Supreme Info About Understanding A Trial Balance Ey International Gaap

Typically prepared after numerous entries have been posted, this.

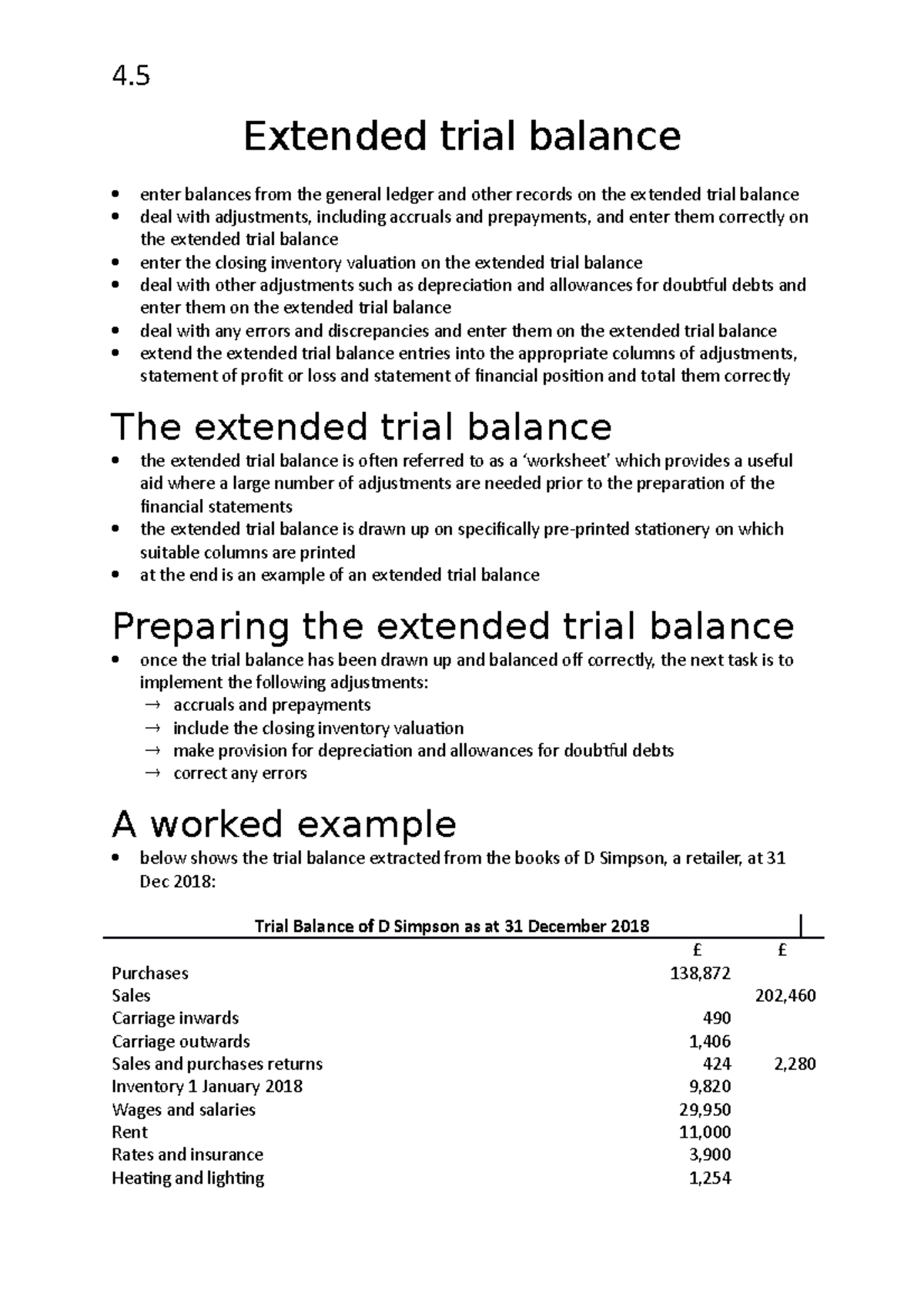

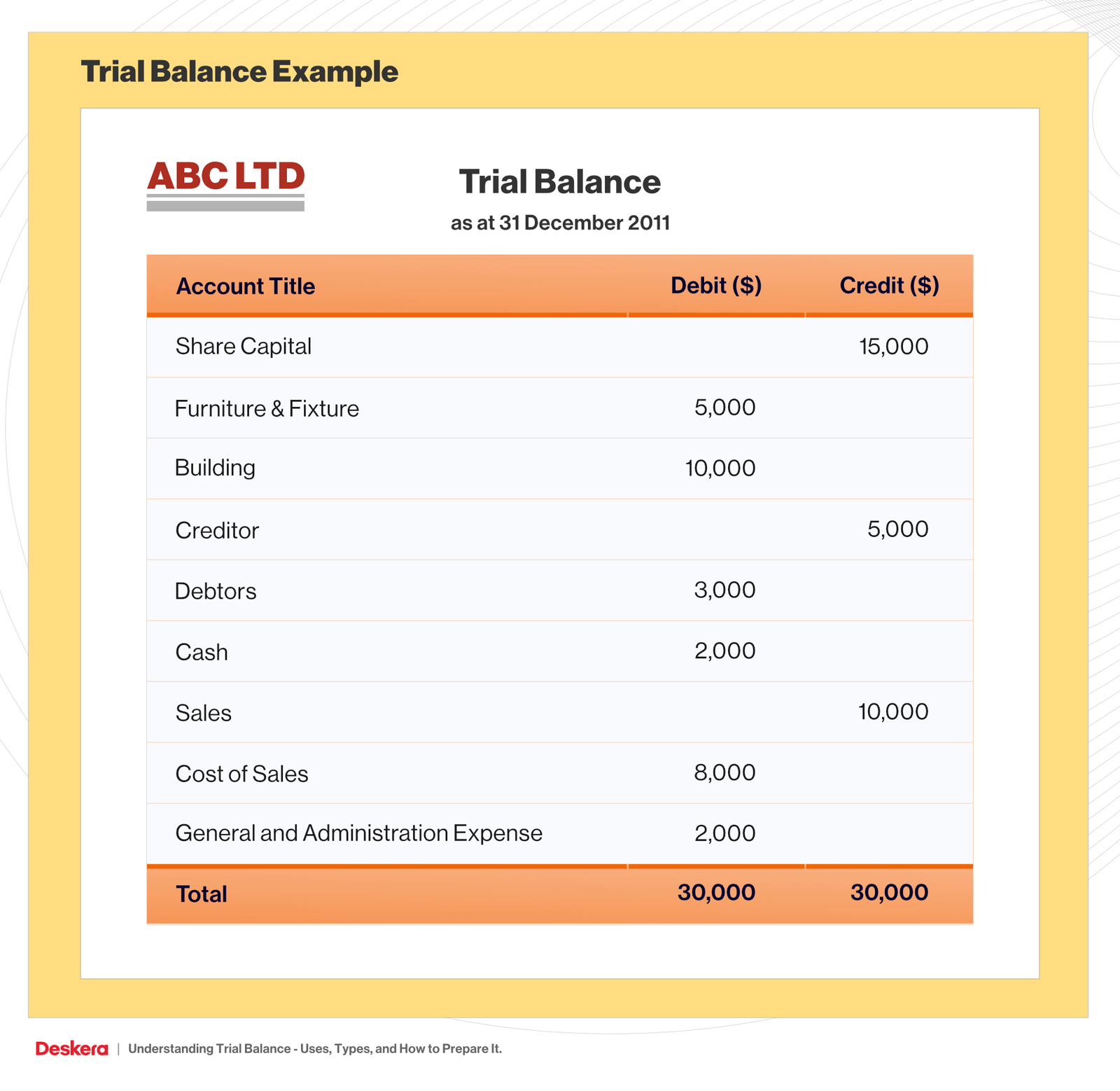

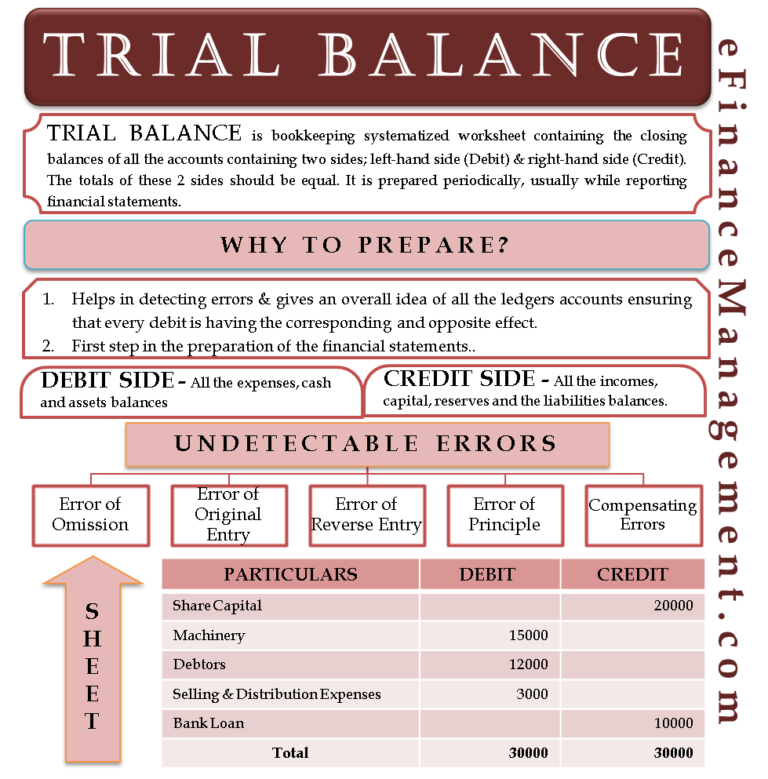

Understanding a trial balance. Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. Definition of a trial balance a trial balance is a bookkeeping or accounting report that lists the balances in each of an organization's general ledger accounts. It includes the amounts credited or debited to each account, the.

Identify which financial statement each account will go on:. A trial balance is composed of several key elements that work in tandem to provide a clear picture of a company’s financial transactions. They offer additional context and understanding of the.

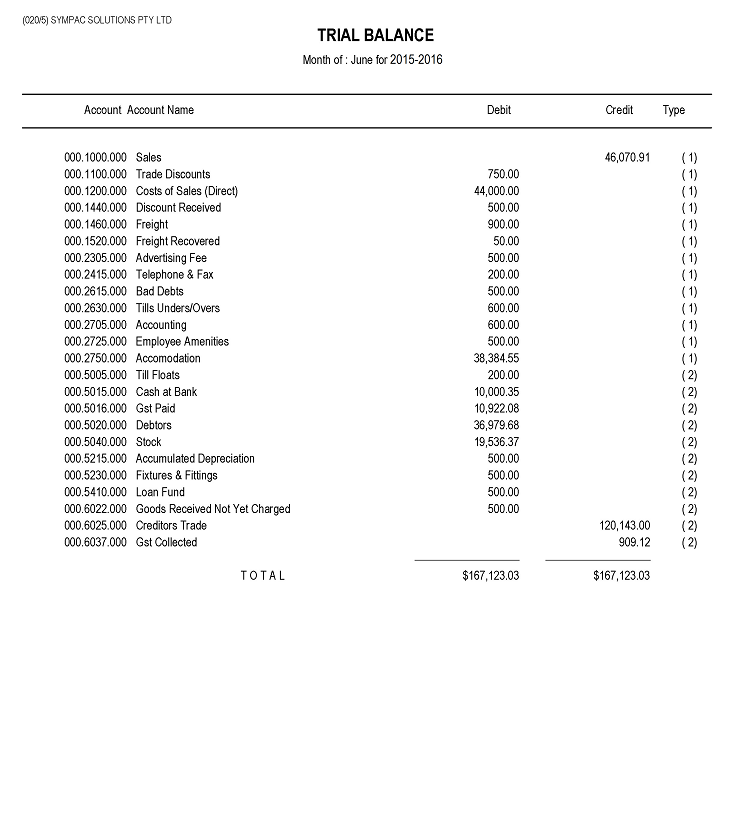

It consists of two columns: A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each. It is not just a precursor to preparing.

A trial balance is a list of the. What is a trial balance? Magnificent adjusted trial balance go over the adjusted trial balance for magnificent landscaping service.

The trial balance can tell you if you've mistyped an entry, forgotten half of a double entry, or incorrectly balanced an account. A trial balance is a bookkeeping worksheet in which the balances of all ledgersare compiled into debit and credit account column totals that are equal. A company prepares a trial balance periodically, usually at the end of every reporting period.

The primary purpose of a trial balance is to identify errors and ensure the equality of debits and credits. Trial balance is a foundational pillar in the world of accounting, essential for both the practice and the understanding of financial management. It compiles all ledger accounts and details their balances.

Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; For example, utility expenses during a period. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

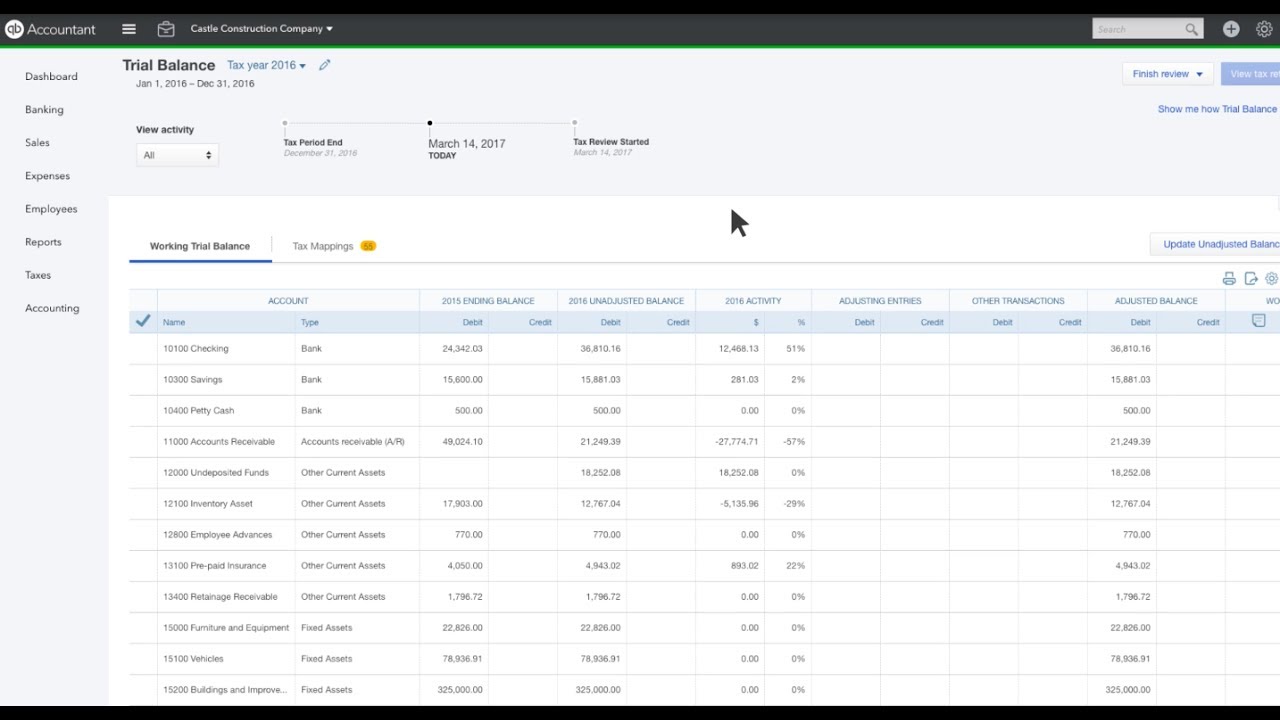

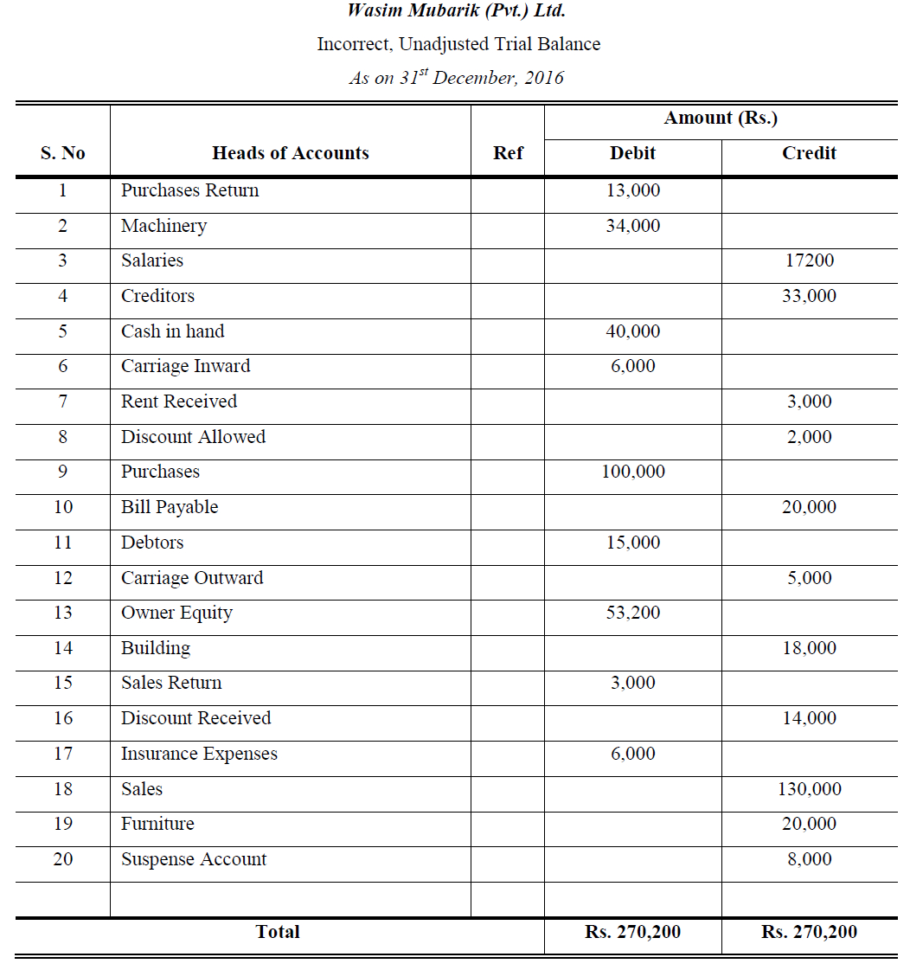

The unadjusted trial balance is the preliminary trial balance report or document that lists all ending balances or totals of accounts to determine if total debits and credit balances for. This statement comprises two columns:. A trial balance is used in bookkeeping to list all the balances in your business’s general ledger accounts.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. Preparing an unadjusted trial balance is the fourth step in the accounting cycle. A trial balance includes all your business accounts that have credits or debits during a given reporting period.

Understanding the concept of a trial balance is fundamental in the significance of a trial balance in accounting cannot be overstated.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)