Matchless Tips About Interest Expense On The Balance Sheet Excel Free Download

Add the prime rate of 3% to the 2% margin.

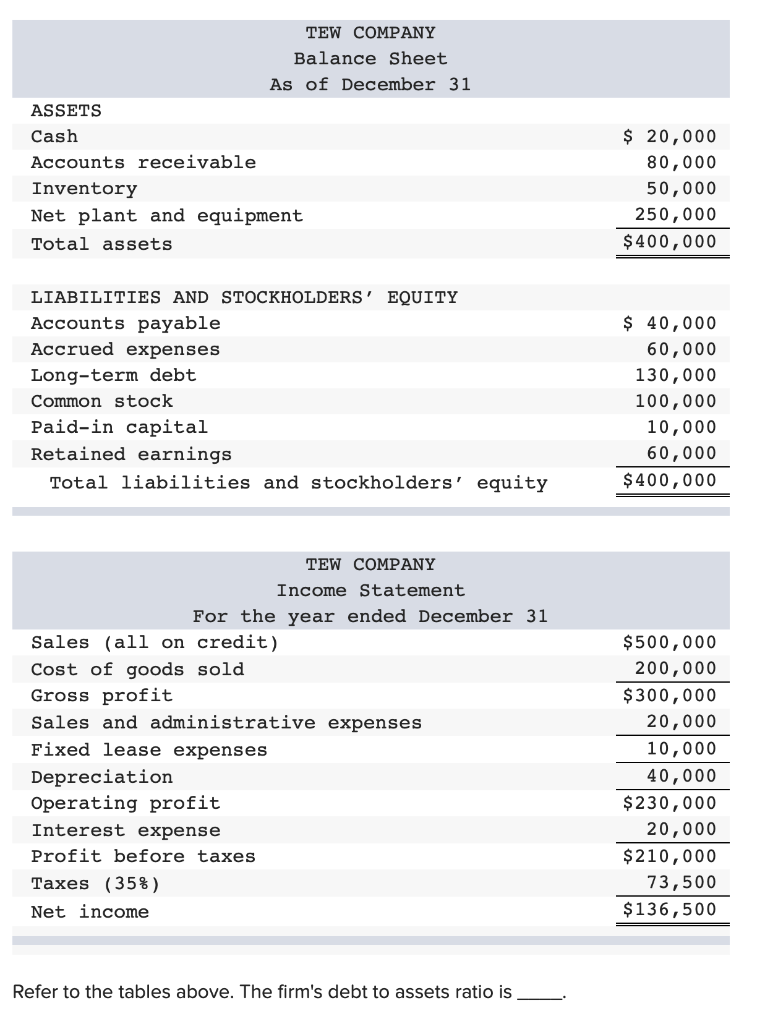

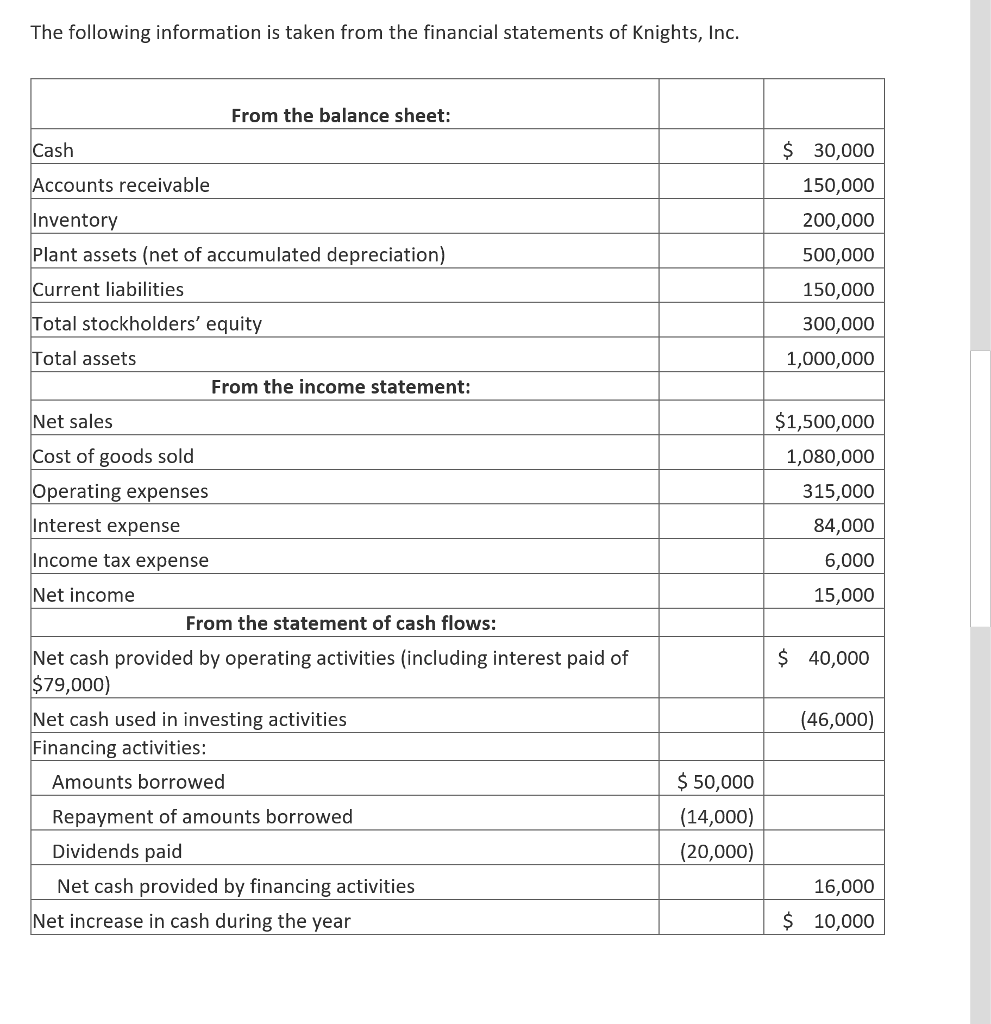

Interest expense on the balance sheet. Interest is found in the income statement, but can also be calculated using a debt schedule. The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. It is useful to always read both the income statement and the.

