Outrageous Tips About Reliance Debt Equity Ratio Business Financial Reporting

Lt debt to equity mrq:

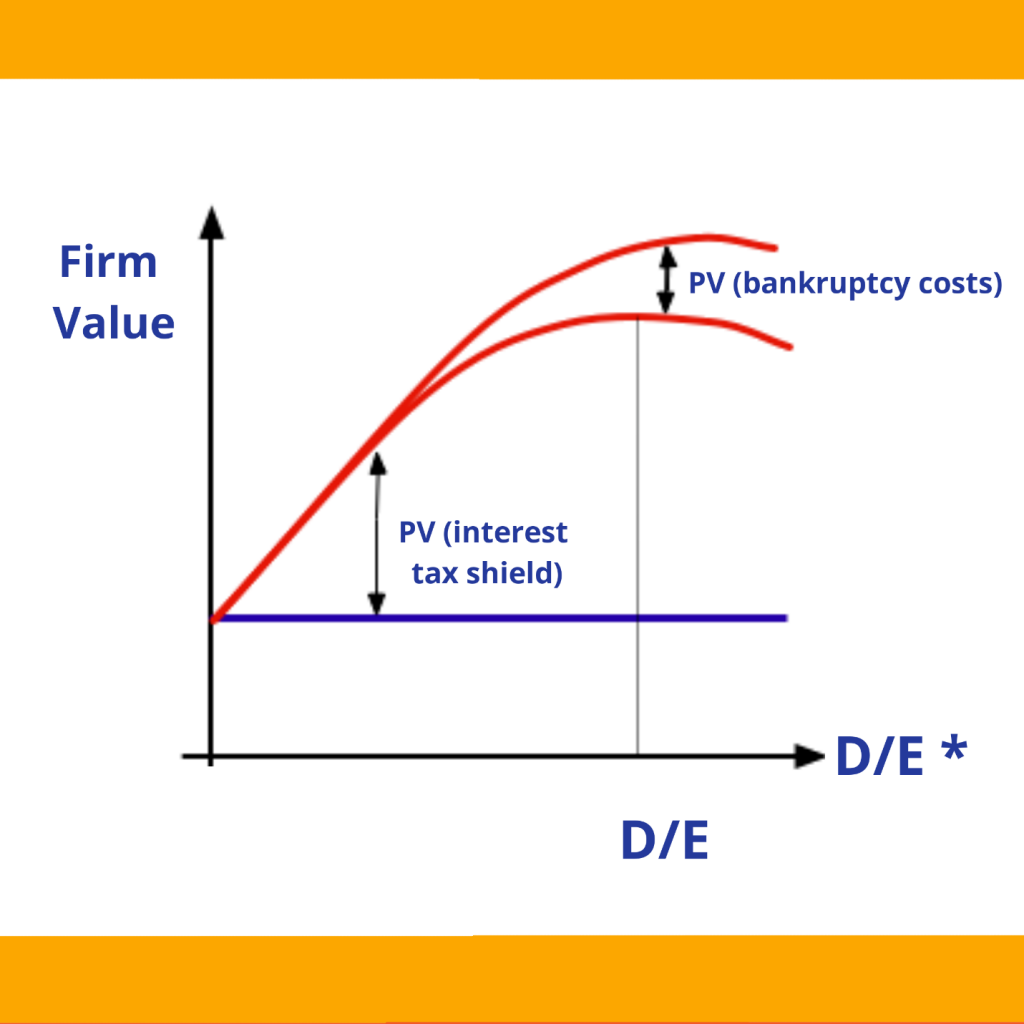

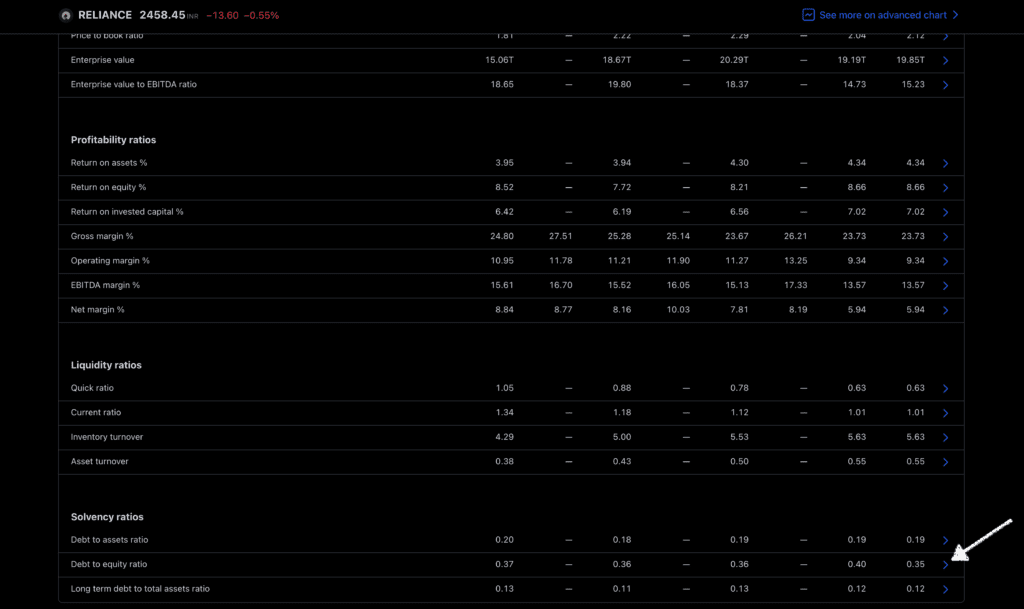

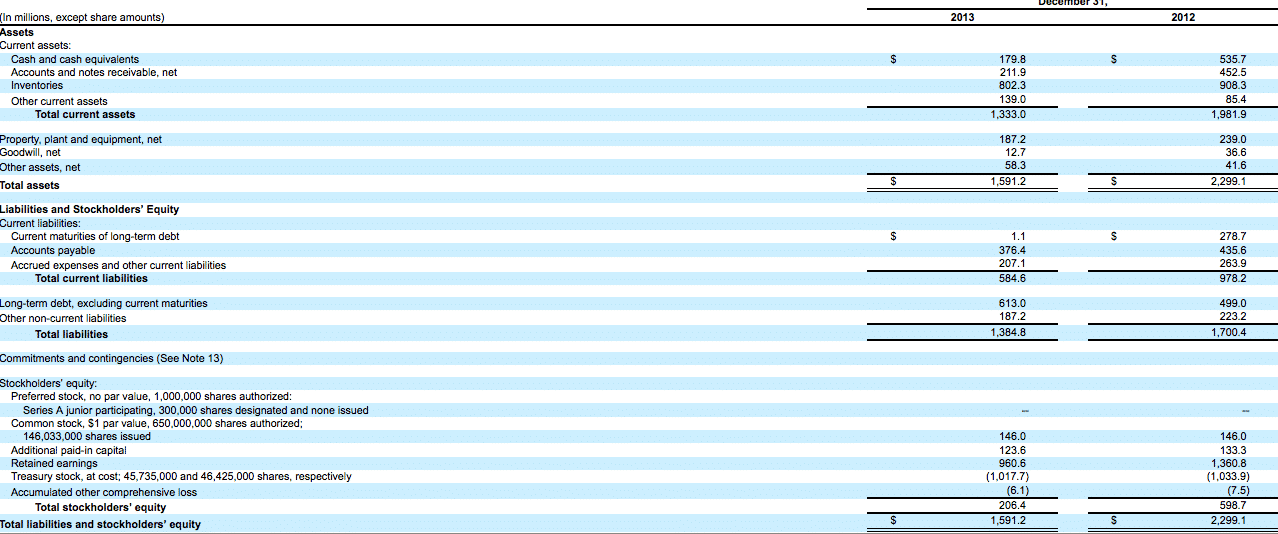

Reliance debt equity ratio. Roe, roce, book value, and debt to equity ratio as of mar 2023 and 10 year history. Company has a low return on equity of 8.23% over last 3 years. Total debt/equity (x) 0.45:

Asset turnover ratio (%) 0.60: Looking back at the last 5 years, reliance industries's debt /. It is affected by several factors, including industry norms,.

