Out Of This World Info About Income And Expenses Account Format Pro Forma Balance Sheet Sample

That decision is based on guideline (eu) 2016/2249 of the ecb of 3 november 2016 on the legal framework for accounting and.

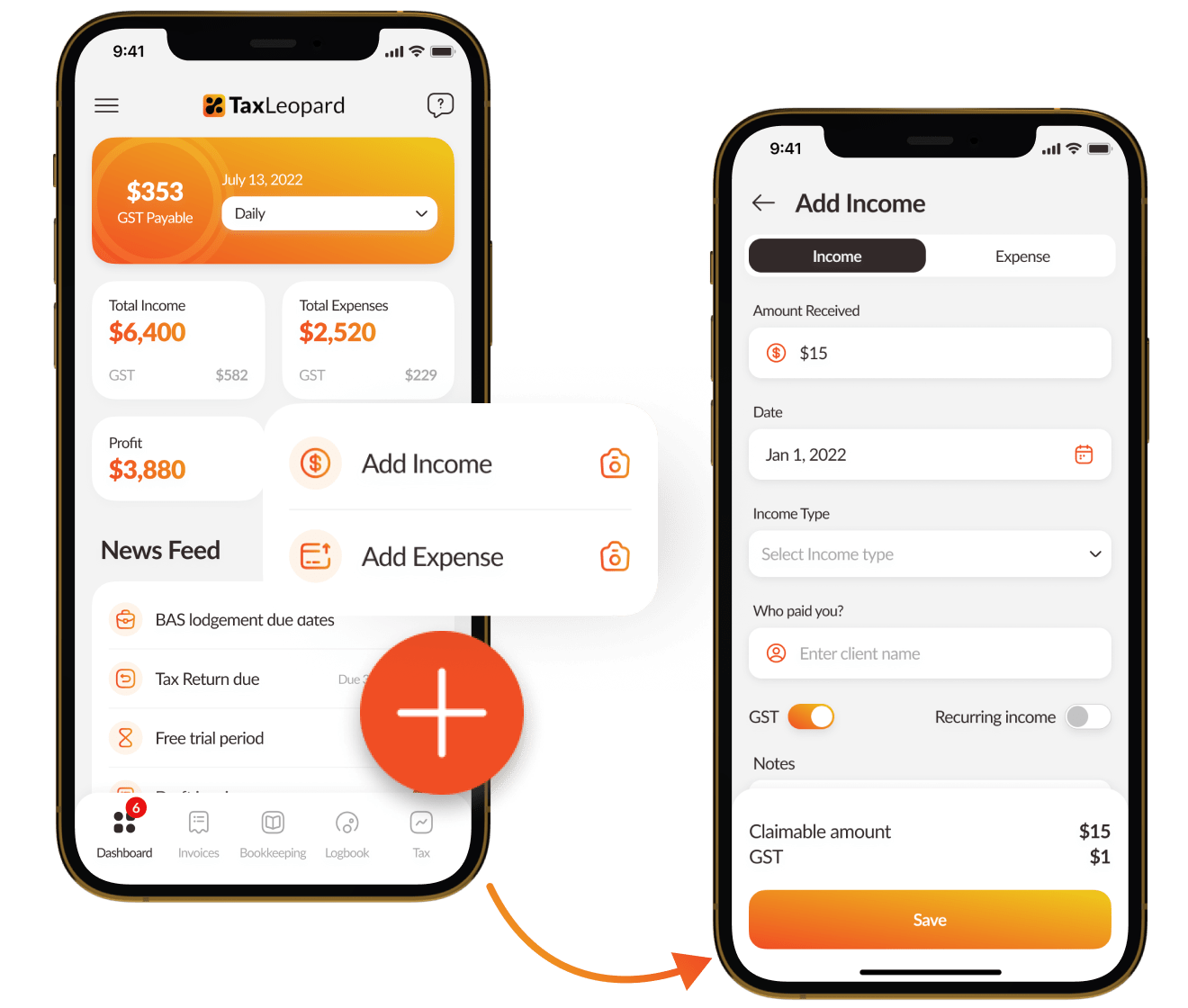

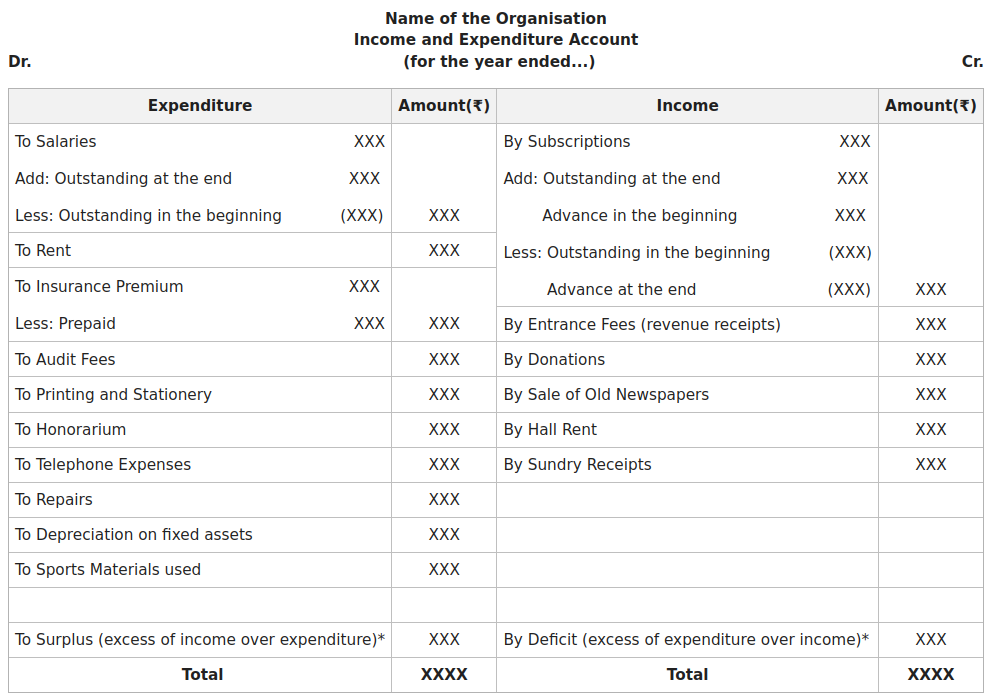

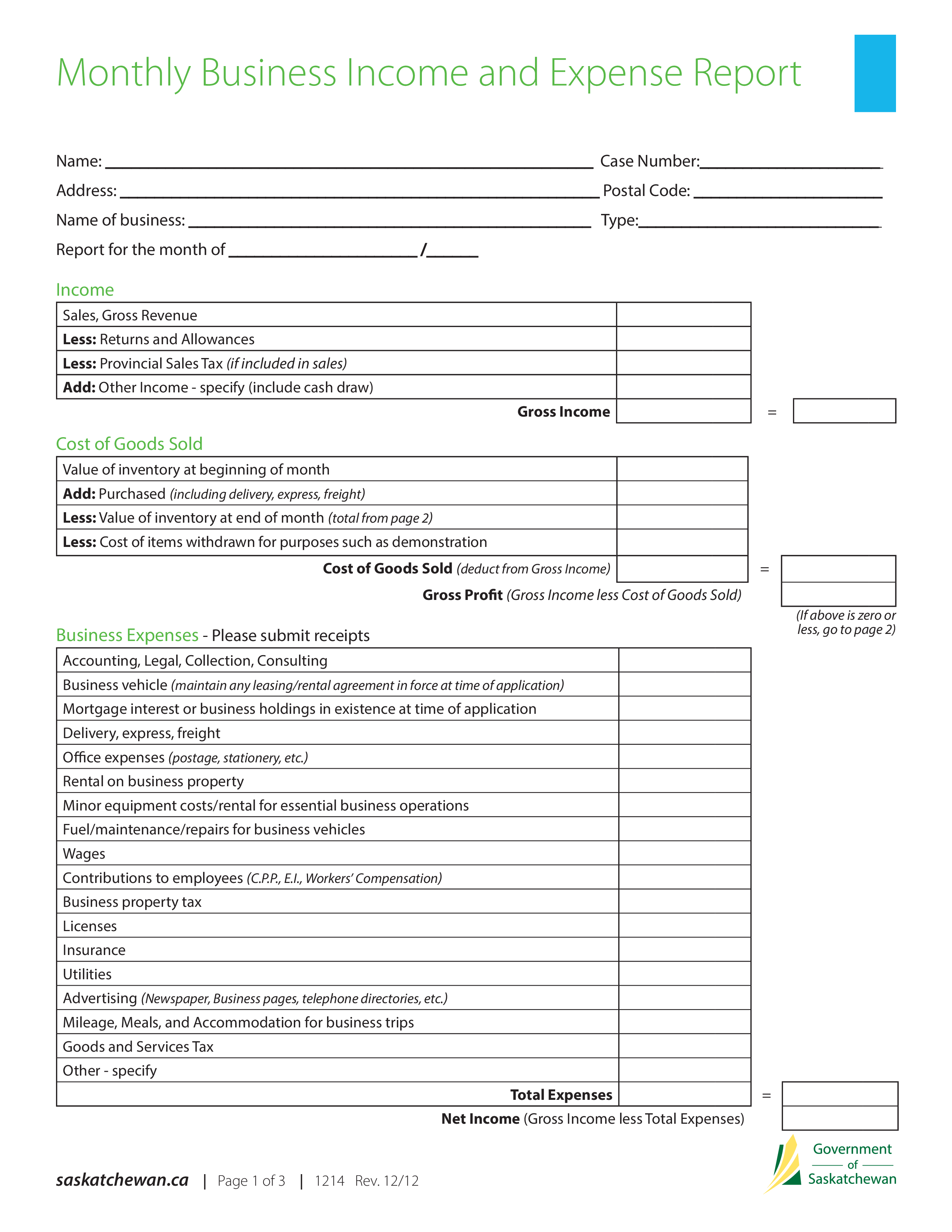

Income and expenses account format. It is prepared with the objective of finding out the surplus or deficit arising out of current incomes over current expenses. By filing your tax return on time, you’ll avoid delays to any refund, benefit. The above mentioned is the concept that is explained in detail about income and expenditure account based on trial balance for the class 12 students.

