Peerless Tips About Closing Balance In Trial Investment Joint Venture Sheet

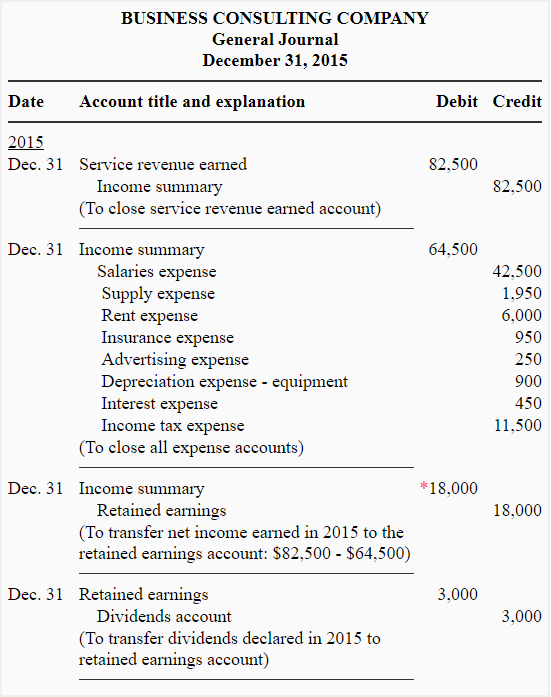

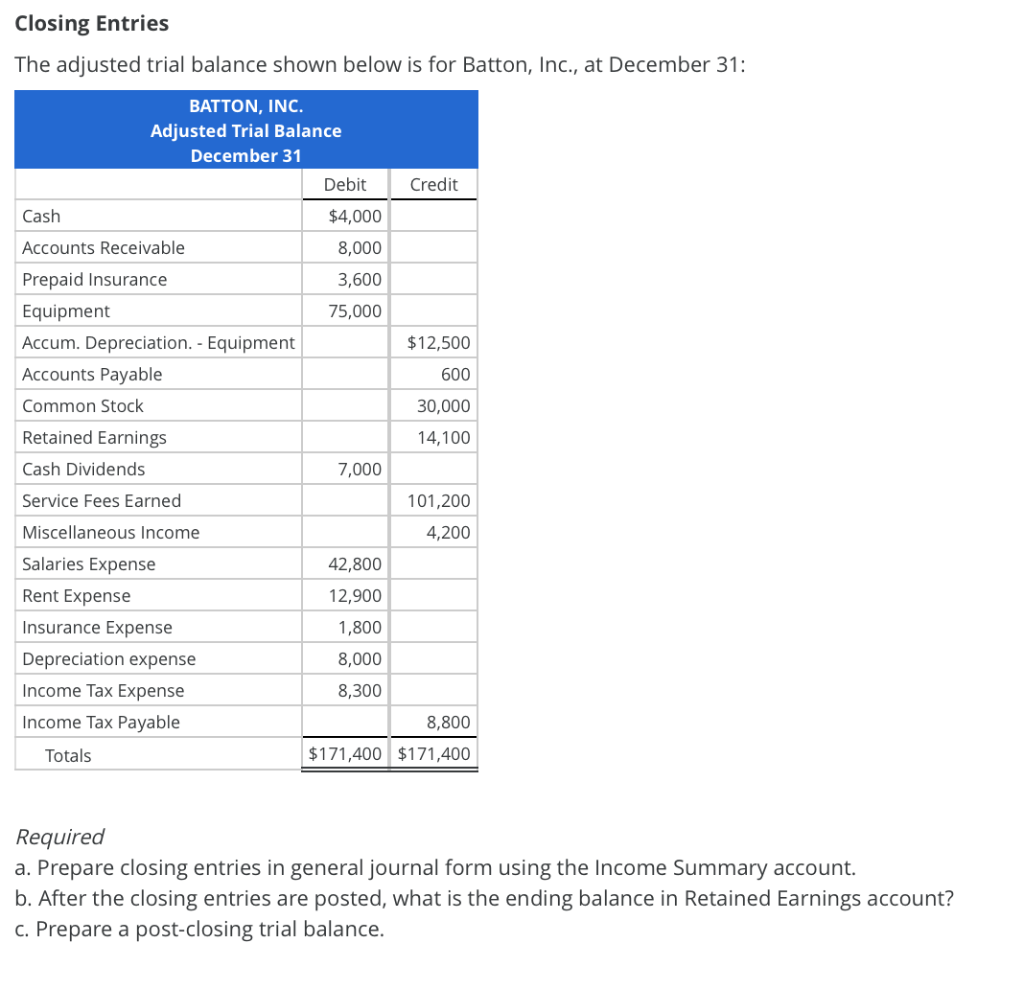

At the end of the period, the following closing entries were made:

