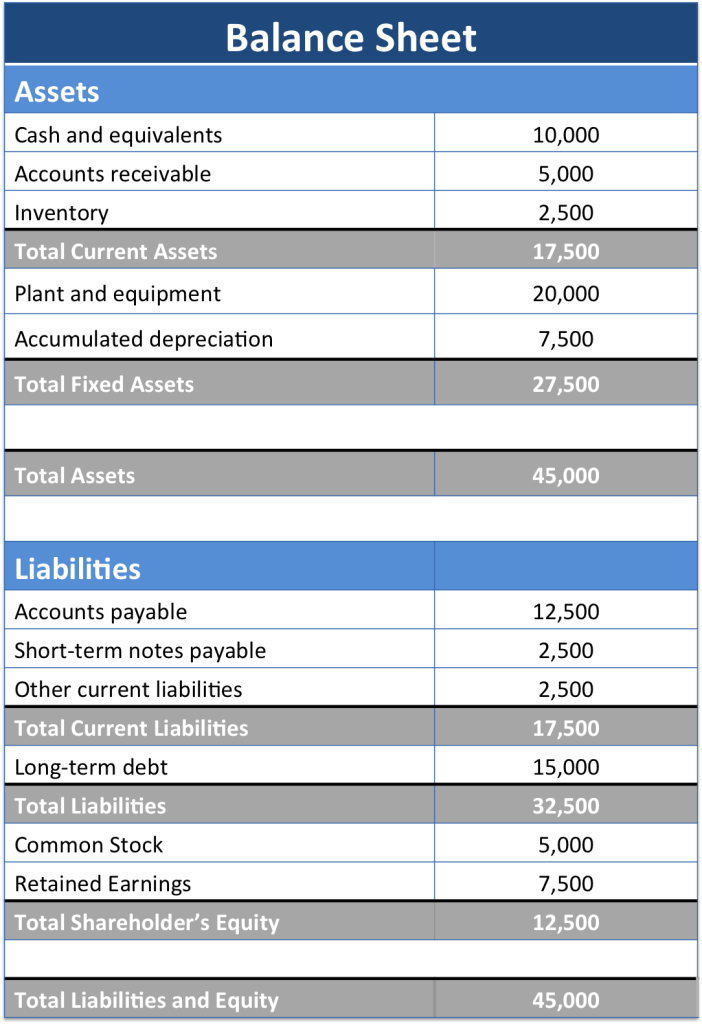

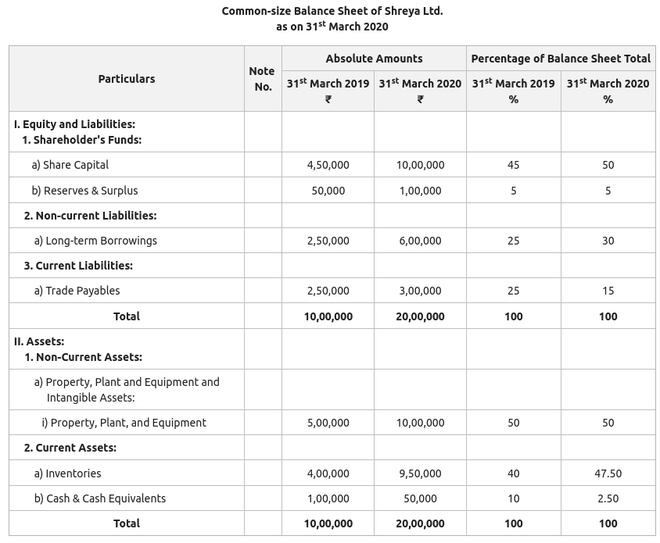

For example, let's assume that company xyz's balance sheet looks like this:

