Fine Beautiful Info About Basic Financial Ratio Gross Margin Balance Sheet

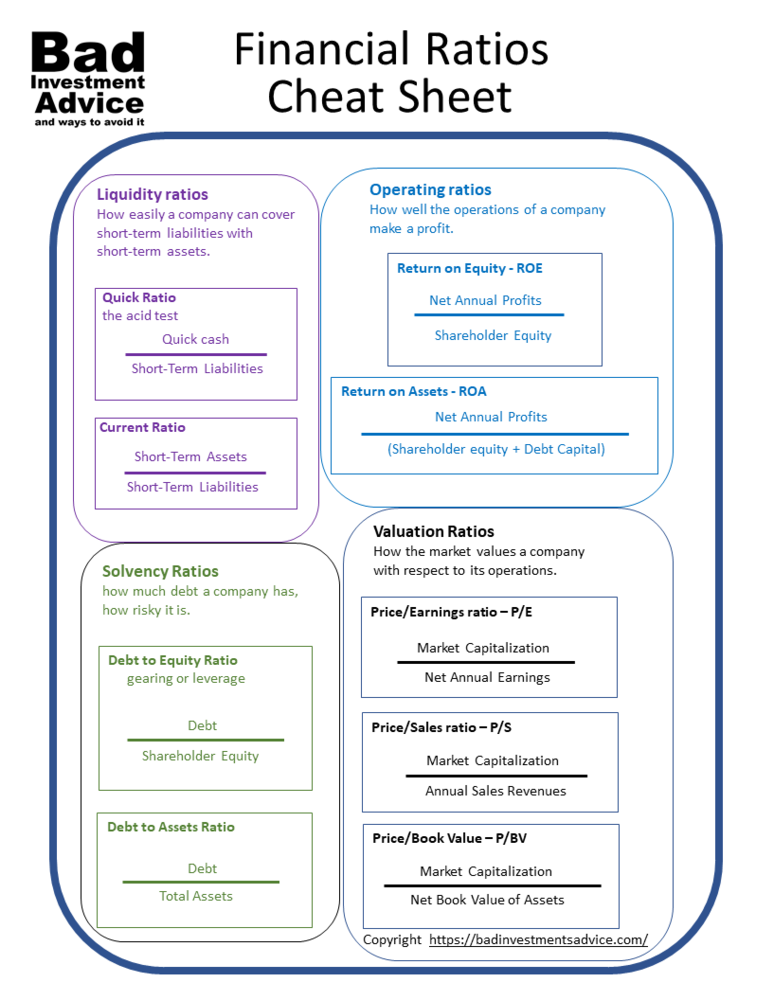

Ratio #4 debt to equity ratio.

