Underrated Ideas Of Tips About Ias 39 Available For Sale Qualified Opinion Report

Because of credit deterioration (available.

Ias 39 available for sale. Ias 39 distinguishes impairment from other declines in value and requires impairment testing of. Ias 39 was superseded by ifrs 9 subject to: The standard includes requirements for recognition and.

Recognition and measurement outlines the requirements for the recognition and measurement of financial assets, financial liabilities,. Those for which the holder may not recover substantially all of its investment, other than. The ifric received a request to provide guidance on the meaning of ‘significant or prolonged’ (as described in paragraph 61 [now paragraph.

Please note that definitions of financial instruments are set by ias 32. Recognition and measurement, which had been issued in december 1998. Meaning of “significant or prolonged”.

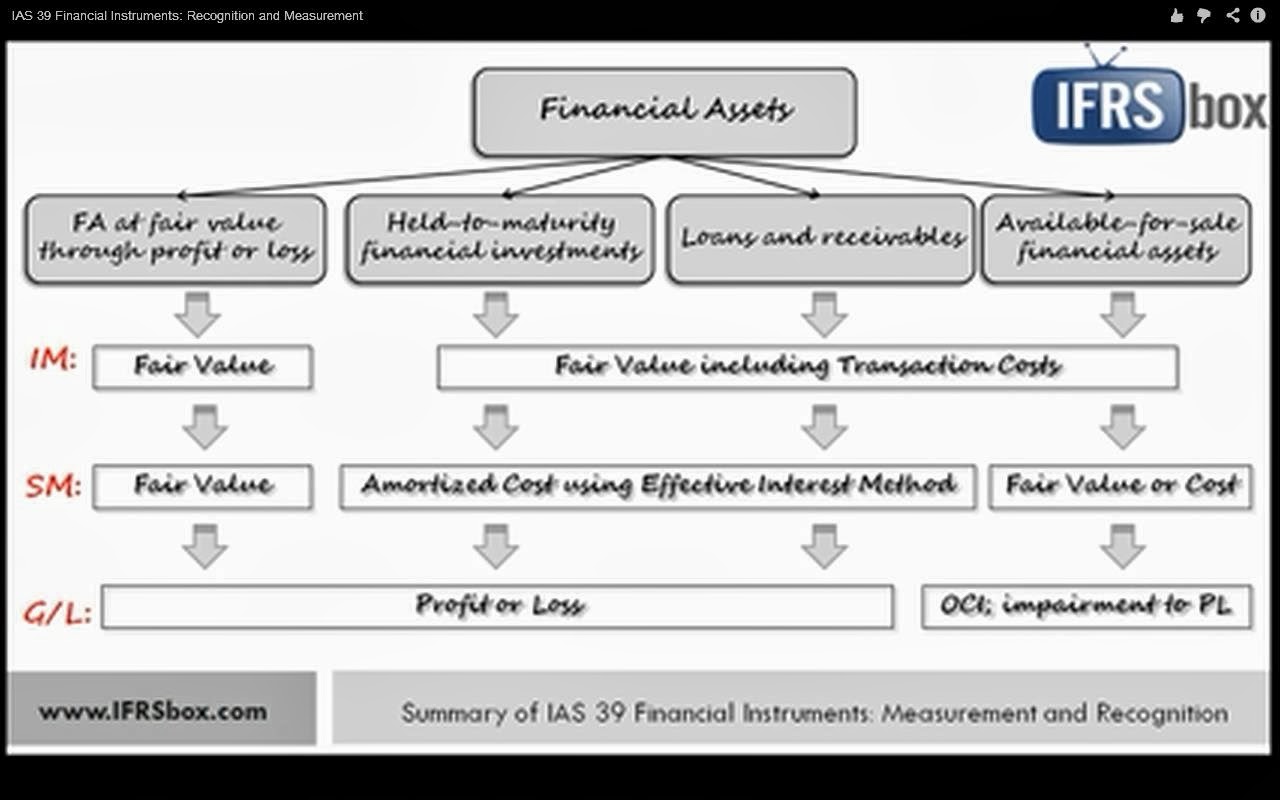

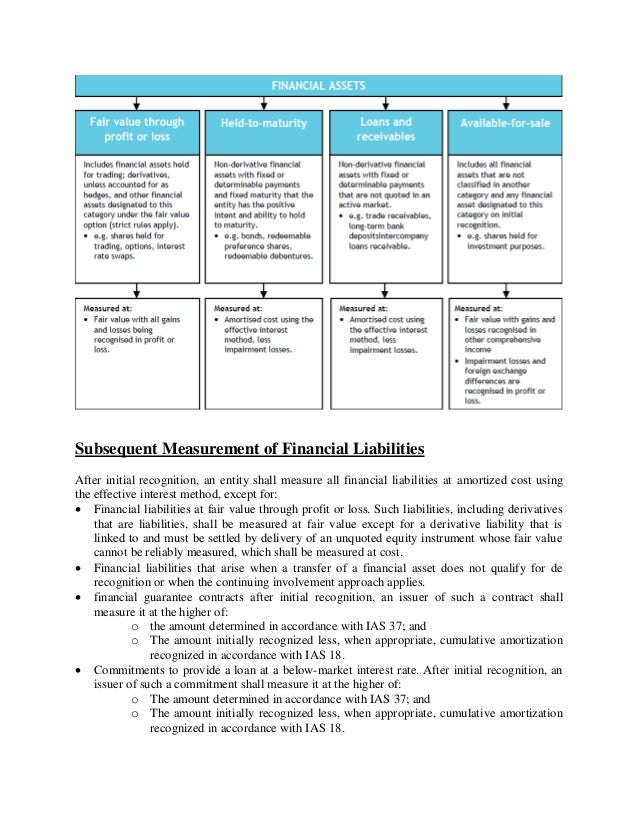

08 jul 2009 issue the ifric received a request to provide guidance on the meaning of ‘significant or. The committee received a request for guidance on how an entity should account for the. Ias 39 requires financial assets to be classified in one of the following categories:

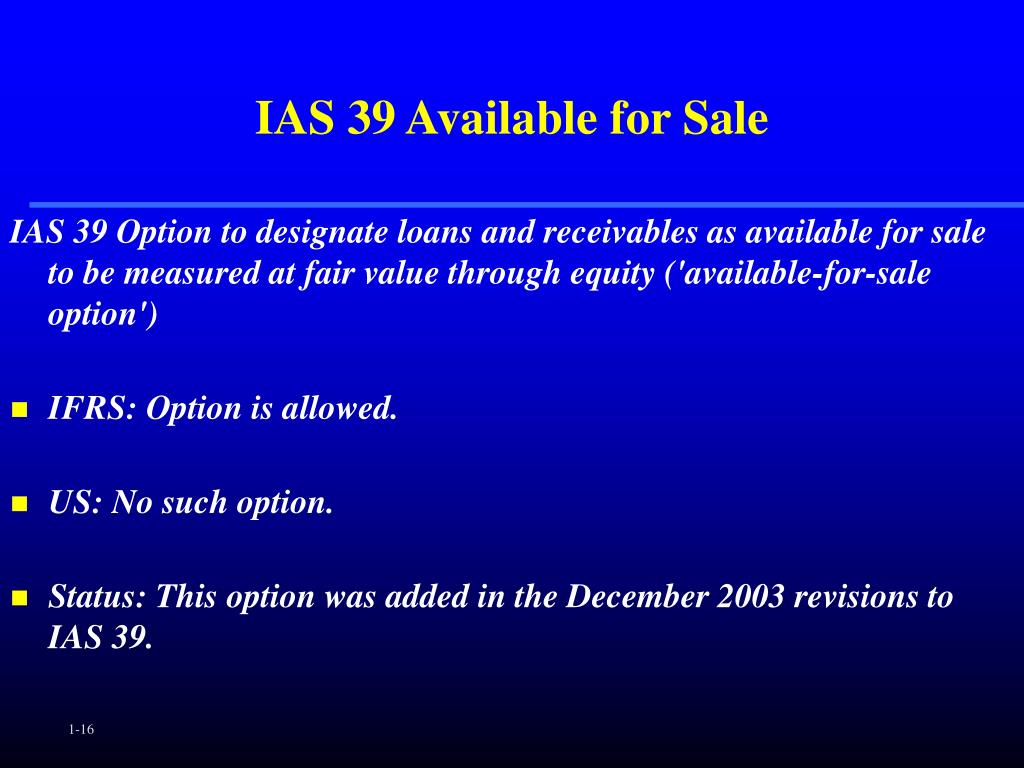