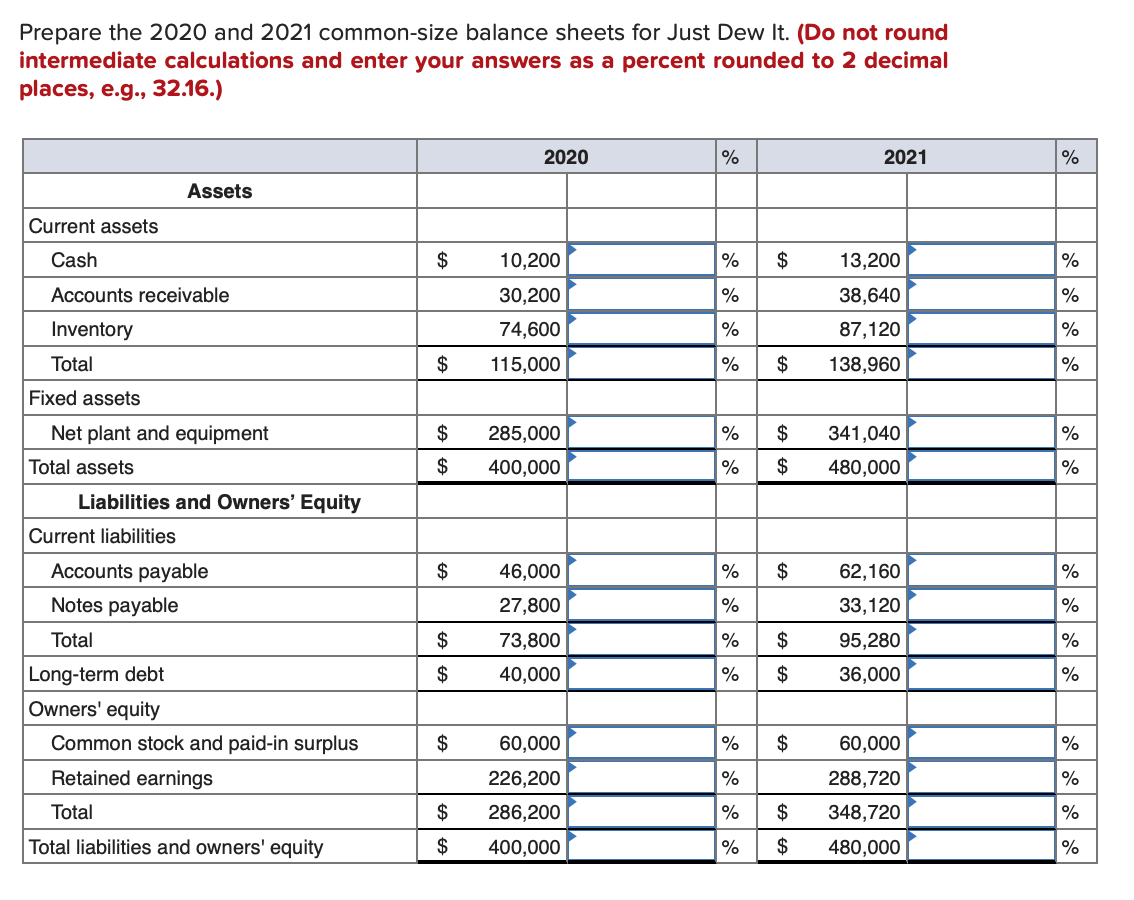

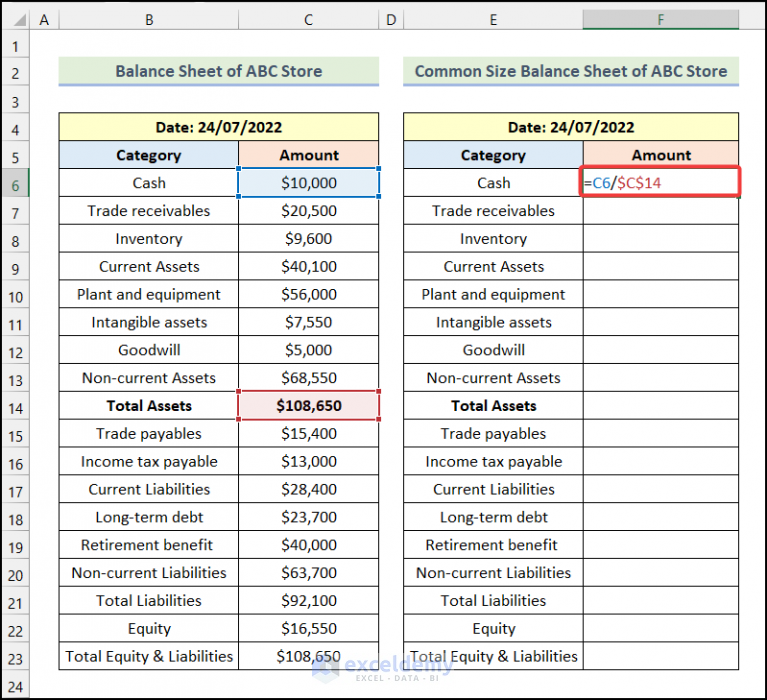

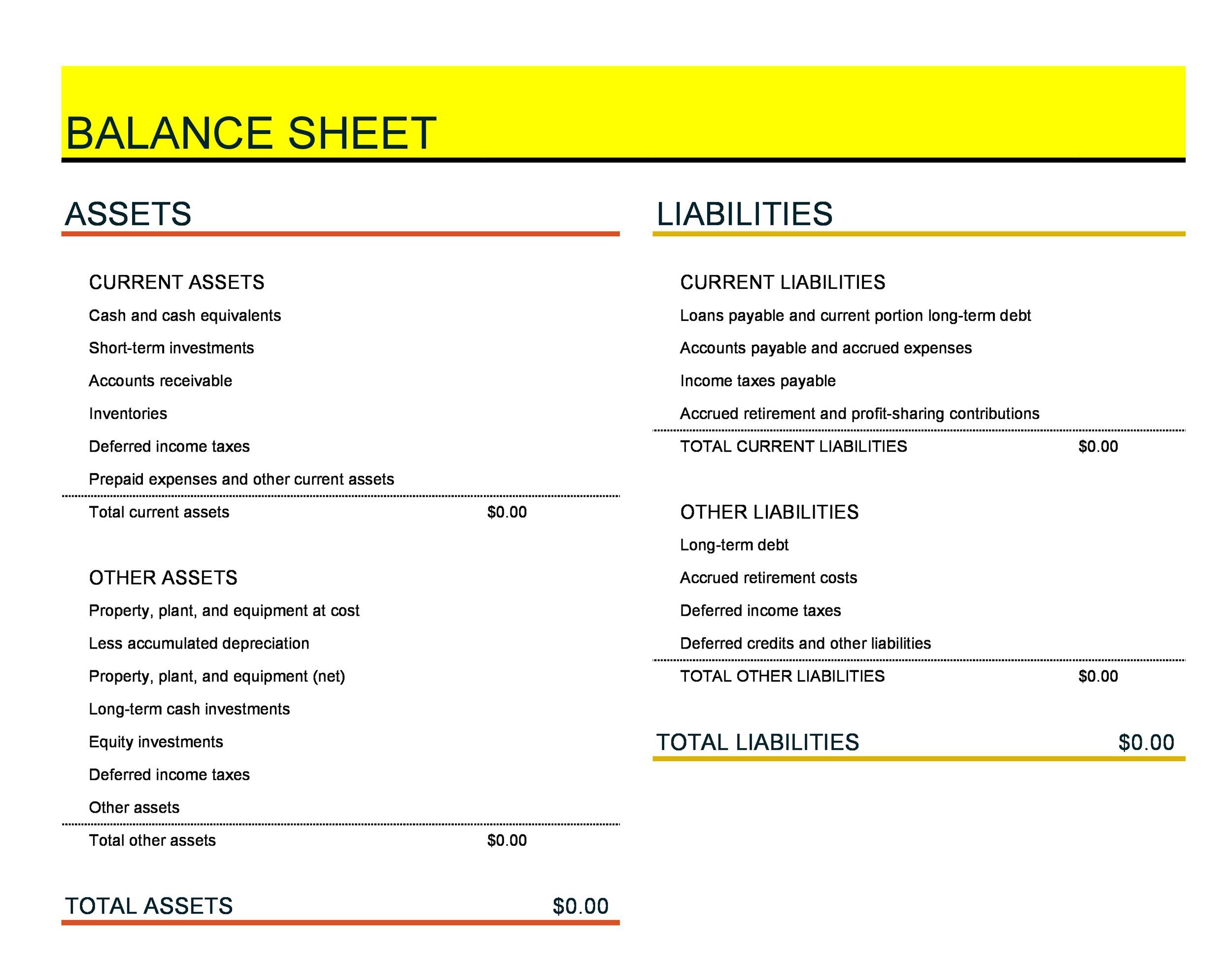

