Unbelievable Info About International Accounting Standards Board Income Statement Under Variable Costing

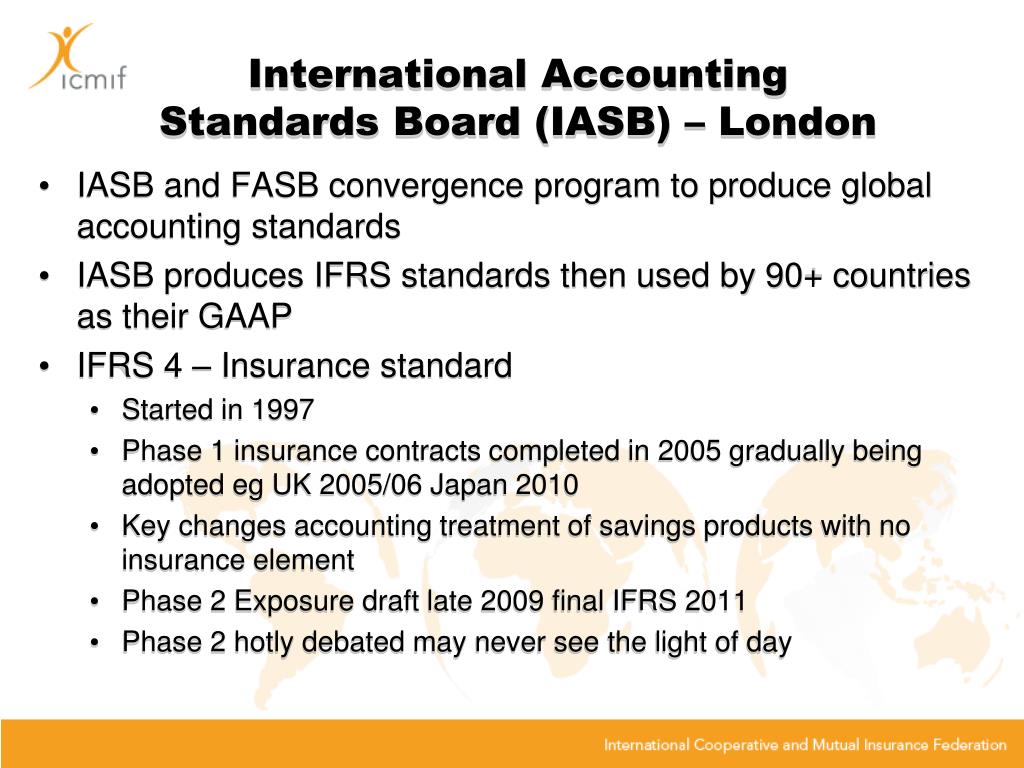

Ifrs accounting standards are developed by the international accounting standards board (iasb).

International accounting standards board. Ifrs accounting standards are developed by the international accounting standards board (iasb). Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when. Standards designed to enhance auditor’s reports for investors and other users of financial statements, as well as changes to other international standards on auditing to address the.

All 14 board members voted tuesday against changing the general approach of a global financial reporting standard introduced in 2018 that requires banks. 2022 handbook of international quality management, auditing, review, other assurance, and related services pronouncements current edition. International accounting standards (ias) are a set of rules for financial statements that were replaced in 2001 by international financial reporting standards (ifrs) and have subsequently.

Links to summaries, analysis, history and resources for ifrs sustainability disclosure standards (ifrs sds), international financial reporting standards (ifrs) and international accounting standards (ias), ifric interpretations, sic interpretations and other pronouncements issued by the international accounting standards board. This page contains links to our summaries, analysis, history and resources for international financial reporting standards (ifrs) issued by the international accounting standards board (iasb). Conceptual framework © ifrs foundation a13 contents from paragraph status and purpose of the conceptual framework sp1.1 chapter 1—the objective of general.

Welcome to the 2021 edition of ifrs in your pocket. The ifrs is issued by the international accounting standards board (iasb). Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when.

