Best Of The Best Tips About Going Concern Frs 102 Vedanta Share Balance Sheet

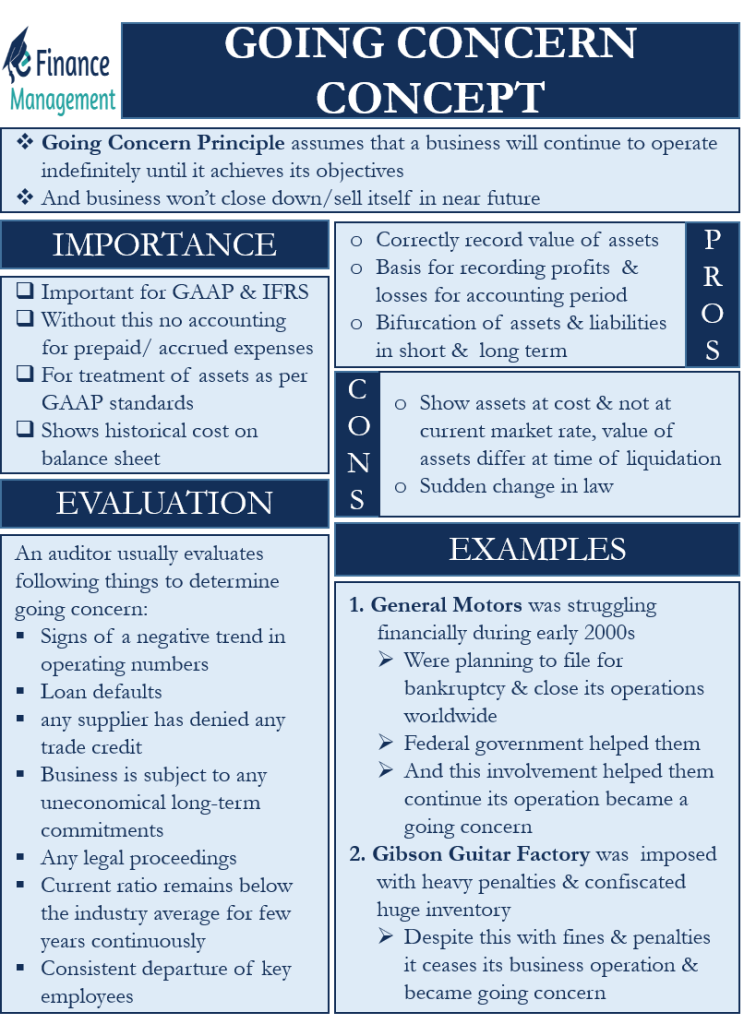

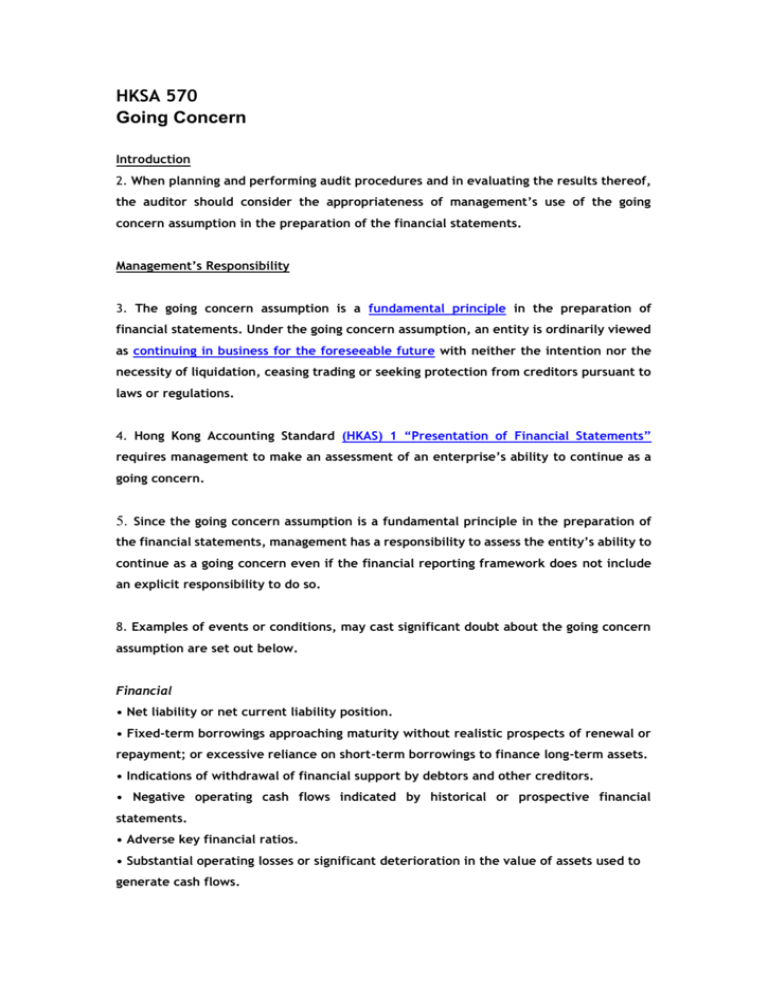

Reporting standard 102 (‘frs 102’) and the charities sorp, the trustees with management, are required to make an assessment of the charity’s ability to continue as.

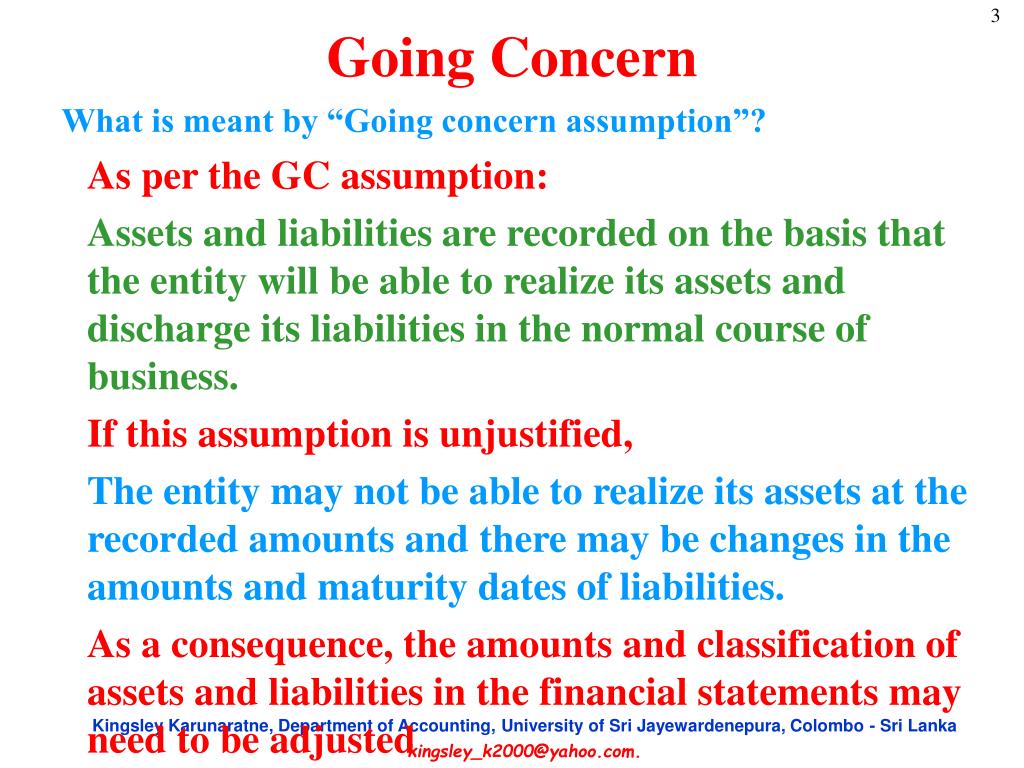

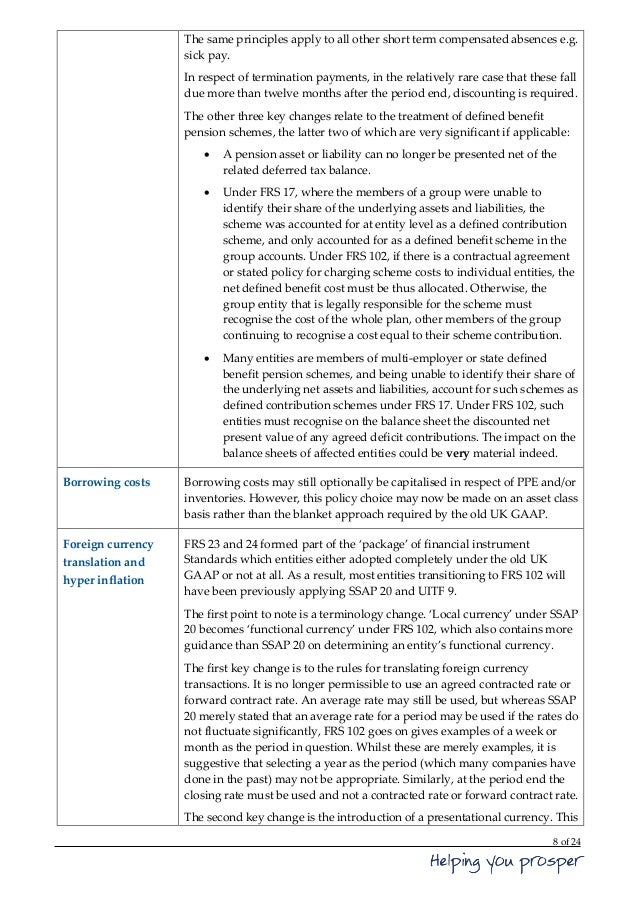

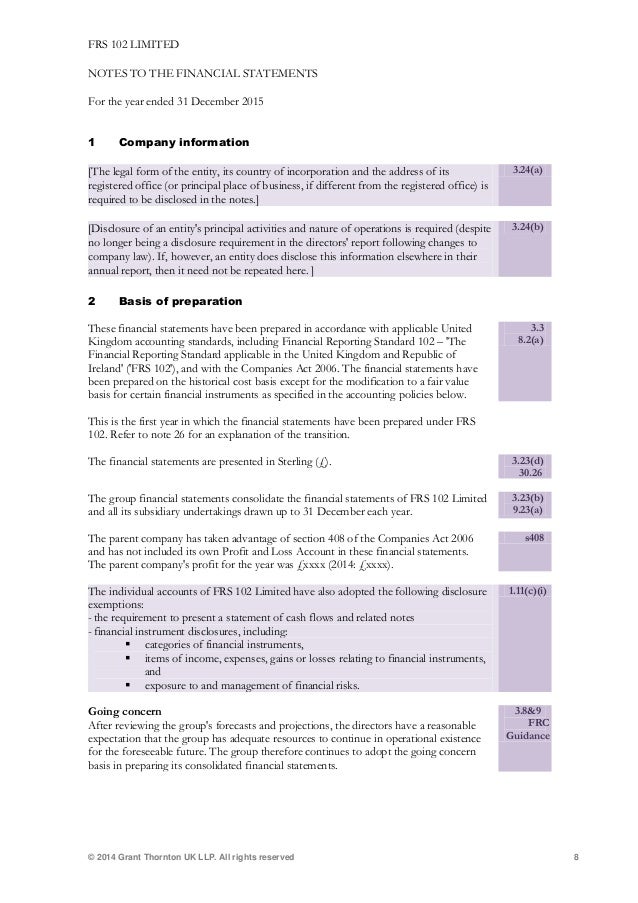

Going concern frs 102. An entity adopts the going concern. Frs 102, paragraph 1ae.1(c) was amended as part of the triennial review to clarify that it is material uncertainties related to events or conditions which cast significant doubt upon. This refers to the concept of.

Frs 102, section 1a, para 1ae.1(c) encourages a small entity to. Frs 102 is part of a suite of standards that form ‘uk gaap’. The requirements of frs 102 and auditing standards are unchanged including the responsibilities of directors around going concern.