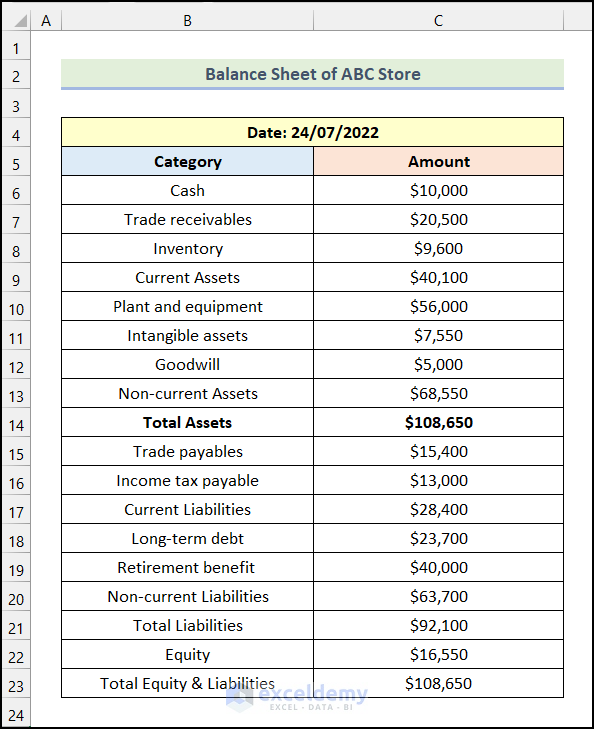

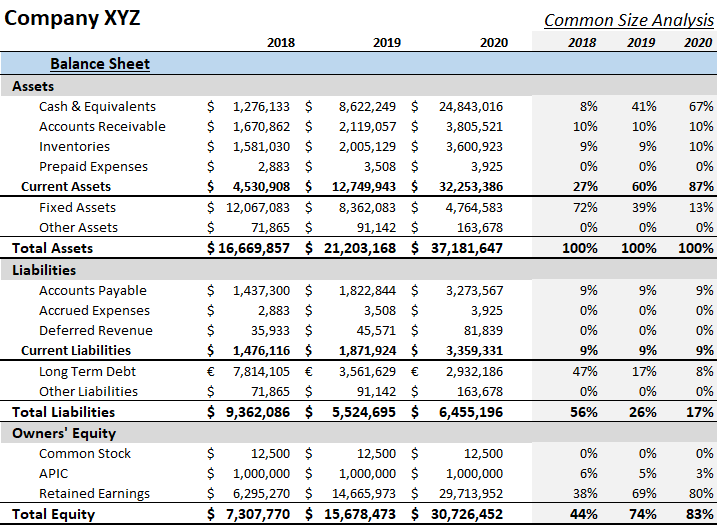

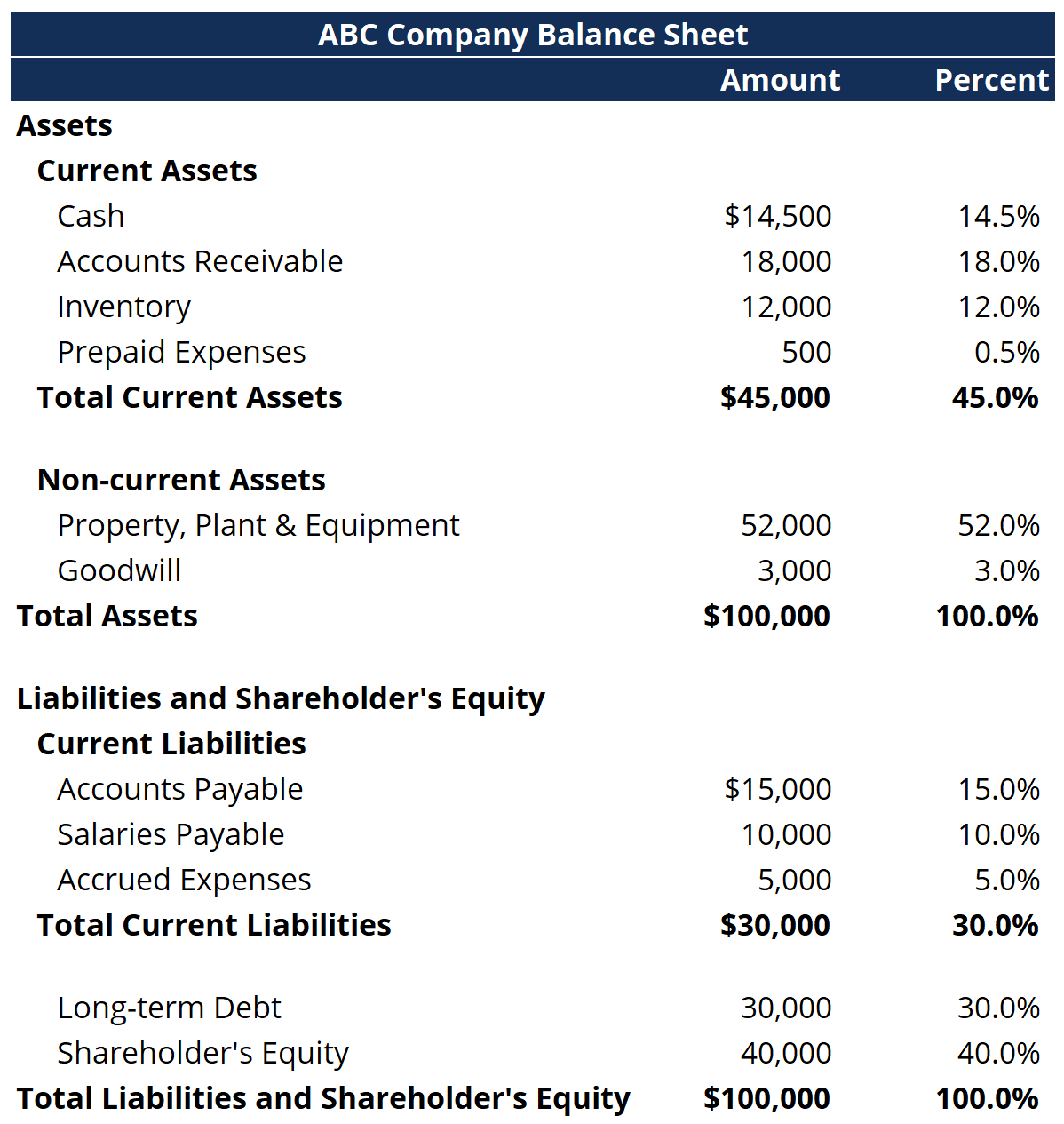

Size of balance sheet. Learn what a balance sheet should include and how to create your own. The “common size balance sheet” format includes various financial elements such as assets, liabilities, and equity, presented as a percentage of total assets. Assets = liabilities + equity.

