Who Else Wants Info About Entrepreneurs Should Prepare Income Statements Statement Of Owners Equity Accounting

Statement of cash flow — combines the income statement and balance sheet to show overall cash activities over time.

Entrepreneurs should prepare income statements. In most circumstances, your external partners will want to see financial statements prepared by an outside accountant, so they can get a reliable, objective perspective on how your company is performing. Financial statements for external audiences. Acquire strategies for business finance.

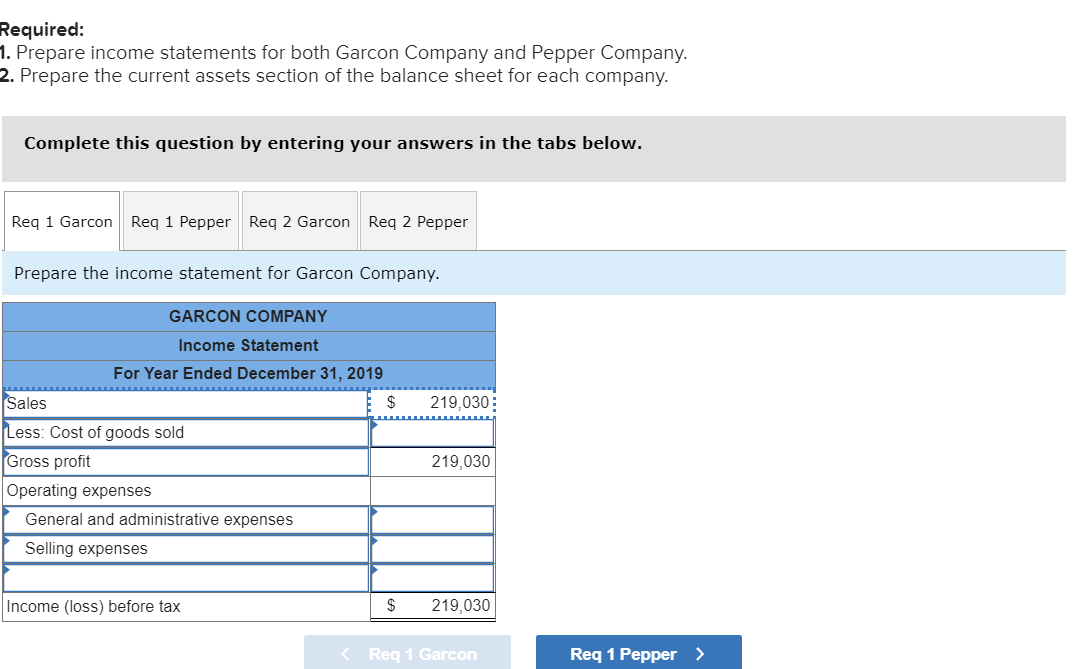

Unpack the complexities of entrepreneurial finance; Multiple choice 30 seconds 1 pt a cost of goods sold section is included in Here's everything you'll need to create one.

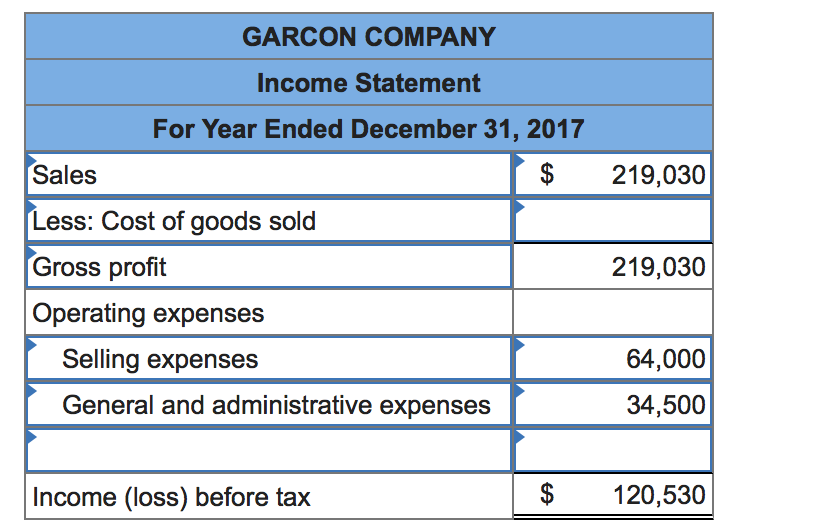

Lists the costs of goods sold, which is the amount of money your company spent on the product or service sold in line one. Income statements also show a record of the business’s income before tax. By eric butow • oct 27, 2023.

Income statements, like balance sheets, are divided into several parts, including sales, gross profits, operating expenses, operating income, and any additional income and expenses, such as interest revenue. How to write an income statement for your business plan your income statement shows investors if you are making money. The one you should choose should reflect your specific goals.

When you’re running a business, your income statement should be the financial statement you’re most familiar with. The first step is to add revenue figures for your reporting period. Monthly reports detail shorter periods so you can make tactical changes to your business the following.

Accounting april 6, 2023 as an entrepreneur, you can set your business up for financial success by mastering the basics of small business accounting. Revenue can include sales from products and/or services sold. Use these financial projections to evaluate the feasibility and attractiveness of a venture and determine next steps, including changes to the business model and approach.

These three statements interrelate, meaning you’ll find items from your balance sheet in your cash flow statement and income statement and vice versa. Multiple choice 30 seconds 1 pt in an income statement, subtracting the cost of goods sold from the net sales provides the revenue net operating income gross profit net income 3. It tells the financial story of a business’s operating activities.

It can also include any revenue earned through interest, sold assets, and other income streams your business might have. Start exploring zeni running a startup involves taking care of a lot of financial details. Lists the gross revenue for the reporting period, which is the total amount of money earned from sales.

Investors around the world use financial statements every day to make investment decisions. The statement of cash flows; We will examine three basic types of financial statements:

That is, every dollar that comes through your accounts; Delve into income statements, balance sheets, cash flow, financial ratios. Proper accounting can help you understand the financial health of your company, plan for future growth and ease the burden of tax season.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)