Build A Info About Accounts Payable On Personal Financial Statement Sample Income And Expenditure

Sba form 413, formally titled “personal financial statement,” is a document that the u.s.

Accounts payable on personal financial statement. 30 apr 2022 (updated 30 sep 2022) us financial statement presentation guide 11.3. What is accounts payable (ap)? A personal financial statement is a document that details an individual's assets and liabilities.

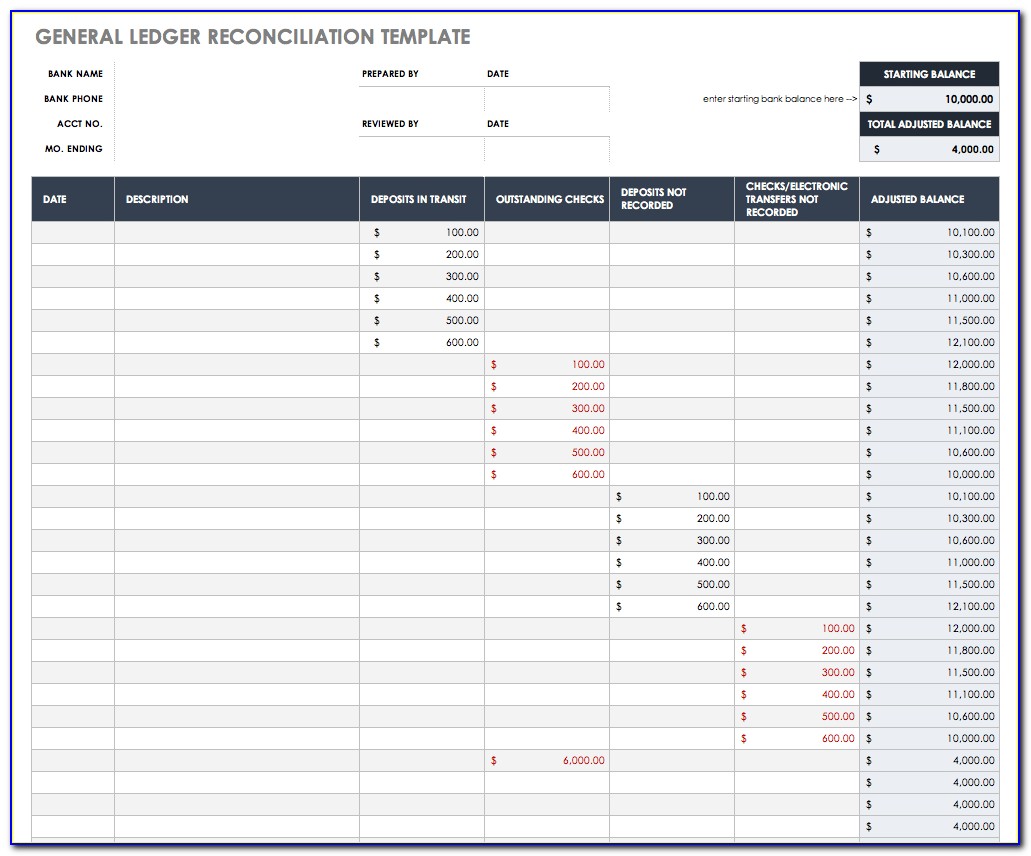

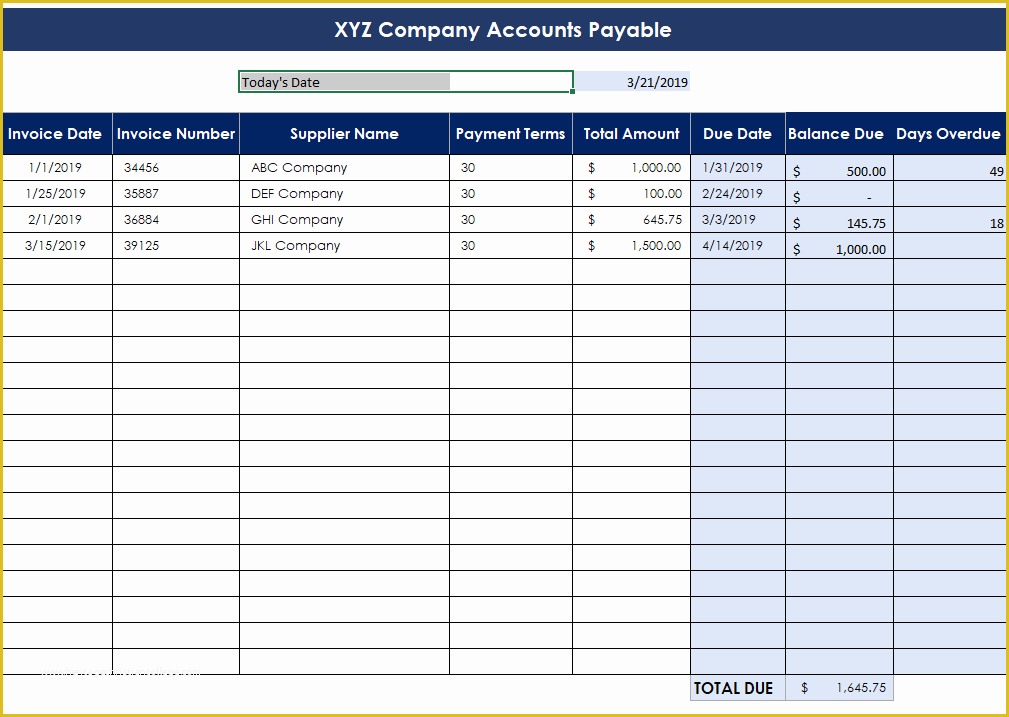

Financial statements are collections of data that provide a comprehensive picture of the financial. Accounts payable specialists maintain this record and provide portions of it at the company's request. Their role is to complete payments and control expenses by receiving payments, plus processing, verifying and reconciling invoices.

The accounts payable portion reflects any debts owed to anyone other than a bank. Certificate of deposit physical cash real estate personal properties with significant value: For year 0, we’ll calculate our company’s days payable outstanding (dpo) using the following formula:

The statement typically includes general. Accounts payable is a credit when the business purchases goods or services on credit. Unlike a budget, a financial statement doesn't track every dollar earned or every expense throughout a period.

Stocks, etfs, mutual funds, bonds, commodities retirement accounts: It can display the company's current financial obligations and help improve company leaders' plans for debt repayment. Some people create more detailed personal financial statements, including an income statement or other documents.

In this article, we discuss how the sba uses form 413, address frequent. The balance is a debit when a portion of its account payable is paid. 11.3 accounts and notes payable.

A personal financial statement, or pfs, is a document or set of documents that outlines a person or family’s financial position. For example, suppose your company hires the consulting services of an individual who needs to be paid one week after the invoice has. Payables appear on a company's balance sheet as.

Enter the total amount due on all notes payable to banks and others paid on an installment basis. The term personal financial statement refers to a document or spreadsheet that outlines an individual's financial position at a given point in time. If your business purchases goods from a vendor and agrees to pay after one month, accounts payable is credited.

Notes payable to banks and others: Accounts payable (ap) is generated when a company purchases goods or services from its suppliers on credit. The sba wants to know about any monthly burdens, such as auto payments.

It is generally recorded as a collection of invoices and promissory notes received from a. With accounts payable, report the total amount of products and services purchased on credit or on a regular payment basis, excluding those using credit cards or personal lines of credit. Balance sheets provide an essential puzzle piece in your financial statement.