Best Info About Salaries Payable Balance Sheet Simple Financial Report

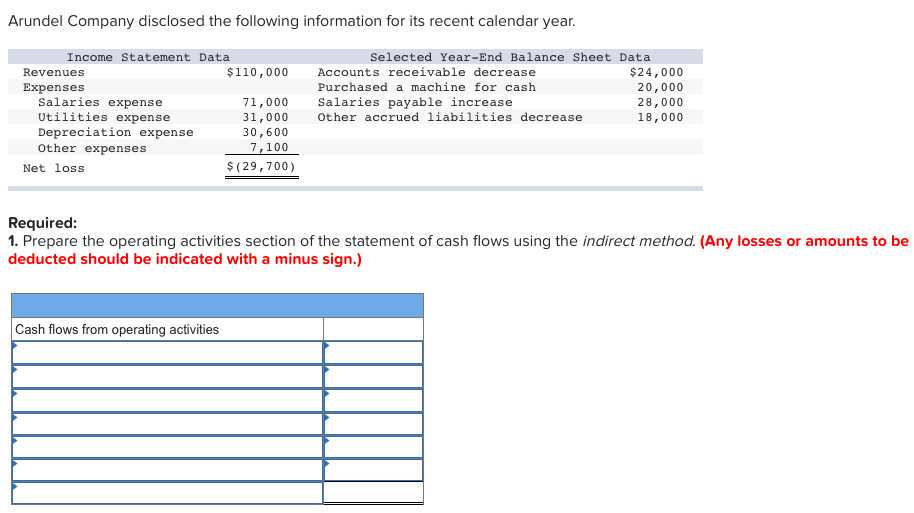

Wages payable are the current liability account that holds salaries waiting to be paid, usually at the end of the month.

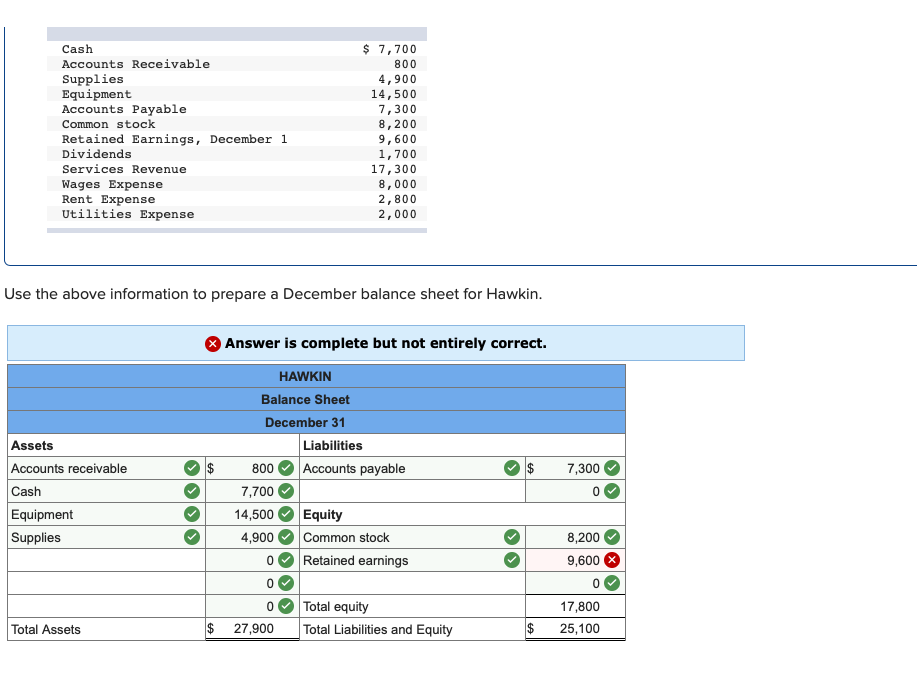

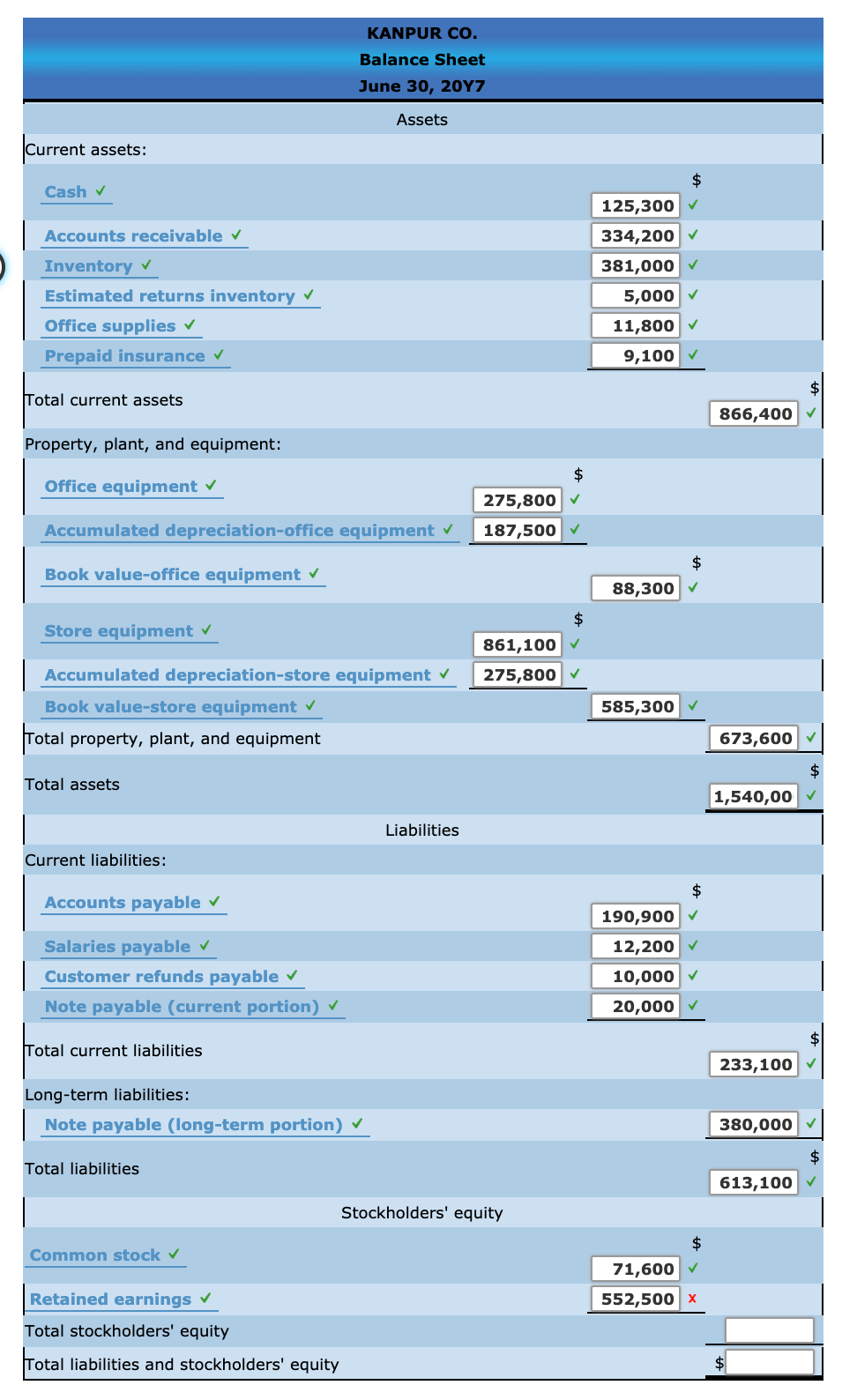

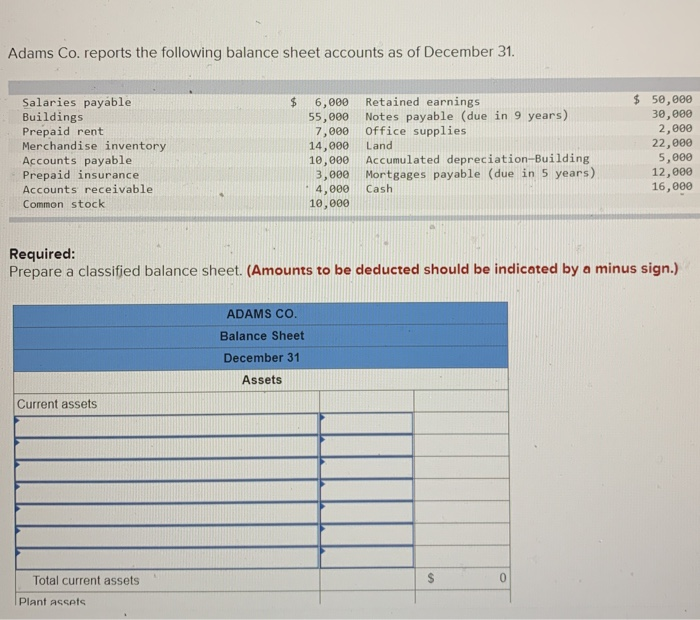

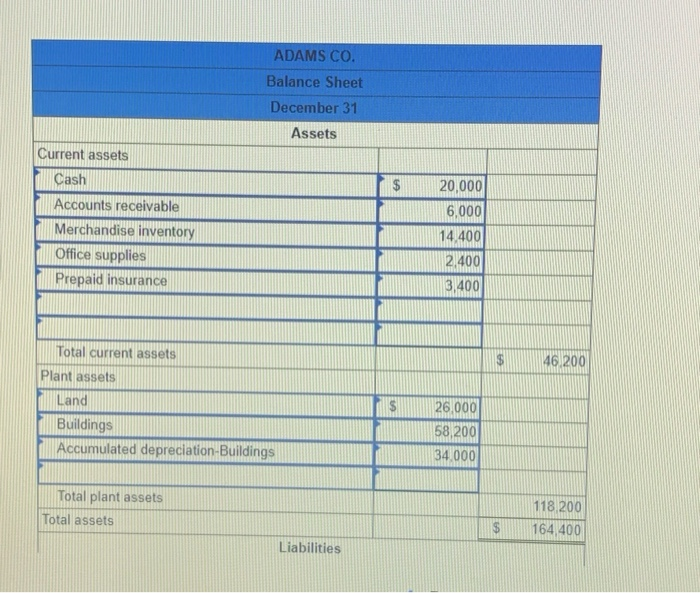

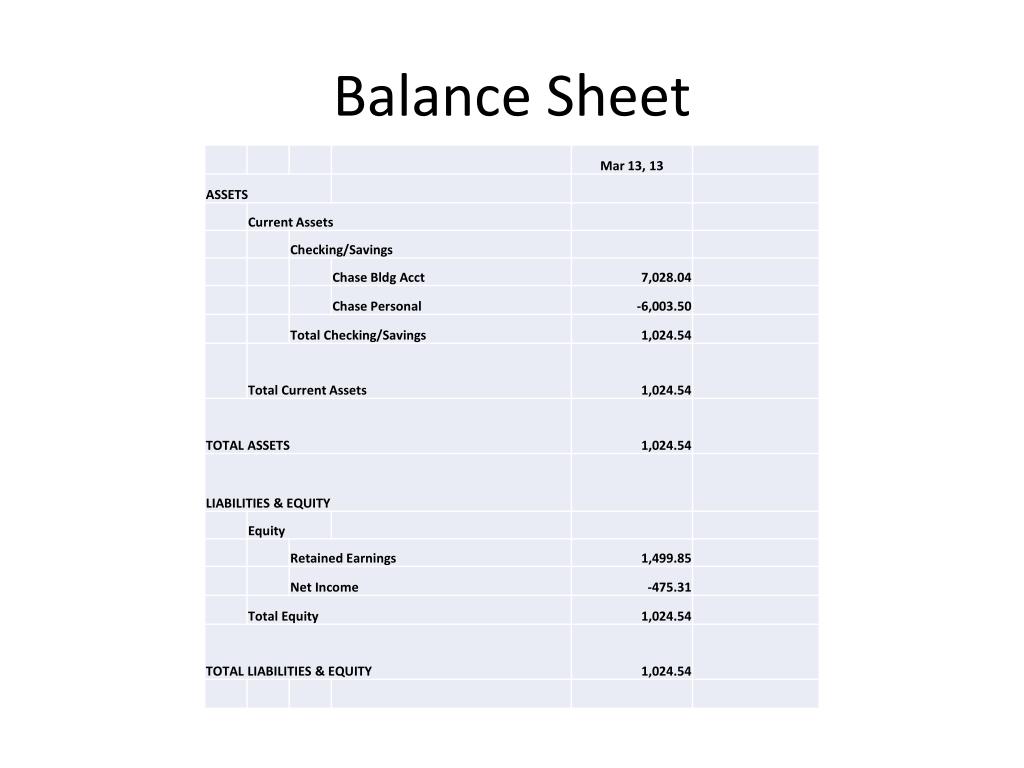

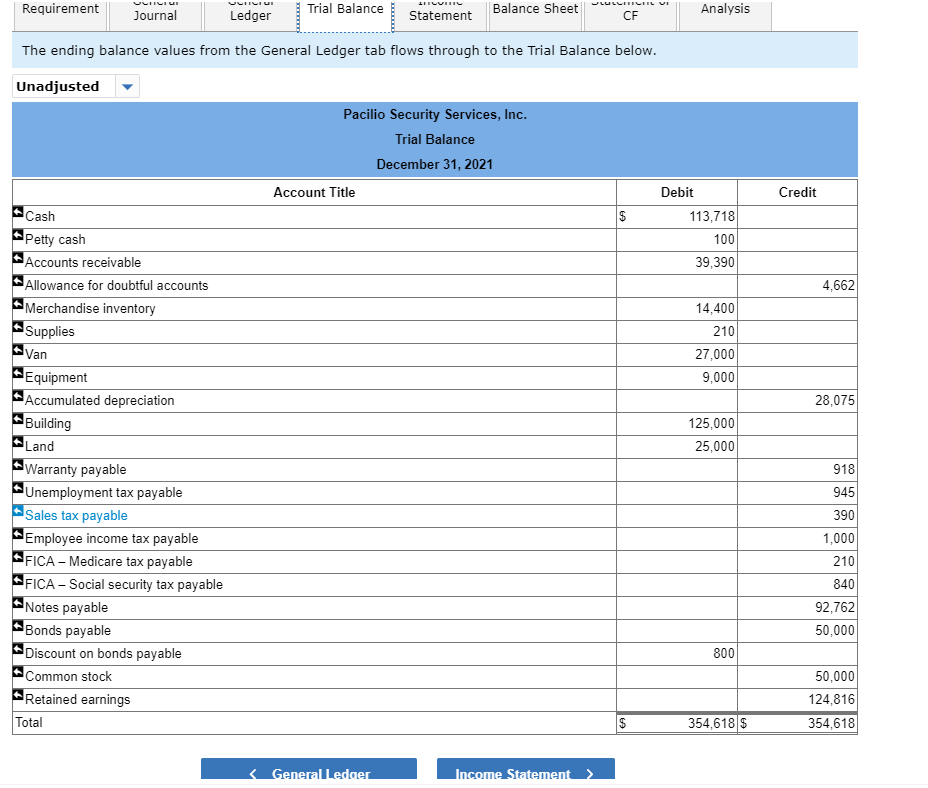

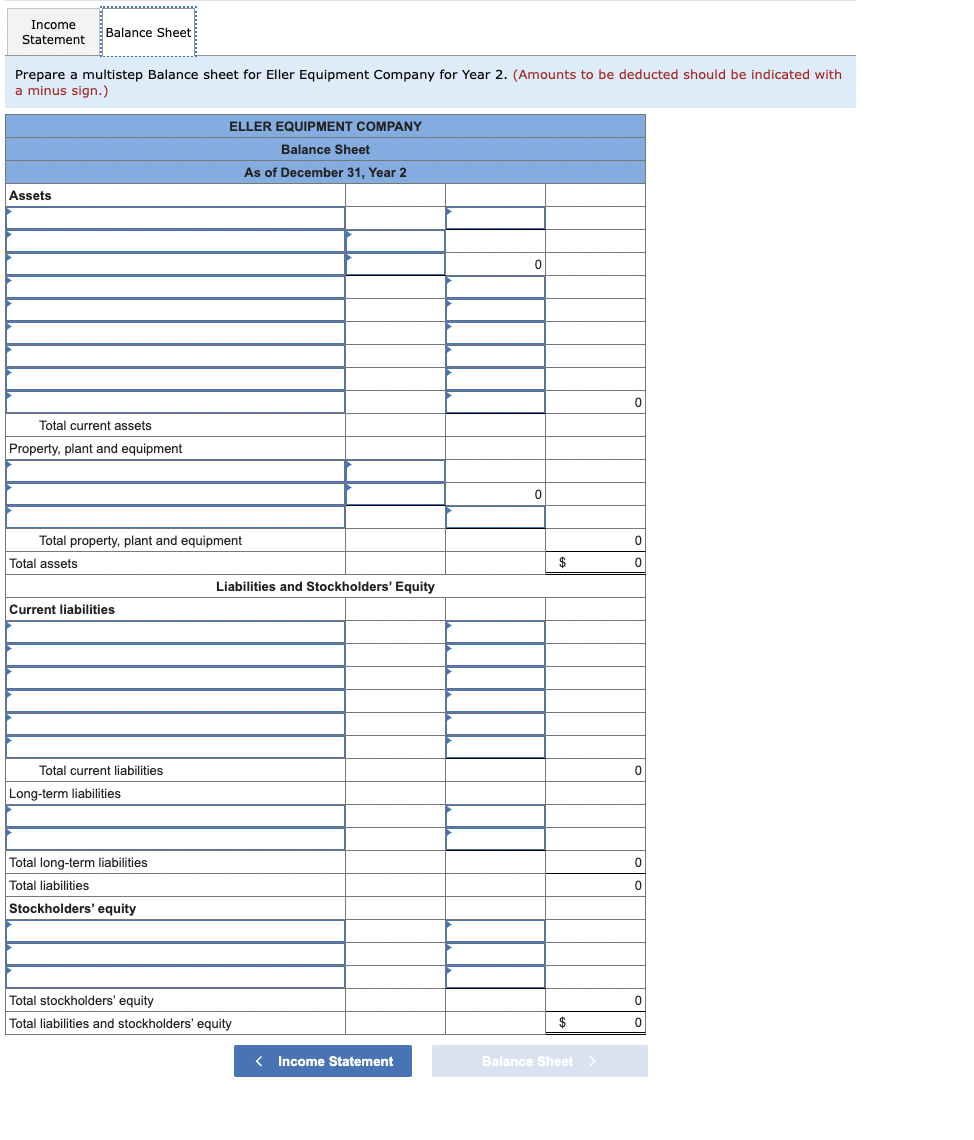

Salaries payable balance sheet. Salaries and wages payable are considered as a current liability on the balance sheet of the company. It is usually included in the current liabilities on the balance sheet as it is expected to be paid within one year. Wages payable refers to the liability incurred by an organization for wages earned by but not yet paid to employees.

This account is a current liability because its balance is usually due within one. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. The balance in the account represents the salaries liability of a business as of the balance sheet date.

This financial statement is used both internally and externally to determine the so. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. This account exists due to the accrual principle in accounting.

Further, such payments are usually made within less than a year, and the payable salary account is reported under current liabilities on the balance sheet. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Accounts payable are found on a firm's balance sheet, and since they represent funds owed to others they are booked as a current liability.

People earning wages are entitled to overtime if they work more than 40 hours per week. Accounts payables are the amounts owed to suppliers, employees, shareholders, vendors, or customers. Difference between salaries and wages;

Salary payable includes various expenses, including salaries, wages, bonuses, overtime, allowances, etc. The balance in this account is typically eliminated early in the following reporting. This refers to the outstanding salaries and wages owed by the company to its employees.

Your balance sheet shows salaries, wages and expenses indirectly. A balance sheet provides a snapshot of a company’s financial performance at a given point in time. When we record a sale on the p&l, we list the indirect labor costs used to generate it on the p&l as well.

Where do salaries go on financial statements? The amount in the salary payable account represents the business’s liability owed to the employees as of the balance sheet date. Current liabilities might also include employee health insurance,.

The difference between salaries and wages. Salary payable is an account that entities use to record accrued salary expenses. What is a balance sheet?

What are salaries payable? October 15, 2023 what are wages payable? The change in a/p subtracts the ending balance in the current year from the prior year’s balance.