Neat Tips About Comprehensive Income Equation Example Of Financial Statement A School

Net income, and other comprehensive income, which incorporates the items excluded from the income statement.

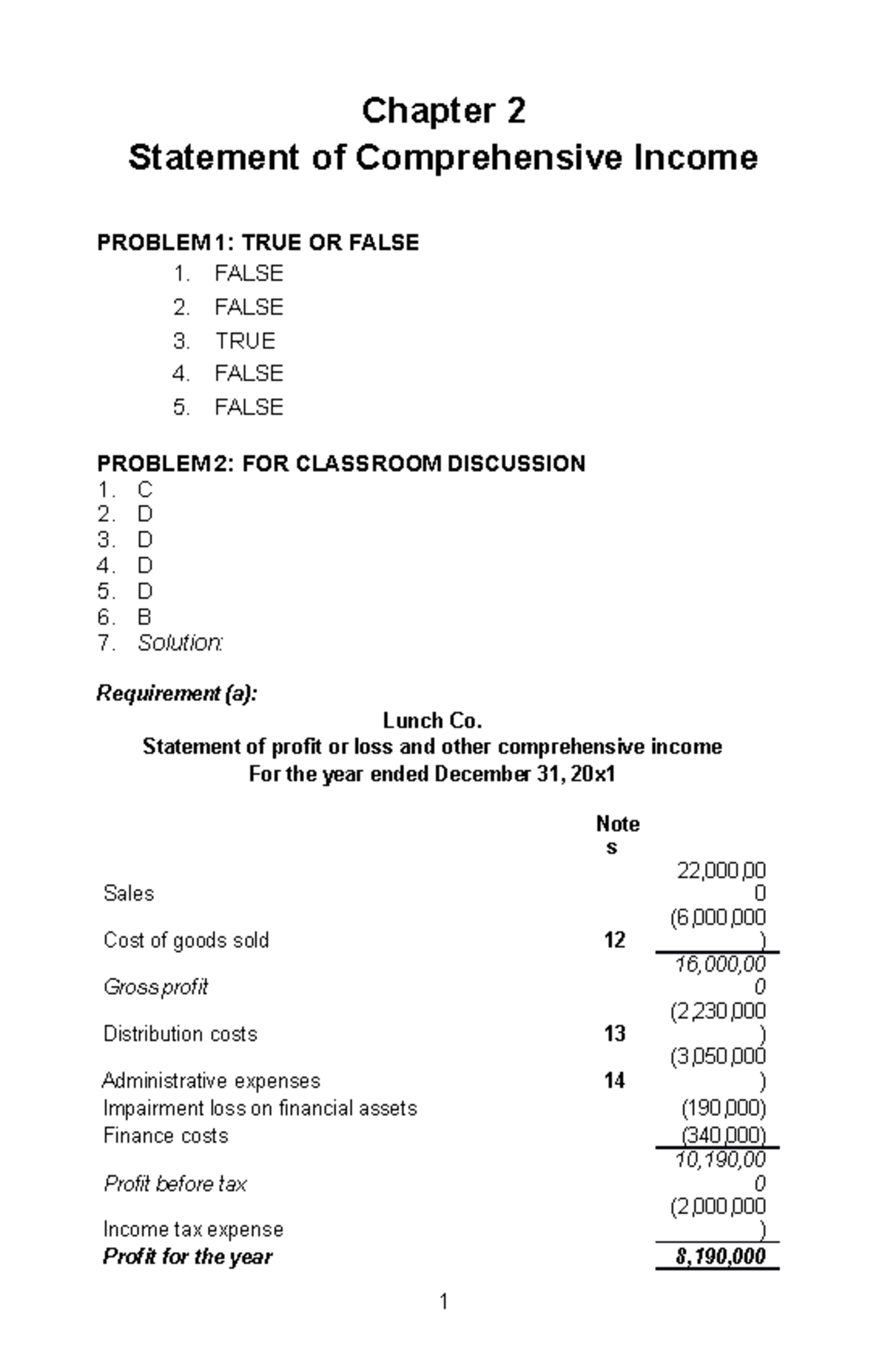

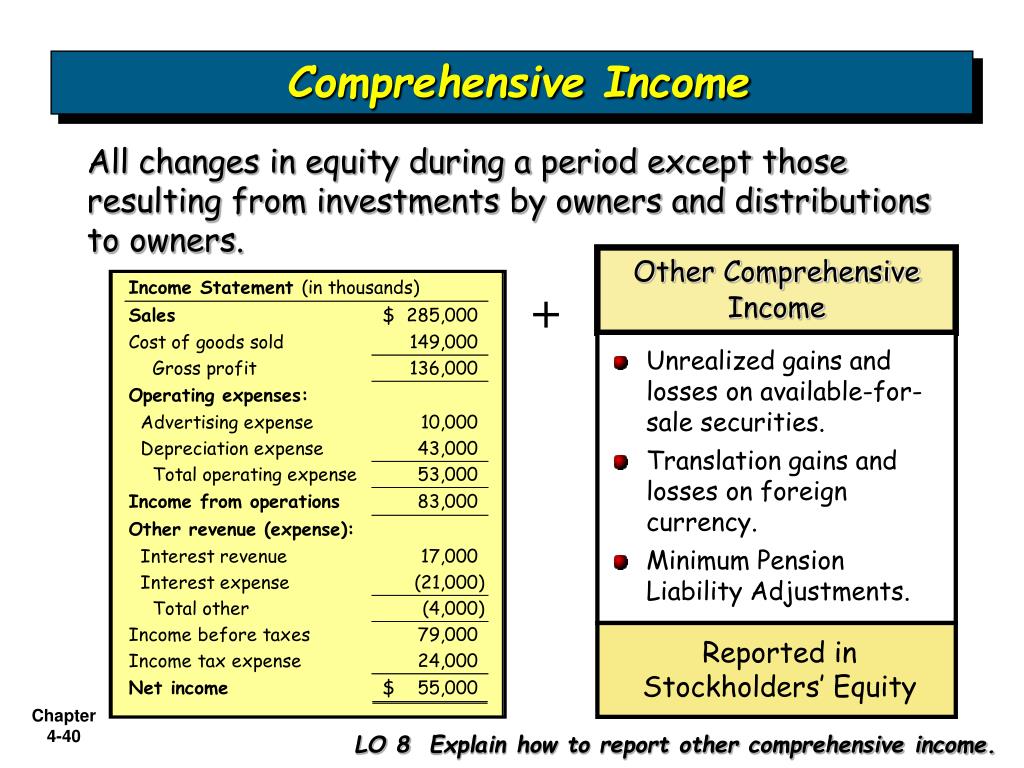

Comprehensive income equation. Net income results from the usual operations of a company. The statement of retained earnings includes two key parts: Comprehensive income statements let businesses record the earnings they get from all sources.