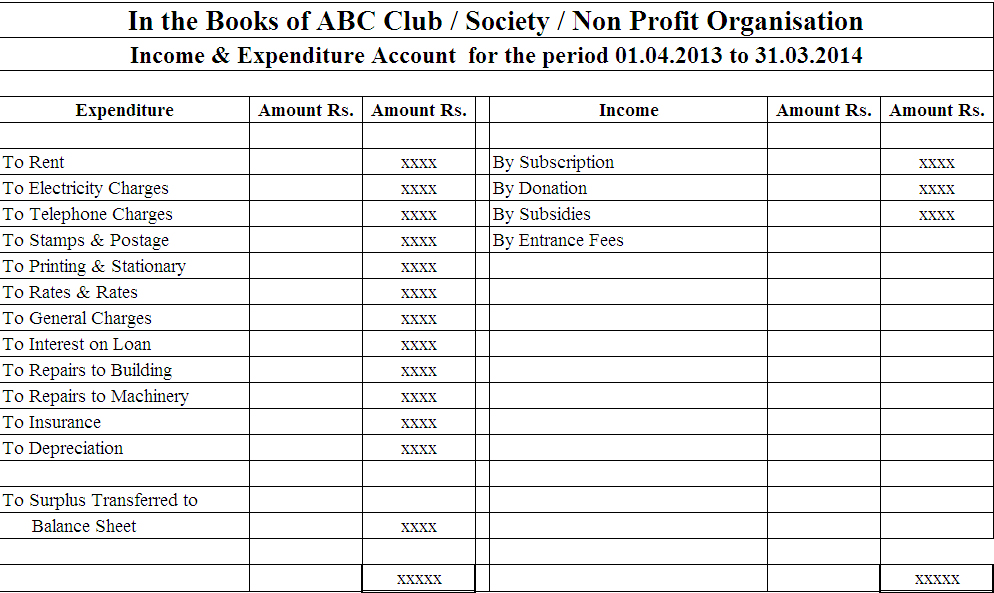

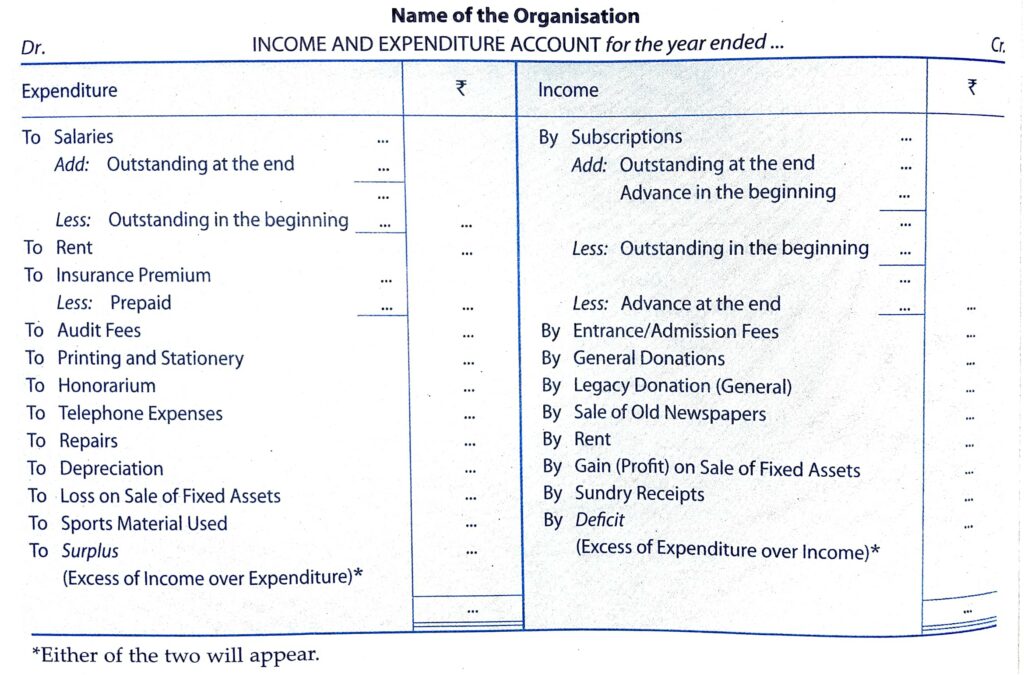

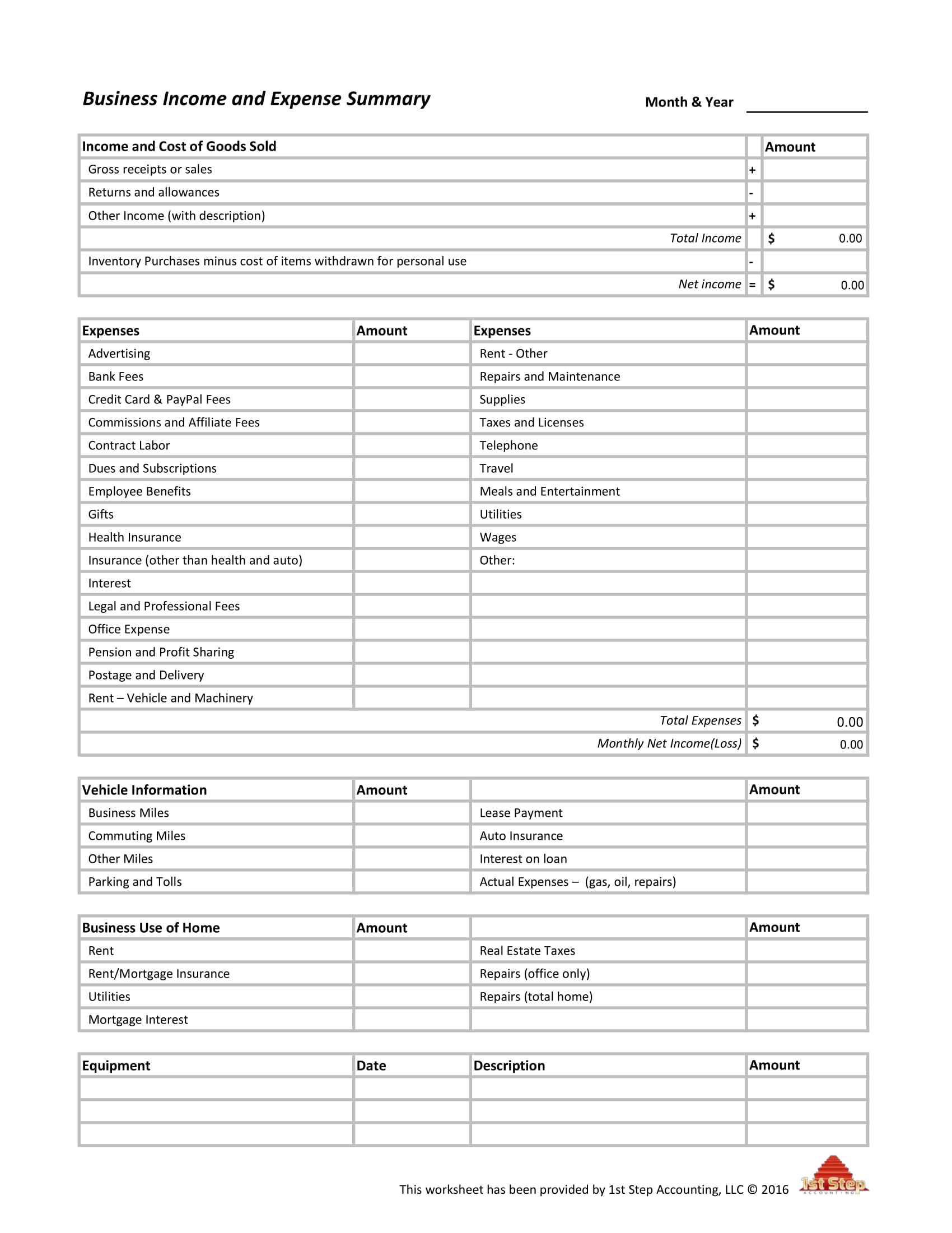

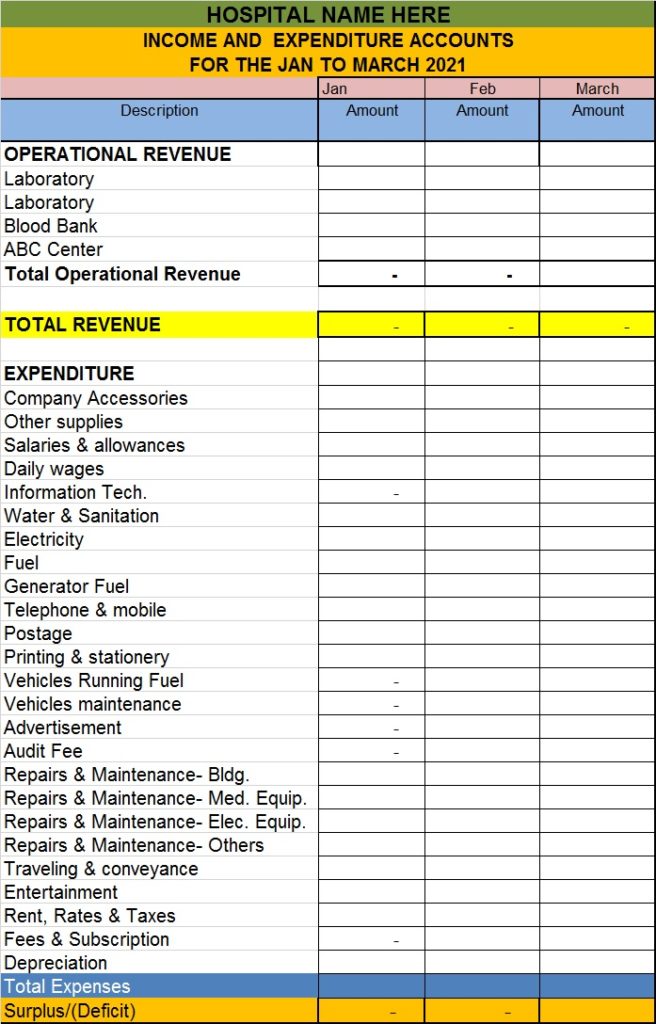

As with assets and liability items, items of income and expense are recorded in nominal ledger accounts according to set rules. The income and expenditure account is a summary of all items of incomes and expenses which relate to the ongoing accounting year. Avoid entering capital incomes and expenses;

