Divine Tips About Debt Issuance Costs On Cash Flow Statement Example Is Income And Profit Loss The Same

31 may 2022 us financial statement presentation guide 12.9 debt issuance costs include various incremental fees and commissions paid to third parties.

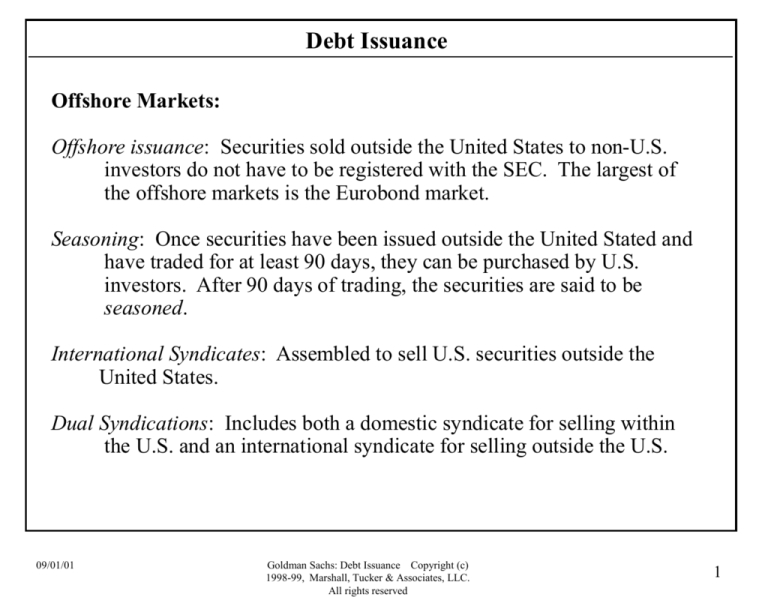

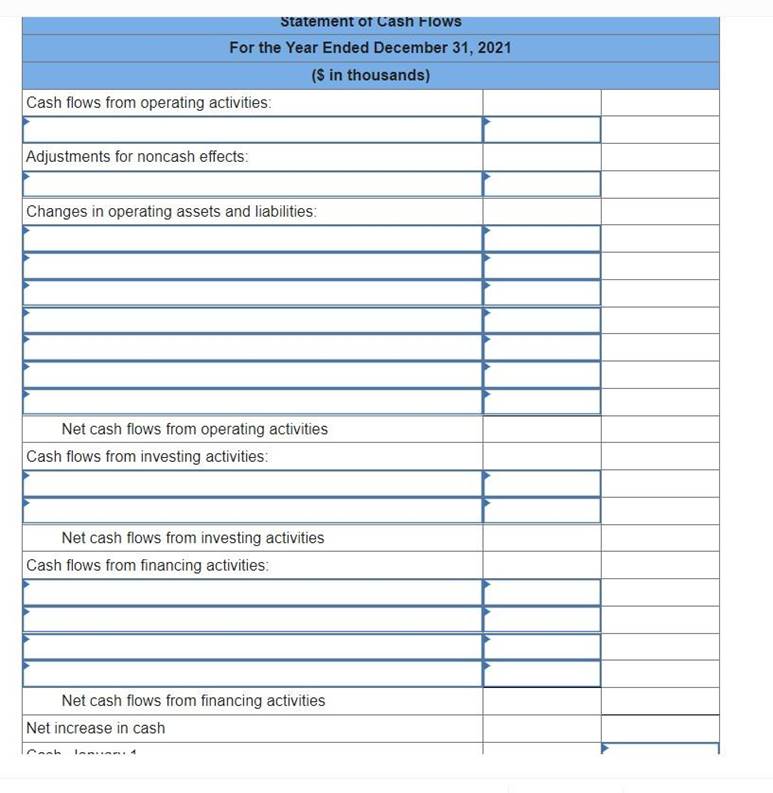

Debt issuance costs on cash flow statement example. Paying debt issue costs; Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. Extinguishments of debt (1) for cash, noncash financial assets, equity shares, or goods or services or (2) as a result of a legal release.

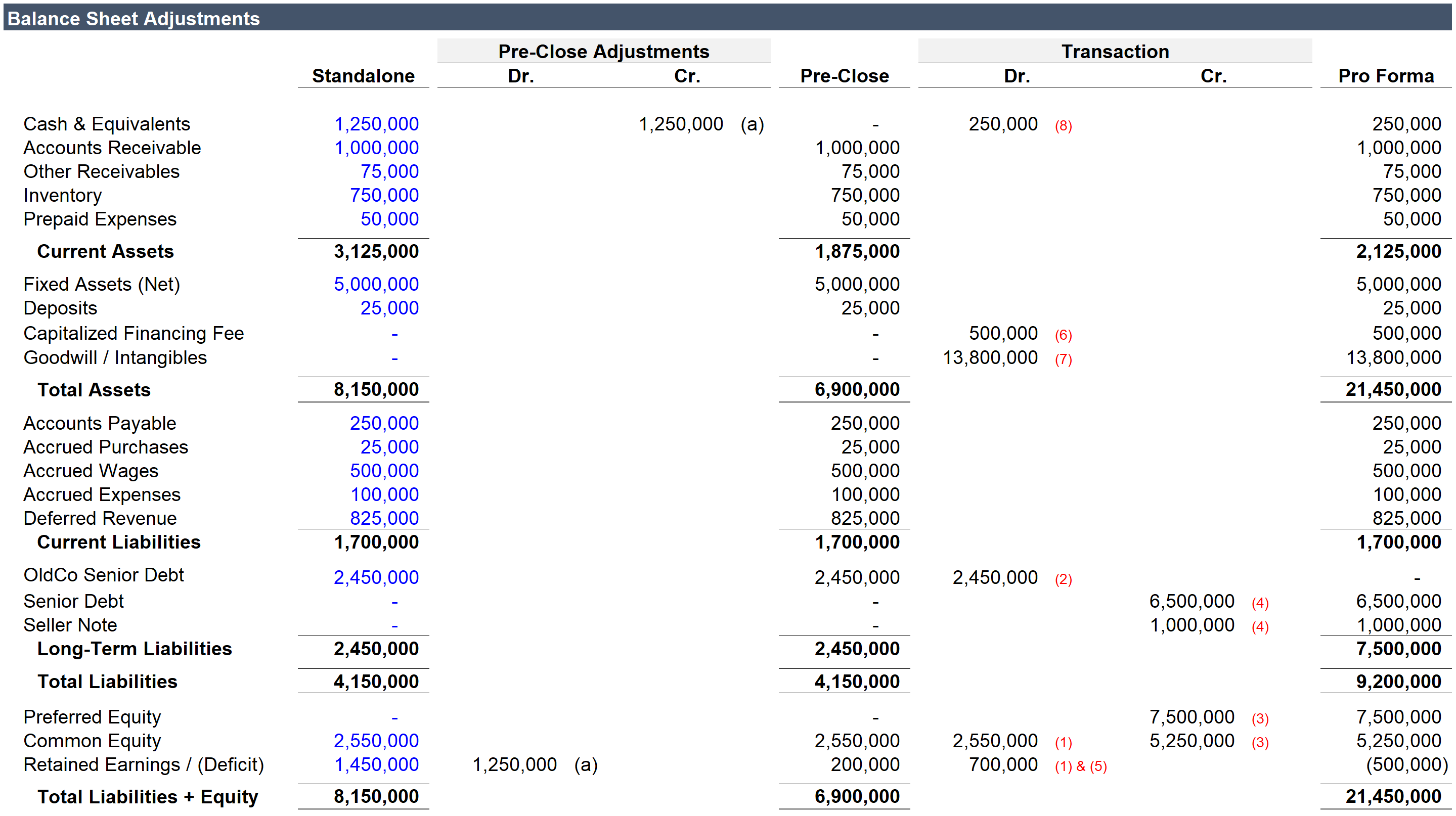

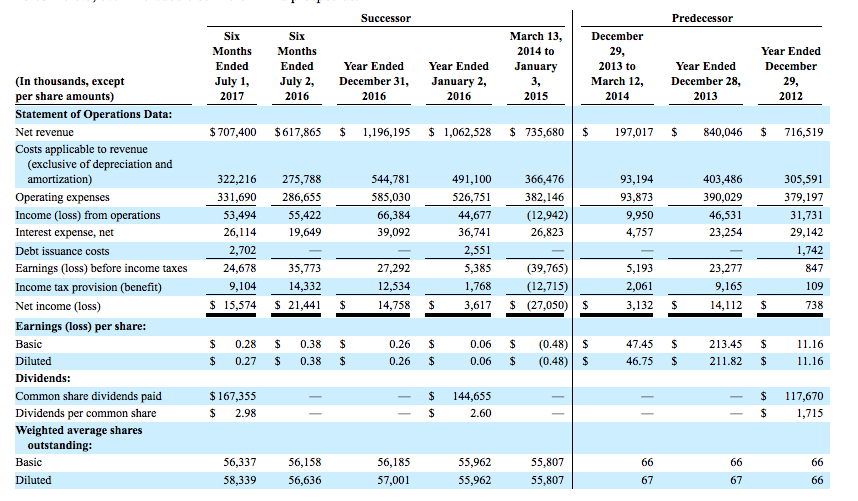

Examples of cash outflows from financing activities are cash outlays for dividends, share repurchases, payments for debt issuance costs, and the paydown of outstanding debt. Us ifrs & us gaap guide the balance sheet presentation of transaction costs for us gaap is generally aligned to ifrs. For example, entities must consider:

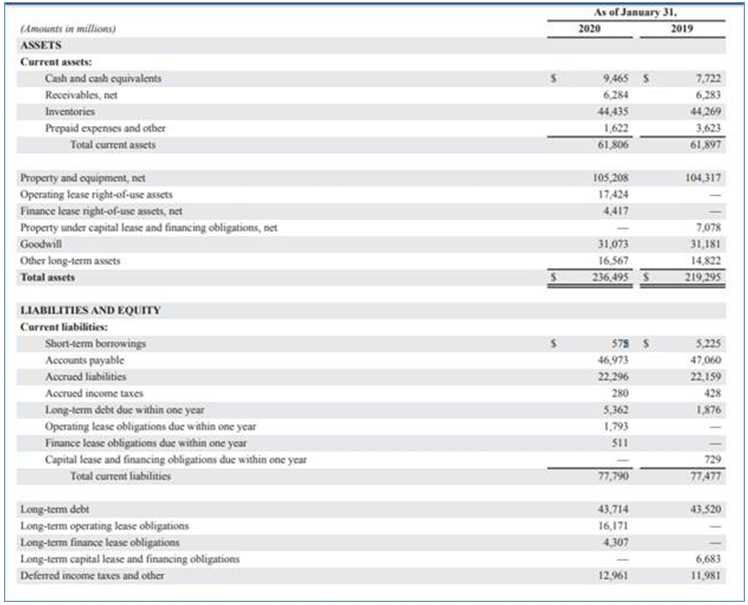

A debt discount may reflect fees paid by a reporting entity to a lender as part of a debt issuance or the issuance of debt at a below market coupon. For example, when bonds are issued, the issuer will incur accounting, legal, and underwriting costs to do so. For example, cash flow statements can reveal what phase a business is in:

A cash flow statement example is the comparative consolidated statements of cash flows for enphase. However, you’ve already paid cash for the asset you’re depreciating; However, there may still be differences in the.

List of debt issuance costs debt issuance costs are the fees associated with issuing new debt. Whether it’s a rapidly growing startup or a mature and profitable company. Example on january 1, 2015, an.

For all businesses whose years begin after 12/15/15 (essentially, starting with the financial statements of 2016 calendar year ends), debt issuance costs are to. To record the amortization expense, debit the debt issuance expense account and credit the credit issuance cost account. In the bottom area of the statement, you will see the cash.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a. For example, depreciation is recorded as a monthly expense. In essence, any expenses that can be directly.

The example below illustrates how an entity would record debt issuance costs before and after adopting the asu’s guidance. Continuing with the example, the annual issuance expense is $10,000 divided by 10, or $1,000.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

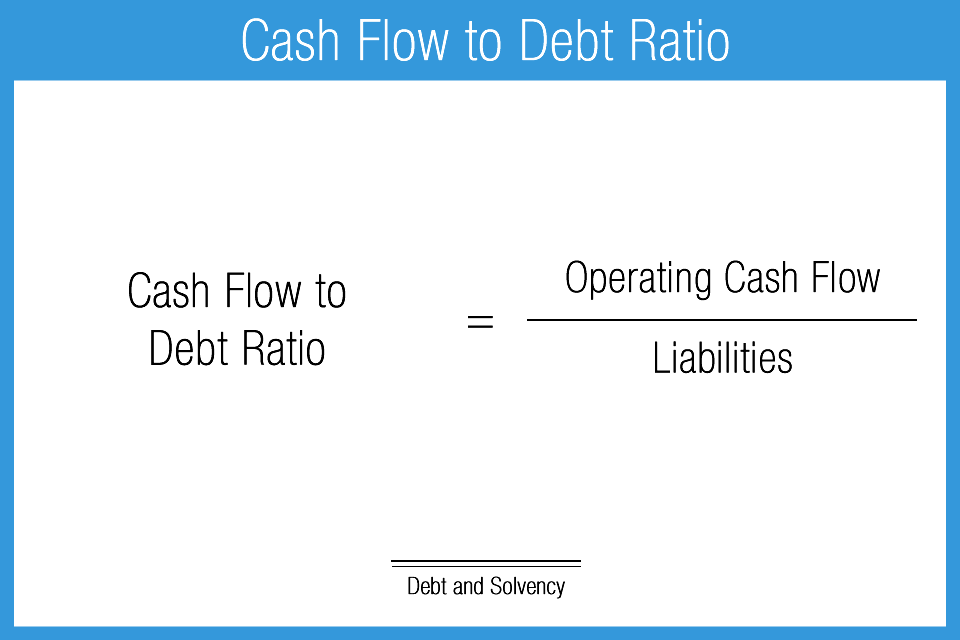

:max_bytes(150000):strip_icc()/final_cashflowtodebtratio_definition_1102-0ee183755e0648dfa9a9027944d8a80c.png)