Fun Info About Cash Basis Income Statement Example Liquidation Of Accounting Ifrs

Trump owes and the $83.3.

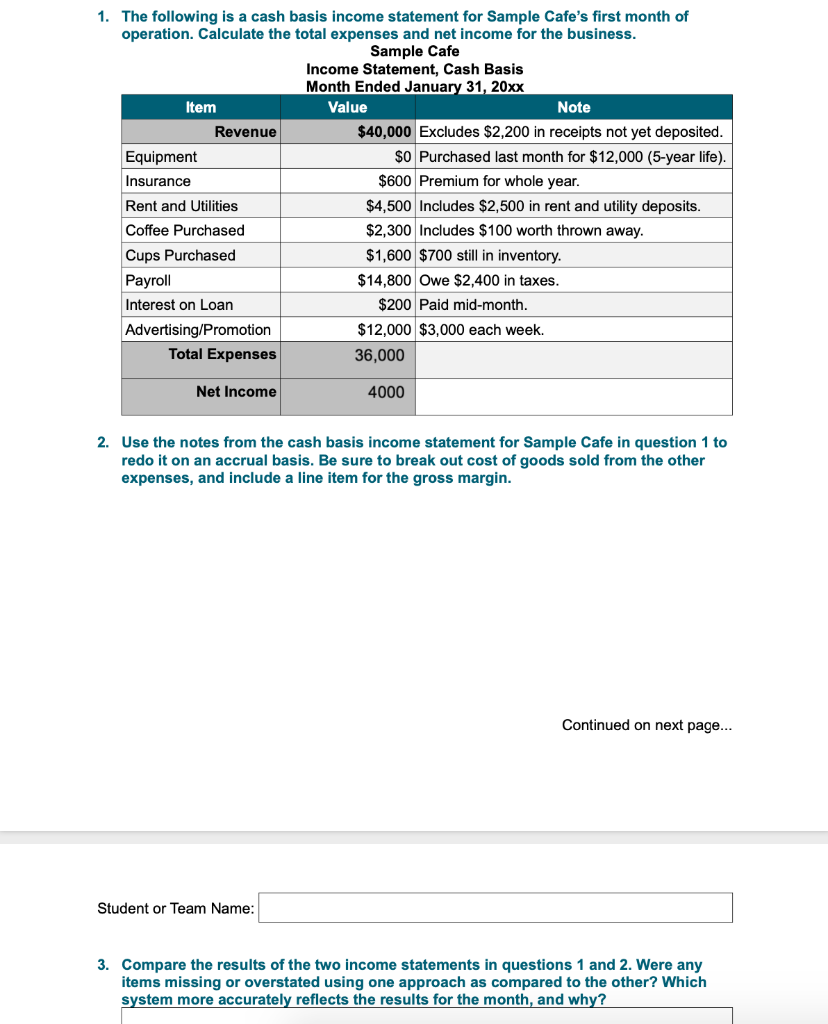

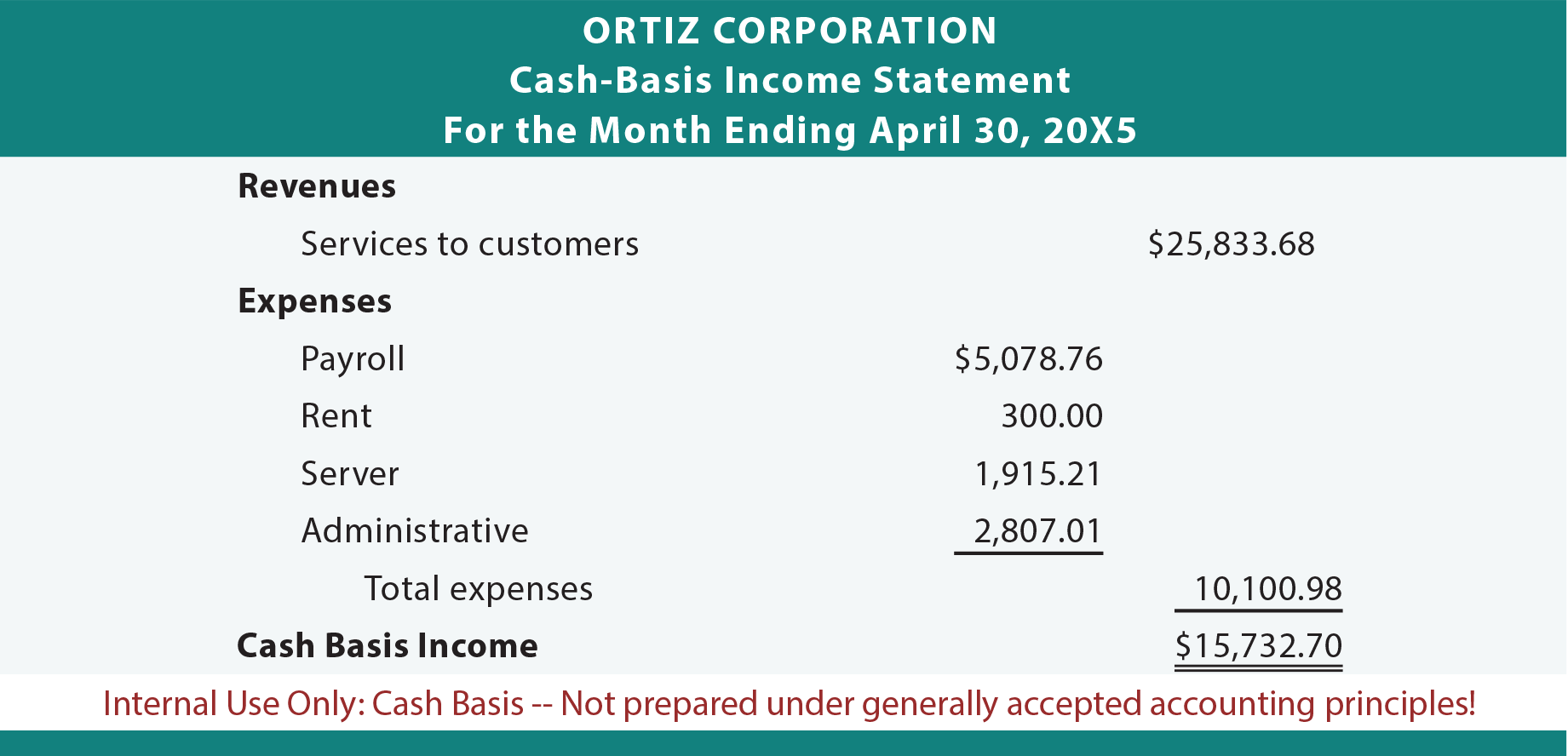

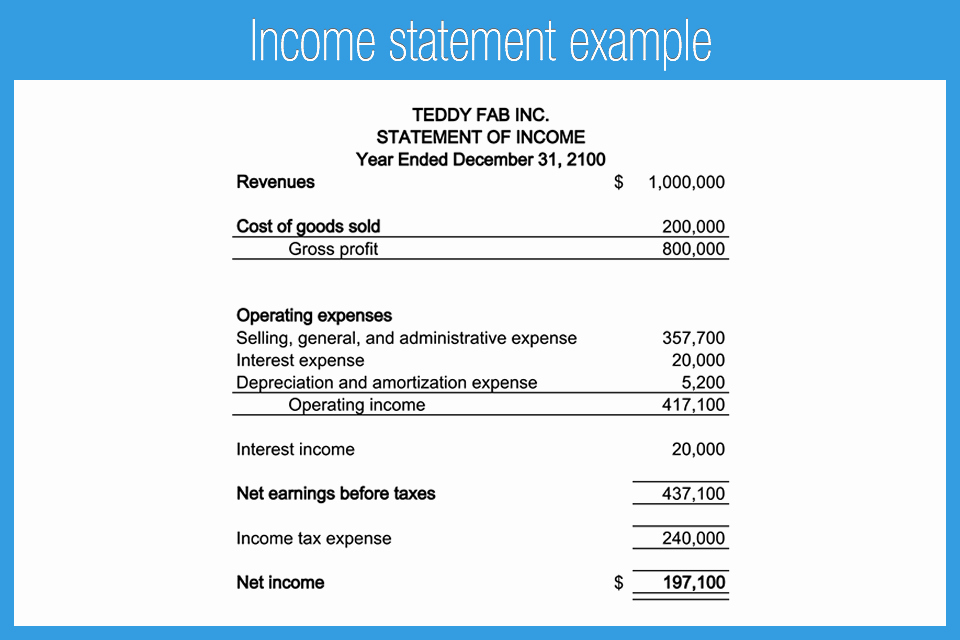

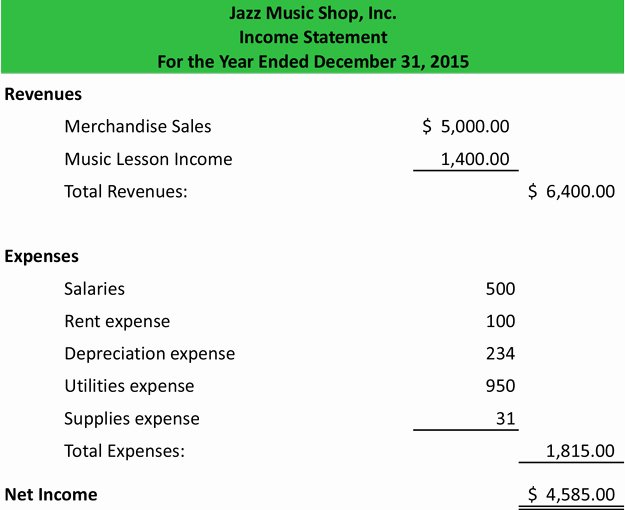

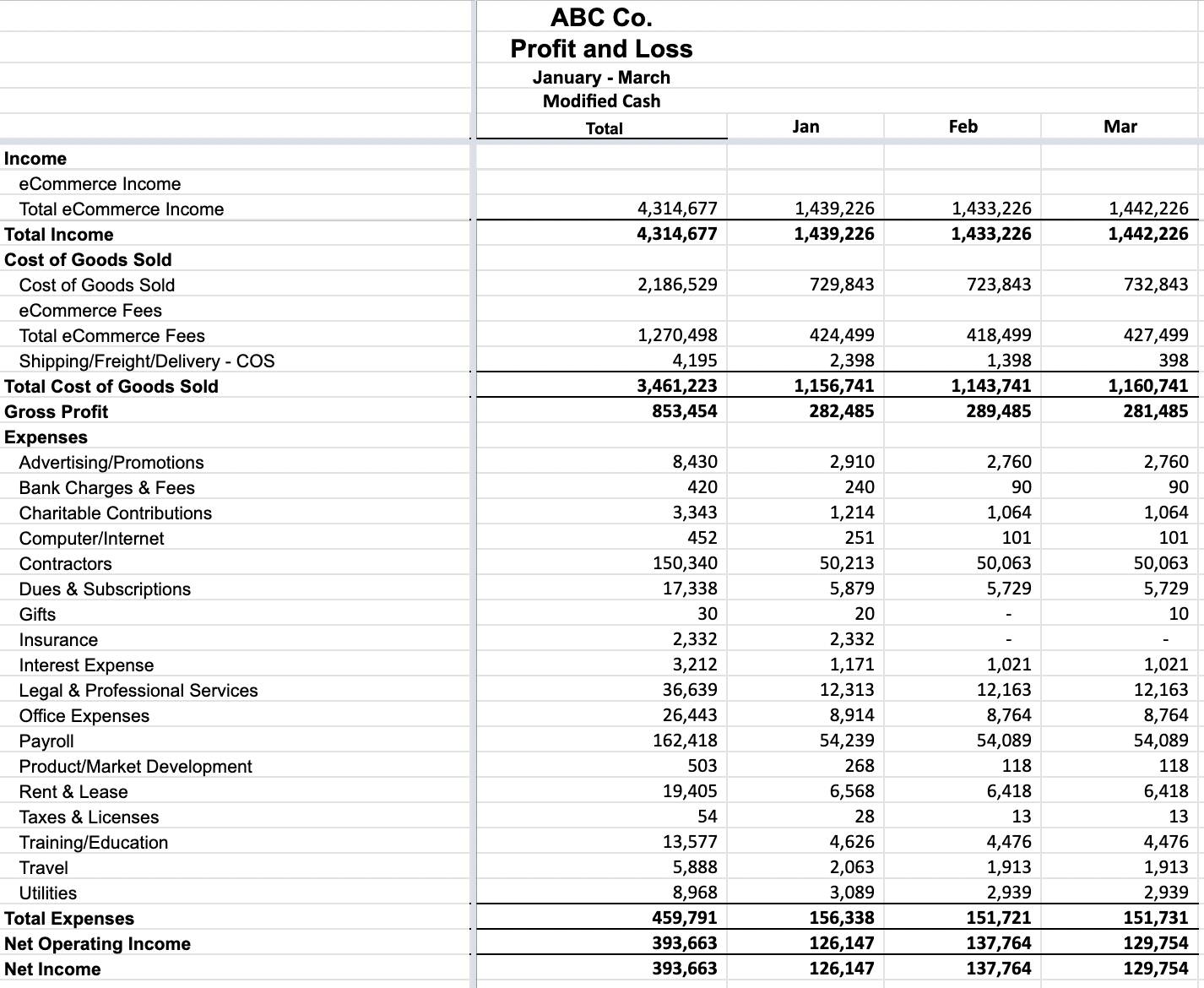

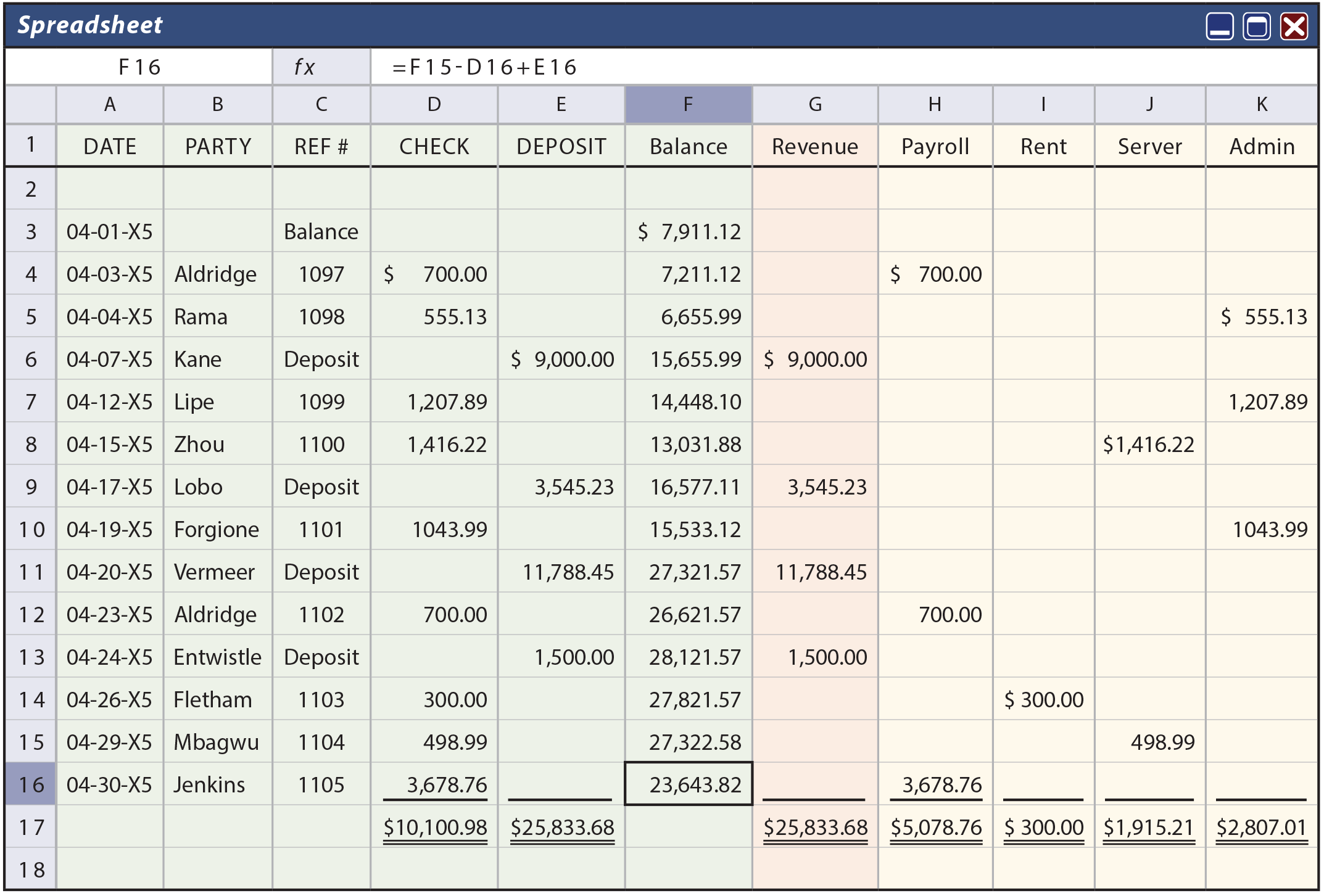

Cash basis income statement example. Thus, it is formulated under the guidelines of cash basis accounting (which is not compliant with gaap or ifrs ). It can be used when items such as cash, income, cost of goods sold, equity, and expenses need to be recorded. It shows a net income of $13,000 for the reporting period.

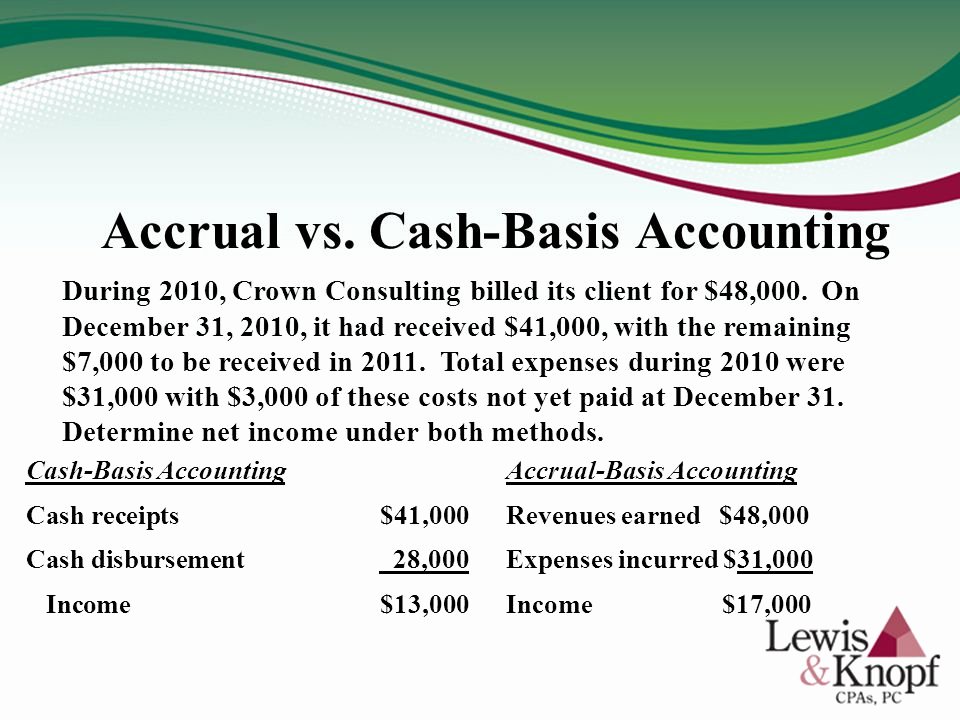

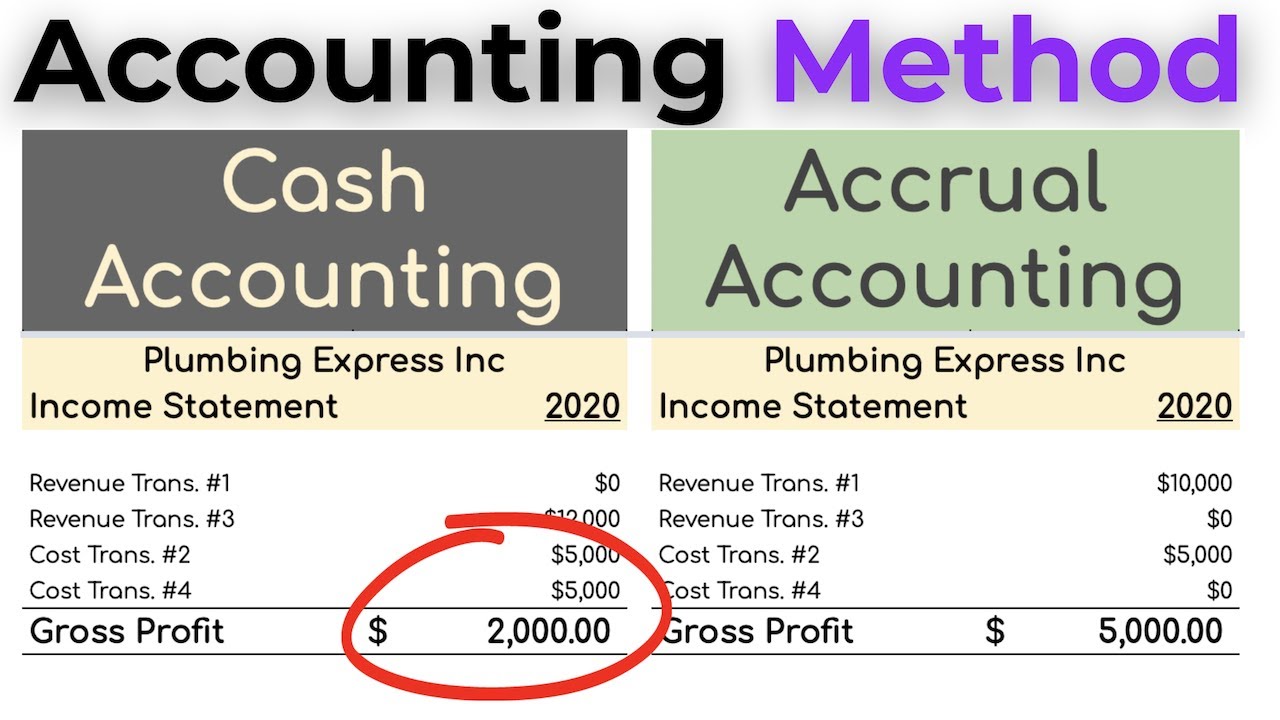

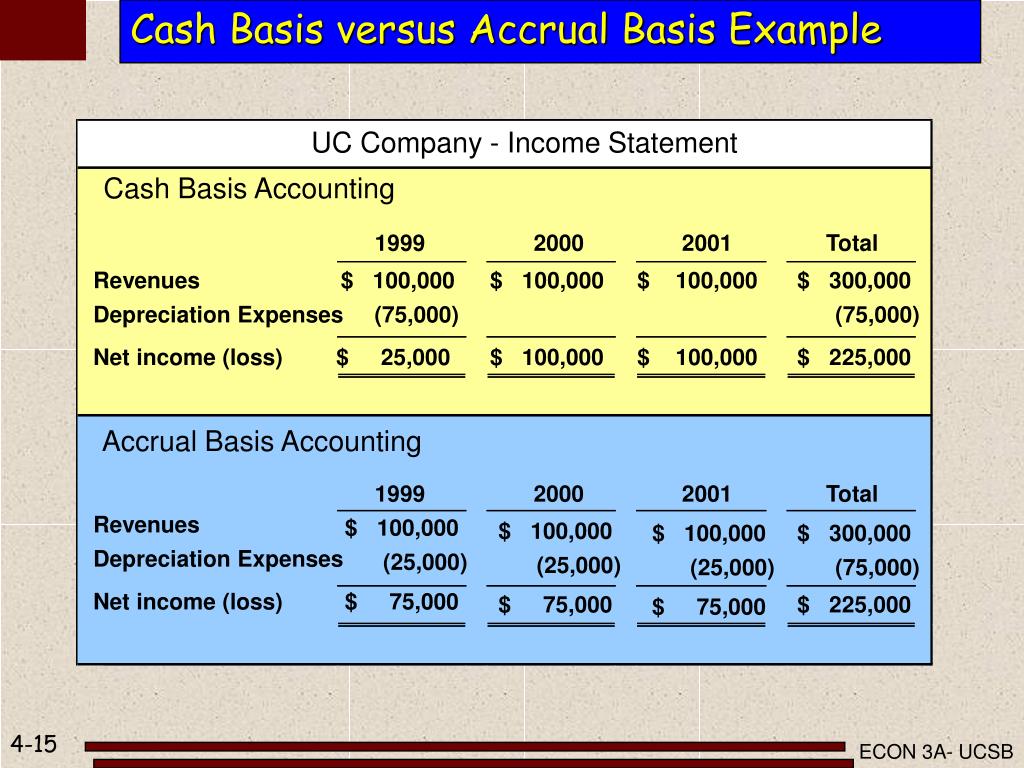

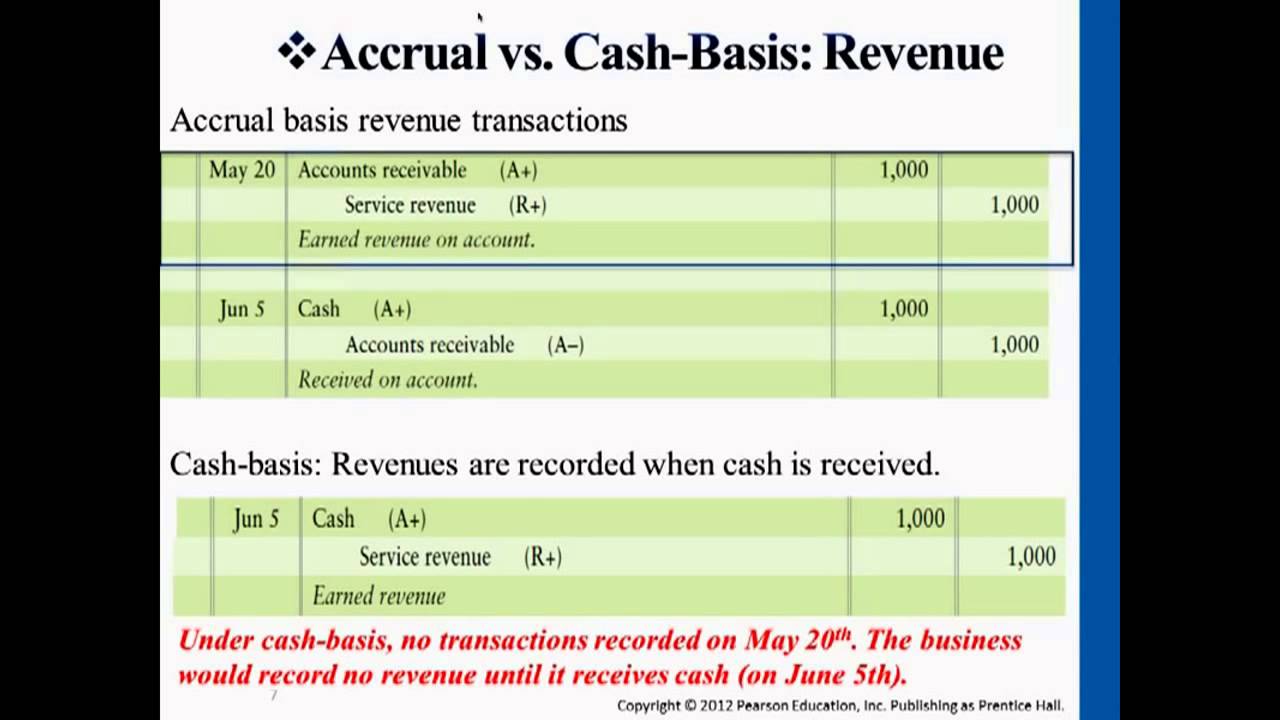

We will also illustrate the difference between cash and accrual basis accounting. For example, ramesh owns a small business for which he sent out an invoice on thursday to the customer. Let’s take an example to get a clear picture of how cash basis accounting works:

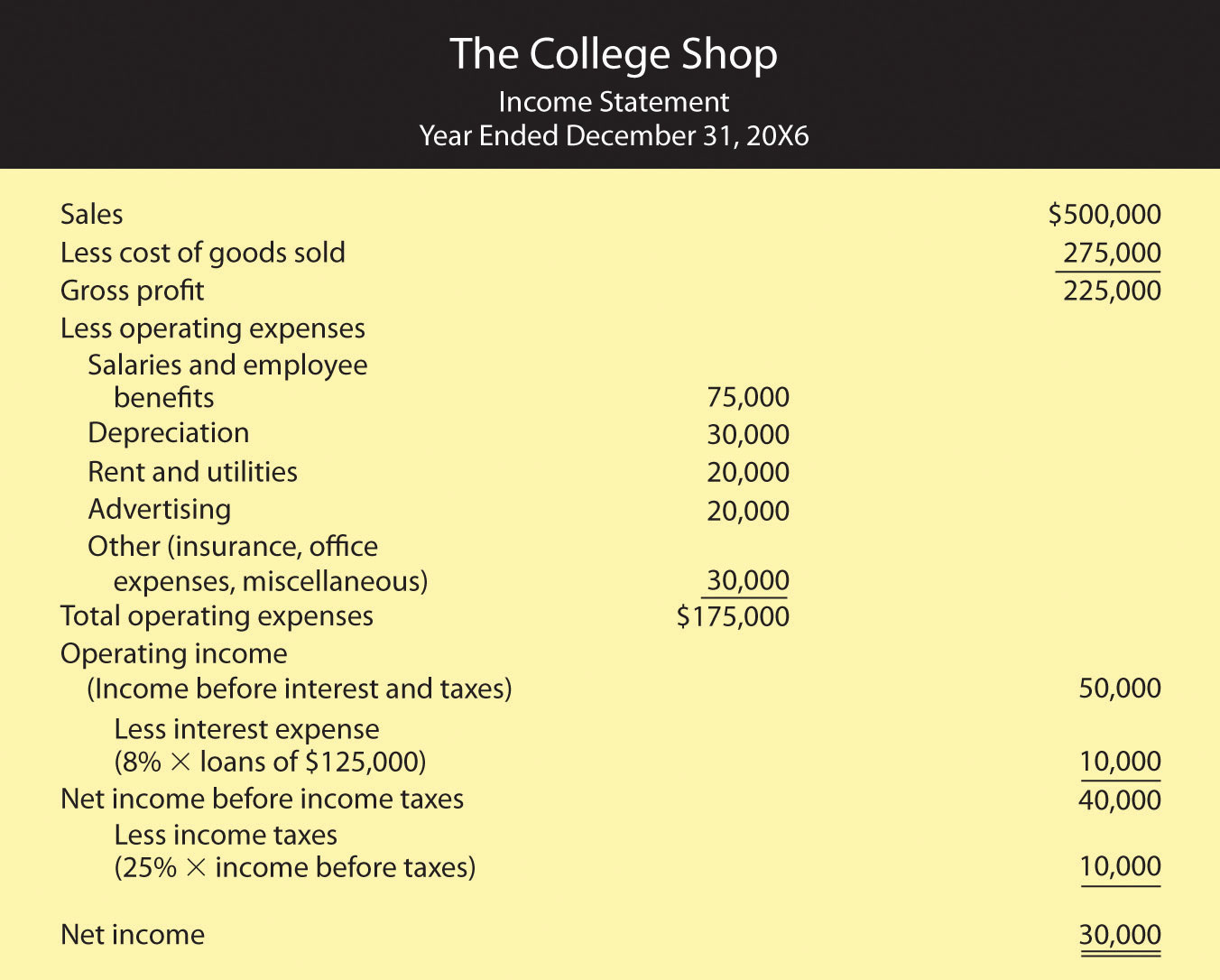

Here are a few examples of what it can look like: Since tax choices may change from year to year a consistency or comparability problem may arise. Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and financing activities.

The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash you have on hand for that time period. Statement of cash flows example. Trump claimed under oath last year that he was sitting on more than $400 million in cash, but between justice engoron’s $355 million punishment, the interest mr.

Since all revenues and expenses are recorded when cash is received or paid, the net income is also the net increase in cash during the period. Let us try to understand the cash basis accounting system with an example. Requires simplified financial reporting:

Cash basis accounting only deals with cash accounts. In this example, the cash basis income statement only includes the cash transactions for expert solutions. Your accrual basis statements might show you haven’t earned much of a profit for the year, but your cash basis financial statements — which are used to file your tax return — could show a.

For example, choices that lower taxable income on the tax returns and net income on the tax basis income statement, may produce a financial picture that leads to higher borrowing costs. Example, financial statements prepared when applying the cash‐ or tax‐basis of accounting may not meet the needs of certain users such as regulators and certain lenders. But he doesn’t receive the billing amount till sunday, so the income is recorded against sunday’s date in the accounting books.

Record adjusted ebitda margin fourth. Cash basis accounting is a simple way to track the cash that’s flowing in and out of your business. Learn how to analyze a statement of cash flows in cfi’s financial analysis fundamentals course.

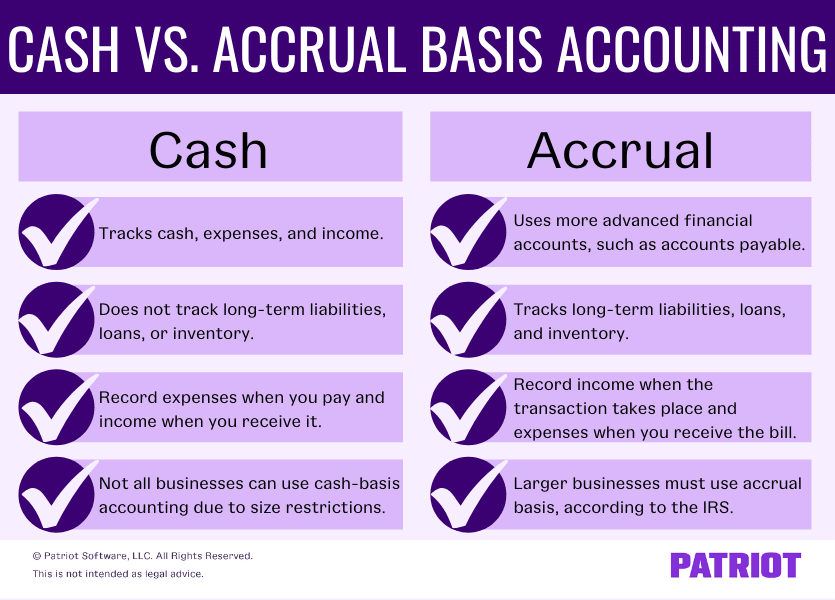

In this lesson, we will explain how to prepare financial statements using the cash basis of accounting. September 21, 2020 when deciding how to report income and expenses, business owners may choose from two accounting methods: Cash basis accounting and accrual accounting.

Along with impacting how a business maintains its records, the different approaches provide varying perspectives on the company’s financial performance. You and the client signed the contract on april 1st, and your entire staff started working on completing deliverables on that date, but you have yet to receive payment. The result is a more complete view of the financial position of the reporting entity.