Exemplary Tips About Forecasting Accrued Expenses Signed Balance Sheet

Examples include gift cards and software for which upfront payment implies rights.

Forecasting accrued expenses. Uber announced its first share buyback last week. Forecasting under the cash vs accrual basis startups are often more interested in forecasts prepared on a cash basis since this more accurately reflects the. Accrued expenses = $12m — decline by 0.5% as percentage of opex each year;

For example, to calculate the prepaid expenses accrual, the formula can be: Prepaid expenses are made in advance for goods and services that will be provided in the future. How to project the balance sheet (19:03) in this tutorial, you will learn which income statement line items should be linked to balance sheet accounts.

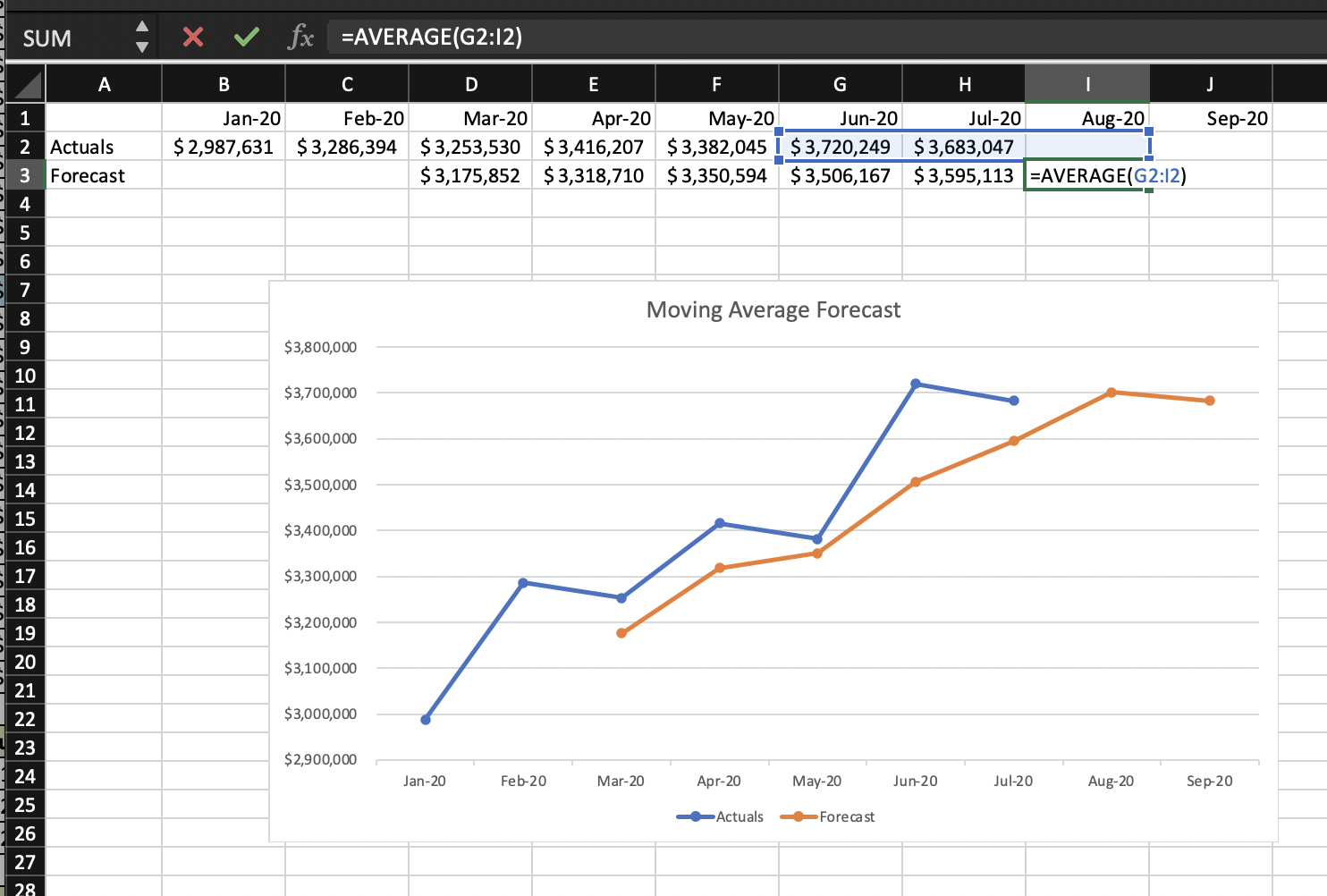

How to forecast expenses. There are several ways to forecast accrued expenses including their balance sheet and cash flow impact, but by far the simplest method is to use the accrued expenses. Take the average of accrued expenses/sales from years 1 through 3, which is 8%, and keep that percentage constant in the forecasted years.

If you aren’t sure, grow with revenue. At its most basic, to make an expense forecast you can simply take last year’s costs, add a percentage increase (say, 4%) to that number, and. Accruals are revenues earned or expenses incurred that impact a company's net income on the income statement, although cash related to the transaction.

Refers to sales that cannot be recognized as revenue yet. If the accrued expenses are largely for expenses that will be classified as sg&a, grow with sg&a. For example, a company might receive goods or services and pay.

