Unbelievable Tips About Net Income From Cash Flow Statement Trial Balance Definition Accounting

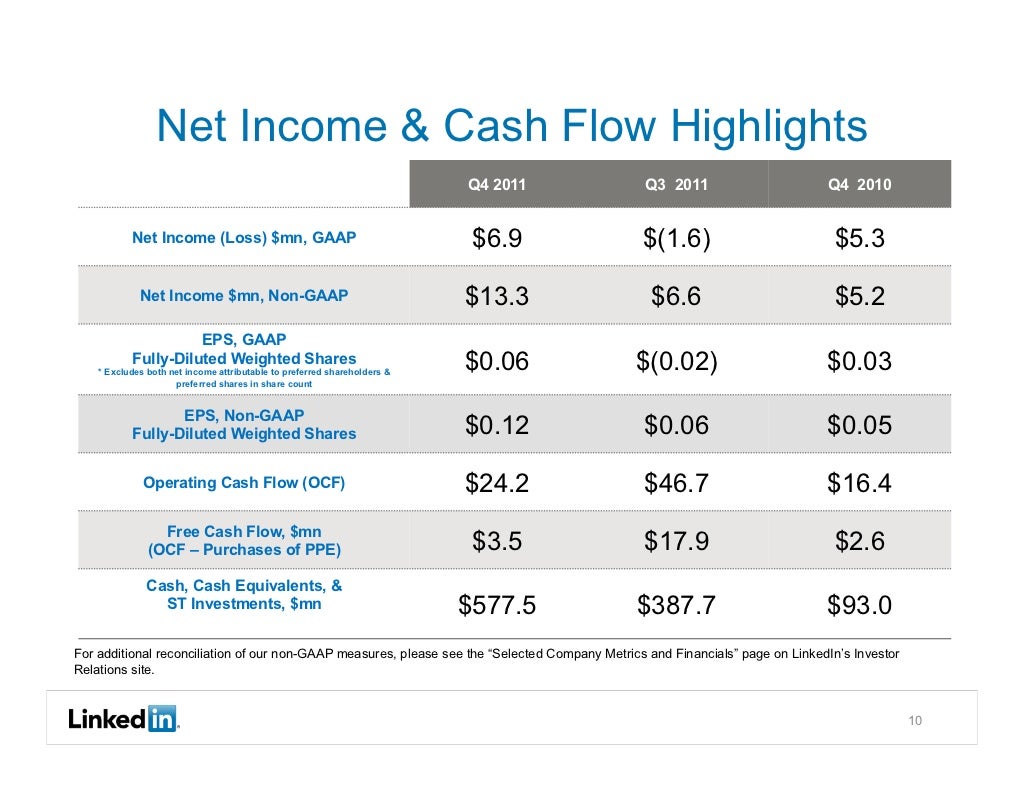

Determine the current period for analysis, whether it's monthly, quarterly, or annually.

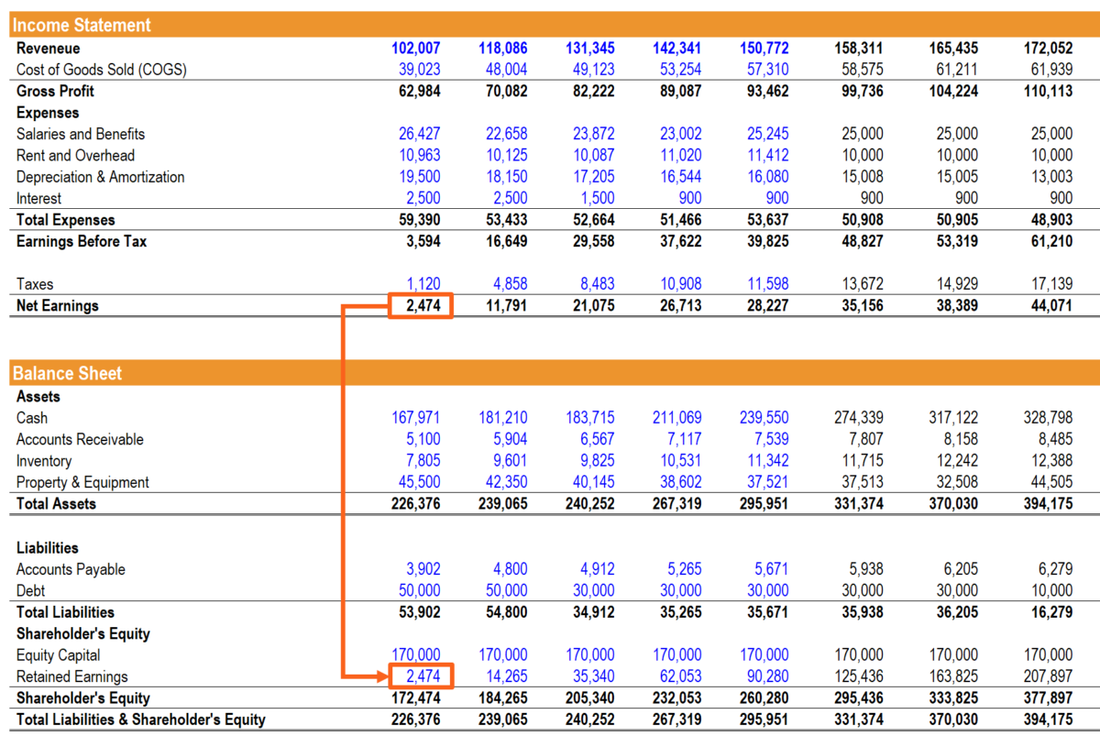

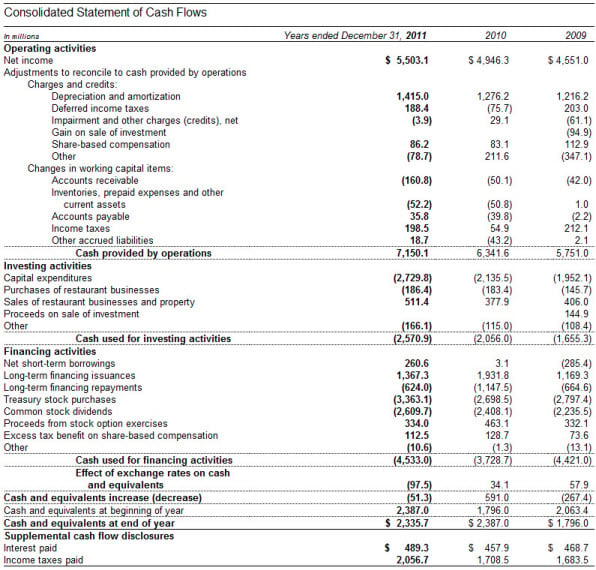

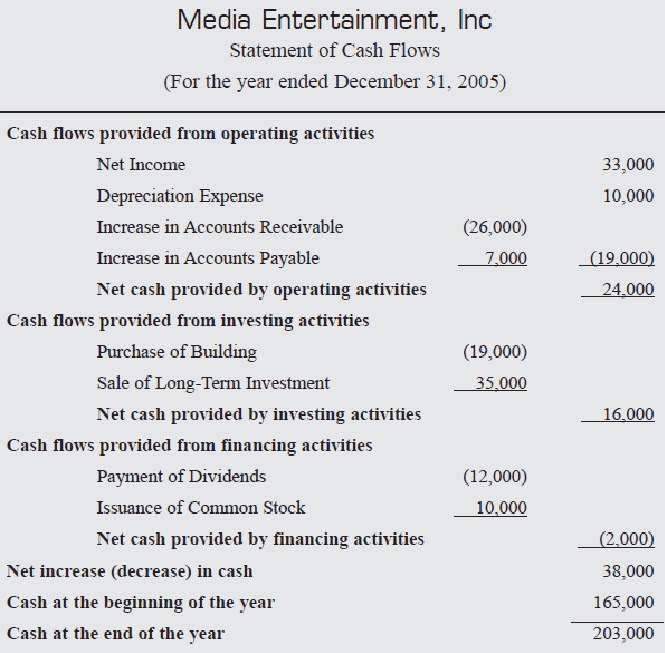

Net income from cash flow statement. Gains or losses from the settlement of asset retirement obligations Like with the cash flow statement,. All lines thereafter, in that section, are then adjustments to reconcile net income to actual cash flows by adding back noncash expenses like depreciation and adjusting for changes in asset and liability accounts.

Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500. The cash flow statement reports the cash generated and spent during a specific period of. Did you get it ⬇️樂 question:

This value does not include accounts receivable, operating expenses or accounts payable and is taken directly from the income statement. The cfs measures how well a. The depreciation amount of $19.8 billion (blue) was added back into cash flow.

On the other hand, a company’s balance sheet shows the assets, liabilities, and shareholders’ equity. The net income figure of $19.8 billion (green) is the top line of the cash flow statement. Net working capital (nwc) line items on the balance sheet are each tracked on the cfs.

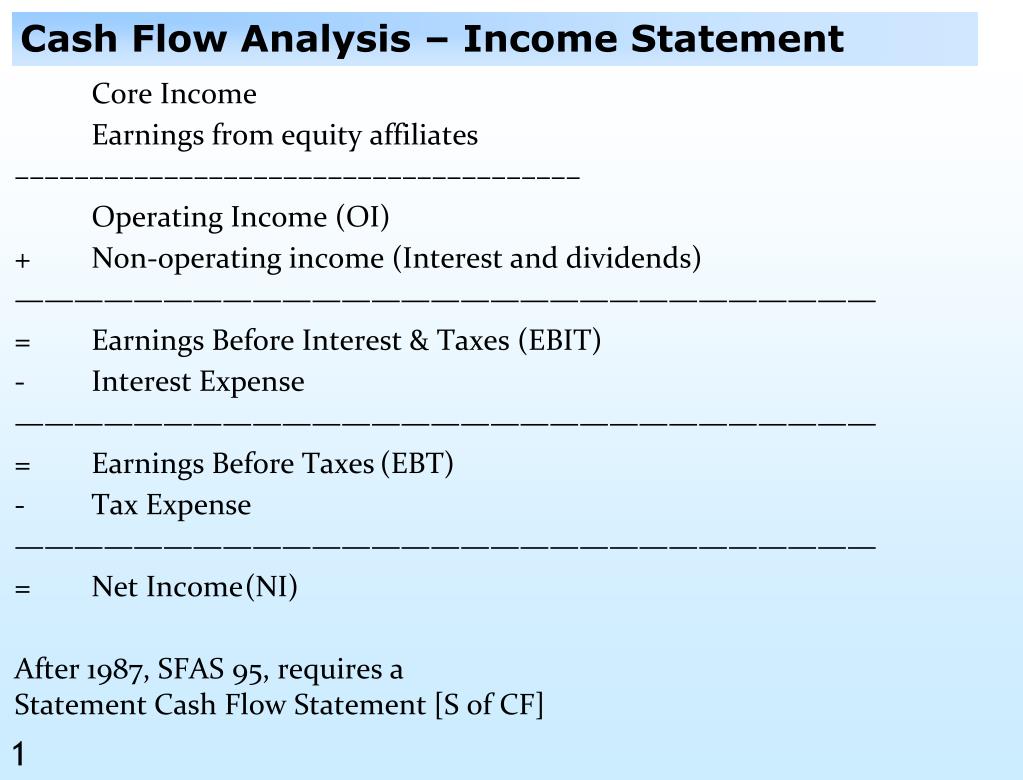

For example, depreciation is a noncash expense. Thus, the income statement to gauge a company’s financial performance and assess their profitability. Net income is the revenues recognized in a reporting period, less the expenses recognized in the same period.

Net income from the income statement flows in as the starting line item on the cash flow from operations section of the cfs. Securities and exchange commission (sec) and the. It follows gross income and operating income and is a final monthly,.

Net income net income is earned revenues minus incurred expenses, including taxes, and costs of goods sold (cogs). Cash flow statement: This amount is generally calculated using the accrual basis of accounting, under which expenses are recognized at the same time as the revenues to which they relate.

Determine the starting point identify the starting point for calculating the free cash flow. The cash flow statement or statement of. Net income is the first line in the company’s cash flow statement.

A cash flow statement is one of the quarterly financial reports publicly traded companies are required to disclose to the u.s. The cash flow statement is typically broken into three sections: From the above example, we can see that the computed cash flow for fy 2018 was $ 2,528,000.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. This is the cash flow statement for xyz company at the end of financial year (fy) 2018. Every cash flow statement begins with a declaration of net income which is the net earnings for that period.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)