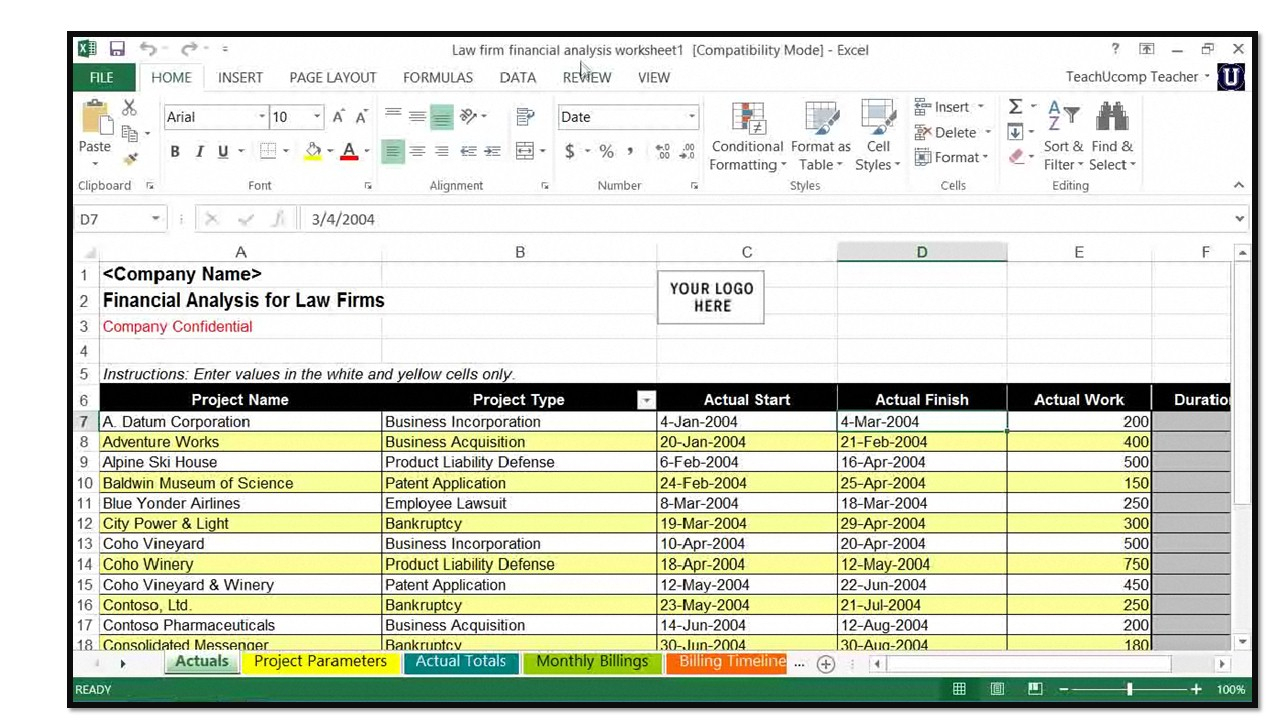

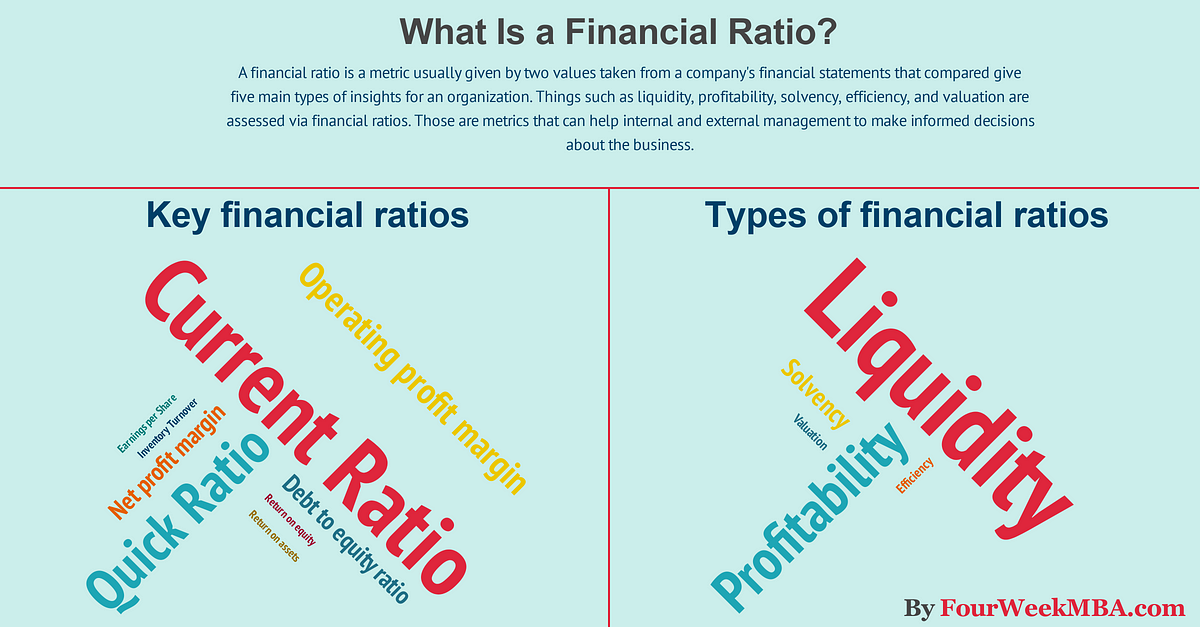

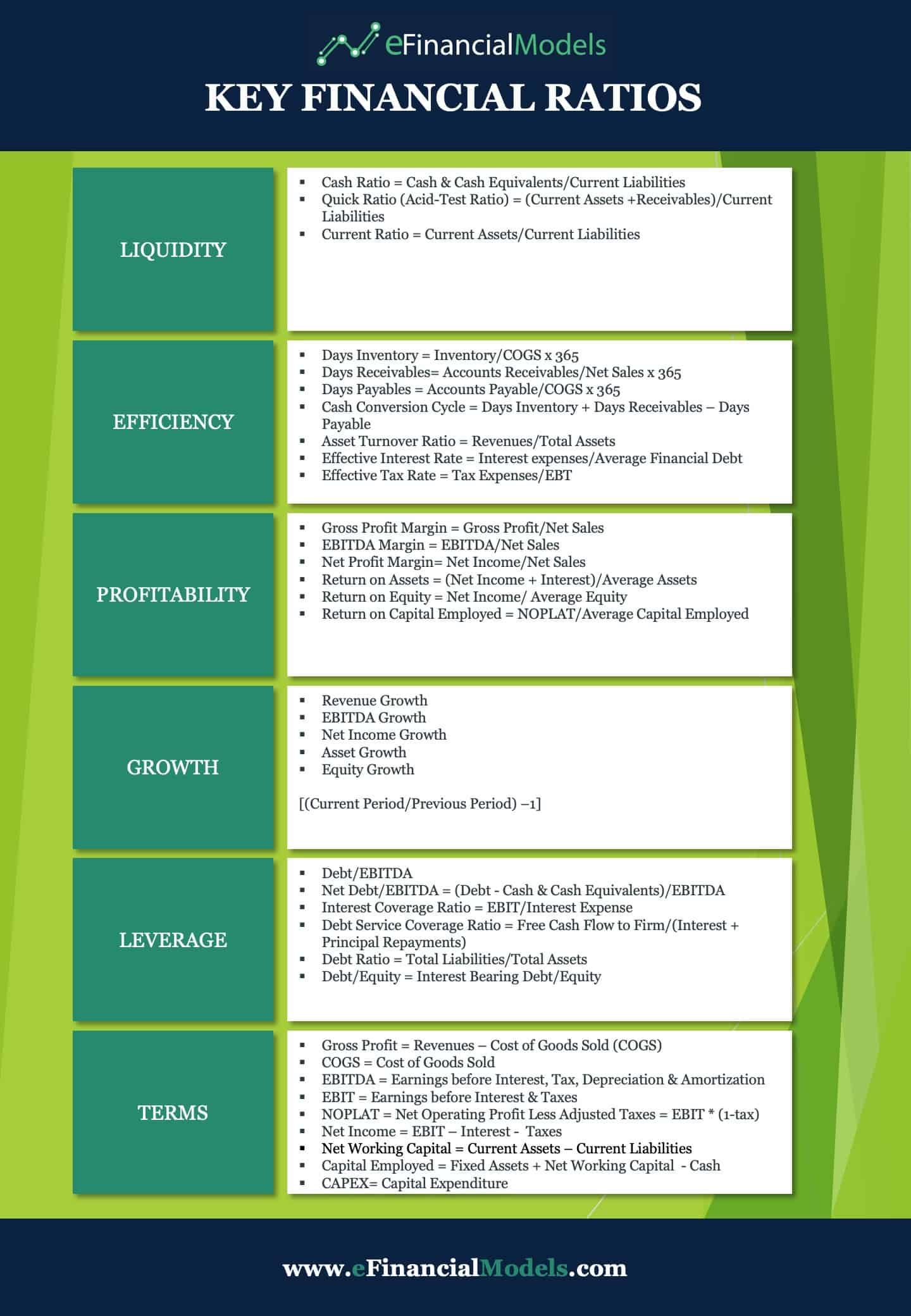

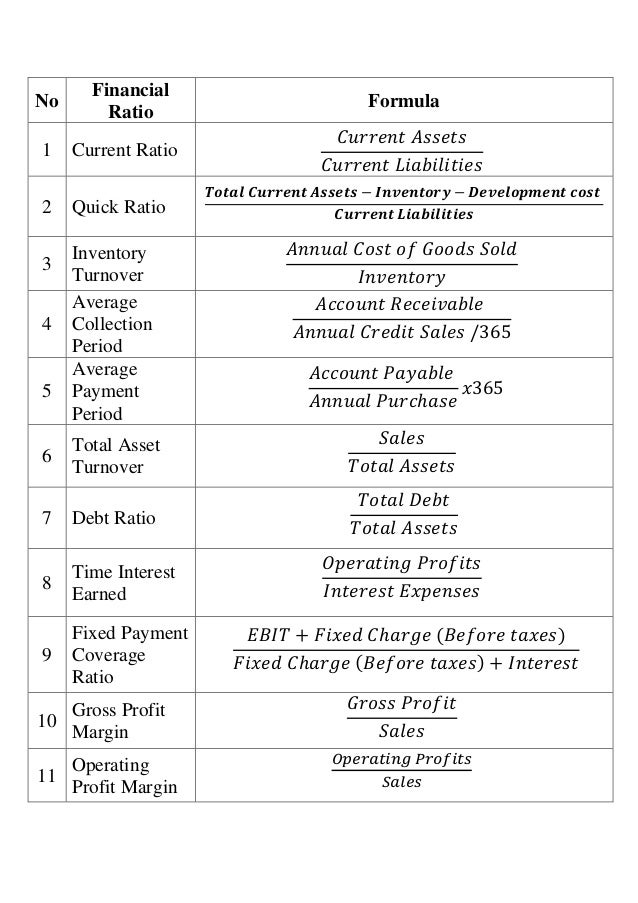

Basic financial ratio. Use financial statements to calculate basic financial ratios to measure the profitability and health of a business. From profitability to liquidity, leverage, market, and activity, these are the 20 most important ratios for financial analysis. Ratios include the working capital ratio, the quick ratio, earnings per share (eps),.