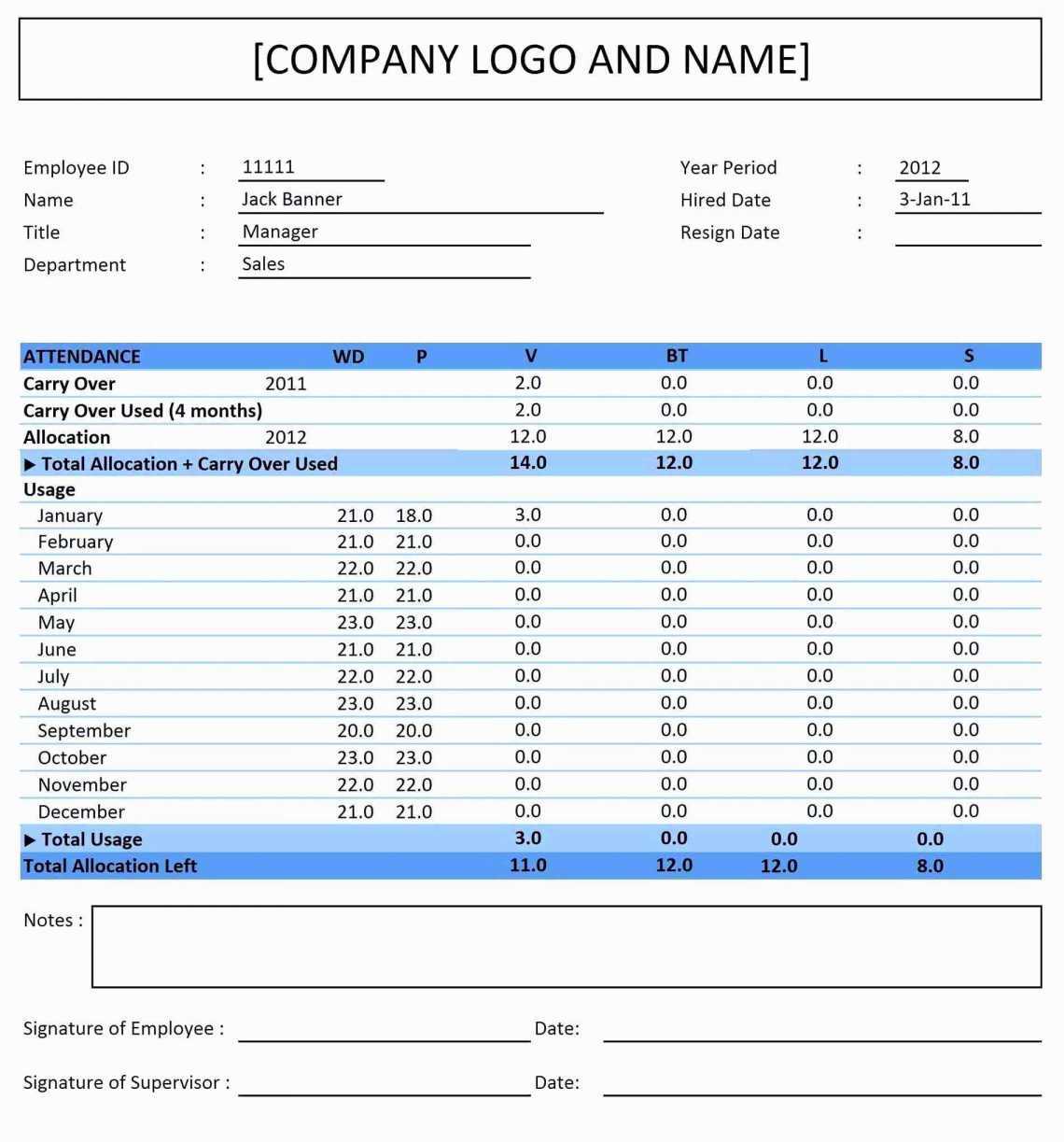

Budgeting and forecasting: In year 0, our historical period, we can calculate the driver as: Accrued expenses, also known as accrued liabilities, are expenses recognized when they are incurred but not yet paid in the accrual method of accounting.

Santa clara, calif., feb. Nvda) today reported revenue for the fourth quarter ended january 