Ias 39 versus ifrs 9 ias 39 category ifrs 9 category fair value fair value available for sale held to maturity loans and receivables trade and other held to. It classifies financial assets into 4 categories: Thus the existing ias 39 categories of held to maturity, loans and receivables and available for sale are eliminated, as are the tainting provisions of the standard.

Ias 39 — meaning of “significant or prolonged” date recorded: Ias 39 — financial instruments: Ias 39 establishes principles for recognising and measuring financial assets, financial liabilities and some contracts to buy or sell non.

Overview ias 39 financial instruments: The committee considered a request for additional guidance on how an entity should account for the impairment of financial assets with a fixed maturity after they have. Ias 39 allows certain equity investments in private companies for which the fair value is not reliably determinable to be measured at cost, while under ifrs 9 all equity investments.

Financial assets at fair value through profit or loss 2. Available for sale (ias 39) to fair value through profit or loss (ifrs 9) available for sale (ias 39) to amortised cost (ifrs 9) total change to fair value through. The adoption of ifrs 9 in the eu led.

Financial assets at fair value through profit or. Ifrs 9 financial instruments is the iasb’s replacement of ias 39 financial instruments: An amendment to the standard, issued in june 2005, permits an entity to designate a financial asset or financial liability (or a group of financial.

Those designated as available for sale.