Smart Info About Profit And Loss Statement Of Company Debit Sheet

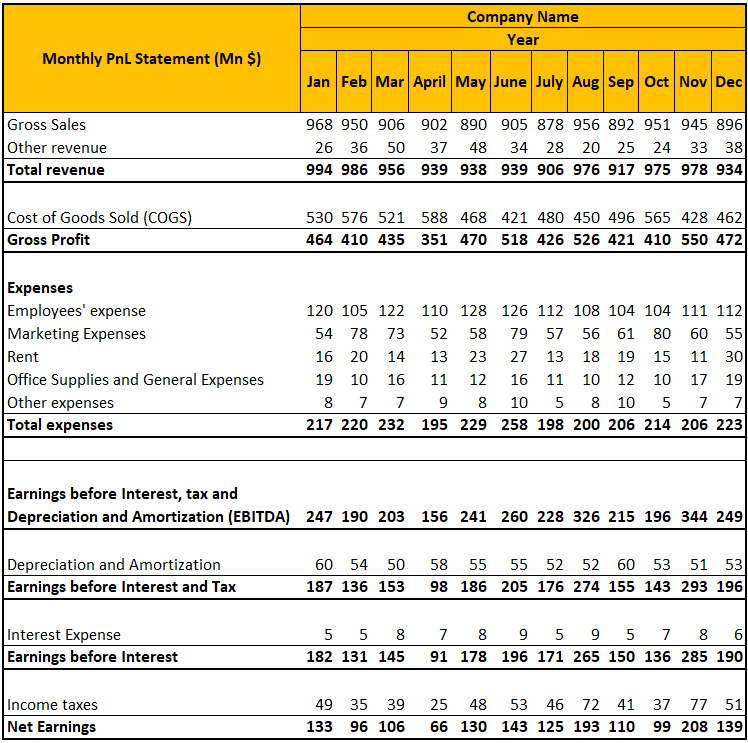