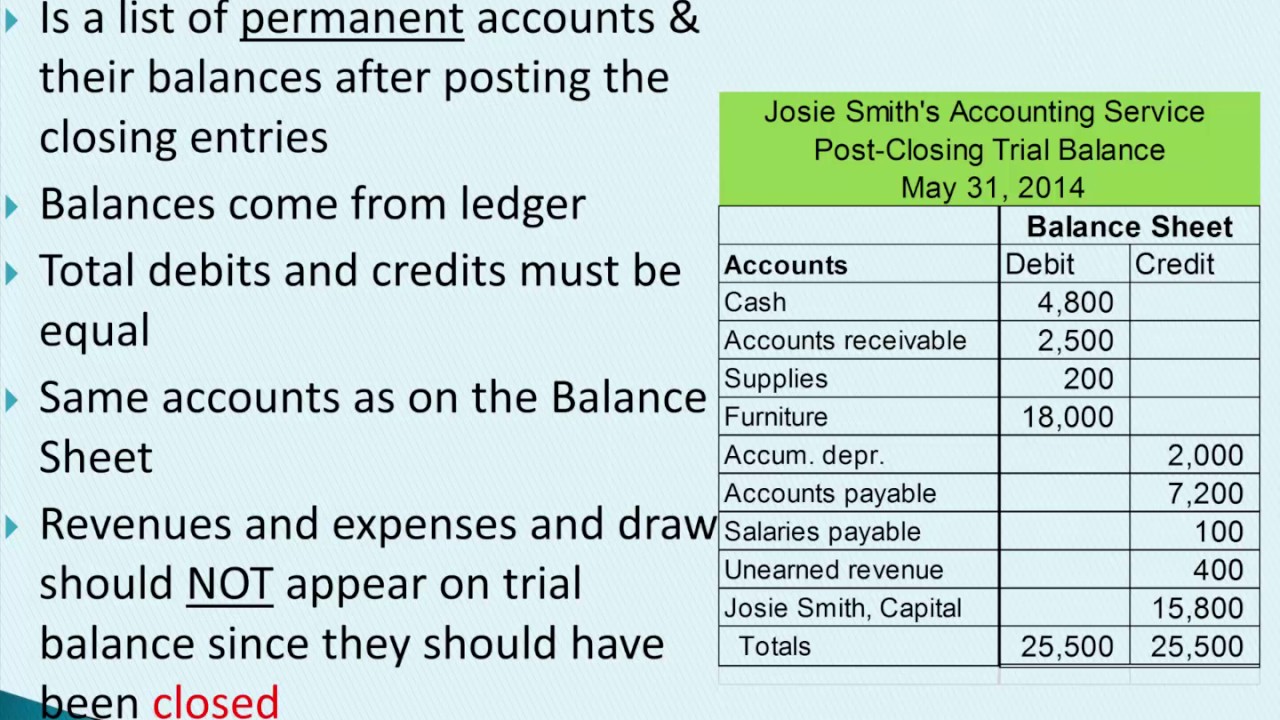

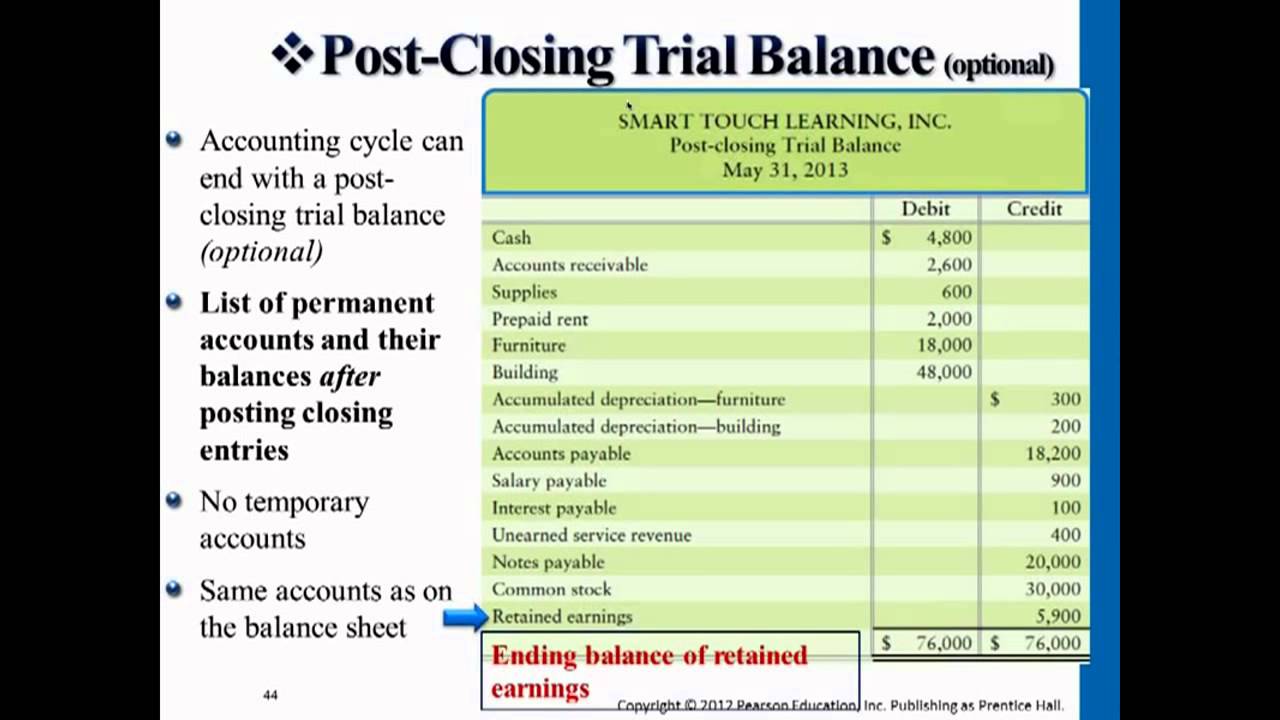

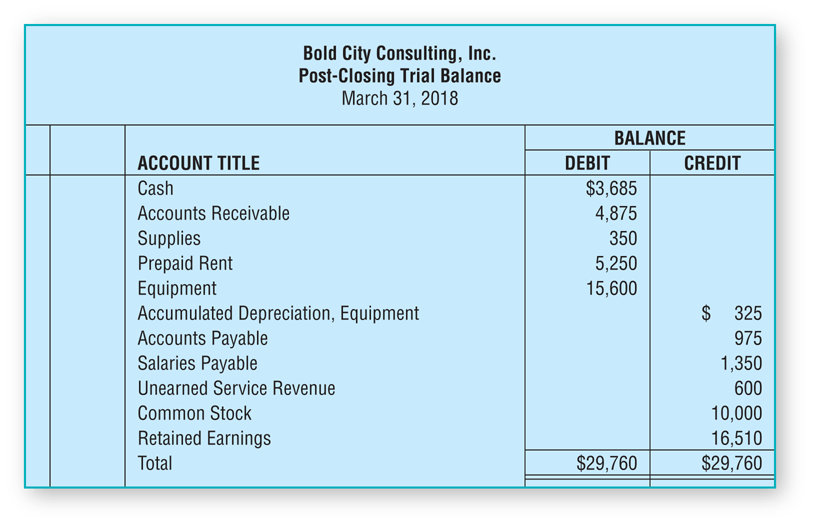

Closing balance in trial balance. Complete a comprehensive accounting cycle for a business; It presents a list of accounts and balances after closing entries have been written and posted in the ledger. The trial balance is prepared after posting all financial transactions to the journals and summarizing them on the ledger statements.

