Looking Good Tips About Closing Stock Entry In Trial Balance What Is The Income Statement Quickbooks

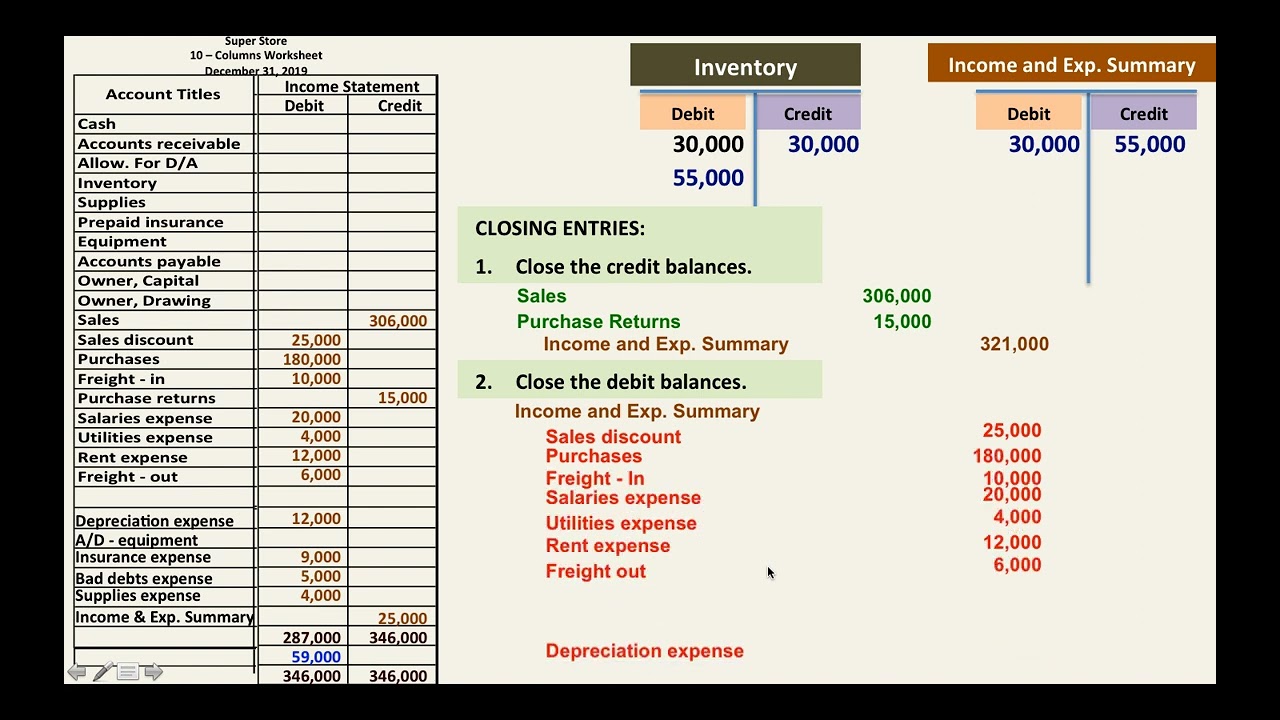

