Impressive Info About Audit Of Banks Other Income Statement

Abstract of external audits of banks, march 2014.

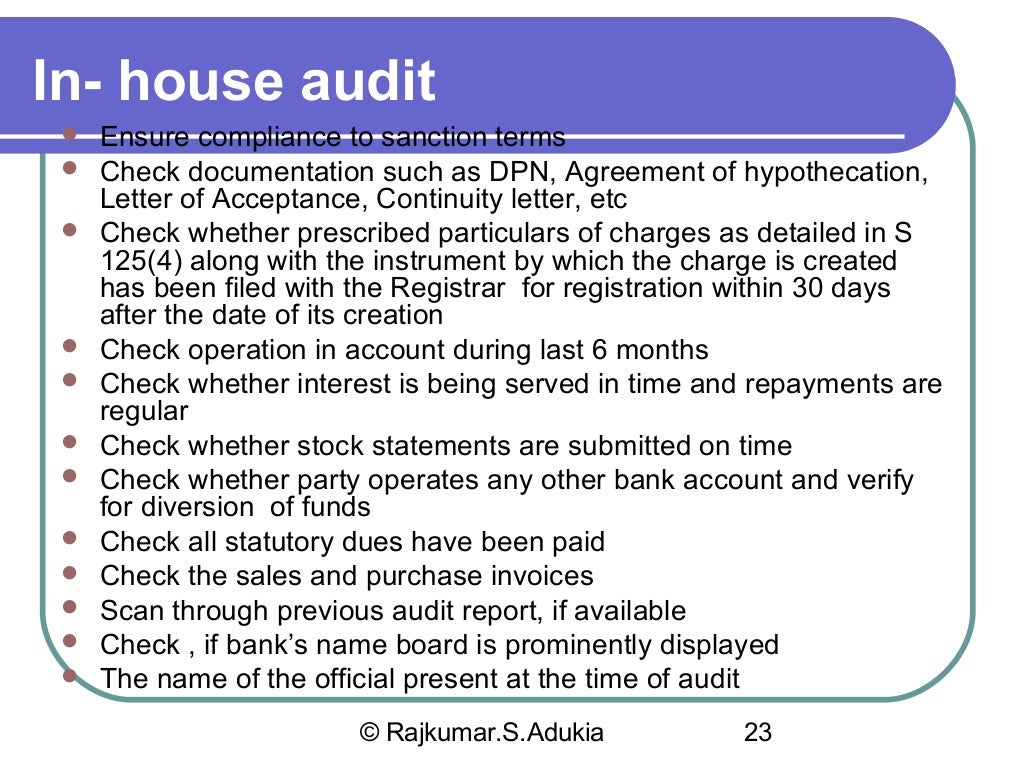

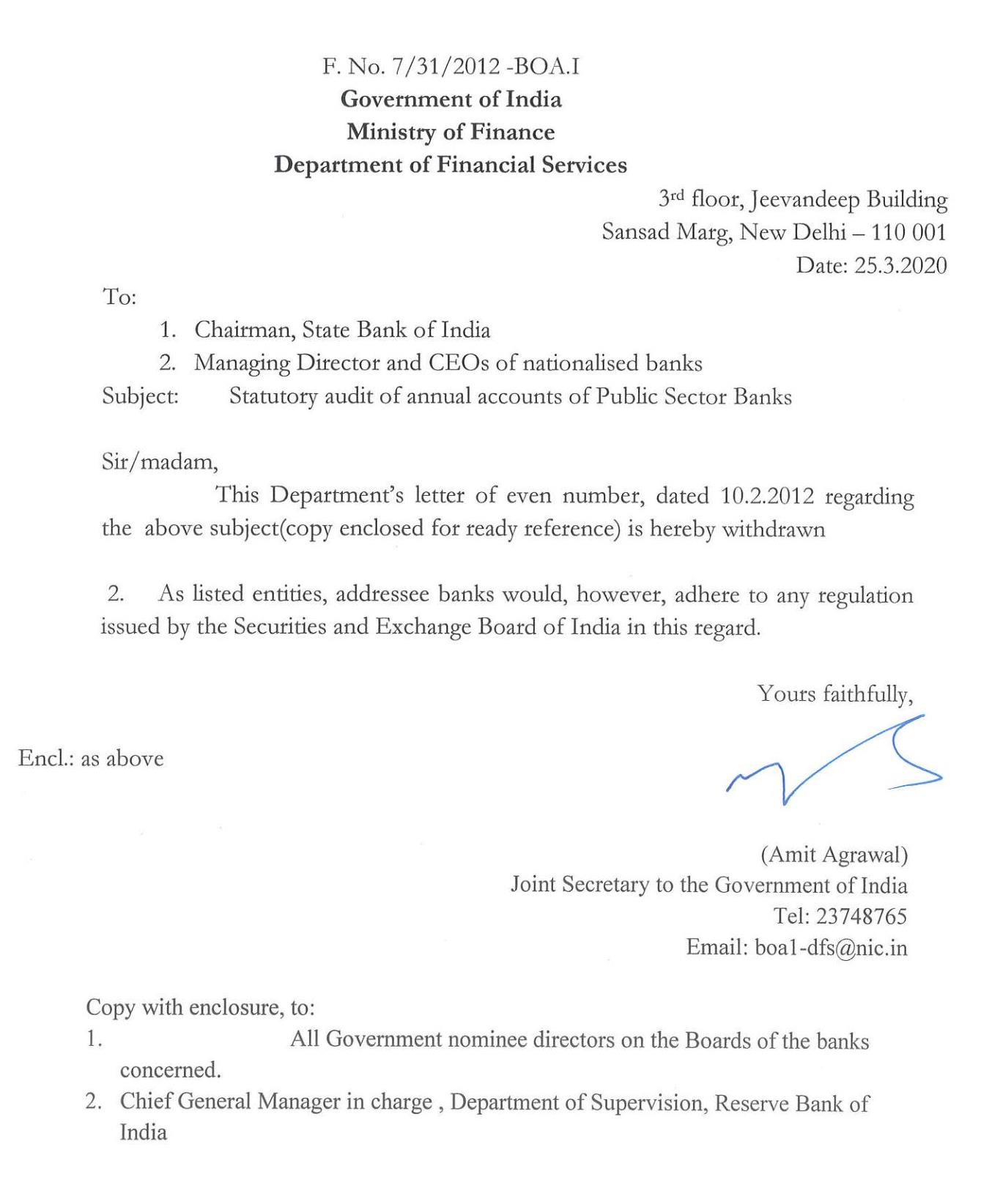

Audit of banks. The withdrawal of practice note (pn) 16 bank. The guidance note on audit of banks brought out by the auditing and assurance standards board of icai every year is an important resource which provides detailed. The auditing and assurance standards board (aasb) of icai under the authority of the council of icai brings out the revised edition of “guidance note on audit of banks”.

Auditing of bank and cash. Though a team of lawyers from her office led the. The guidance note on audit of banks is issued by the auditing and assurance standards board of the institute of chartered accountants of india (icai) under the authority of the.