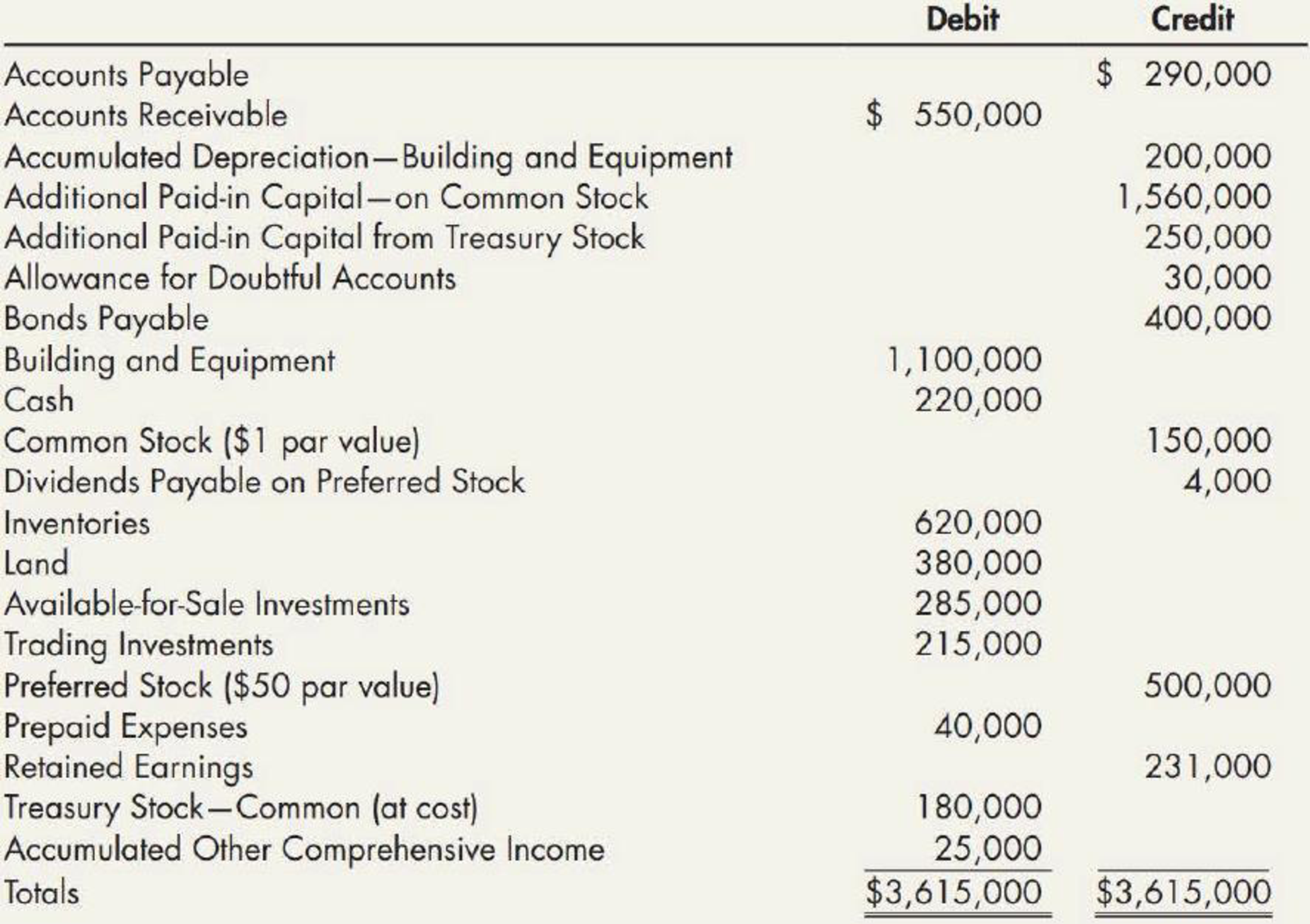

Adjusted trial balance is an internal business document that presents the closing balances of all ledged accounts after reconciliation or adjustments. Investment in equity securities $55,000. The accounts reflected on a trial balance are related to all major accounting items, including assets , liabilities, equity, revenues, expenses , gains, and.

It contains the total of each account on your chart of accounts. While there isn't a specific report to show both the beginning and closing balance, you