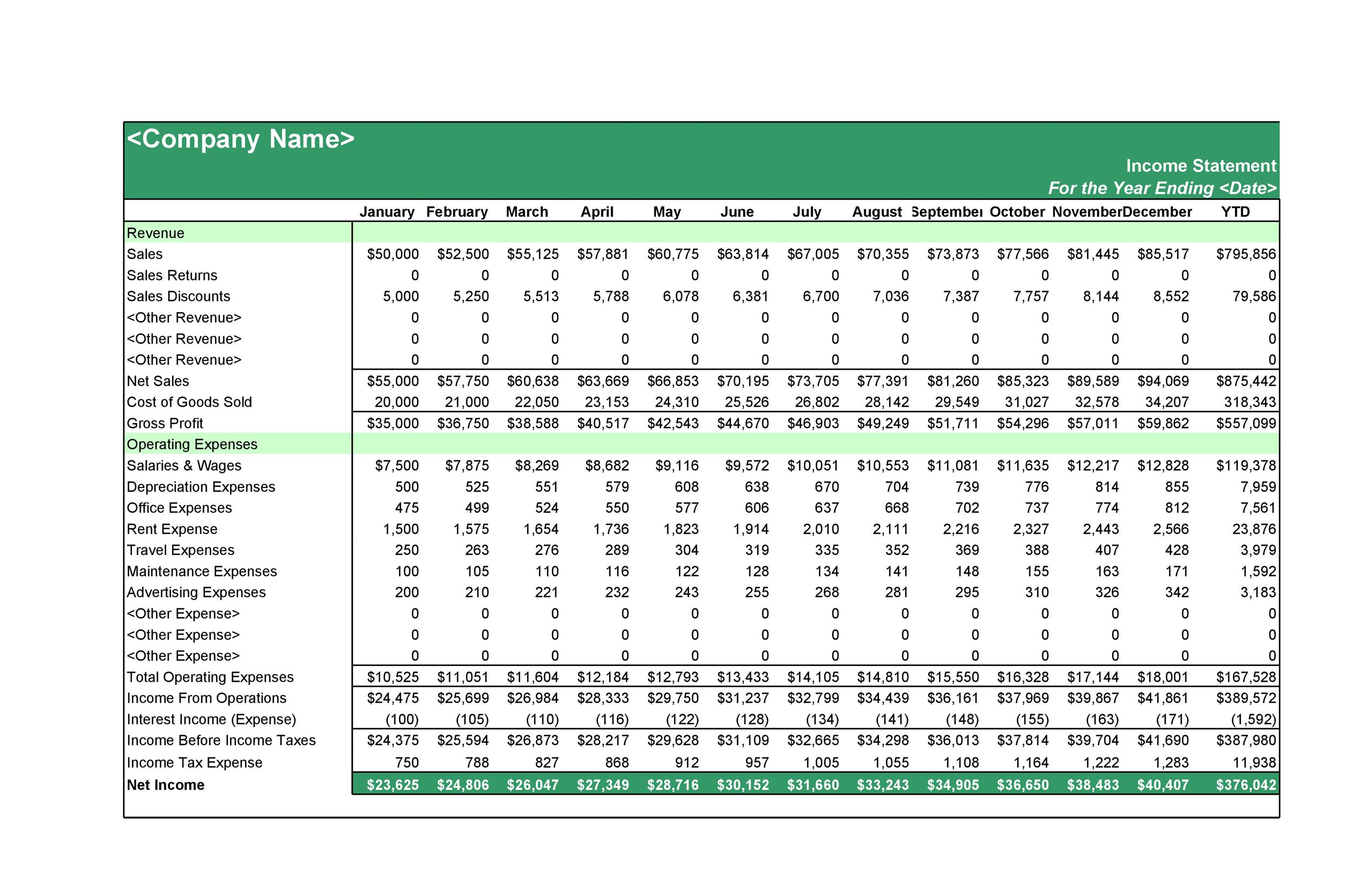

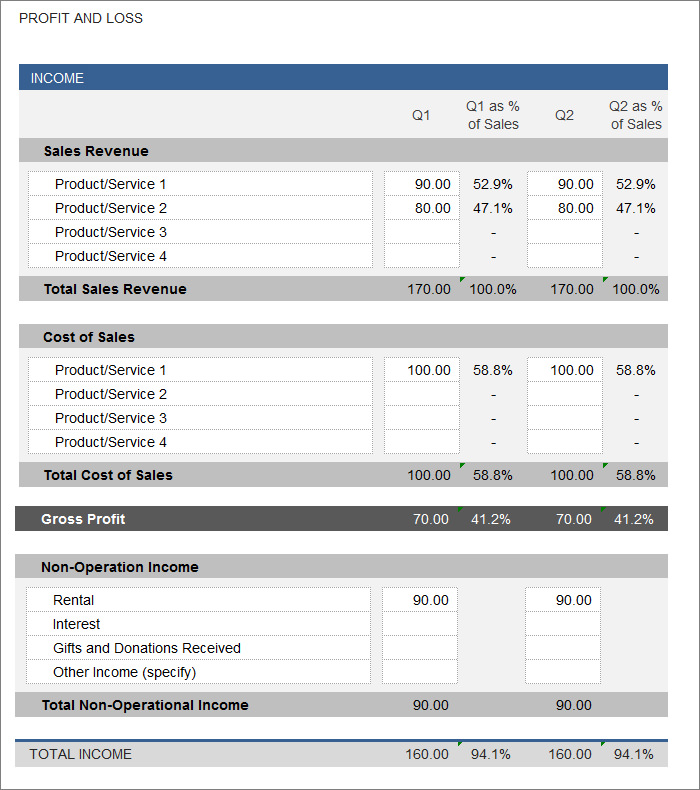