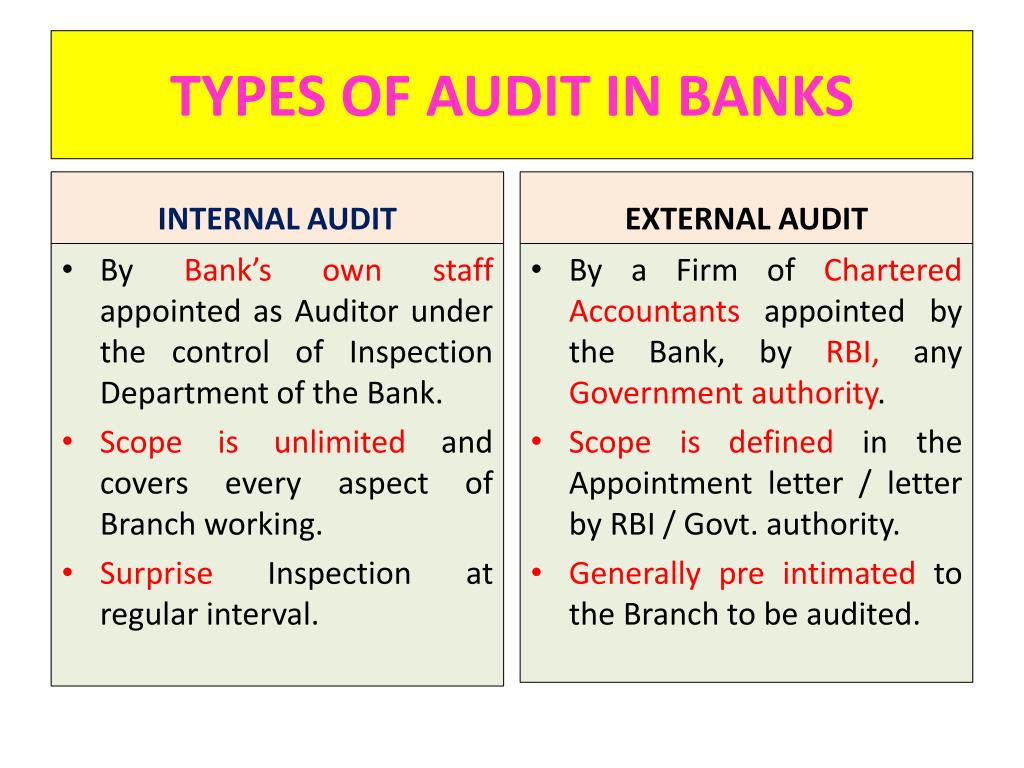

Hence to understand how this audit needs to be conducted, an understanding of the processes of. The concurrent audit covers all transactions of the bank. Future of bank audits:

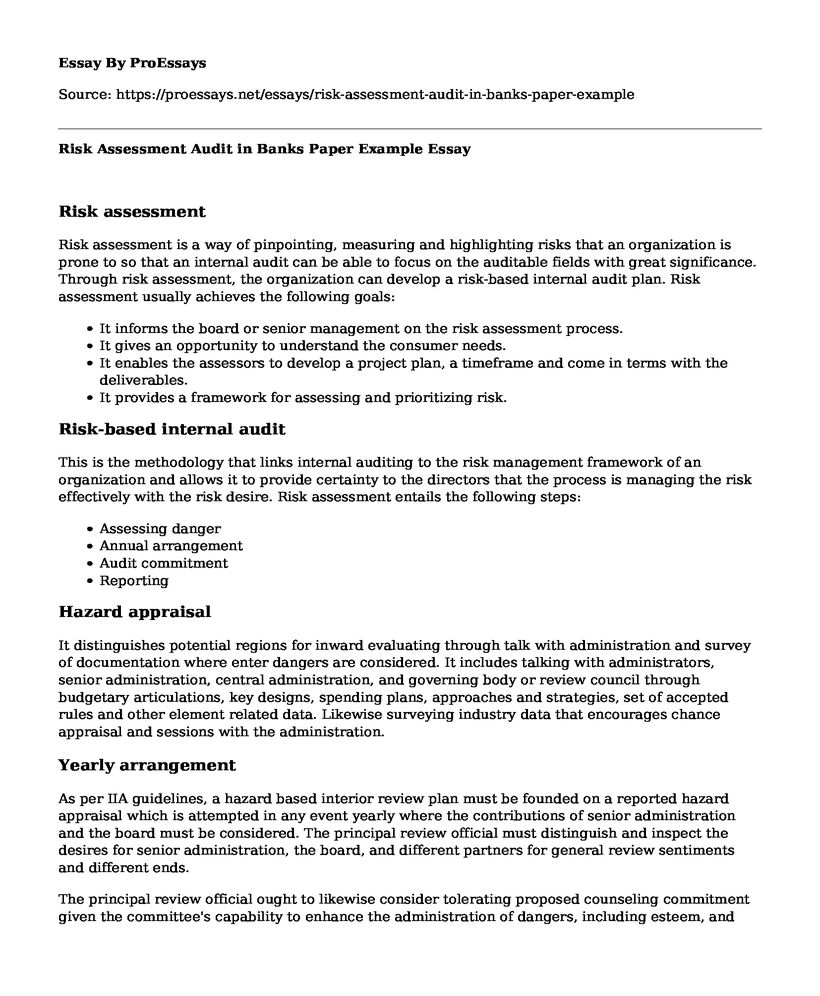

Guidance note on audit of banks (2022 edition) a. An external auditing program complements the internal auditing function by providing management and the board of directors with an independent and objective. Foreword and preface of past years;