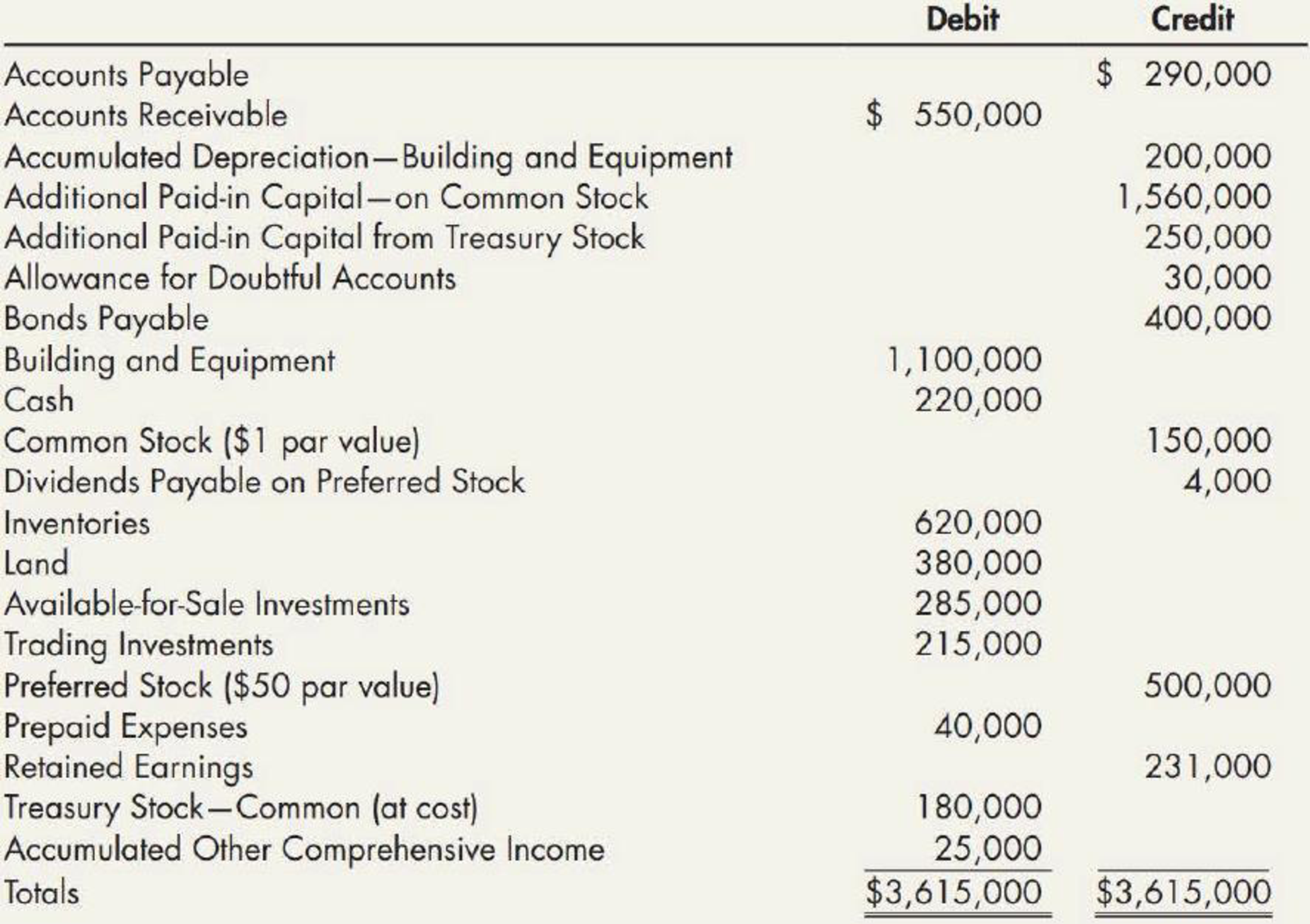

Total purchases are already included in the trial balance, hence.

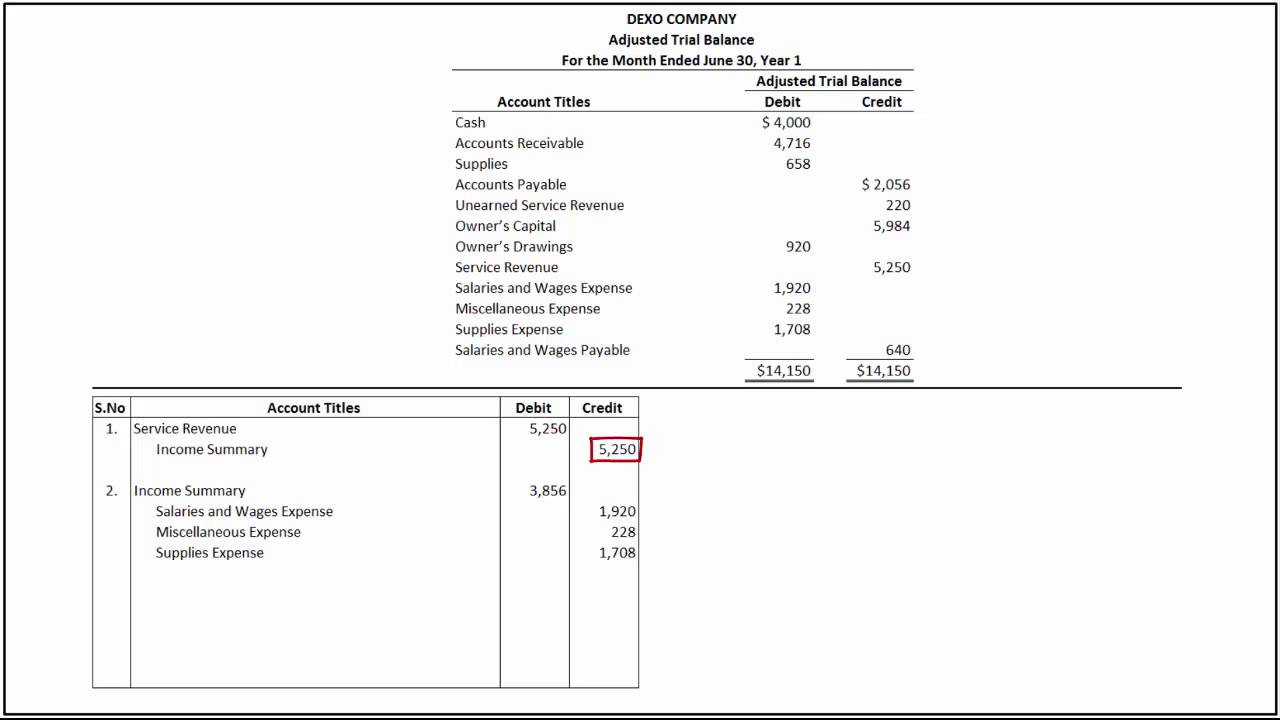

Closing stock entry in trial balance. Close all income accounts to income summary in the given data, there is only 1 income account, i.e. Notice that the effect of. Usually, the closing stock does not appear in the trial balance when the accounts are being finalized as the closing stock is ascertained by physical verification, which takes.

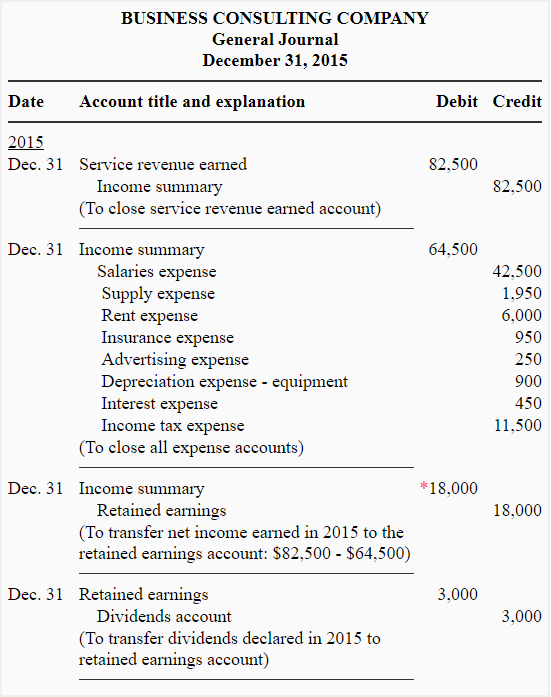

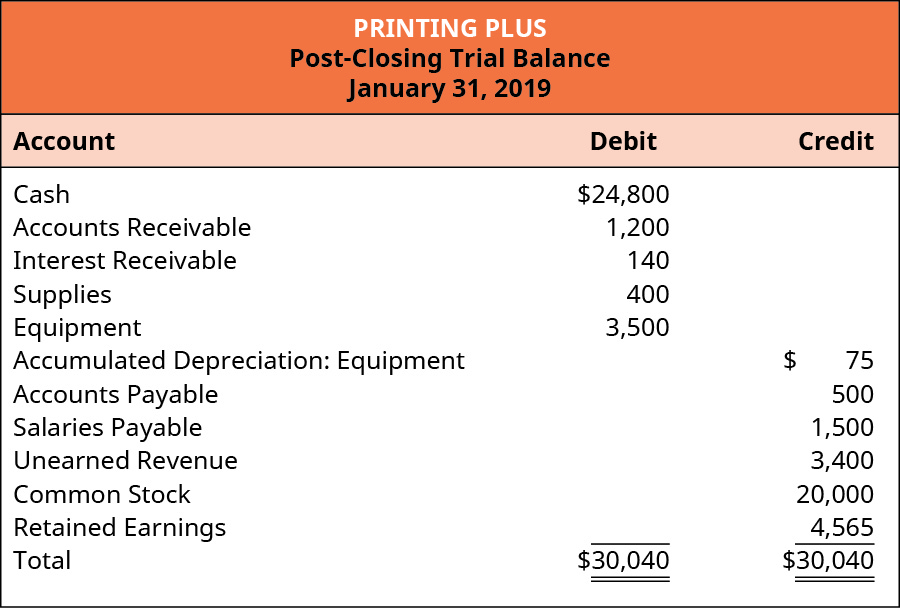

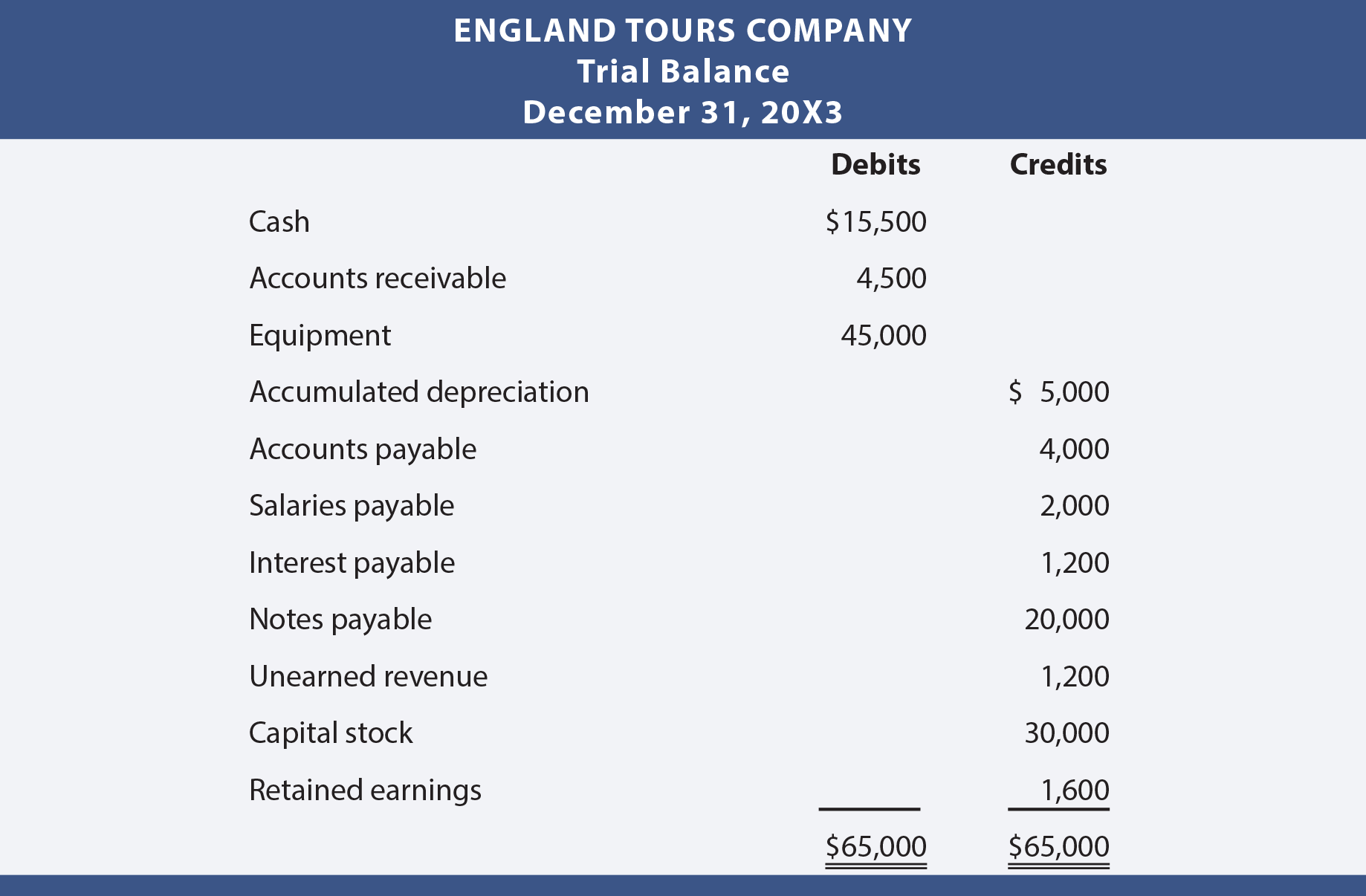

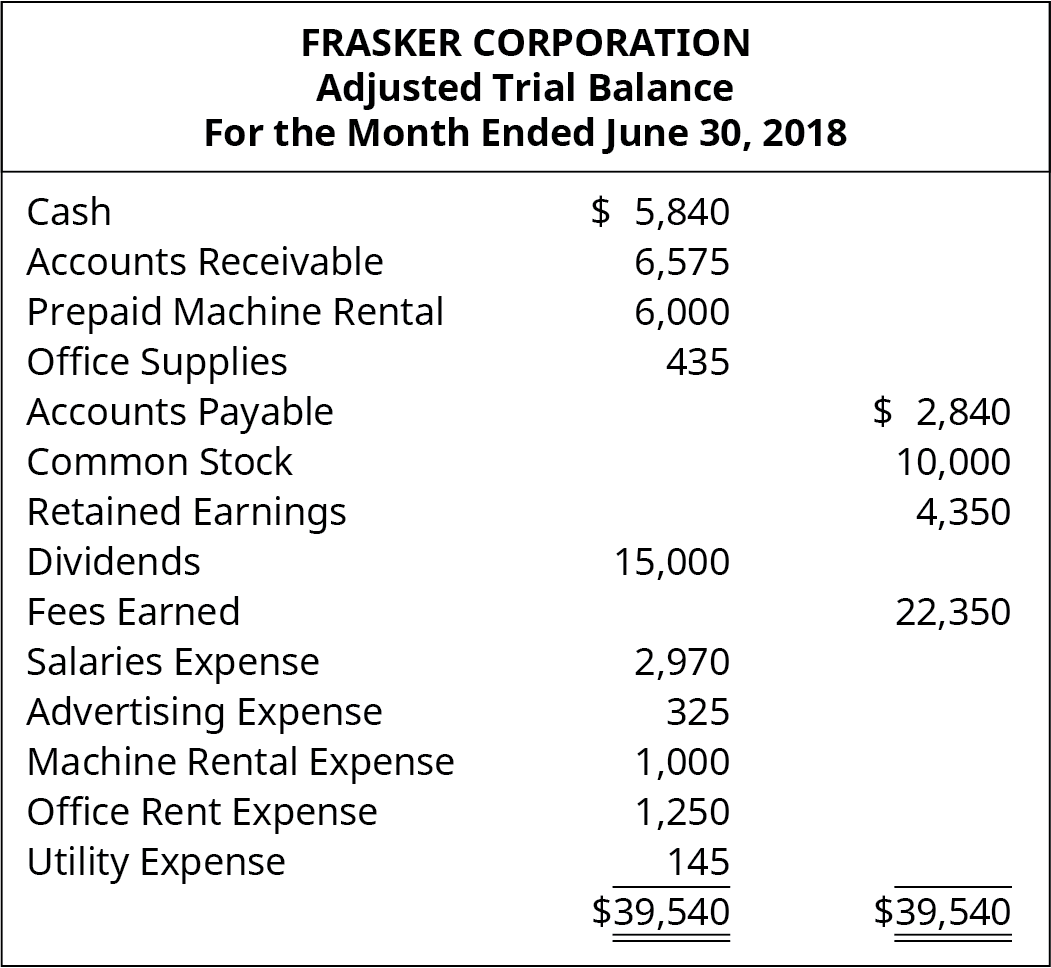

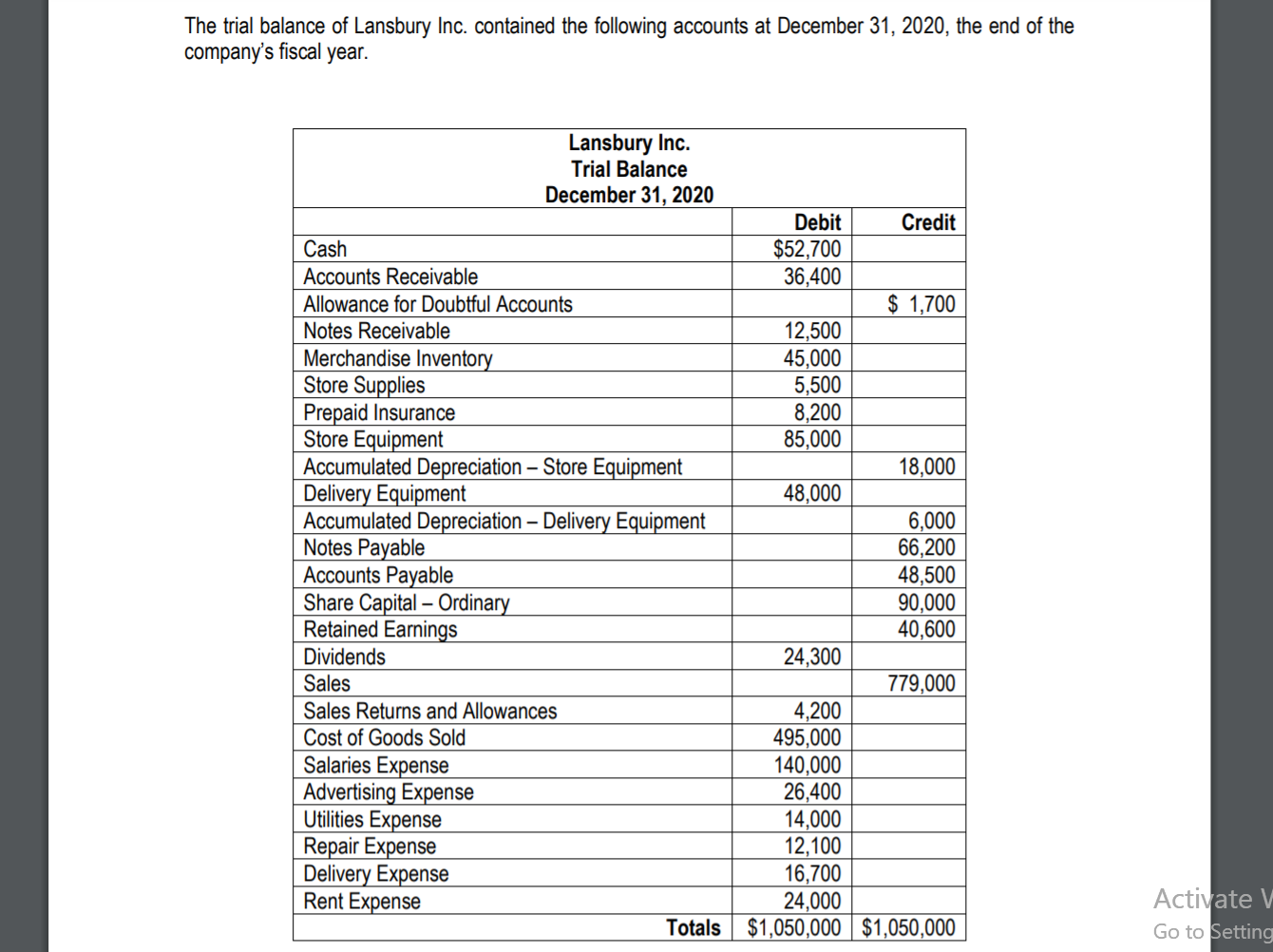

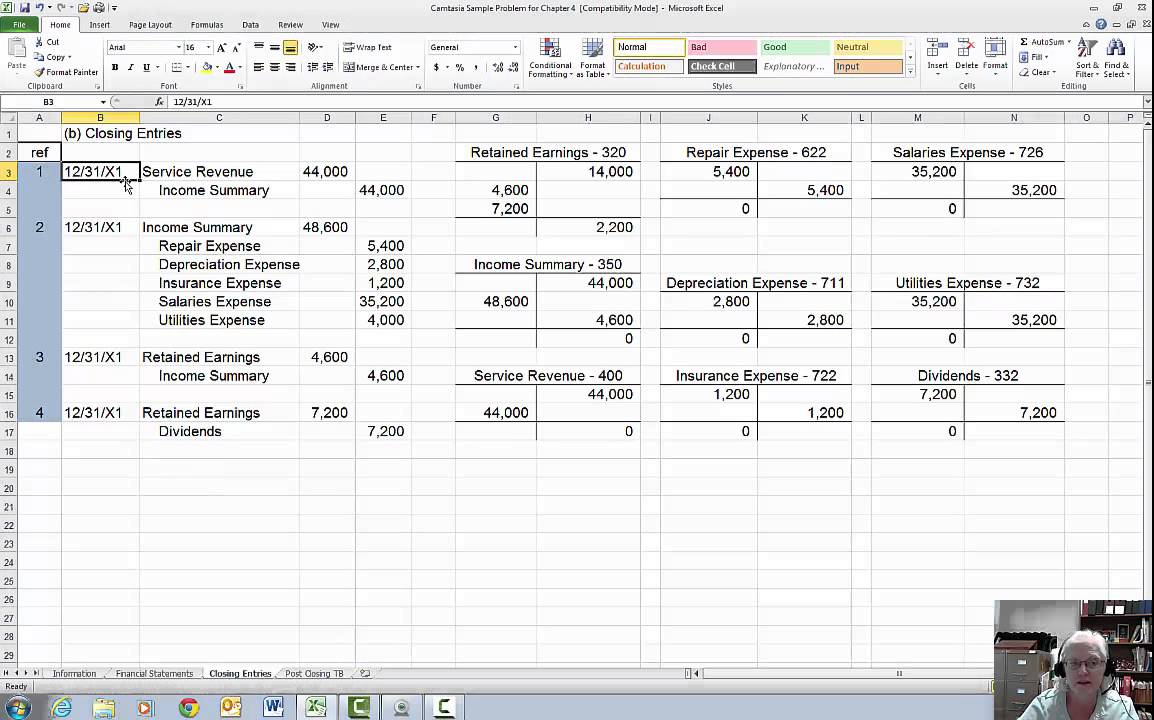

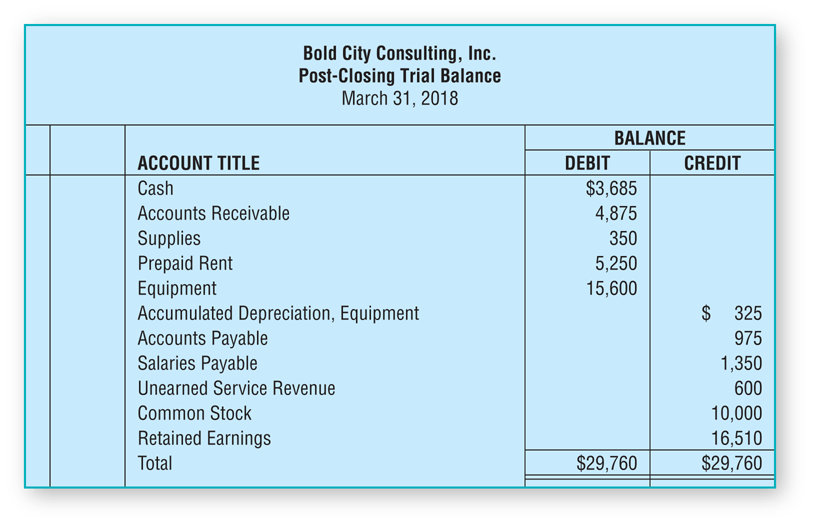

The only accounts that should be open are assets, liabilities, capital stock, and. The closing journal entries required to transfer the balance on each of these accounts to the retained earnings account is as follows: A trial balance is an important step in the accounting process, because it helps identify.

Closing stock or ending inventory is the stock of inventory which a business has left over at the end of its accounting period, and it includes merchandise that was. Our discussion here begins with journalizing and posting the closing entries. As per this treatment, the closing stock is not shown in the trial balance.

The announcement came one day after a new york judge ordered trump and the trump organization to pay over $355 million as part of a civil fraud case. Closing stock is the leftover balance out of goods which were purchased during an accounting period. The balance sheet is going to.

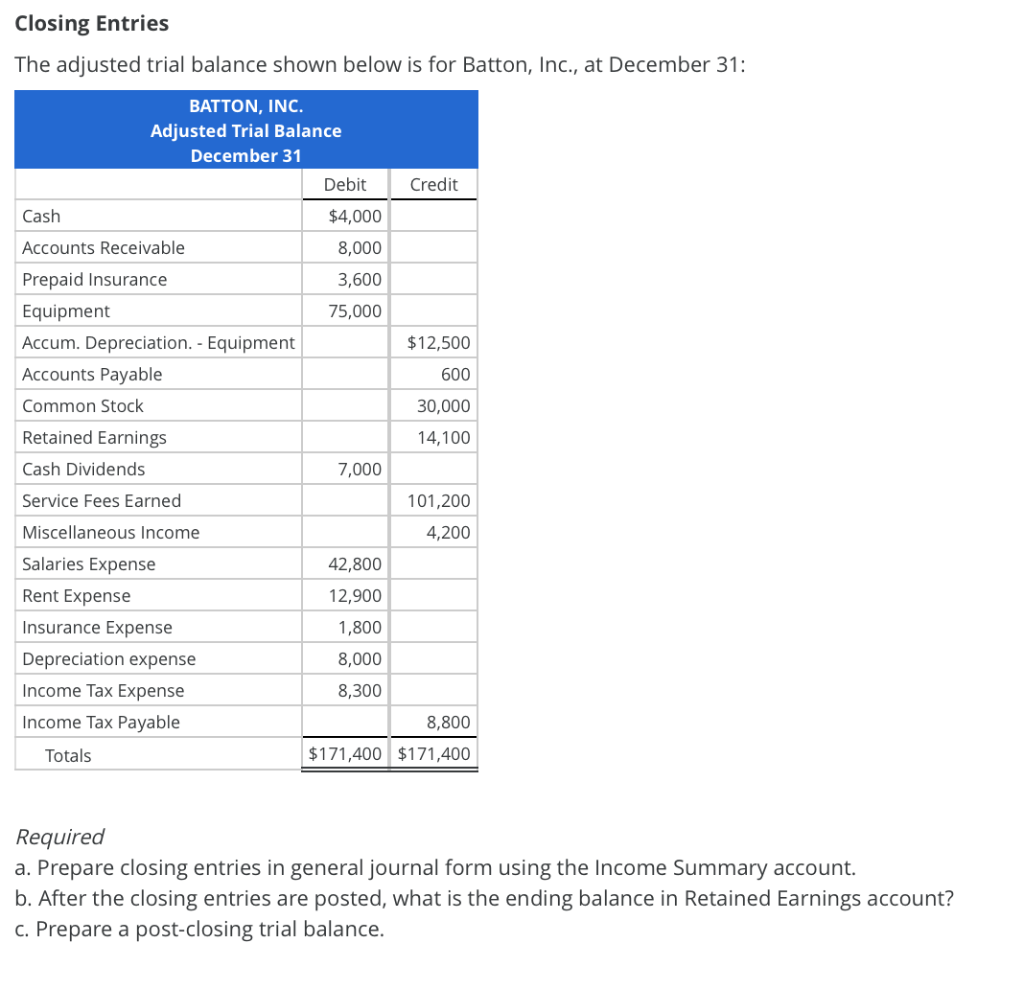

We see from the adjusted trial balance that our revenue accounts have a credit balance. Uncommon, but possible scenario where the closing stock is shown in the trial balance, it is only possible when the closing stock is already adjusted against purchases. Below is the journal entry for closing stock when it is reduced from purchases.

Its purpose is to test the equality between debits and credits after closing entries are prepared and. A trial balance is a list of all accounts in the general ledger that have nonzero balances. Closing stock is not shown in the trial balance:

The value of total purchases is already included in the trial. Closing stock is shown in the trial balance. It has a credit balance of $9,850.

In case where adjustment for closing stock is to be done before preparation of trial balance, then it will be shown on the credit side of the trial balance, since it is an asset. The statement of retained earnings will include beginning retained earnings, any net income (loss) (found on the income statement), and dividends. You are preparing a trial balance after the closing entries are complete.