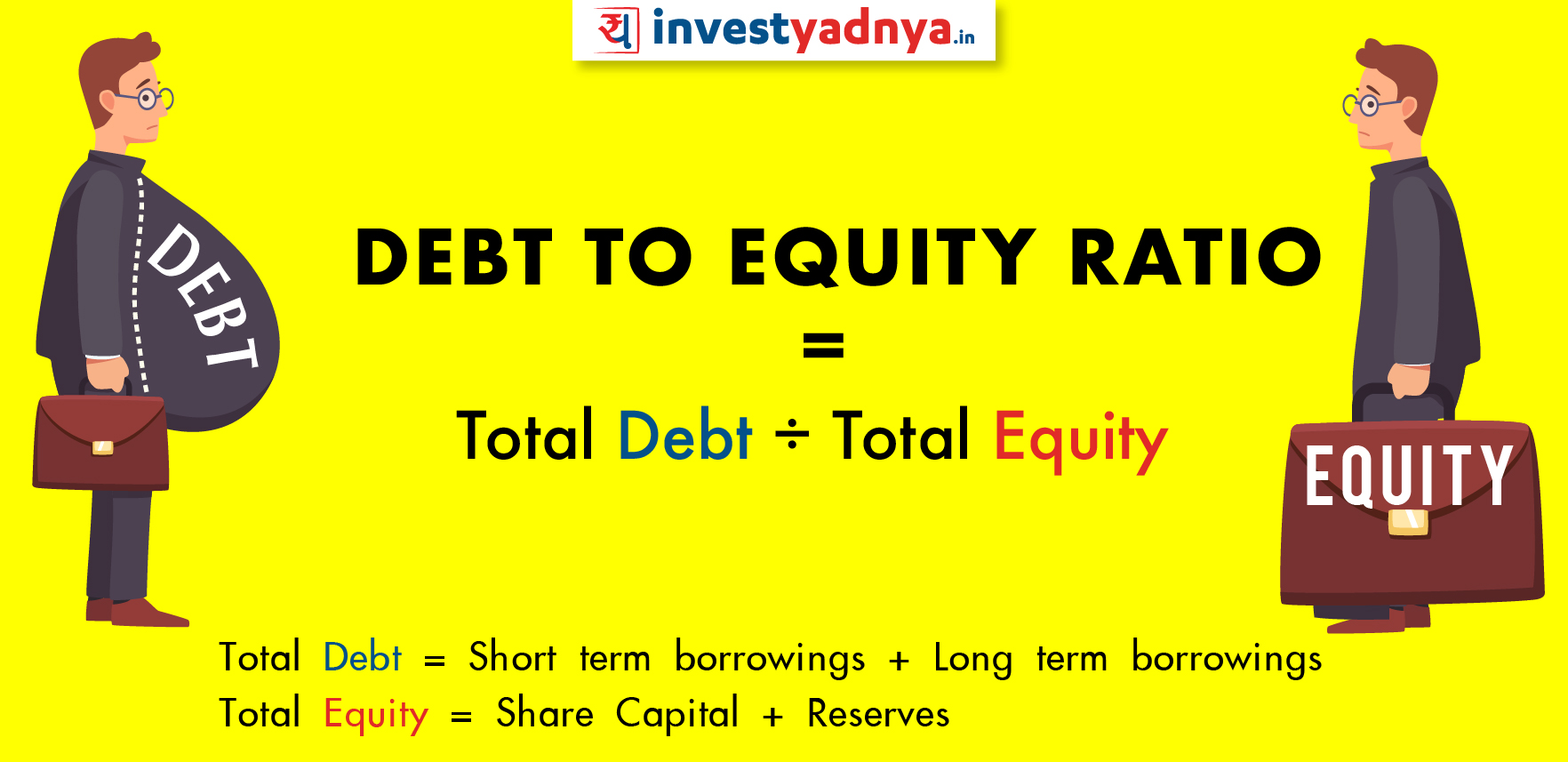

And the median was 0.67. 21 rows debt to equity ratio definition read full definition. * the pros and cons are machine generated.