28,. Accrued expenses are expenses that a business incurs, but hasn't yet paid yet.

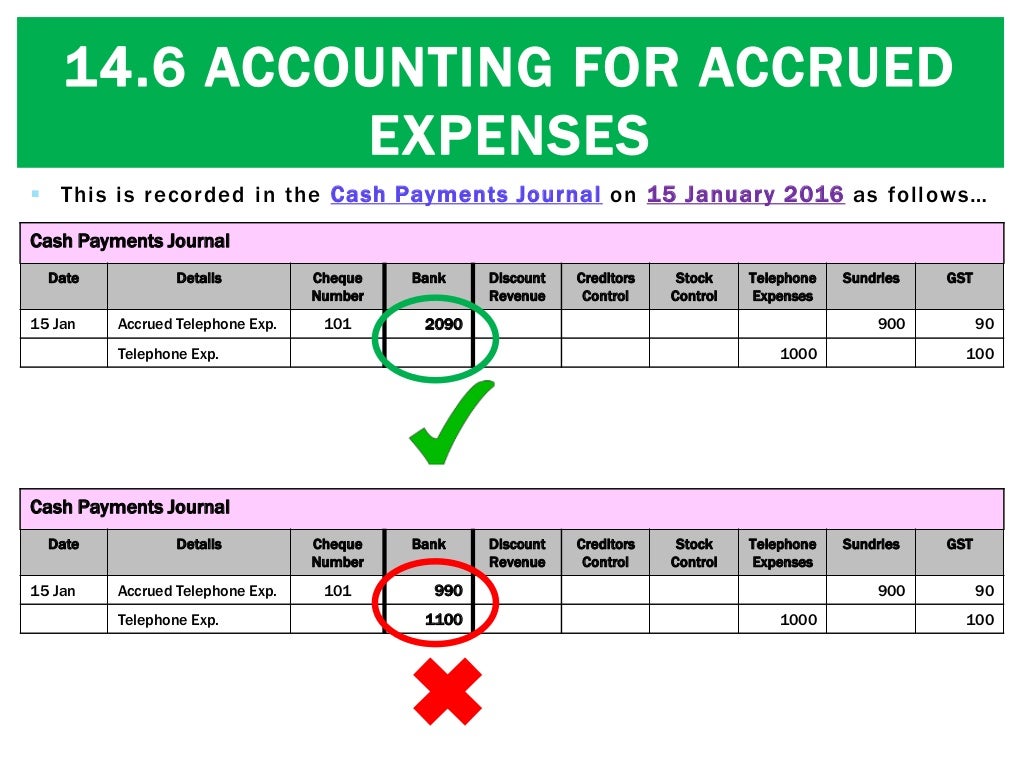

Forecasting the capital structure of a company impacts both the balance sheet and the income statement through different items, including dividends and interest expense. Excel formulas make calculating accruals and deferrals simple. What are accrued expenses?

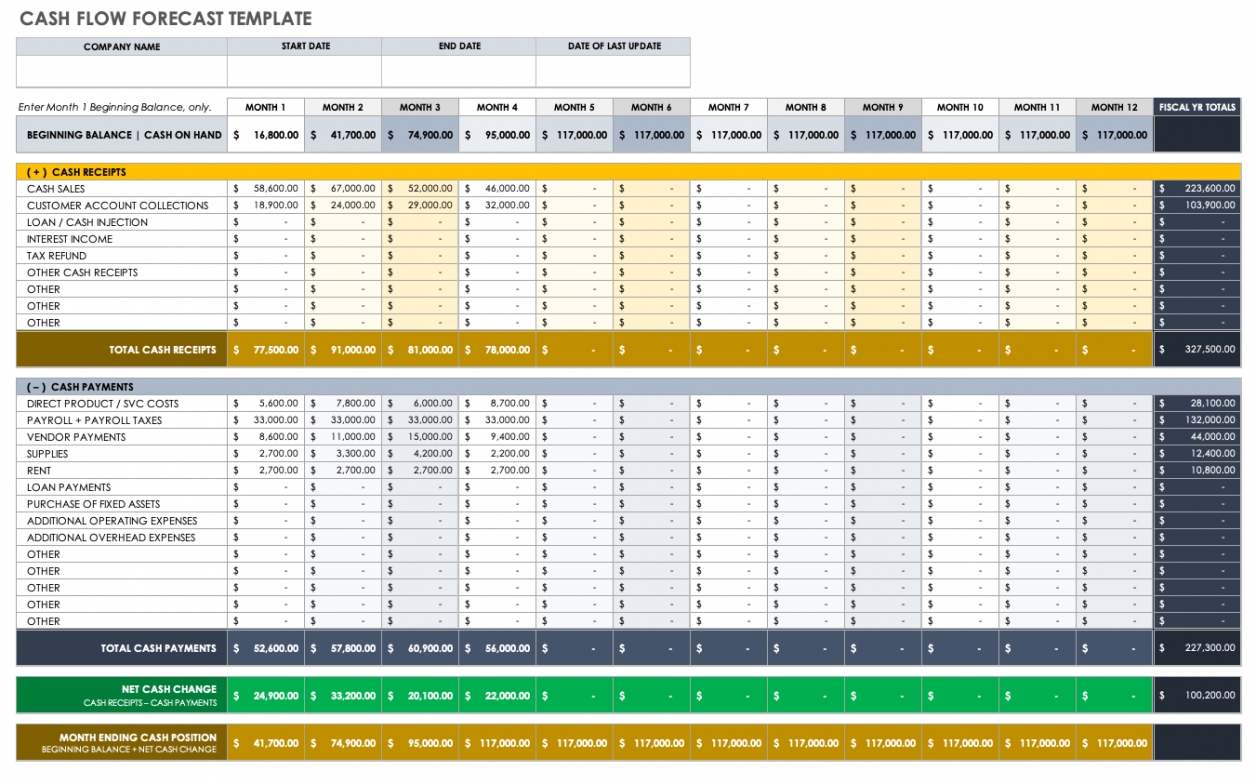

A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out based on. The formula reads =sum (d42:d43). An accrued expense refers to a cost that a business has incurred but has not yet paid.

Accrued expenses provide insights into future cash outflows, allowing companies to more accurately budget and forecast their. Grab has trimmed its workforce, as well as cut back on some incentives and technology costs over the past.

![Accrued expenses payable Cash Flow Forecasting [Book]](https://www.oreilly.com/api/v2/epubs/9780750661362/files/bg8c.png)