Cool Info About Accounting For Convertible Loan Notes Frs 102 Amazon Web Services Financial Statements

2% convertible payable loan €1,000.

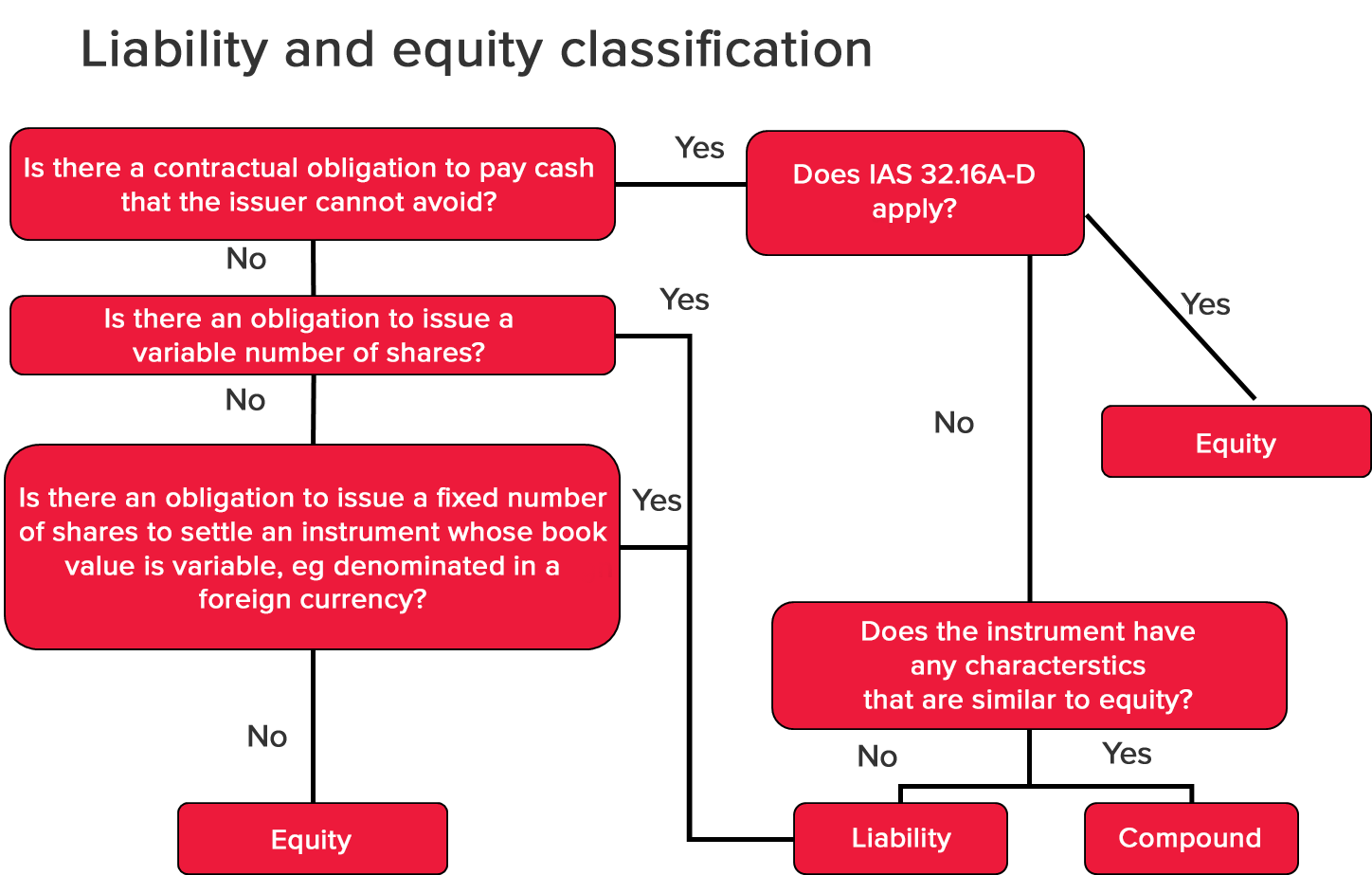

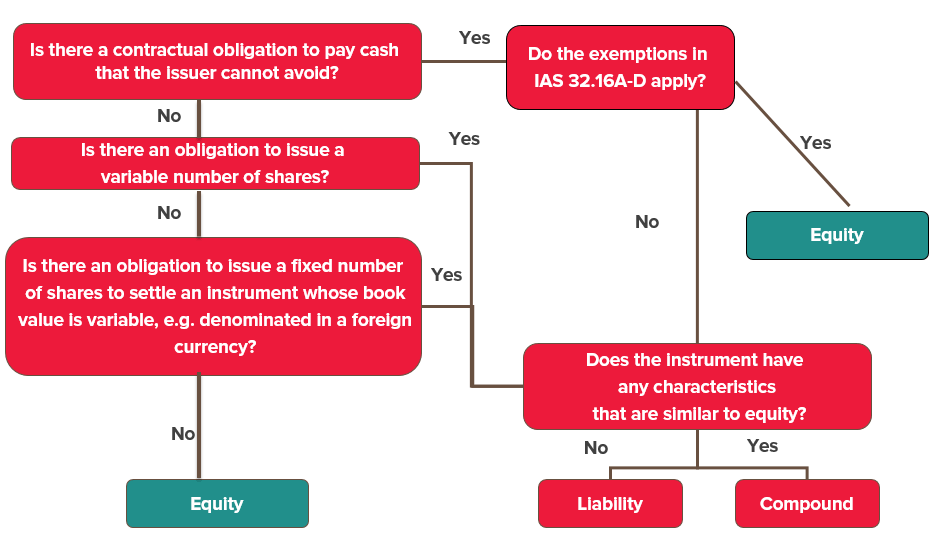

Accounting for convertible loan notes frs 102. Bonds and similar debt instruments; Financial instruments (sections 11, 12 and 22) identifying a financial. Frs 102 section 22 liabilities and equity sets out the requirements classifying financial instruments as either liabilities or equity, accounting for compound financial instruments,.