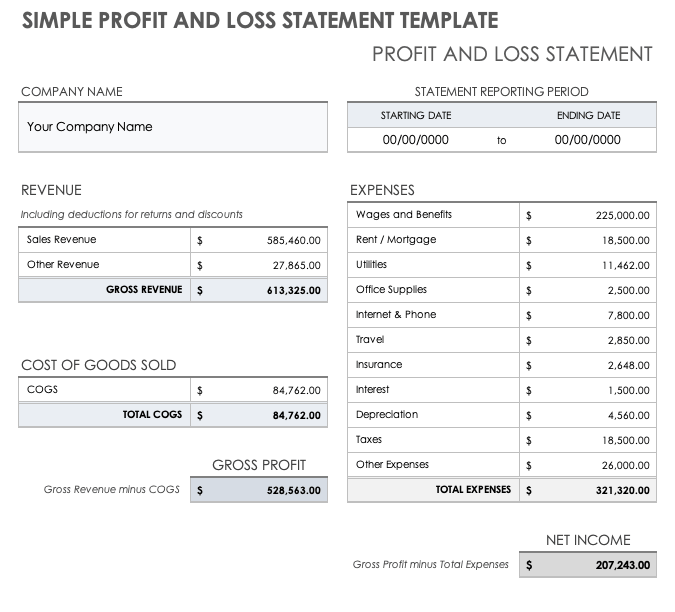

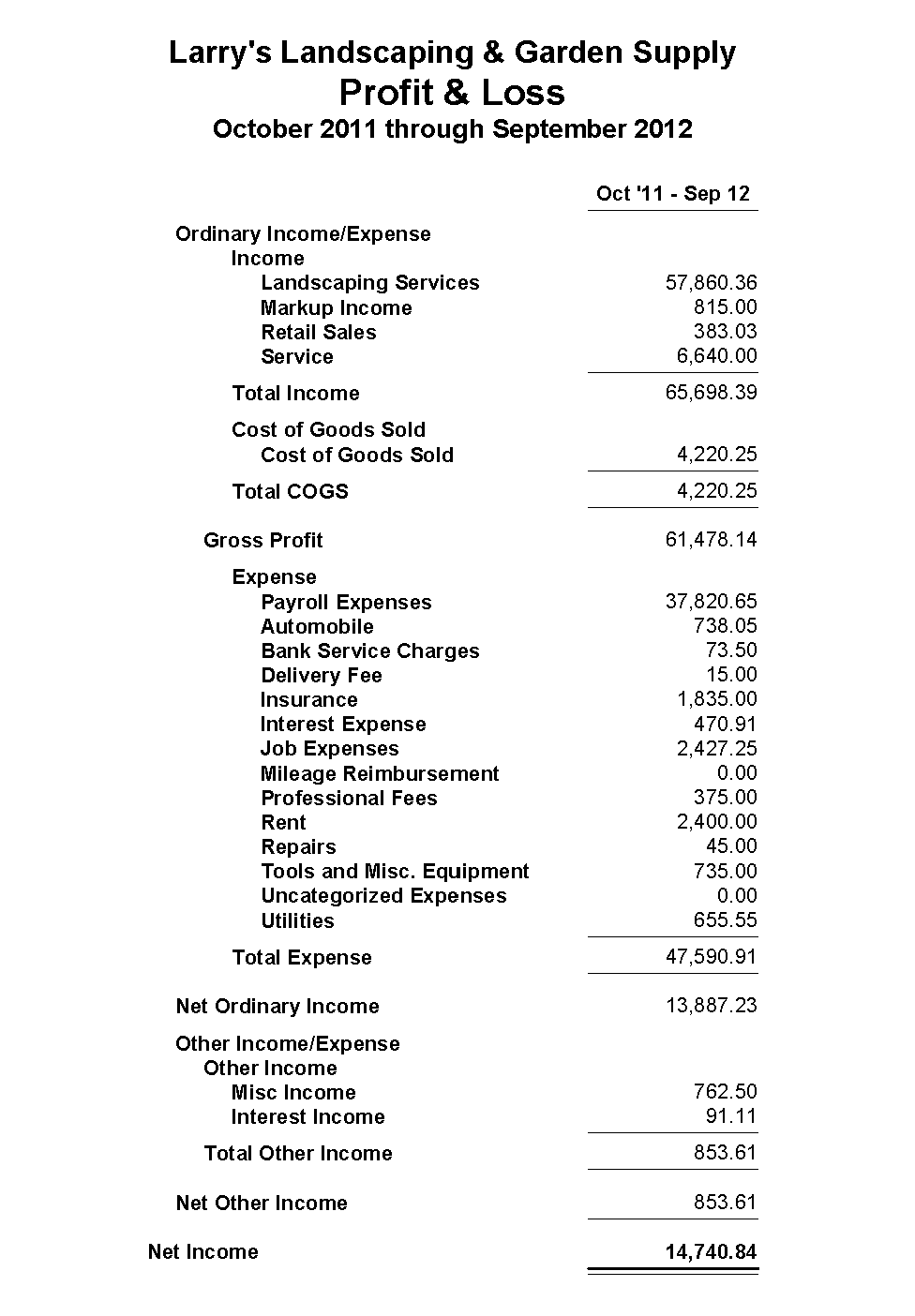

