Build A Info About Audited Accounts Meaning Five Year Financial Projection

Auditing makes certain that companies represent their financial positioning fairly and accurately, and in accordance with accounting standards.

Audited accounts meaning. An auditor examines a company’s financial data and reporting methods to determine accuracy and compliance with generally accepted accounting principles. Over the years, the role of auditing evolved to verifying written reports: In accounting, there are three main types of audits:

Are there different types of auditing in accounting? An audit cycle is the accounting process that auditors employ in the review of a company's financial statements and related information. The purpose of an audit is to ensure that an organization's financial records are honest and accurate.

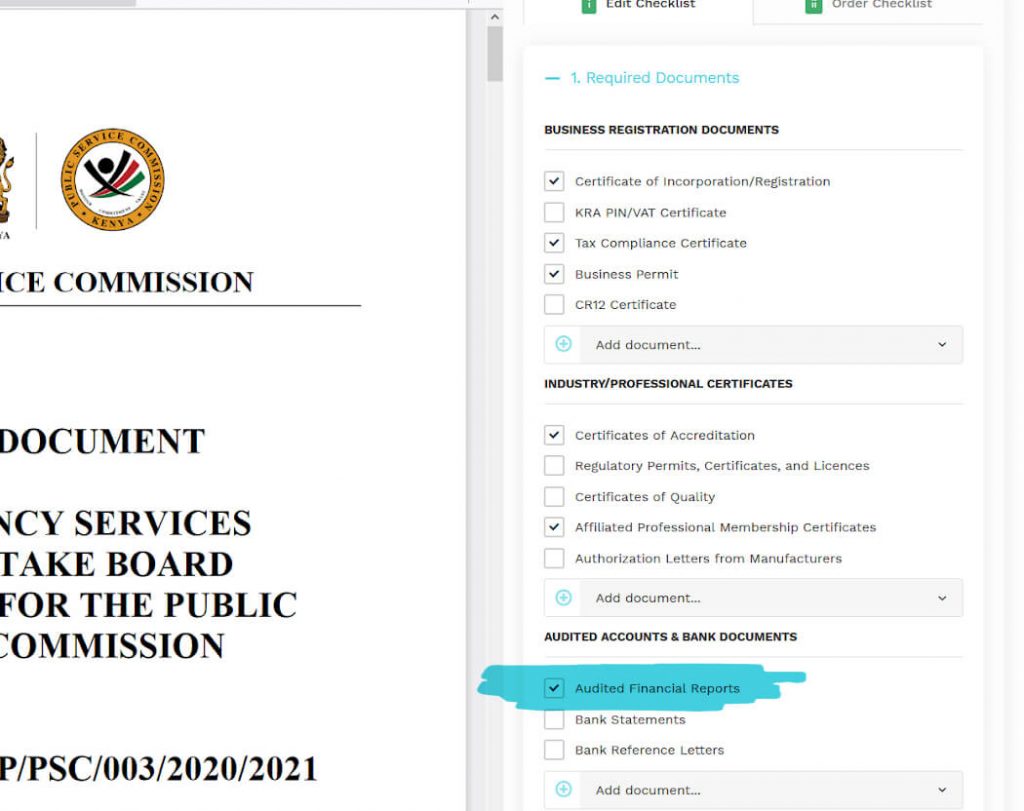

Specifically, the financial records of individuals and businesses. Noun [ plural ] accounting uk us a company's financial records that have been officially examined to check that they are accurate: An audited financial statement is any financial statement that a certified public accountant (cpa) has audited.

An auditor is a person authorized to review and verify the accuracy of financial records and ensure that companies comply with tax laws. Based on 18 documents. Auditing auditors come in behind accountants and verify the work they do.

External, internal, and internal revenue service (irs) audits. Auditing, a staple of the accounting practice, is the process of examining the accuracy of financial statements and a company's financial reporting. Audited financial statements are the financial statements of an organization that have been examined by a certified public accountant (cpa).

This is also why accountants often make good auditors—they know what to look for and when something appears problematic. If all is well, the auditor will state that the accounts give a true and fair picture of the company's affairs. 1 n an inspection of the accounting procedures and records by a trained accountant or cpa synonyms:

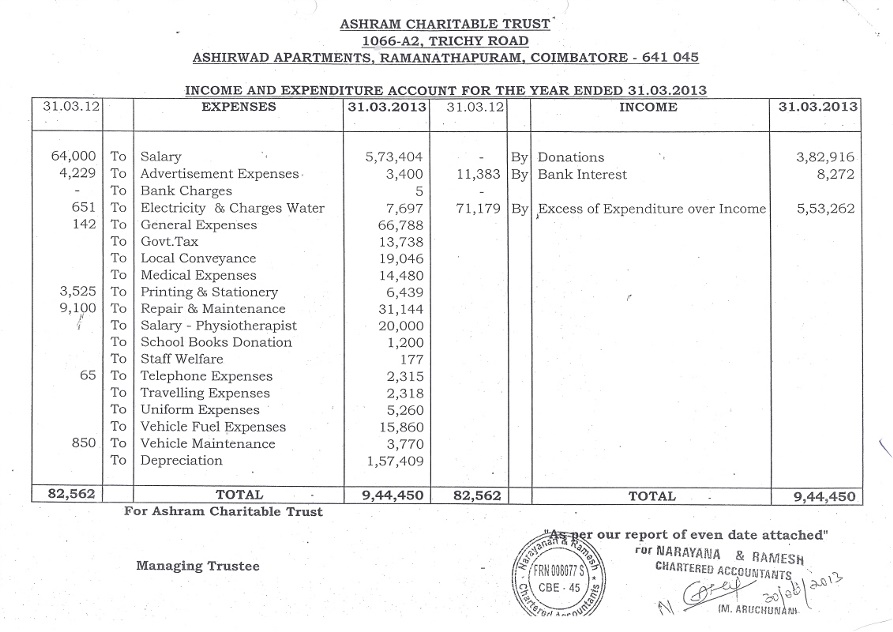

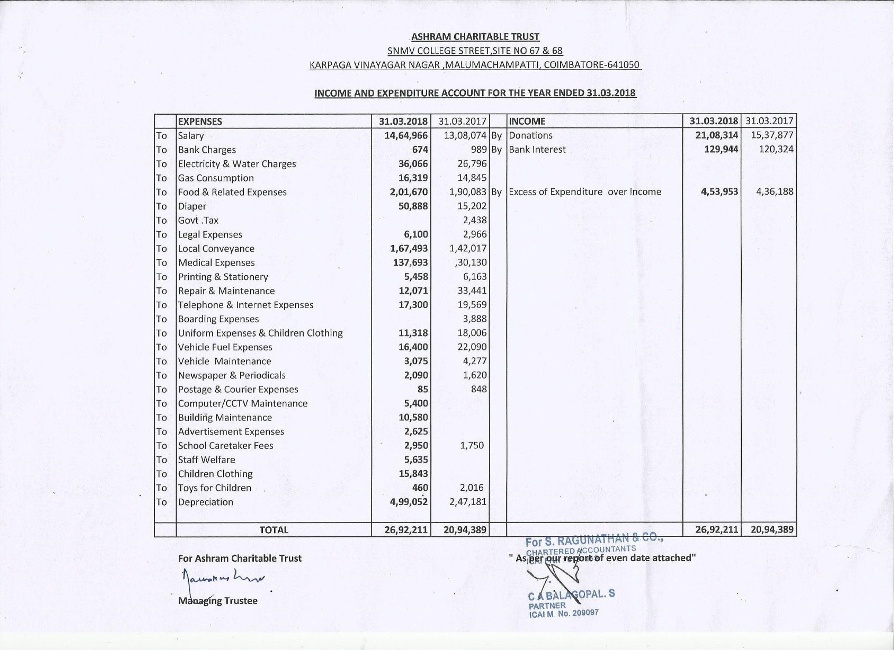

When the financial results which a company compiles have been checked by an accountant qualified to conduct an audit, known as an auditor, they are known as audited accounts. Financial audit an attestation that the client's financial statement is accurate limited audit an audit of limited scope (limited in time span or confined to particular accounts etc.) type of: Accounting involves generating financial records, while auditing involves checking them.

An audit is the review or inspection of a company or individual's accounts by an independent body. The purpose of the independent audit is to provide assurance that company management has presented financial statements that are free from material error. They examine the financial statements prepared by accountants and ensure they represent the company's financial position.

Audited financials include a signed statement from the auditor, saying that the financial statements present fairly the results, financial position, and cash flows of the issuing entity. Audited and unaudited financial statements contain the same types of financial information. There are different types of audits that can be performed depending on the subject matter under consideration, for example:

The company must submit fully audited accounts. An unaudited statement is a financial statement that has been prepared by an auditor, but for which a standard set of audit procedures have not been performed. An impartial study and assessment of an organization's financial statements constitute a financial audit.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)