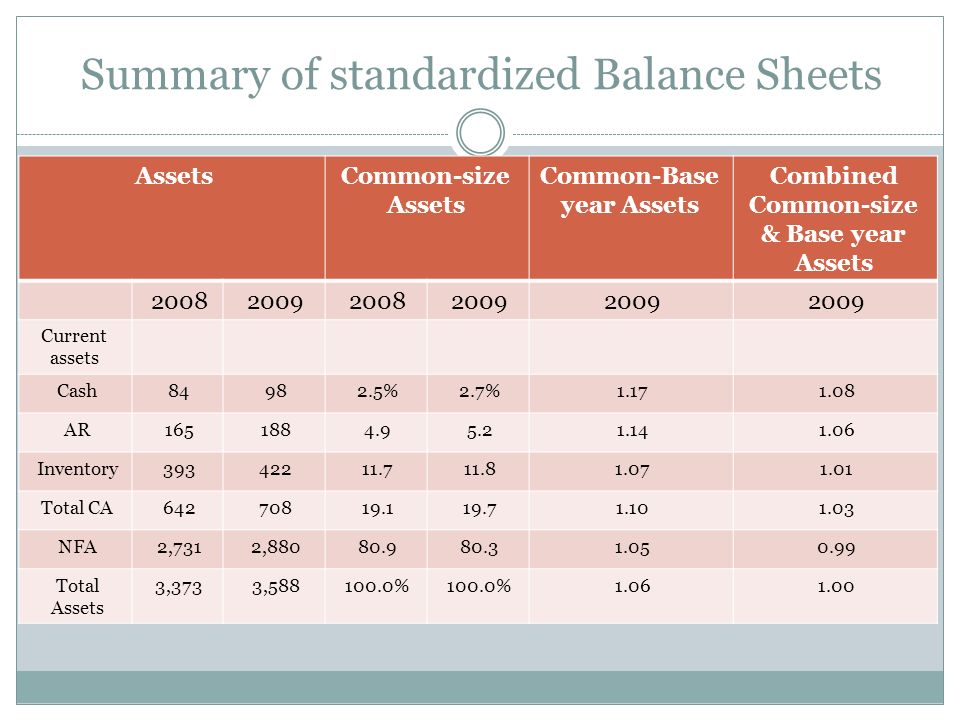

Helps in building trend lines to discover the patterns over a specific. Jason fernando updated january 31, 2024 reviewed by margaret james what is a balance sheet? Balance sheet common size analysis.

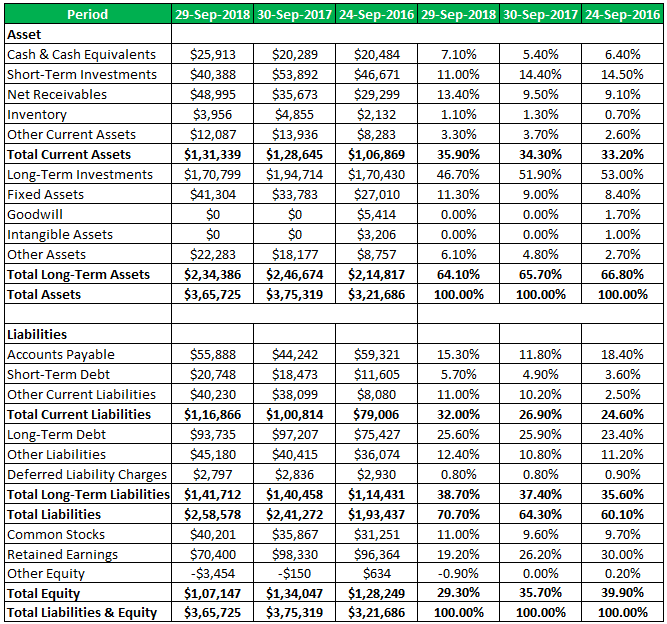

Example of common size balance sheet. A financial statement or balance sheet that expresses itself as a percentage of the basic number of sales or assets is considered to be of a common size. (1) to evaluate information from one period to the next within a company and (2) to evaluate a company relative to its competitors.

Formula for common size balance sheet = (line item / total assets)*100 uses of common size balance sheets: A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to rivals. Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new.

Common size balance sheet is the balance sheet that prepares by management to show both values of each item in assets, liabilities, and equity in currency (usd) and percentages (%) at the end of the accounting period. Assets are expressed as a percentage of total assets, liabilities as a percentage of total liabilities, and shareholder equity as a percentage of total shareholder equity. A typical size balance sheet shows the numeric amount and the relative % for total assets, total liabilities, and equity accounts.

The term balance sheet refers to a financial statement that reports a company's assets, liabilities,. A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. A common size balance sheet displays the numeric and relative values of all presented asset, liability, and equity line items.

The common size balance sheet analyzes a balance sheet that presents each item as a percentage of a standard figure. Both parties must match (assets = liabilities + equity) to show an. But tight management of the balance sheet often liberates more cash, preserves options and.

Cumulatively, the policy response resulted in the most aggressive rate hiking cycle in decades (figure 3) and in a faster pace of balance sheet reduction than over the period from 2017 to 2019. This format is useful for comparing the proportions of assets, liabilities, and equity between different companies, particularly as part of an industry analysis or an acquisition analysis. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

Its presentation enables a comparison of the proportionate composition of each category within the balance sheet. It can also be referred to as a statement of net worth or a statement of financial position. A balance sheet includes a summary of a business’s assets, liabilities, and capital.

The formula for calculating a balance sheet into a common size balance sheet you must divide each line item by total assets. Still, policy was also tightened by reductions in the size of the federal reserve’s balance sheet, beginning in june 2022. A common size balance sheet displays the numeric value of all entries and the percentage that each entry is relative to the total value of related entries.

:max_bytes(150000):strip_icc()/Commonsizebalancesheet_final-63f083ed70e64e9da232560ae41429ce.png)