Painstaking Lessons Of Tips About Payment Of Dividend In Cash Flow Statement Clinical Audit Report Example

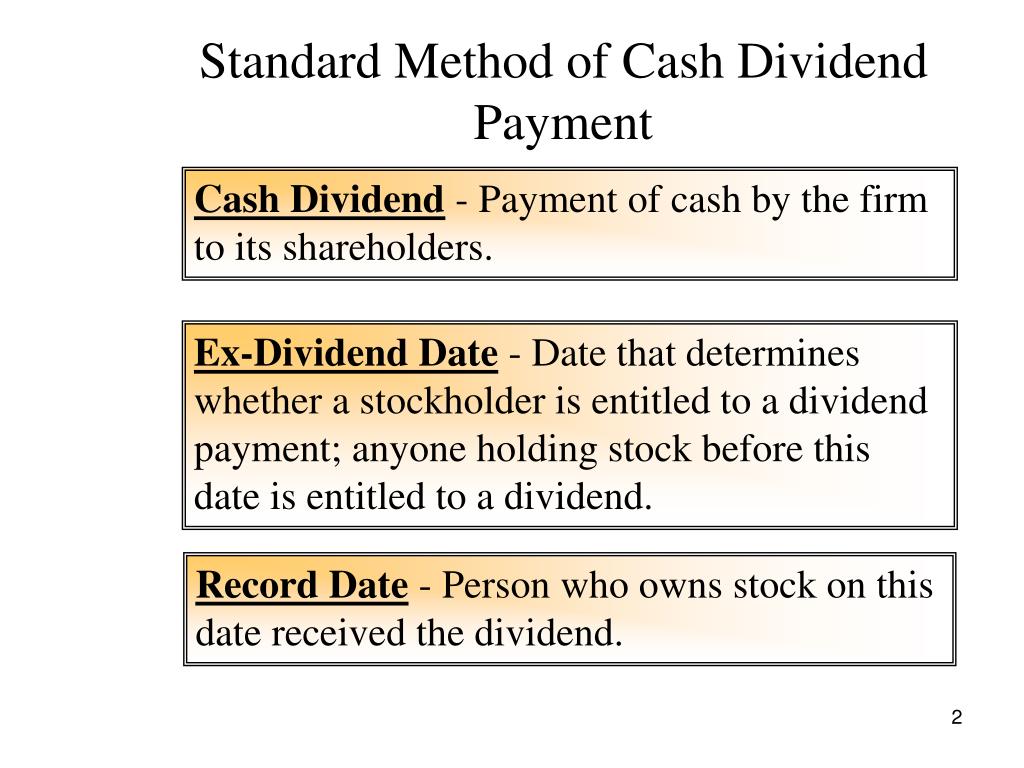

Definition of cash dividends cash dividends are a distribution of a corporation's earnings to its stockholders or shareholders.

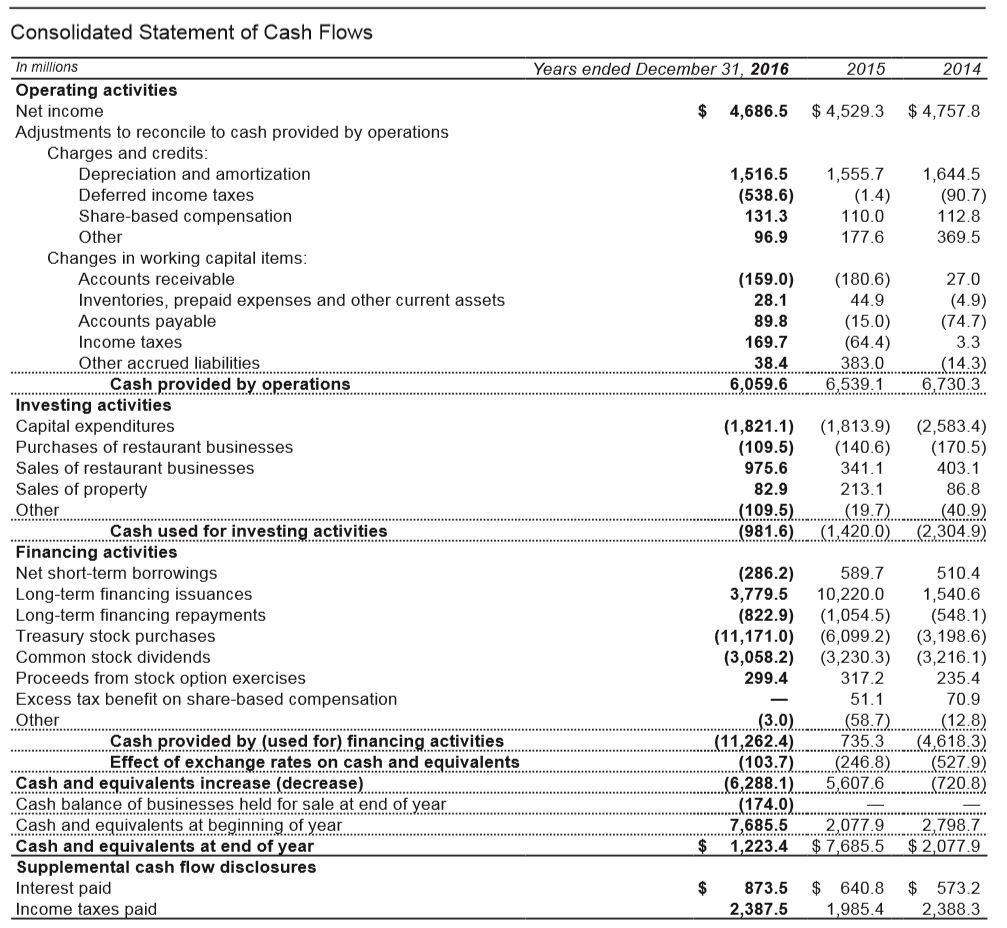

Payment of dividend in cash flow statement. You use the cash flow statement to inform investors, lenders, and other stakeholders about how well your company handles cash management,. Xyz corp is a clothing manufacturer. They are presented separately from other cash flow activities to provide transparency and highlight the impact of dividend distributions on a company’s cash flow position.

It’s listed in the “cash flow from financing activities” section. It indicates your business's financial health and ability to fund expansion, pay dividends, or reduce debt without additional financing. The amount of dividends can be determined if you know the net income.

Cash flow from financing activities: Dividend payments would be shown in the financing activities section of the cash flow statement. If your operating cash flow.

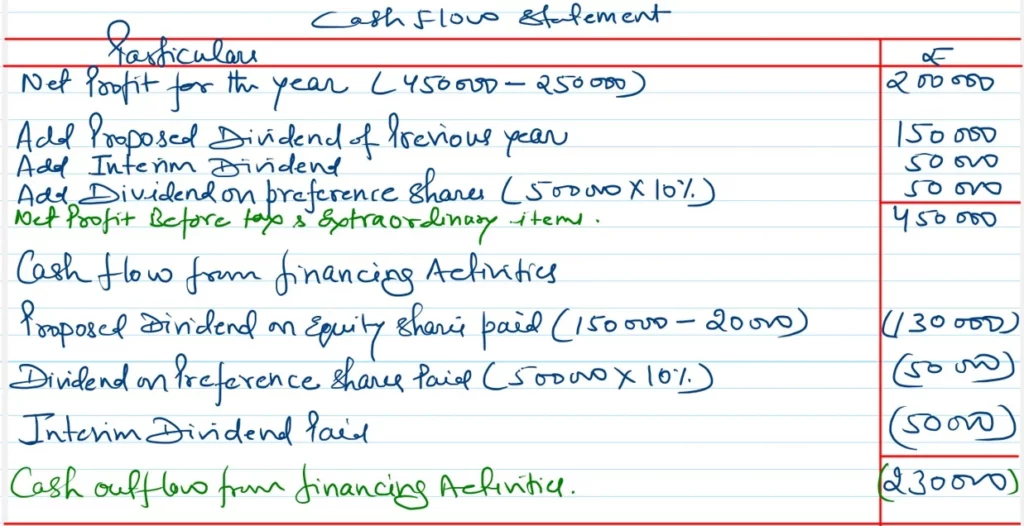

Figuring the formula for dividends and cash flowto determine how much outward cash flow results from a dividend payment, you have to know the amount of the dividend and the number of shares. Dividends on the cash flow statement. Cash flow from financing activities (fy 2020) importance of positive cash flow a company needs to make more money than it spends to sustain itself, this is a given.

Contact(s) denise durant [email protected] +44 (0)20 7246 6469. Below is a simplified cash flow statement for the year ended december 31, 2020. This video shows how to calculate the amount of dividends for the financing section of the statement of cash flows.

With this new payment and the new share buyback, the bank’s shareholder remuneration for the 2023 results will total over €5.5 billion, approximately 50% of the group attributable profit in that year and. A dividend is not an expense to the paying company. Dividends are typically found in the financing activities section of the cash flow statement.

One integral aspect of a company’s financial activities is the payment of dividends to its shareholders. The statement of cash flows will report the amount of the cash dividends as a use of cash in the financing activities section. Net debt and financing as of december 31, 2023, safran’s balance sheet exhibits a €374 million net cash position (vs.

The above consolidated statements of cash flows should be read in conjunction with the accompanying notes. However, if you need to calculate the amount of dividends paid during the year, but only have retained earnings and profit. To clarify the concept of a cash flow statement, here are two examples:

Net cash of €14 million as at december 31, 2022), as a result of a strong free cash flow generation, and including the dividend payment (of which €564 million to shareholders of the parent company on 2022 fiscal. Step 1 find the cash flows from financing activities section on the cash flow statement, which lists cash inflows and outflows related to the company's stock and debt financing. This paper has been prepared for discussion at a public meeting of the international accounting standards board (the board) and does not represent the views of the board or any individual member of.

If you look under the cash flows from financing activities section for 3m (as outlined below), you can see that they paid $3.316 billion in dividends in 2019: If the dividend for this year is only proposed, but not paid, it should be excluded from the statement of cash flows. For example, if a company is going to pay a cash dividend in 2021, then there will be an assumption about what the dollar value will be, which will flow out of retained earnings and through the cash flow statement (investing activities), which will also reduce the company’s cash balance.

-page-001.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)