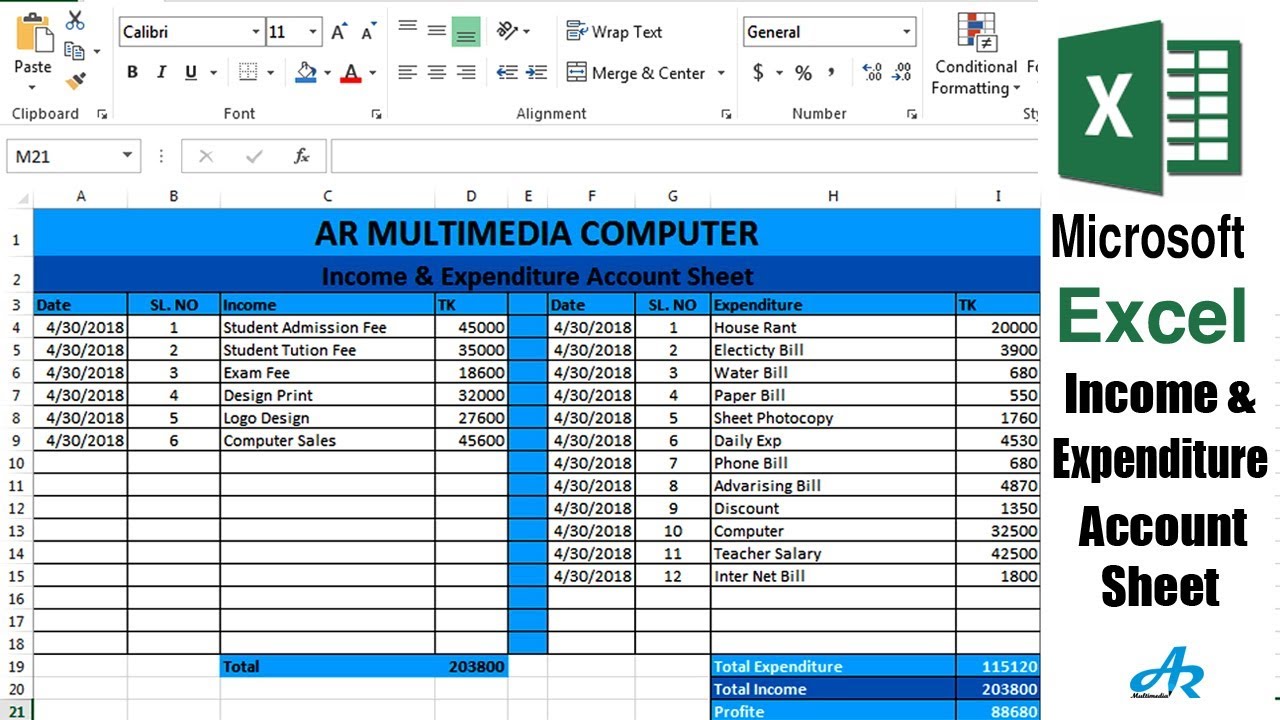

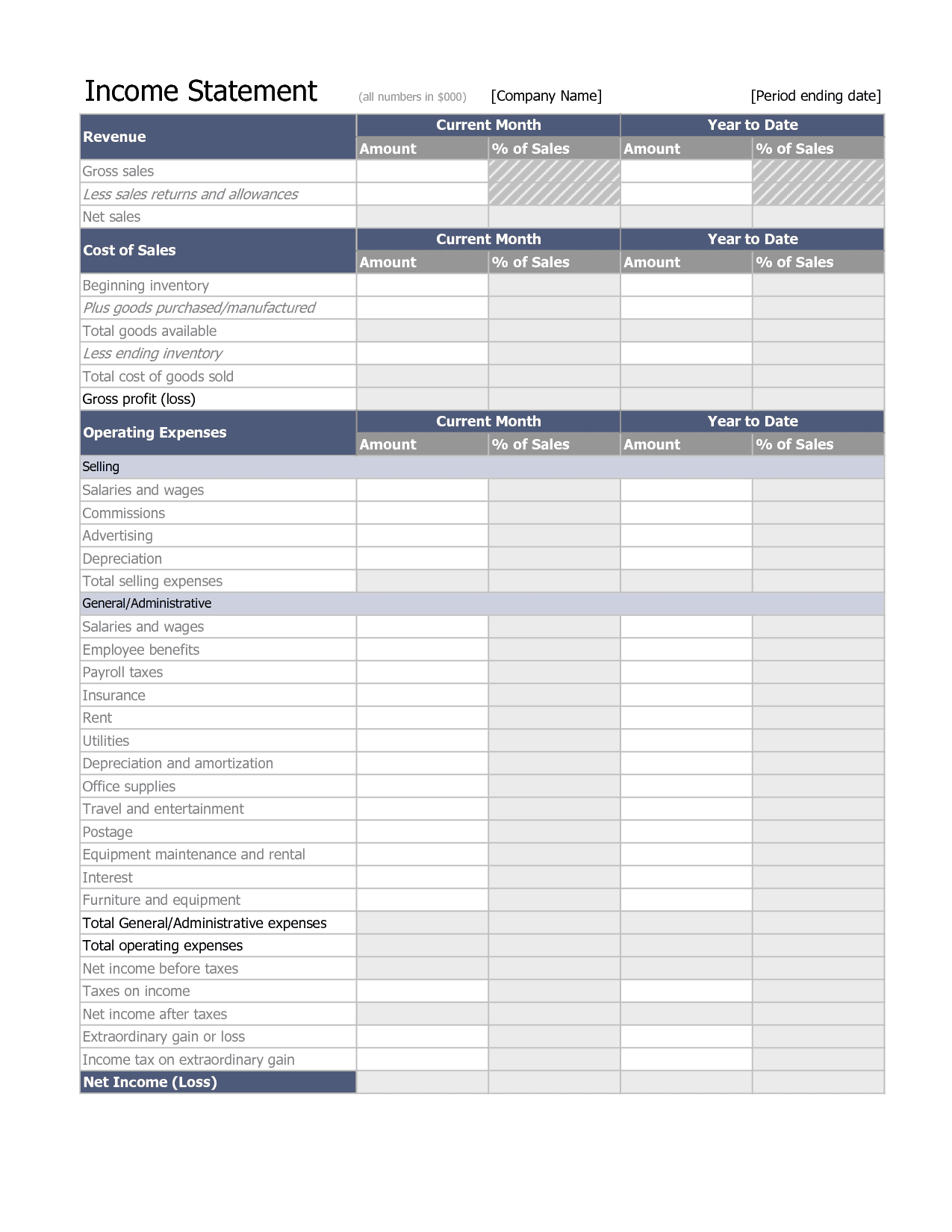

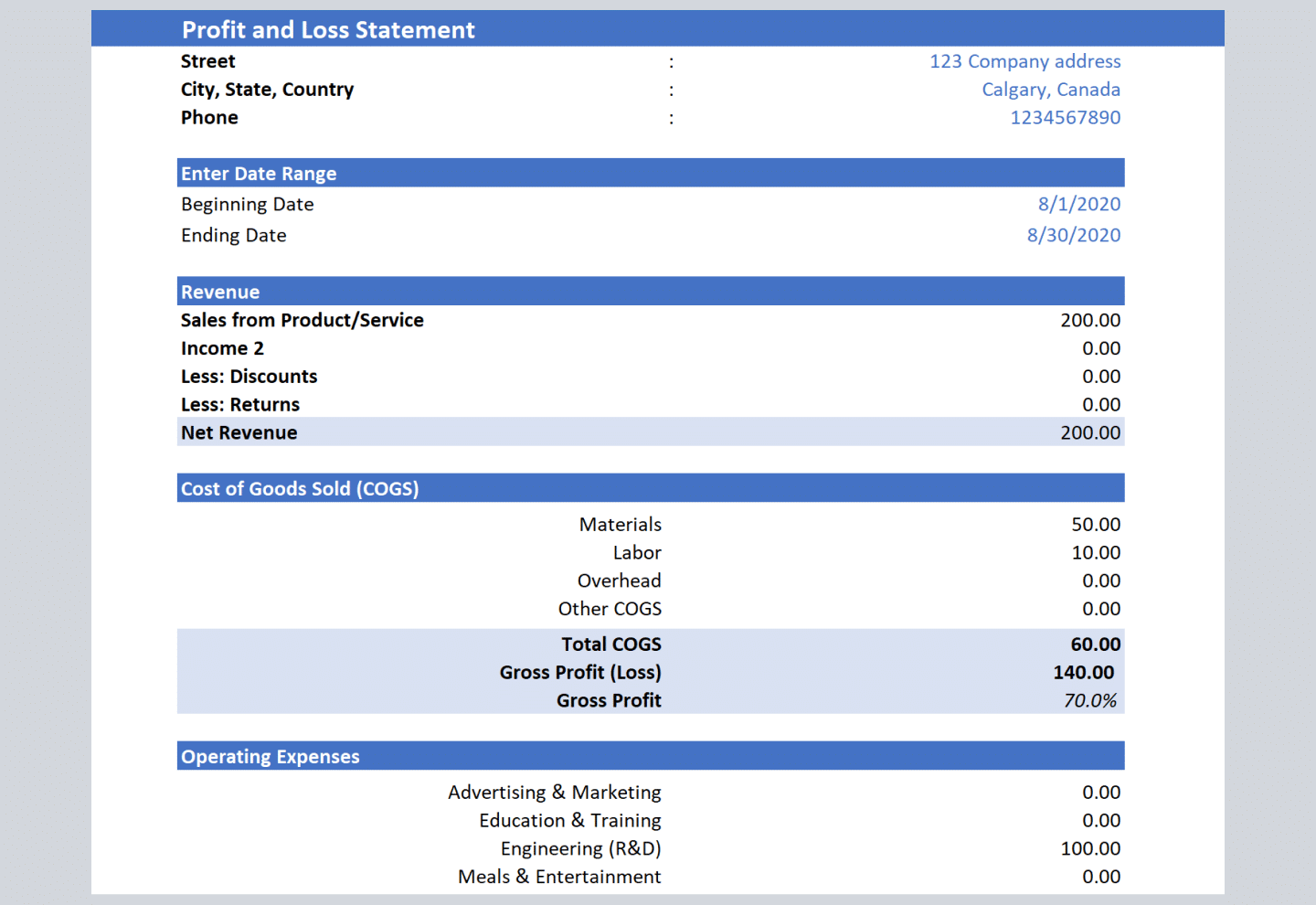

Revenue minus expenses equals profit or loss. Format of income and expenditure account: The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner.

The income and expenditure account is a summary of all items of incomes and expenses which relate to the ongoing accounting year. Make adjustments of prepaid and outstanding expenses and incomes Hmrc is reminding employers of the main changes:

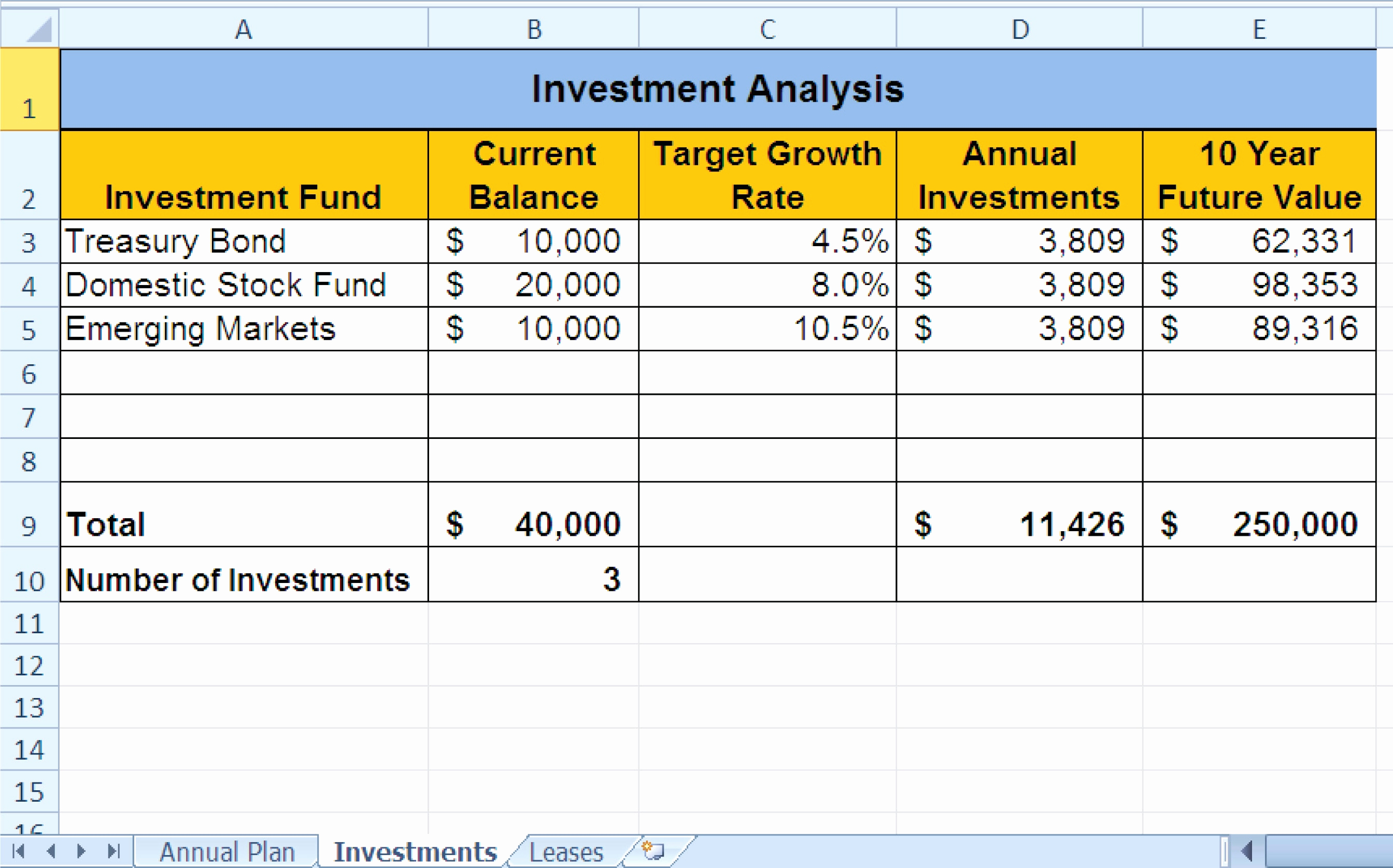

) * represents that the income and expenditure a/c will either have a surplus or deficit balance, i.e., when the income side is greater than the payment side, the difference is denoted as a surplus, and when. The annual financial statements of the ecb are prepared in accordance with decision (eu) 2016/2247 of the ecb of 3 november 2016 on the annual accounts of the ecb (recast) (ecb/2016/35) (oj l 347, 20.12.2016, p. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting.

The income statement is a financial statement that summarizes a company's revenues, expenses, and the resulting net income. There are two kinds of income and expenditure and balance sheet formats depending on the final calculated amount. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi).

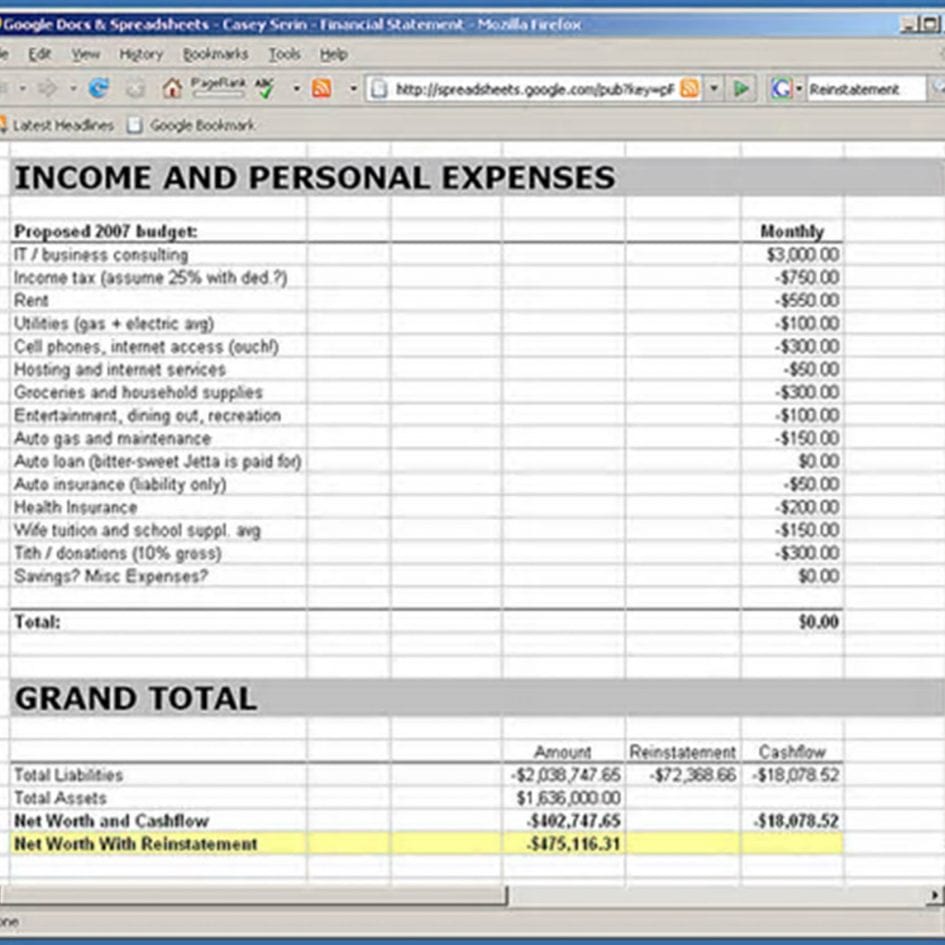

We need to sequentially compute for: The format of an income and expenditure account based on a trial balance is as follows: A cut to the main rate of class 1 employee national insurance contributions from 12% to 10%.

It is possible to prepare an income and expenditure account in any of the following forms: Follow the below section to familiarize yourself with both formats. This format is less useful of external users because they can’t calculate many efficiency and profitability ratios with this limited data.

There are two income statement formats that are generally prepared. Tax return for seniors, is april 15, 2024. For example, if you itemize, your agi is $100,000 and your.

Taxpayers are also encouraged to read publication 17, your federal income tax (for individuals) for additional guidance. Include all items of receipts and expenditure, on the respective side of the account; But there is a floor.