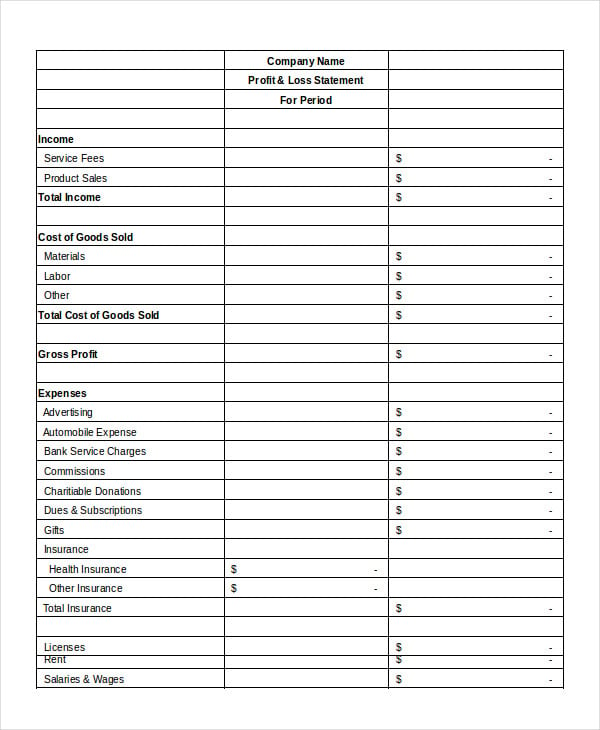

Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received.