Calculate the annual interest rate: In february, the interest expense would be slightly lower because. Add “interest payable,” which is the amount of interest the company owes (not yet paid), under “current liabilities” on the balance sheet.

Interest expense impacts a company’s income statement, balance sheet, and cash flow statement and plays a key role in financial metrics like the interest. Record it in a liabilities account, if it was accrued. Interest payable on the balance sheet.

So an increase in interest expense of x dollars, reduces. To calculate the annual interest expense: Where are expenses on the balance sheet published:

8% = 0.08 = interest expense. It is a liability account, and the sum shown on the balance sheet until the balance sheet date is usually depicted as a line. Interest expense is the cost of borrowed funds.

31 days / 365 days = time period. December 27, 2023 learn where expenses are listed on the balance sheet and understand their. In this case, 3% + 2% = 5%.

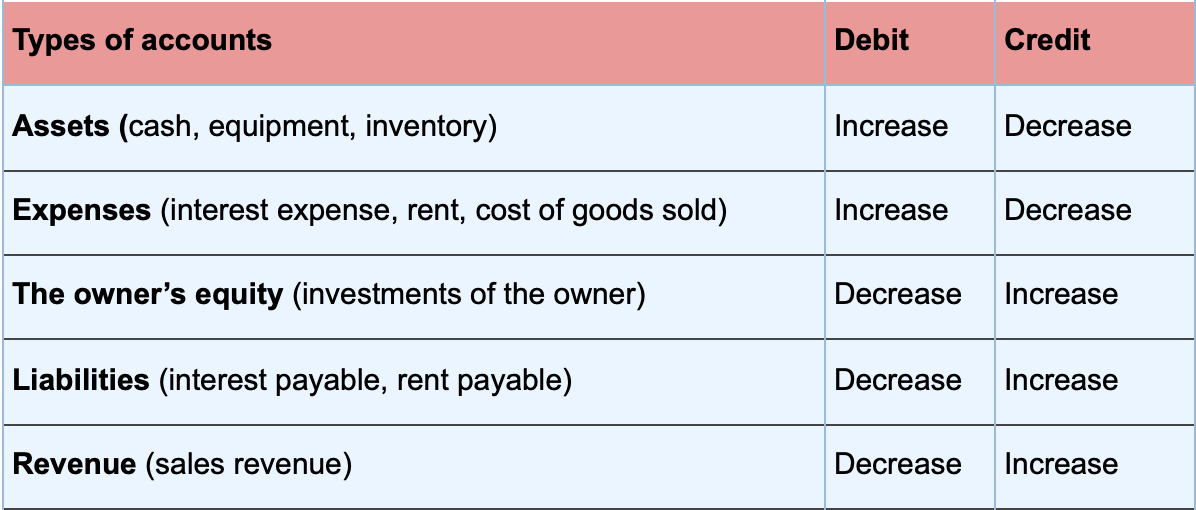

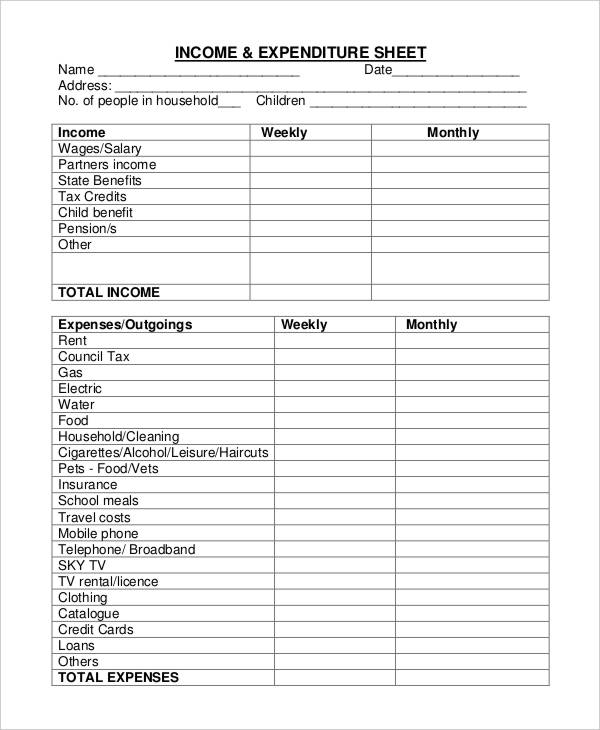

Most of a company's expenses fall into the following categories: Sales, general and administrative expenses; The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

Interest expense calculation example if “circ” = 0 → interest is zero (circularity switch is “on”) if “circ” = 1 → interest is calculating using the average debt. Since the payment of accrued. In short, expenses appear directly in the income statement and indirectly in the balance sheet.

Treasurer's guidebook accounting for interest expense once calculated, interest expense is usually recorded by the borrower as an accrued liability. Below is an example of where interest expense appears on the income statement: Interest expense is subtracted from gross profit on the income statement.

Interest expenses may be recorded on the balance sheet as current liabilities before they are expensed.