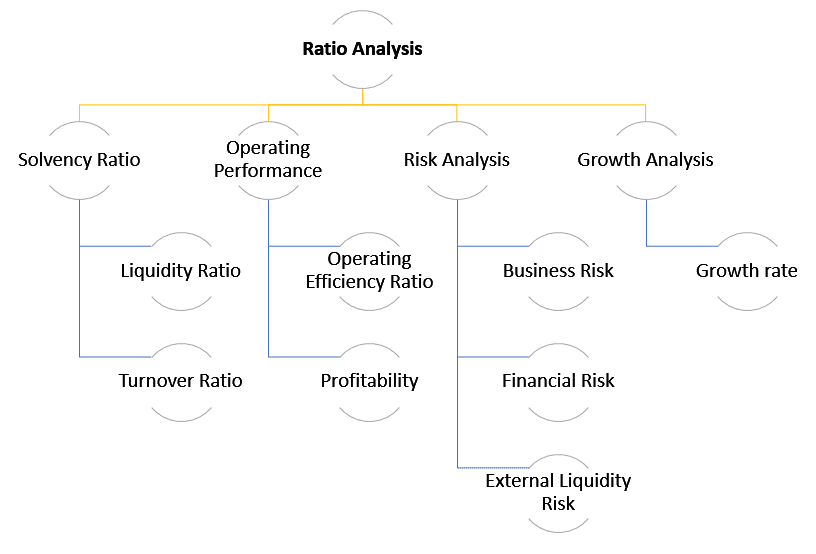

Everything you’ll learn in the financial ratios definitive guide. Eps = net profit / number of common shares to find net profit, you’d subtract total expenses from total revenue. Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc.

Common financial ratios come from a company’s balance sheet, income statement, and cash flow statement. What are financial ratios? The data you can glean from them will give you an edge, compared to others who don't take the time to look at these figures.

Financial ratios are snapshots, so it's important to compare the information to previous periods of. As tools of financial analysis, these numerical metrics offer profound insights into a company's profitability, liquidity, efficiency, and solvency. Why to use ratio analysis;

Analysis of financial ratios serves two. Corporate finance ratios are quantitative measures that are used to assess businesses. Uses and users of financial ratio analysis.

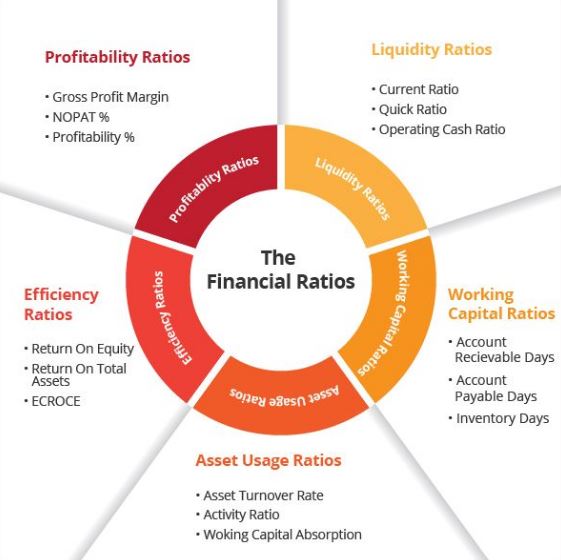

The working capital ratio is calculated by dividing current assets by current liabilities. Ratio #3 quick (acid test) ratio. The idea is to show how well current liabilities are covered by cash and by items with a ready cash value.

Liquidity, solvency, efficiency, profitability, market prospect, investment leverage, and coverage. Financial ratios are made with the utilization of mathematical qualities taken from budget reports to acquire significant data about an organization. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization.

Using a ratio means taking one number from a company's financial statements and dividing it by another. So, assume a company has a net profit of $2 million, with 12,000,000 shares outstanding. Financial ratios are grouped into the following categories:

Financial ratio analysis is performed by comparing two items in the financial statements. Ratio #5 debt to total assets. Financial ratios are basic calculations using quantitative data from a company’s financial statements.

Financial ratios allow consumers of financial information to compare how companies are doing relative to their industry or even how they are faring from one period (month, quarter, year) to another. Liquidity ratios, leverage financial ratios, efficiency ratios, profitability ratios, and market value ratios. A best practice approach to ratio analysis;