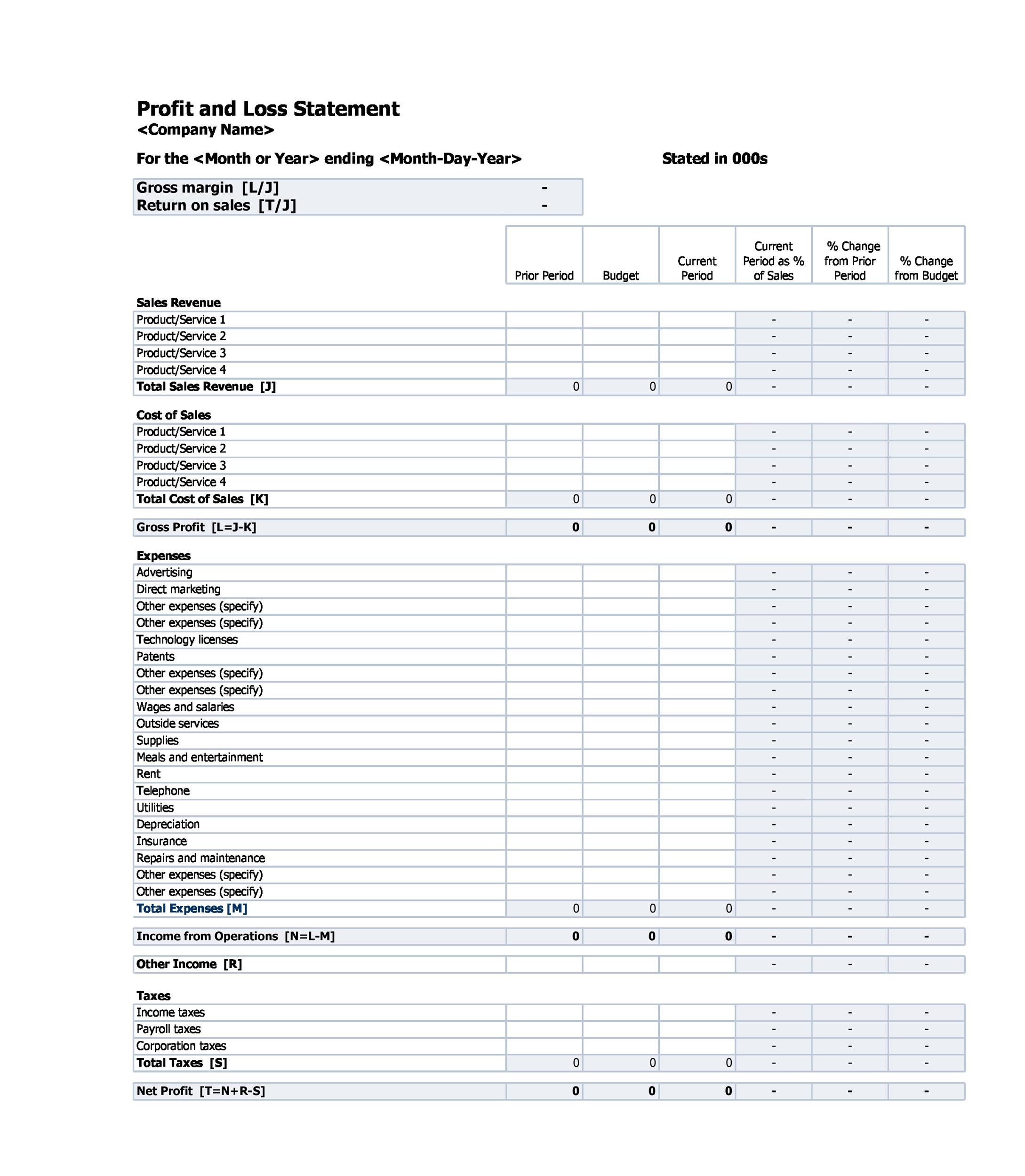

Profit and loss statement of company. You’ll sometimes see profit and loss statements called an income. What we’re referring to is the profit and loss statement (p&l), which gives you insight into how well your business is doing. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income.

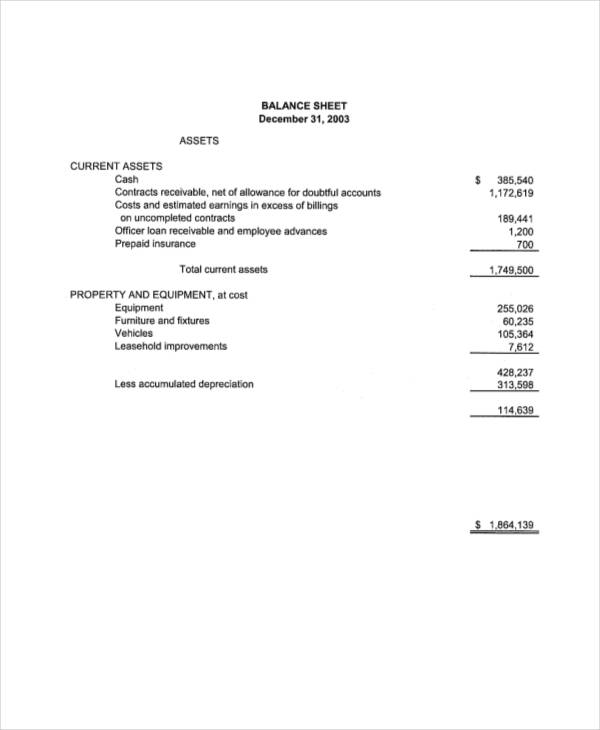

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. The profit and loss (p&l) statement is one of the most important financial statements companies report to provide insights into their financial performance. The main categories that can be found on the p&l include:

Accounts that will be reclassified to profit or loss 14. A profit and loss statement serves a simple purpose: A profit and loss (or income) statement lists your sales and expenses.

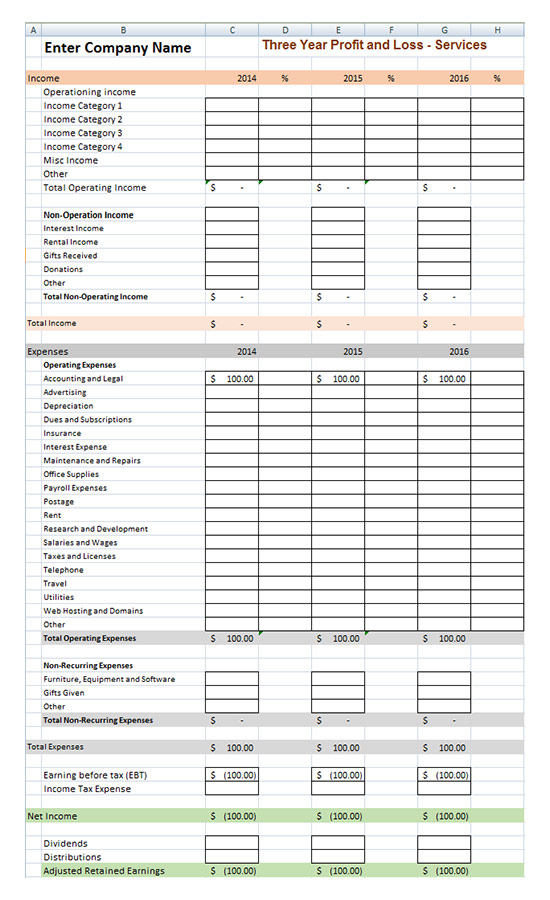

A profit and loss (p&l) statement, commonly referred to as an income statement, is a summary of the net profit and loss of a company over a period of time. How do you prepare a profit and loss statement? But, the profit and loss statement summarizes the profit or loss for a.

