Nice Tips About Cash Flow Statement For Dummies Project Report On Comparative Analysis Of Two Companies Pdf

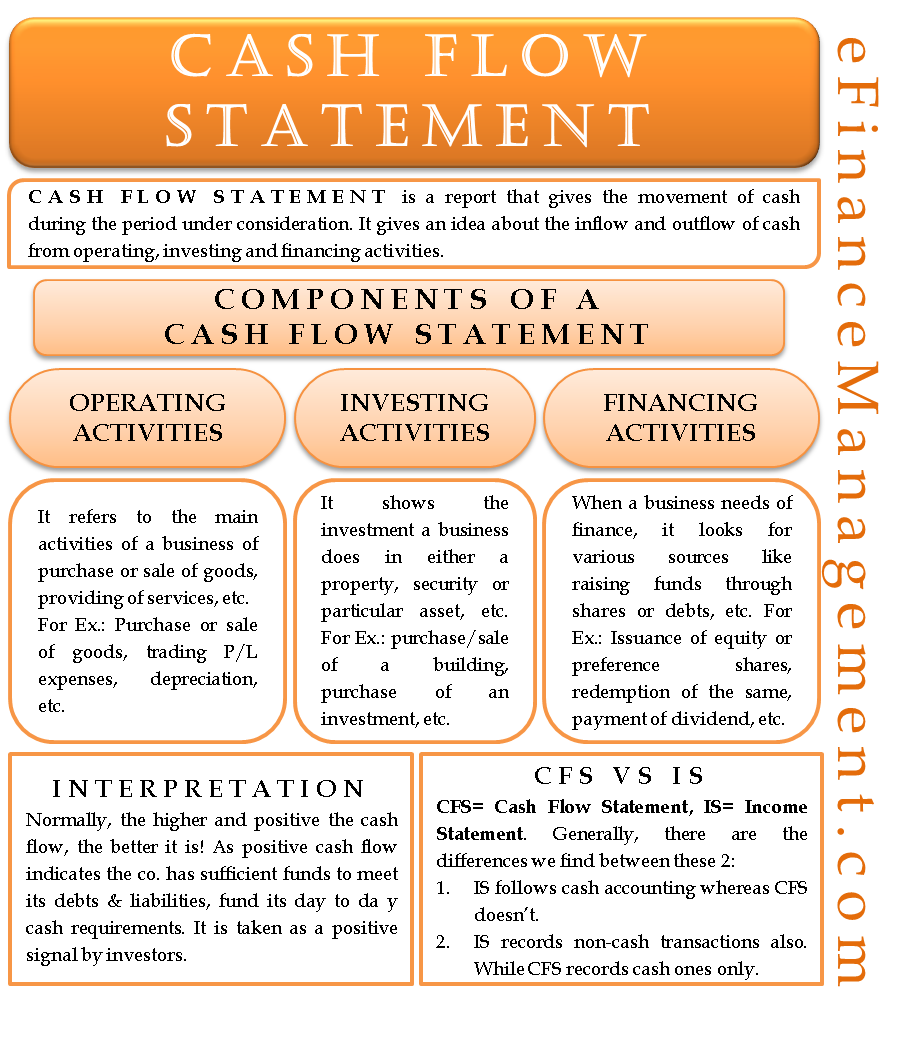

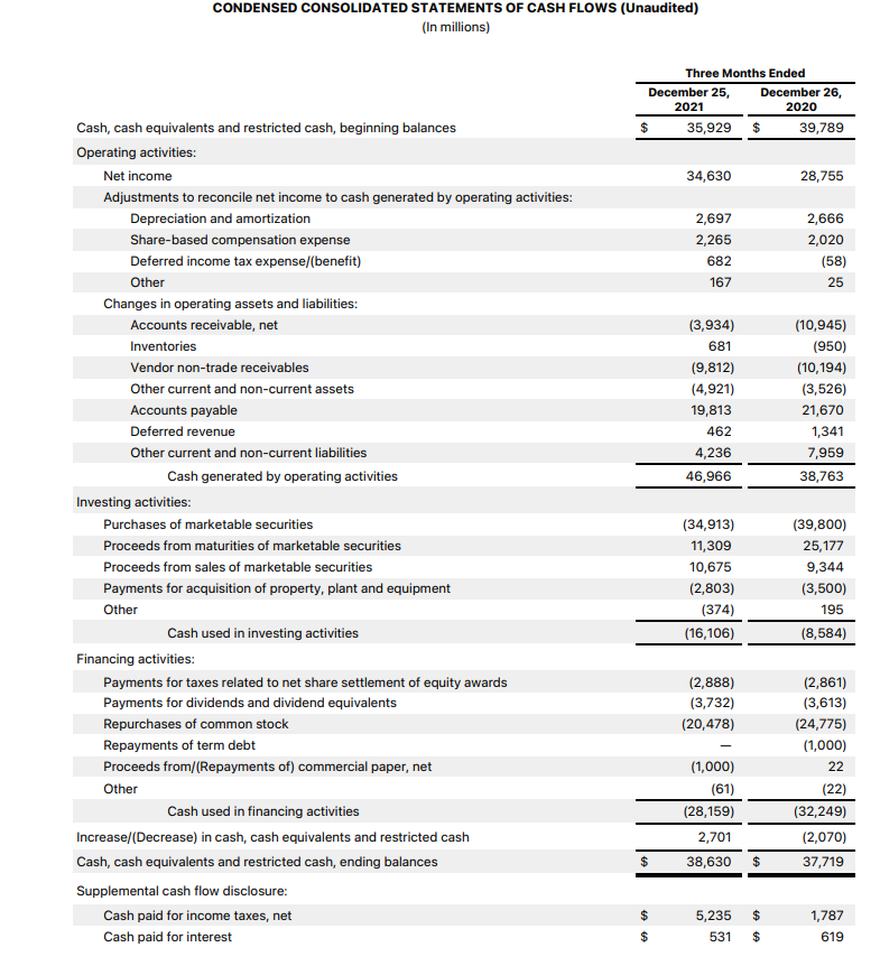

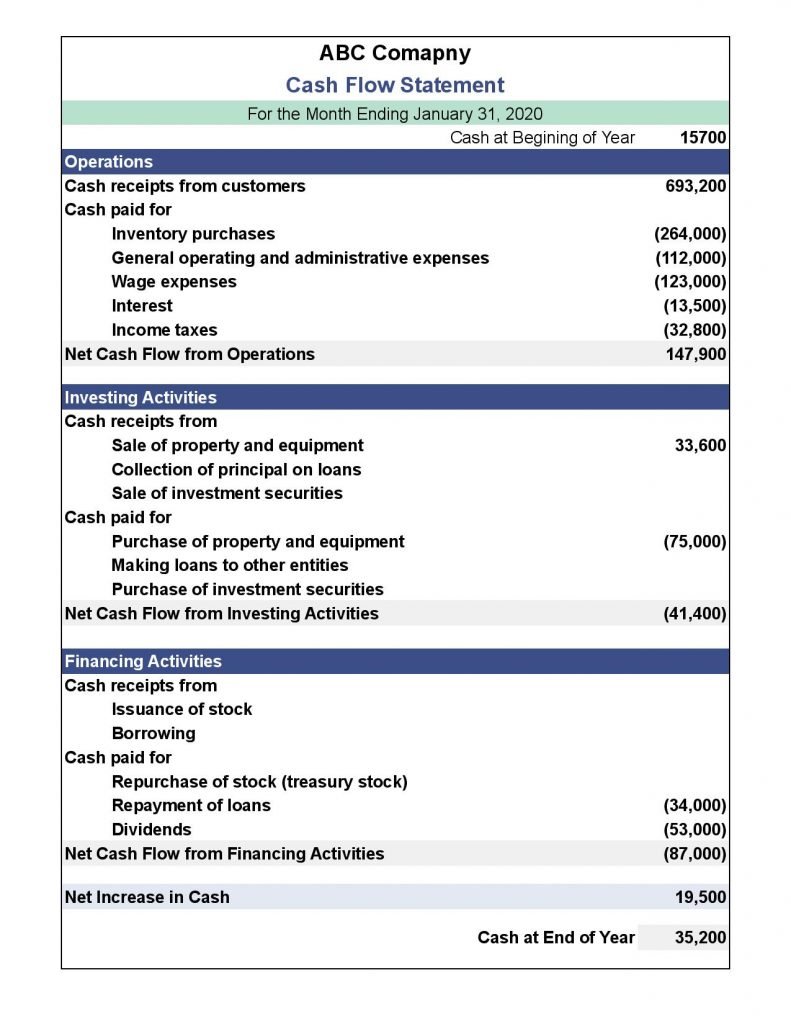

The statement of cash flows has three different sections classifying all cash receipts and payments:

Cash flow statement for dummies. The cash flow statement is a financial statement that reports a company's sources and use of cash over time. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. The sources and uses of cash in the operating section come from revenue, expenses, gains, losses, and other costs.

The cfs measures how well a. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. Cash flow for dummies tage c.

Learn the key components of the cash flow statement, how to analyze and interpret changes in cash, and what improved free cash flow means to shareholders. The cash flow statement is required for a complete set of financial statements. Free cash flow eur 423 million;

Looking over a cash flow statement is one of the best ways to find areas to cut back so you can maximize your business's profits. Cash flow statements provide details about all the cash coming into and exiting a company. This is a dummy description.

You should think of cash flow as the lifeblood of your business, and you must keep that blood circulating at all times in order avoid failure. Cash flow from operations, cash flow from investing, and cash flow from financing are summed to calculate the net change in cash. Ceo statement “in 2023, we delivered another strong and resilient performance.

A cash flow statement is the best way to see how much money you're making and losing over any given time period—anywhere from two weeks to a month, a year, or five years. The direct method of preparing the statement of cash flows shows the net cash from operating activities. If the company prepared a statement of cash flows for the prior year, you can find this information there.

Updated february 7, 2021. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. This article offers an overview of the statement of cash flows.

A company's cash flow can be categorized as cash flows from operations, investing, and. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. We will use these names interchangeably throughout our explanation, practice quiz, and other materials.

The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. If not, you will have to find information from the prior year's ending balance sheet and calculate the ending cash balance. This section shows sources and uses of cash from debt and equity purchases and sales;.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Managing cash flows is essential to the successful operation of your business. A cash flow statement is one of three key documents used to determine a company's financial health.

![[PDF] Cash Flow For Dummies by John A. Tracy eBook Perlego](https://book-extracts.perlego.com/1002129/images/9781118018507-pp0101_fmt-plgo-compressed-1000.jpg)