International accounting standards (iass) were issued by the antecedent international accounting standards council (iasc), and endorsed and amended by the international accounting standards board (iasb). Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when. Iasb releases webcast series on the fice ed 08 feb 2024

It was revised in march 2018. The iasb will also reissue standards in this series where it considers it appropriate. The international accounting standards board (iasb) in conjunction with the european accounting association (eaa) and the european financial reporting advisory group (efrag) will hold a virtual research workshop on the iasb’s exposure draft 'financial instruments with characteristics of equity' on 11 march 2024.

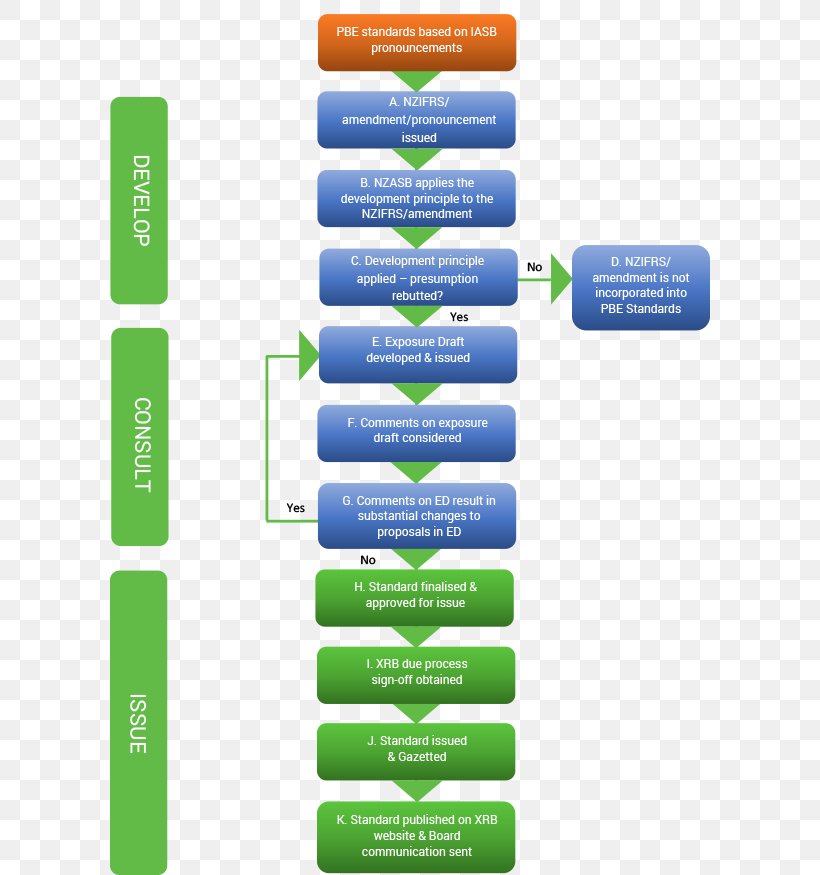

A summary of the structure and governance of the ifrs foundation, the international accounting standards board (iasb), and the international sustainability standards board (issb). Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when. The iasb was founded on april 1, 2001, as the successor to the international accounting standards committee (iasc).

The table above lists the most recent version (s) of each pronouncement and the date each version was originally issued. Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when. Ifrs accounting standards are developed by the international accounting standards board (iasb).

The iasb operates under the oversight of the ifrs foundation. The iasb was formed in 2001 to replace the international accounting standards. In april 2001 the international accounting standards board (board) adopted ias 1 presentation of financial statements, which had originally been issued by the international accounting standards committee in september 1997.

Financial reporting developed by the international accounting standards board (iasb) sets out the The iasb met on 23 november 2022 to discuss the accounting for regulatory returns on an asset not yet available for use when an entity capitalises borrowing costs to construct that asset (agenda papers 9a and 9c). Ifrs accounting standards are developed by the international accounting standards board (iasb).

/paper-with-title-international-financial-reporting-standards--ifrs---850740234-6e303822ed5e4800b523b0ac24db396c.jpg)