Accumulated other comprehensive income (aoci) are special gains and losses that are listed as special items in the shareholder equity section of a. The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of users.

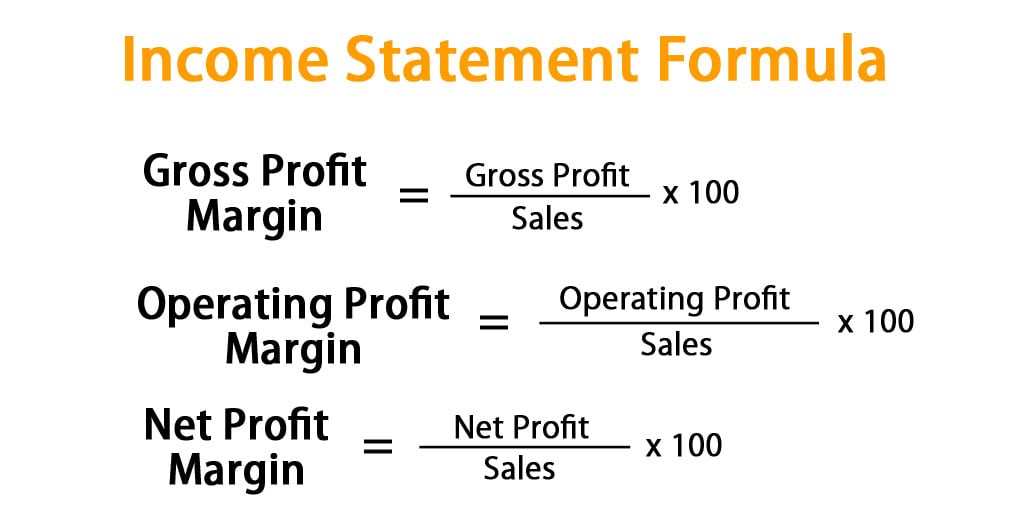

Net income or net loss (the details of which are reported on the corporation's income statem. The differences between net income and comprehensive income are referred to as other comprehensive income items. Definition of comprehensive income comprehensive income for a corporation is the combination of the following amounts which occurred during a specified period of time such as a year, quarter, month, etc.:

Definition and formula components of comprehensive income comprehensive income has two major components, which are other comprehensive income (oci) and net income. Quote guest, 2 september, 2014 the opening statement is inaccurate. Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a company prepares the financial statements of the accounting period, and the same is presented after net income on the company’s income statement.

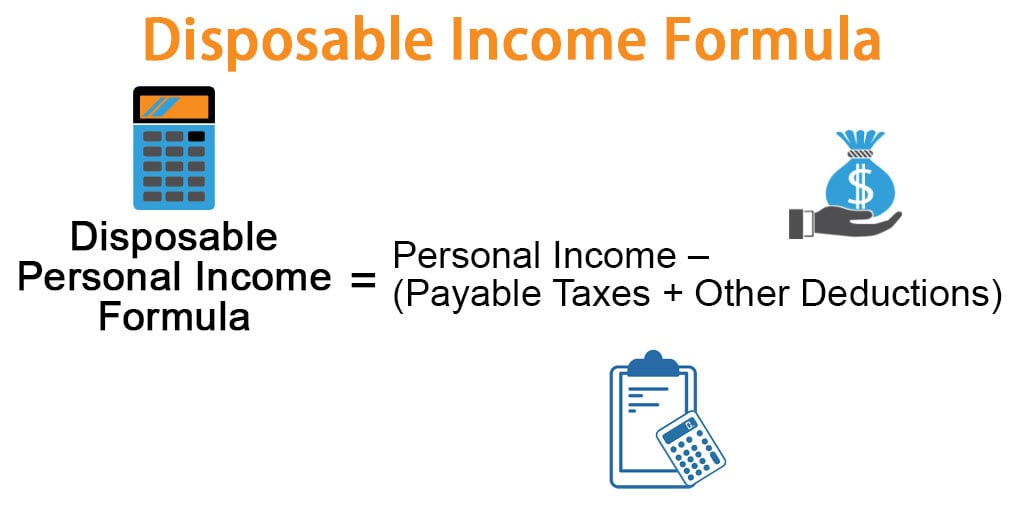

Learn about the comprehensive income with the definition and formula explained in detail. Net income plus other comprehensive income = comprehensive income. Example of comprehensive income calculation.

Other comprehensive income = unrealized gains and losses on available for sale securities, foreign currency exchange rates, and changes to pension benefit obligations. The statement should be classified and aggregated in a manner that makes it understandable and comparable. Other comprehensive income (oci) refers to any revenues, expenses, and gains / (losses) that not have yet been realized.

The statement of comprehensive income reports the change in net equity of a business enterprise over a given period. Use the following comprehensive income formula: Analogously, the patterns of relative decision usefulness differ between income definition equation (6) and components equation (7) and adjusted r 2 s are uniformly larger for equation (7), lending further support to hypothesis h 5 and the disclosure of comprehensive income components.

Some people refer to net income as net earnings, net profit, or simply your “bottom line” (nicknamed from its location at the bottom of the income statement ). In business accounting, other comprehensive income (oci) includes revenues, expenses, gains, and losses that have yet to be realized and are excluded from net income on an income statement. Fact checked by marcus reeves what is comprehensive income?

Comprehensive income calculation. The best way to demonstrate the computation of comprehensive income is the use of an an example. Comprehensive income includes net income.

There is a formula to calculate comprehensive income. The net income from the other comprehensive income statement the sum total of comprehensive income is calculated by adding net income to other comprehensive income. Lewis what is comprehensive income?

:max_bytes(150000):strip_icc()/comprehensiveincome_final-2ff1de7967204cd2a69a4ab5b8778fff.png)