Stunning Info About The Two Methods Of Accounting For Uncollectible Receivables Are Soc 1 Aicpa

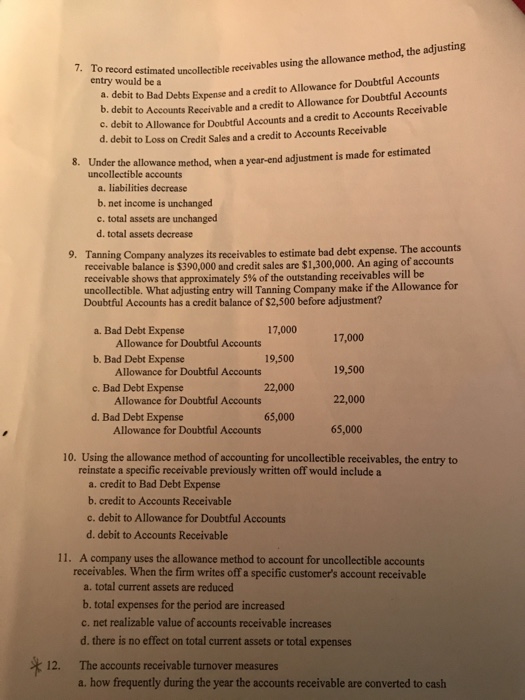

Two common ways of estimating the amount of uncollectible receivables are:

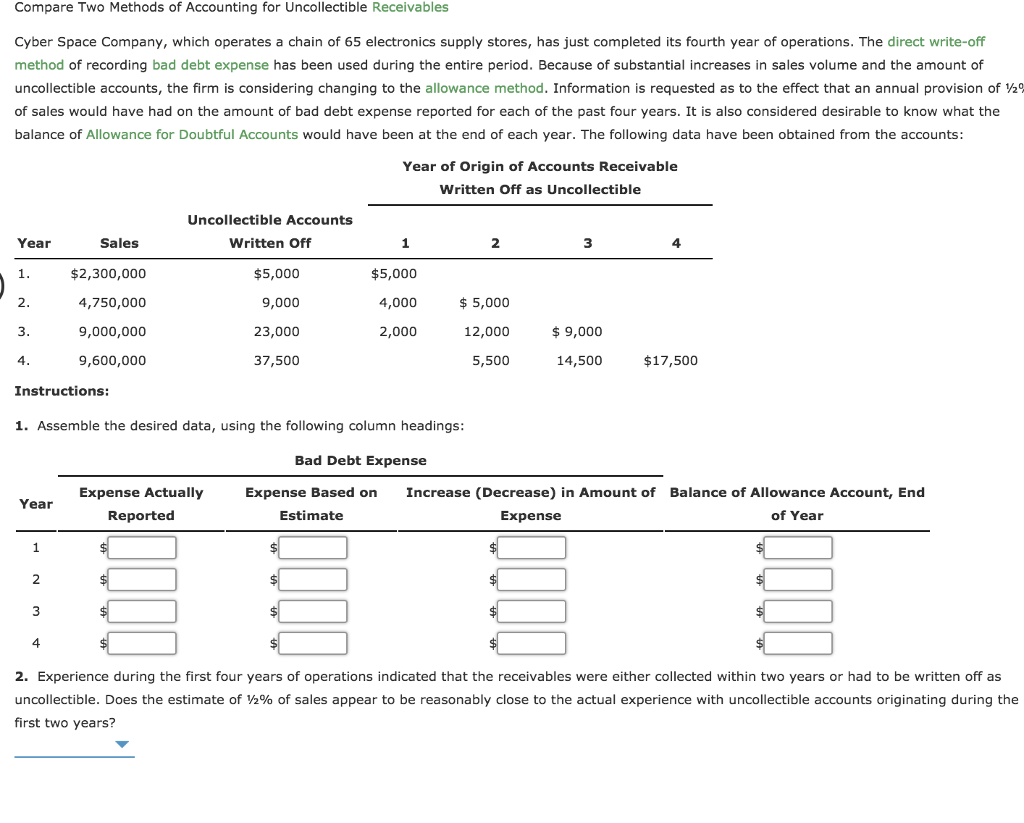

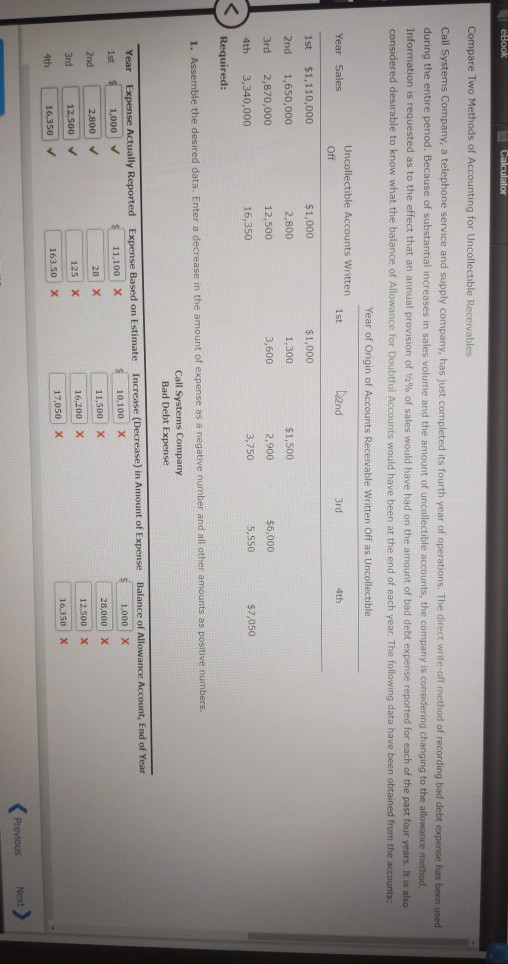

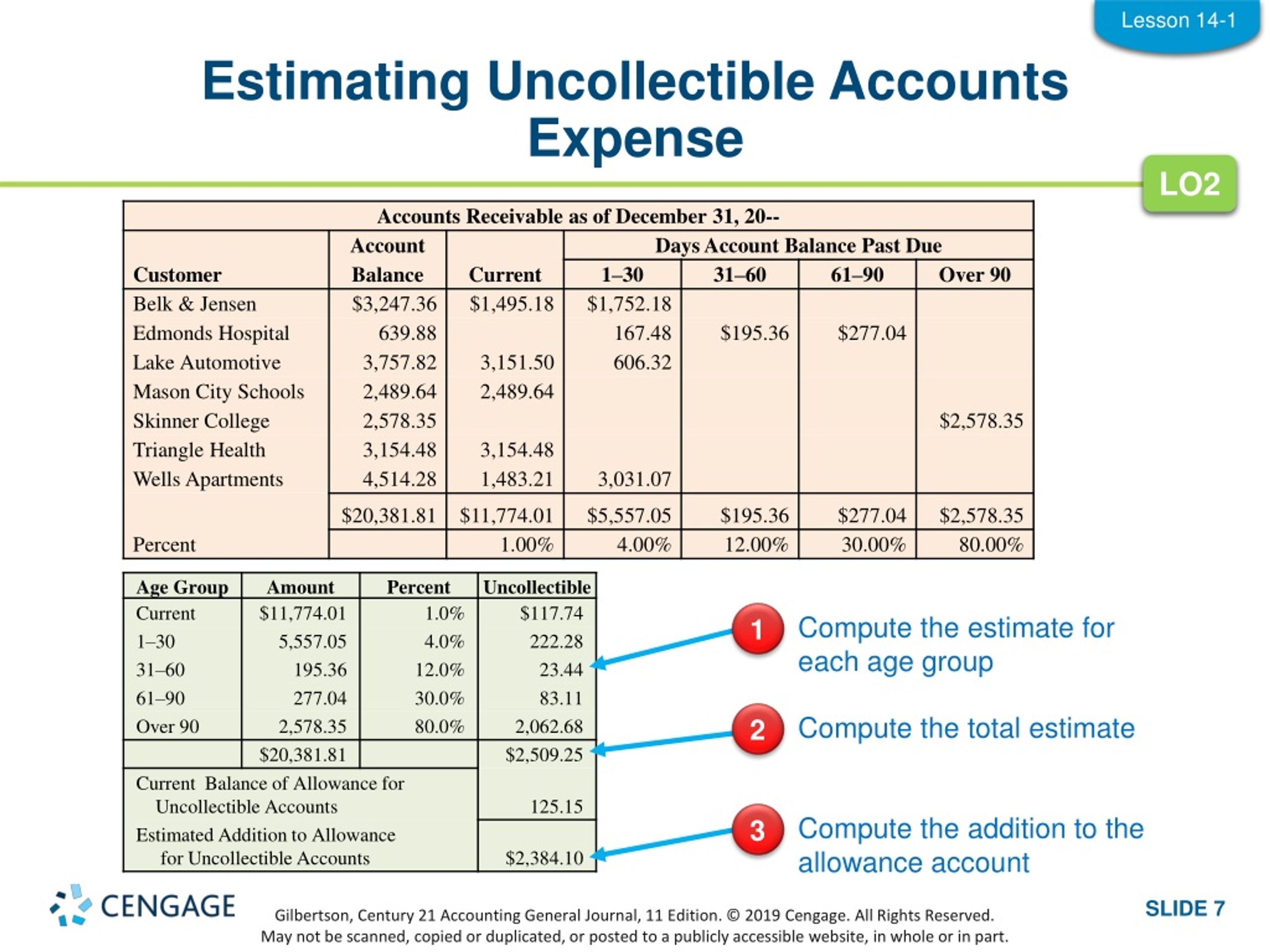

The two methods of accounting for uncollectible receivables are. However, it may happen that the payments still arrive later and results in two scenarios below: Preparing an aging of accounts receivable to identify the potentially uncollectible accounts. Of the two methods of accounting for uncollectible receivables, the allowance method provides in advance for uncollectible accounts.

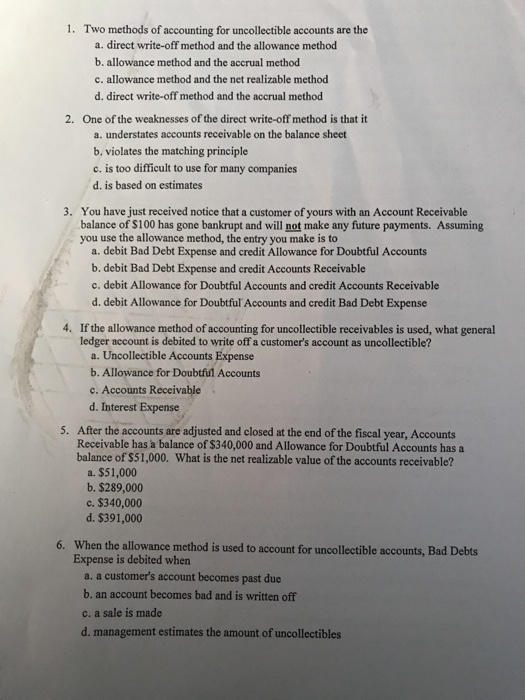

In financial reporting, terms such as “bad debt expense,” “doubtful accounts expense,” or “the provision for uncollectible accounts” are often encountered. True or false the amount of the. There are two methods a company may use to.

Two methods of accounting for uncollectible receivables:1.the allowance method2. The two methods of accounting for uncollectible receivables are the allowance method and the a. On december 31, year 2 before adjustments, silver co.'s accounts receivable account balance was $20,000 and the allowance for doubtful accounts account balance.

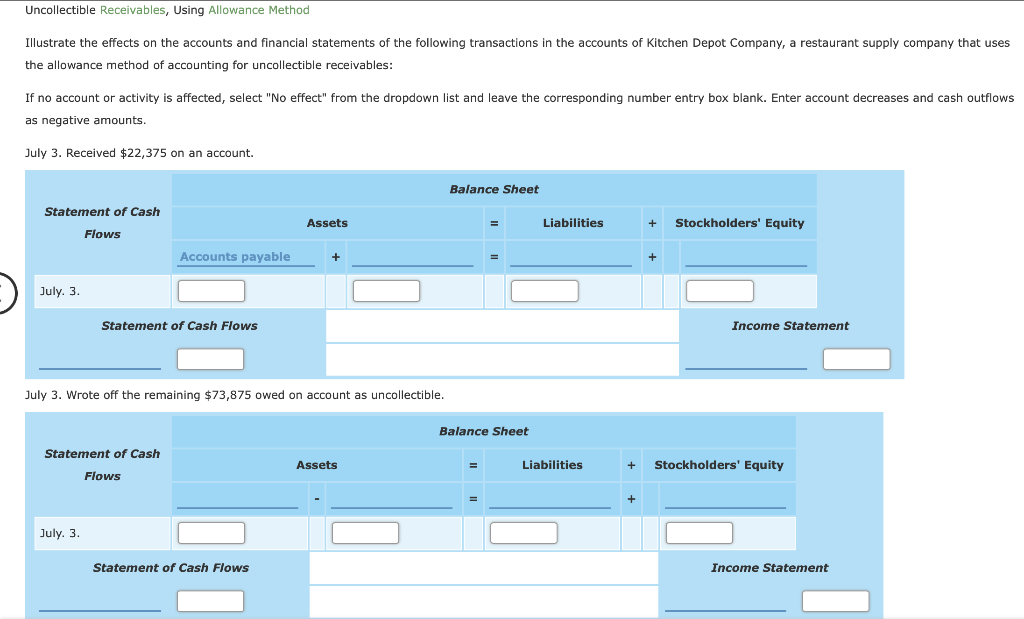

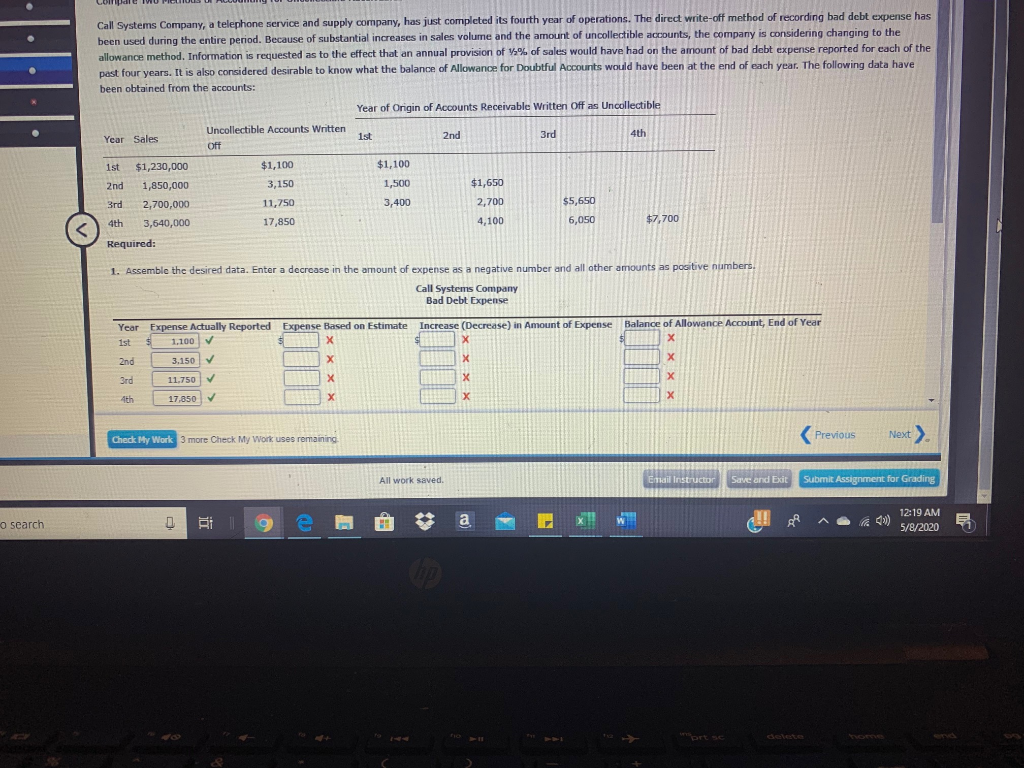

Effective collections how to audit receivables derivation from total sales a simpler approach is to assume that a percentage of total credit sales will not be. Compare two methods of accounting for uncollectible receivables call systems company, a telephone service and supply company, has just completed its. At the beginning of 2024, the allowanceaccount had a credit balance of $54,000.

The allowance method and the direct write−off method. There are two fundamental methods for handling these uncollectible accounts: The excellus company uses the allowance method to account for bad debts.

The two methods of accounting for uncollectible receivables? Terms in this set (89) the two methods of accounting for uncollectible accounts receivable are ________. There are two methods a company may use to recognize bad debt:

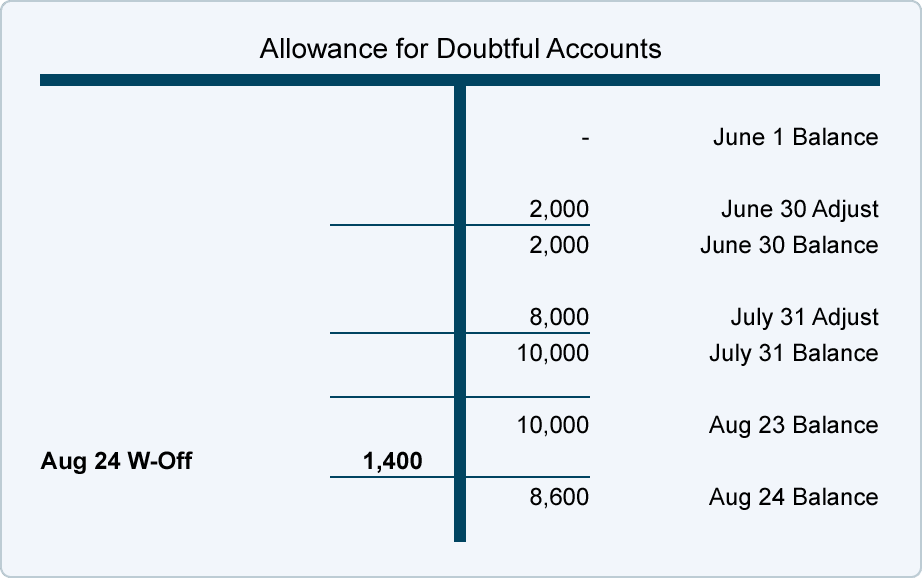

When future collection of receivables cannot be reasonably assumed, recognizing this potential nonpayment is required. Figure 9.2 bad debt expenses.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)