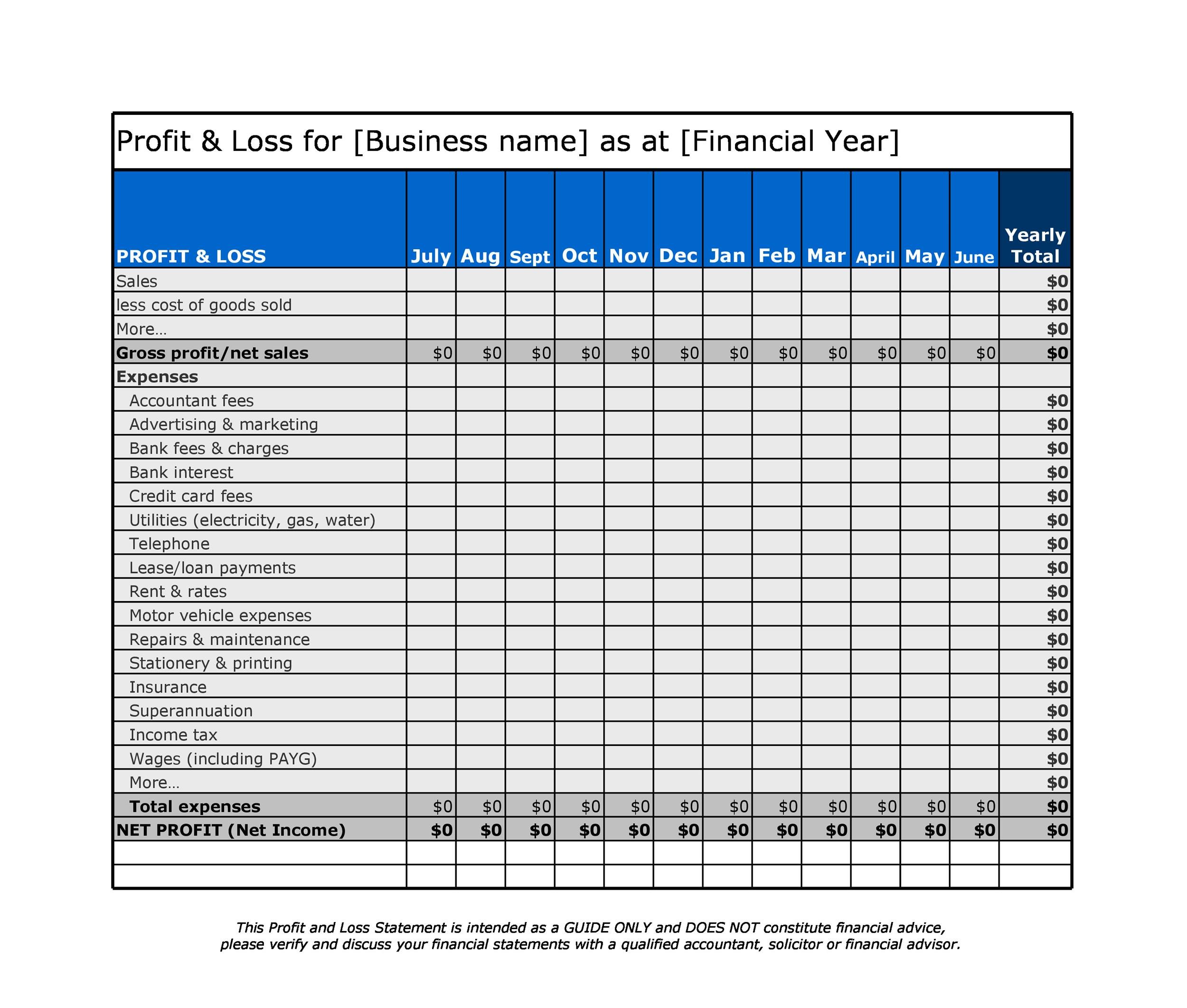

A profit and loss statement (p&l) is a vital financial document for businesses, providing a snapshot of a company’s financial performance over a specific period, such as monthly,. To show how your total revenue as a business compares to your. What is a profit and loss statement?

Gain (loss) from adjustment due to translation of financial. In fact, experts consider a. A company’s statement of profit and loss is portrayed over a period of time, typically a month, quarter, or fiscal year.

The final figure will show the financial performance and. Selling, general & administrative (sg&a) expenses 4. Calculate gross profit you can calculate your gross profit by taking the sum of the gross revenue and.

A p&l statement, also known as a profit and loss statement or income statement, is a financial document that explains a company’s financial health for a. It tells you how much profit you're making, or how much you’re losing. Or how badly, for that matter.

A company’s profit and loss (p&l) statement shows the companies revenues, costs, expenses, and net profit for a certain period. A profit and loss (p&l) statement is a type of financial statement covering a specific period and revealing a company’s revenues, costs, and expenses. A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364 million in a civil fraud case, handing a win to.

The income statement gives a more detailed view of a company’s financial performance. A profit and loss statement (p&l) sets out your company income versus expenses, to help calculate profit. A profit and loss statement template, sometimes referred to as a p&l template or income statement, is a financial report that lists a company’s costs, income, and profits for a.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Rental-Property-Profit-and-Loss-Statement-Template-TemplateLab.com_-scaled.jpg)