The standard defines going concern by explaining that financial statements are prepared on a going concern basis unless. Paragraph 3.2 of frs 102 requires financial statements to present fairly the financial position, performance and cash flows of an entity. When assets are impaired, frs 102 requires entities to disclose the amount of the impairment loss recognised in profit or loss during the period and the line item (s) in.

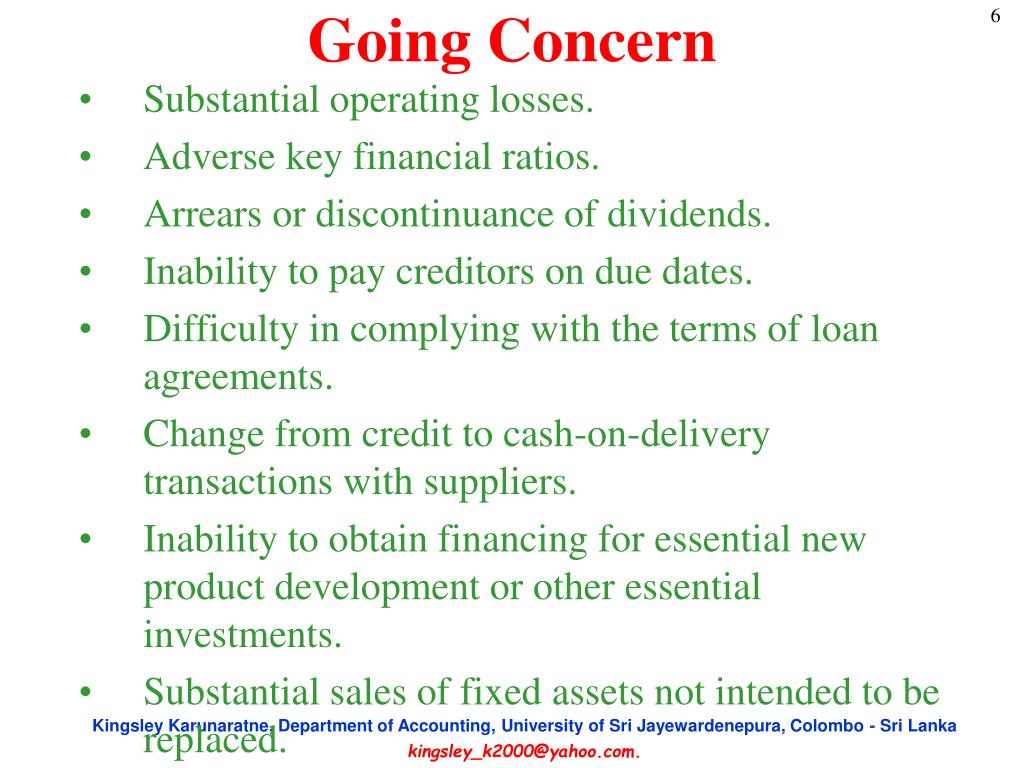

What does frs 102 say? As disclosed in the accounting policies note at note x, the company ceased to trade on 4 february 2016 on the grounds that the directors were unable to source additional finance. The going concern concept is a fundamental accounting concept and, as such, underlies the financial statements.

The companies act 1985 also requires that ‘the. The standards are listed below, together with the dates of the latest editions in issue at the time of writing: Entity’s ability to continue as a going concern.

When there is objective evidence that debtors were not recoverable as at the balance sheet date they must be written down immediately (frs 102.11.21), for example there is. We have published our comment letter on the financial reporting council’s (frc’s) financial reporting exposure draft (fred) 75 'draft amendments to frs 104 interim. Introduction on 18th april 2016, the frc published guidance on the going concern basis of accounting and reporting on solvency and liquidity risks.

Entities reporting under frs 102 must provide disclosures in their financial statements regarding key assumptions concerning the future, and other key. When an entity does not prepare financial statements on a going concern basis, it is required to disclose that fact, together with the basis on which it has prepared. When preparing financial statements, management must make an assessment of the company’s ability to continue as a going concern.