can run the transaction detail by account. Based on the provided trial balance and additional information, let's prepare the balance sheet for almway corporation at december 31, 2024:

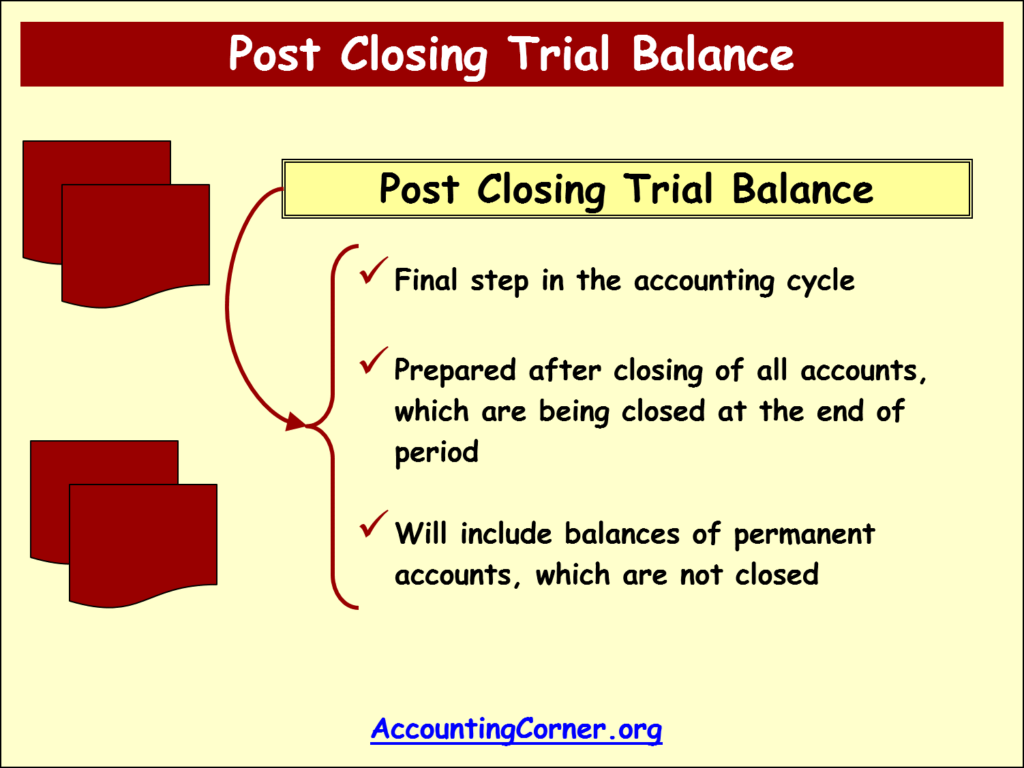

Normally, the entity records its daily business transactions in general ledgers. The post closing trial balance lists all remaining accounts with balances after the closing entries have been posted to ensure that no temporary accounts still exist. Almost every trial balance statement requires adjusting entries.