Global debt levels hit a new record high of $313 trillion in 2023, with developing economies scaling a fresh peak for the ratio of debt to their gross domestic product, a. Debt to equity ratio of reliance rose. Debt to equity ratio:

Pros / cons are based on a checklist to highlight important points. Financial ratios analysis of reliance industries ltd. Economic calendar ipo all stats technical trends earnings f&o big shark portfolios us markets currency stock scanner sensex 72,426.64 376.26 ( +0.52 %) nifty 50.

Reliance industries has a d/e ratio of 0.4505 which means. Reliance industries's operated at median debt / equity of 46.7% from fiscal years ending march 2019 to 2023. Economic calendar ipo all stats technical trends earnings f&o big shark portfolios us markets currency stock scanner sensex 72,426.64 376.26 ( +0.52 %) nifty 50.

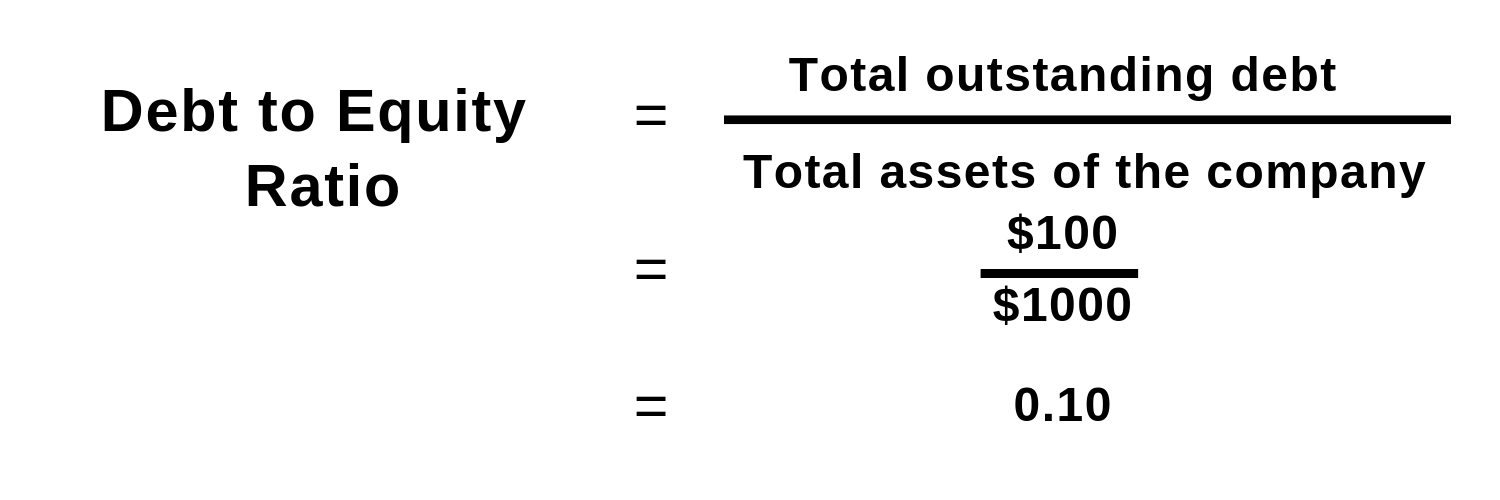

Debt to equity ratio 0.388 of reliance industries ltd. To calculate it, you divide.

.png)