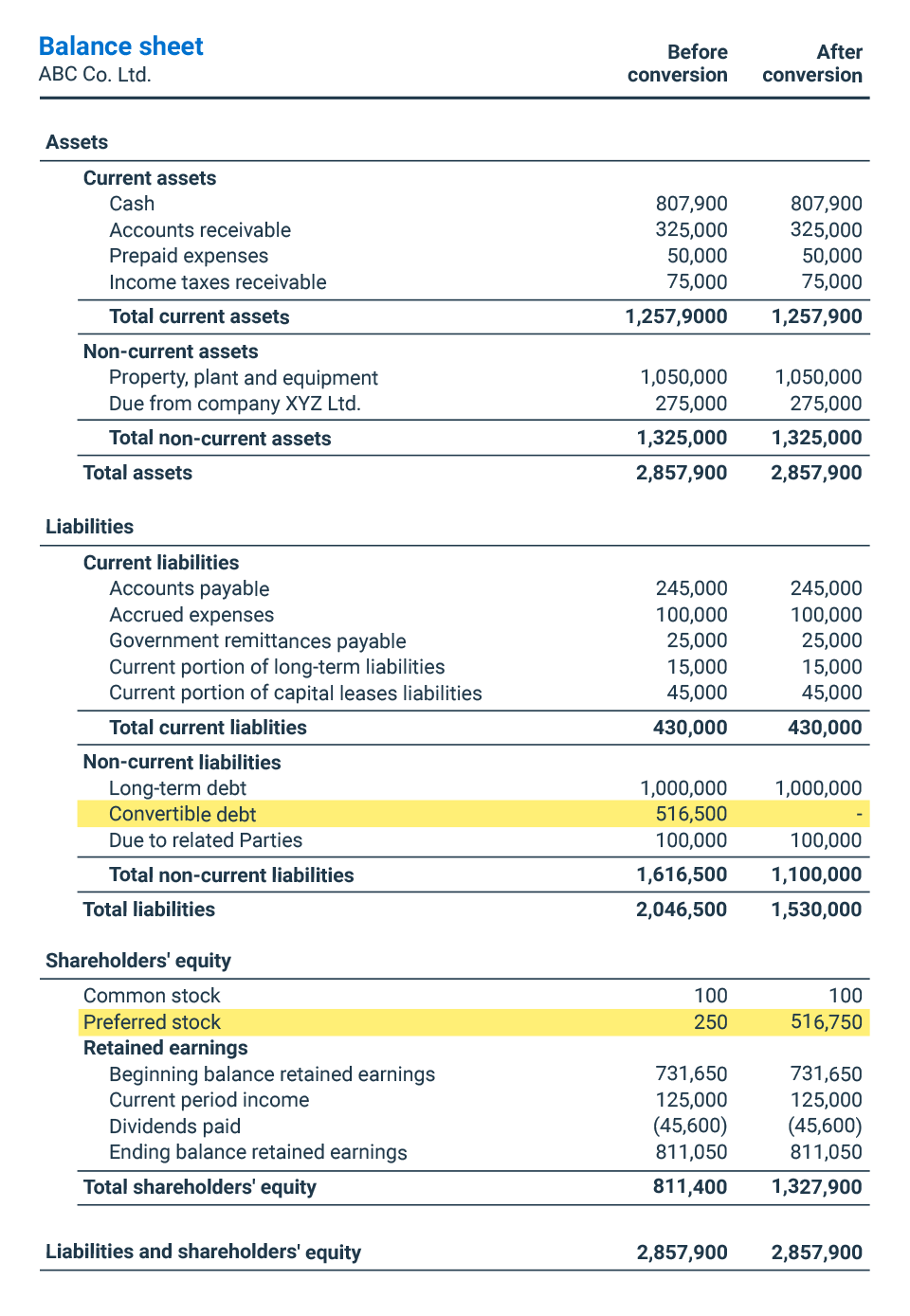

This basically means the company has offered the bank the option to convert the loan at the end into. Frs 102 deals with accounting for financial instruments in section 11 ‘basic financial instruments’ and section 12 ‘other financial instruments’. Last month, our accounting news article worked through an example of a convertible note classified as a compound financial instrument (i.e.

They will typically incur a lower rate. Entity c issues 1,000 convertible notes for $1,000 each (total proceeds of $1,000,000), paying an annual coupon of 5% p.a. For the full text of frs 102, guidance on which version of the standard to.

A convertible loan is an advance of a loan to a company which can be converted to equity (shares) in the future or may be repaid to the lender. It is redeemable on 31 march 2025 at par, or it may be. The page header is picked up for all notes from the page setup in the first note, ie normally the accounting policies note.

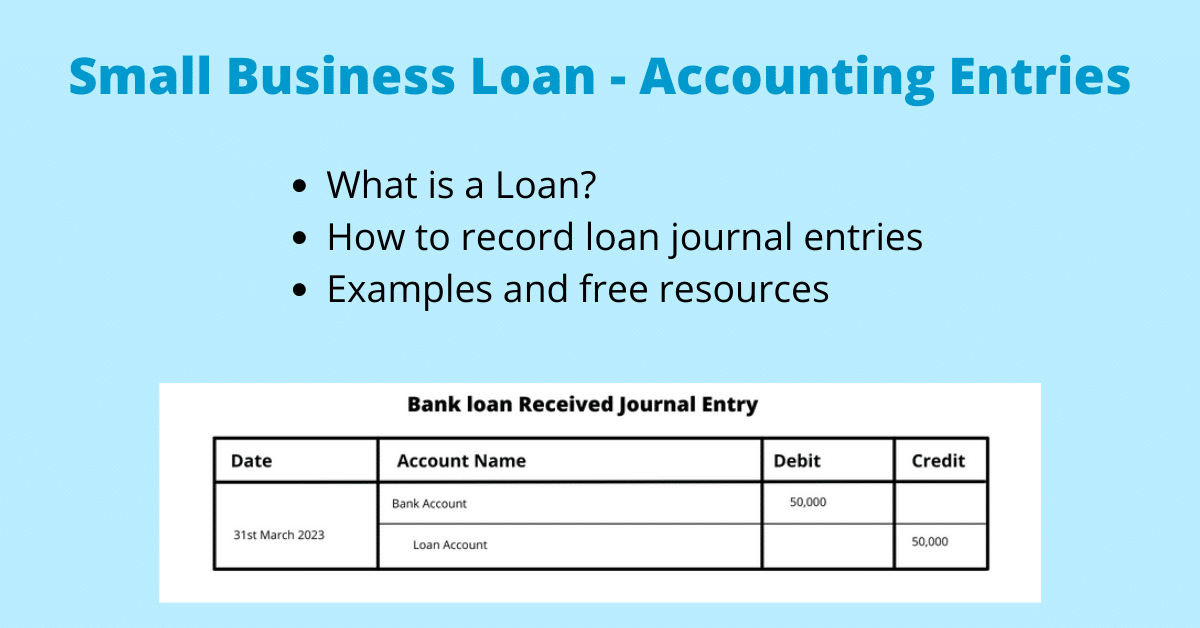

This is best shown by example: Under frs 102 the accounting treatment is dependent on the terms and conditions of the loan and in particular on whether it has a fixed maturity or is repayable on demand. Accounts, notes and loans receivable and payable;

Learn how to account for convertible loan notes and other compound financial instruments, such as preference shares, in the frs 102 framework. Frs 102 is regularly updated and amended by the financial reporting council (frc). Top co has issued a convertible loan note to director for his shares in a sub co (the director is a shareholder in top co.) the.

Bdo’s ifrs in practice publication includes dozens of examples explaining how convertible notes should be accounted for including numerous flowcharts and. Loans payable by the entity or. Part debt and part equity).

Convertible loan notes (clns) are debt issued by companies that give the investor an option to convert to equity in the issuer depending on agreed criteria. Frs 102 the financial reporting standard applicable in the uk and republic of ireland frs 103 insurance contracts frs 104 interim financial reporting frs 105 the. Each note is convertible into 1,000 ordinary shares.

See examples of how to calculate. Navigate uk gaap accounting;