The international federation of accountants (ifac) welcomes the opportunity to comment on the basel committee on banking supervision (bcbs) consultative document,. Increased regulation and impact on audit functions. This article discusses the audit of banks.

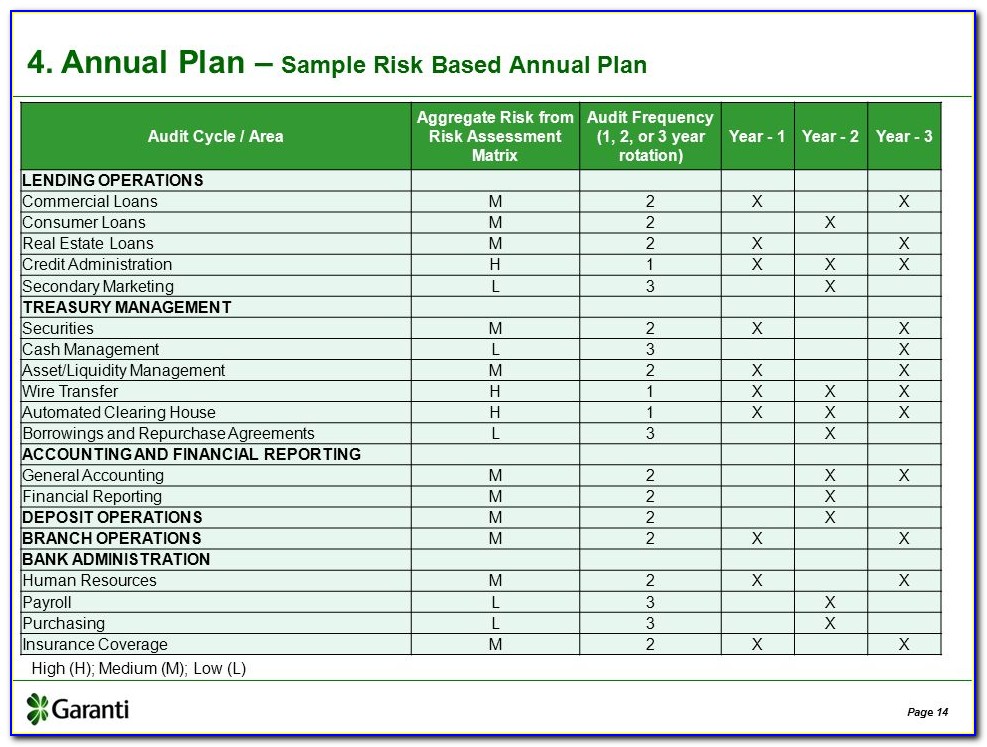

The note applies to internationally active banks applying ifrs 9 and subject to a financial statement audit, including those within a banking group and holding. After a retrospective analysis of recent bank failures, deloitte concluded that banks. 2.13 the guidelines published in march 2014 by the basel committee on banking supervision (basel committee) on ‘external audits of banks’ should be considered by.

A detailed guide about banking operations, auditing framework & audit of advances by taxmann. Text of guidance note on audit of banks (2022 edition) c. The recent financial crisis not only revealed weaknesses in risk management, control and governance.

Irregularities have been so widespread that even otherwise impartial observers are joining the chorus of voices demanding a recount. The recent financial crisis not only revealed weaknesses in risk management, control and governance processes at banks,. To assist banking supervisors in managing their relationships with banks’ auditors and in developing their policies which will contribute to building enhanced auditing and.