Trial balance is the records of the entity’s closing ledgers for a specific period of time. The trial balance is made to ensure that the debits equal the credits in the chart of accounts. The total of debit balance in trial balance should match with a.

Adjusted trial balance is an advanced form of the commonly used trial balance statement. Taking caffeine tablets significantly improved the ability to safely balance on a static or dynamic platform, as seen by a significant increase in the mean berg balance scale (bbs) score from 37.6. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

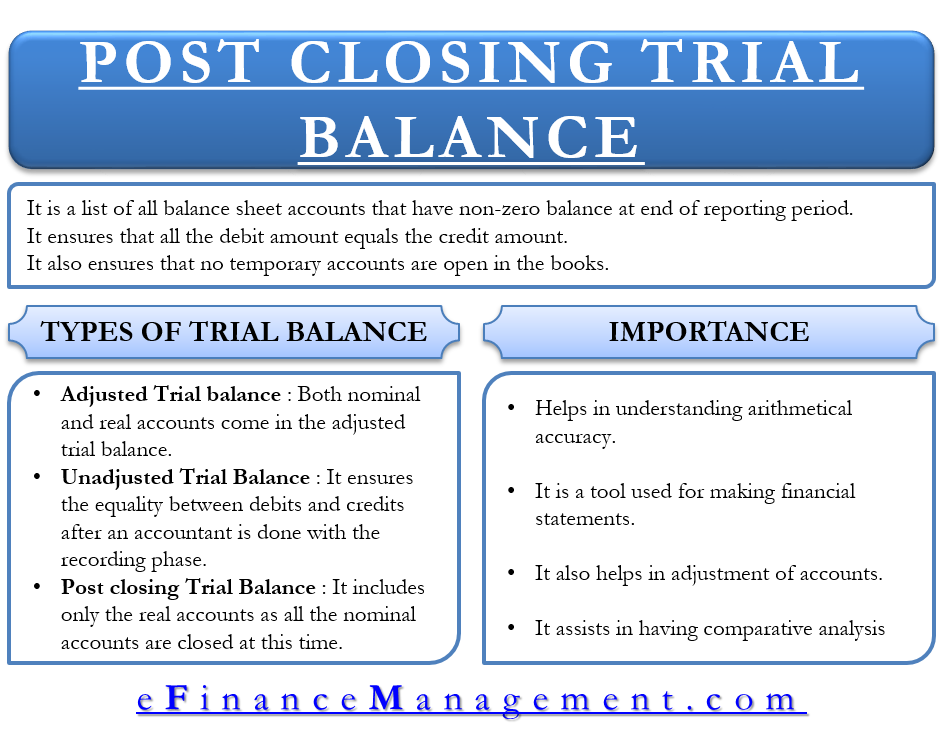

There are three types of trial balance: Close dialogue 1 / 1 next image previous image. The following are the financial statements of maggie’s music shop.

At the end of the period, the ledgers are closed and then move all of the closing balance items into trial balance. To prepare a trial balance, you will need the closing balances of the general ledger accounts. This statement comprises two columns:

It is usually prepared at the end of an accounting period to assist in the drafting of financial statements. Trial balance and balance sheet detail reports will show the beginning balance of each account. Then we produce the trial balance by listing each closing balance from the ledger accounts as either a debit or a credit.

The initial one is the unadjusted trial balance.this version contains the ending balances of all accounts in the general ledger, before any adjustments have been made to them with adjusting entries.this is the initial version that an accountant uses when preparing to. Each is used at different stages in the accounting. Example to illustrate, here is a sample adjusted trial balance: