Outrageous Info About Is Cost Of Goods Sold On The Balance Sheet Profit And Loss Statement Uber

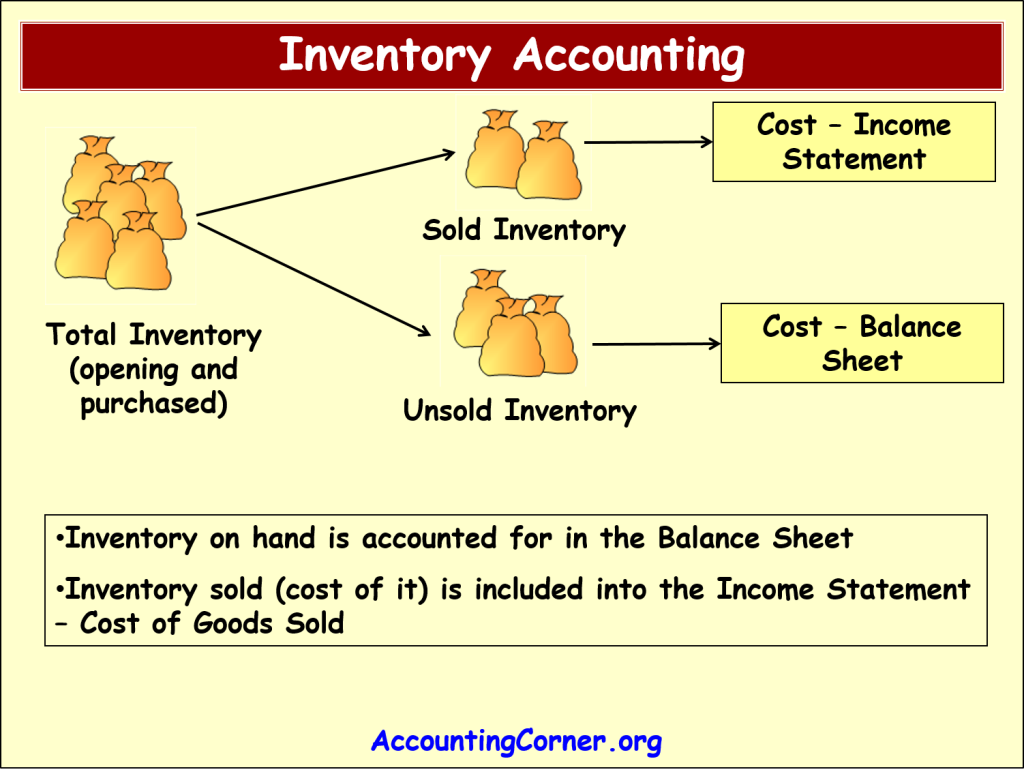

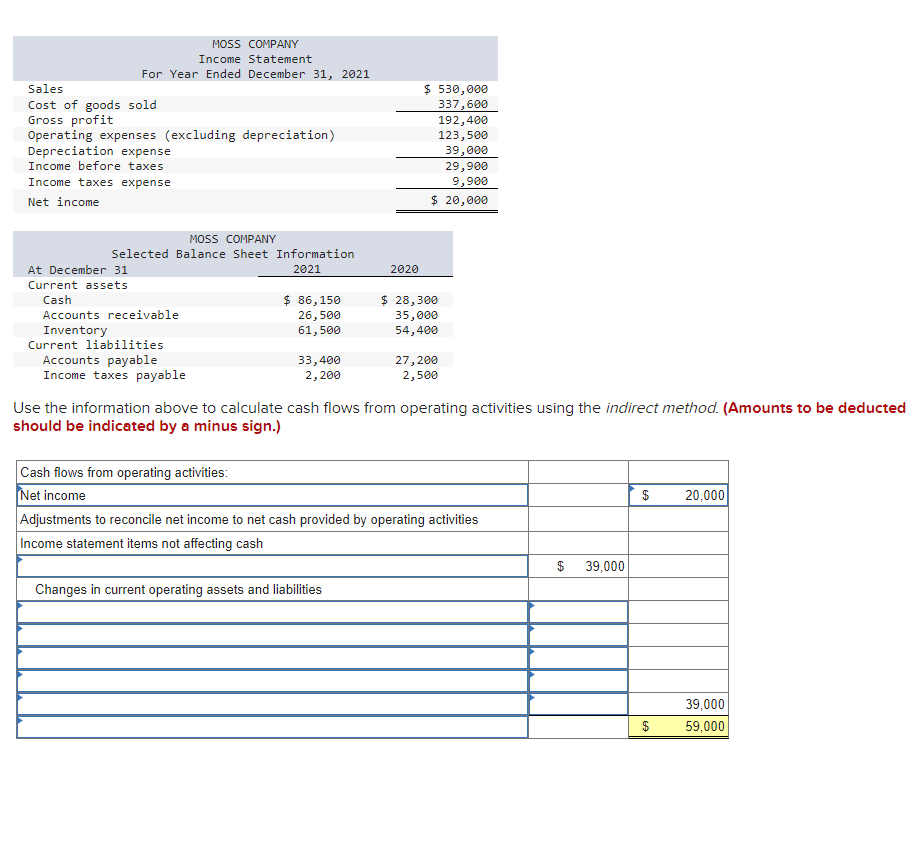

We cannot find the cost of goods sold on the balance sheet as it is the income statement line items.

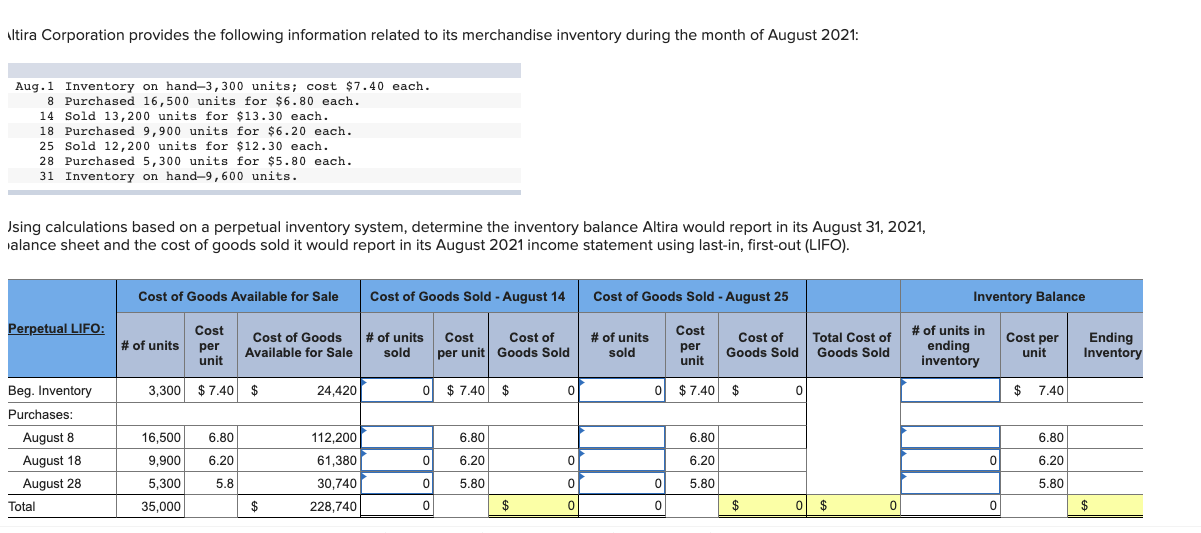

Is cost of goods sold on the balance sheet. This entry distributes the balance in the purchases account between the inventory that was sold (cost of goods sold) and the amount of inventory that remains at period end. The cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. Cost of goods sold is an important aspect of financial reporting that helps businesses understand how much it costs to produce goods or services sold to customers.

This figure constitutes the formula companies use to calculate gross profits. Cost of goods sold (cogs) is an important financial metric that reflects the direct expenses incurred by a company in producing and selling its products. Cost of goods sold appear in the income statement, but inventories—which are goods yet to be delivered and are associated with the cost of sales—appear on the.

Cogs covers all the direct costs involved in. When a sale is made so that inventory is surrendered, the seller reports an expense that has previously been identified as “cost of goods sold” or “cost of sales.”. The cost of goods sold (cogs) represents the total expense a company incurs to produce the goods it sells in a specific period.

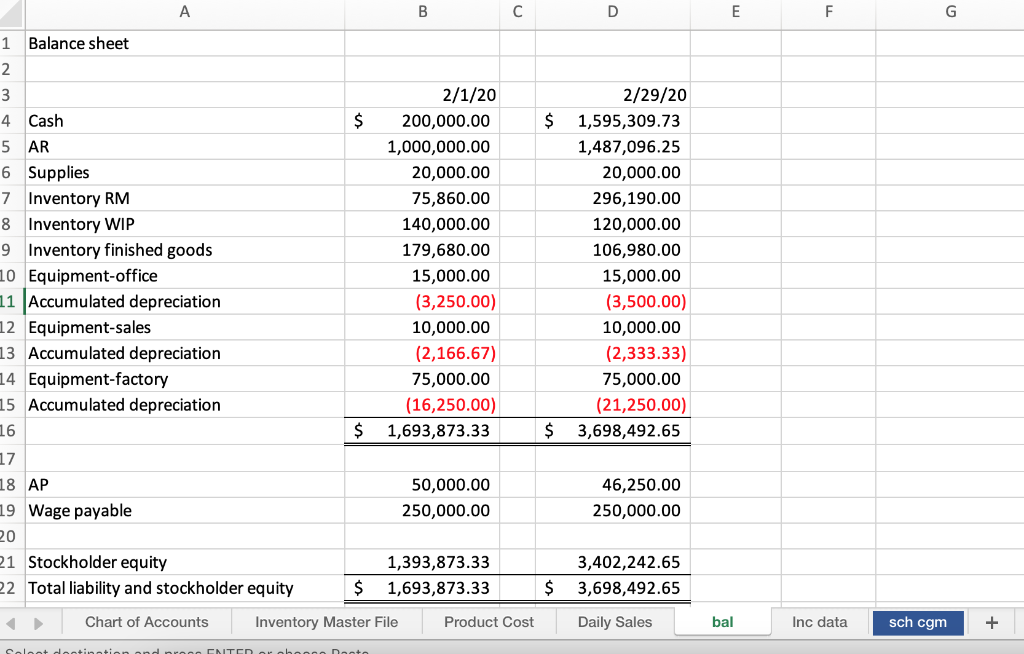

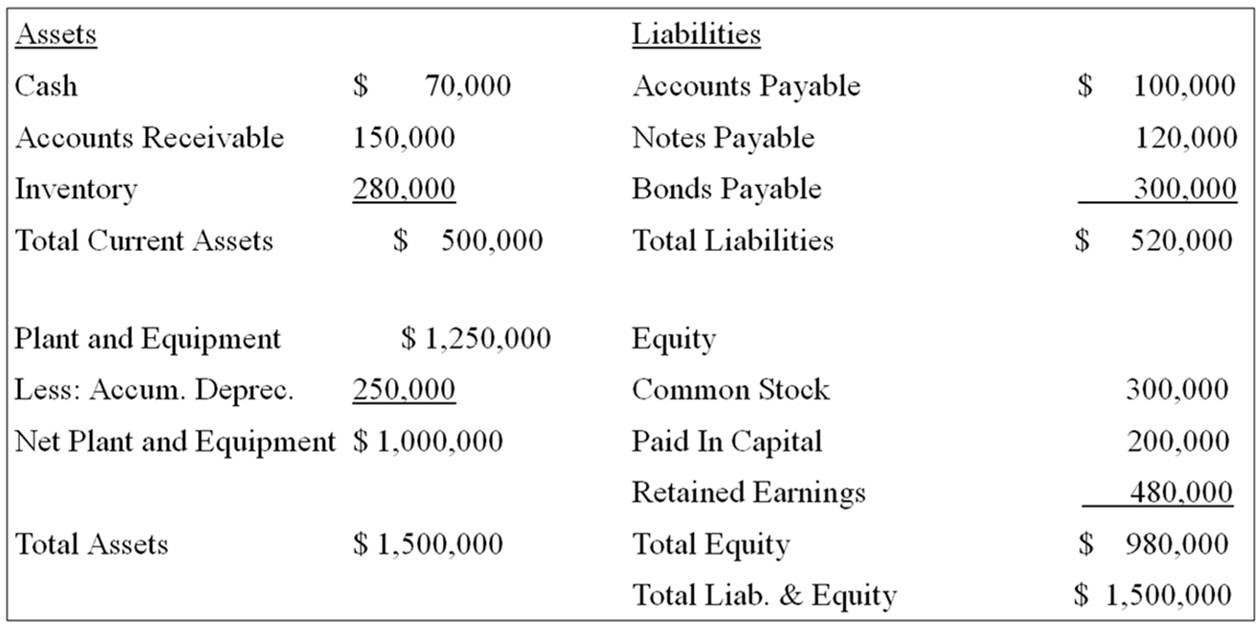

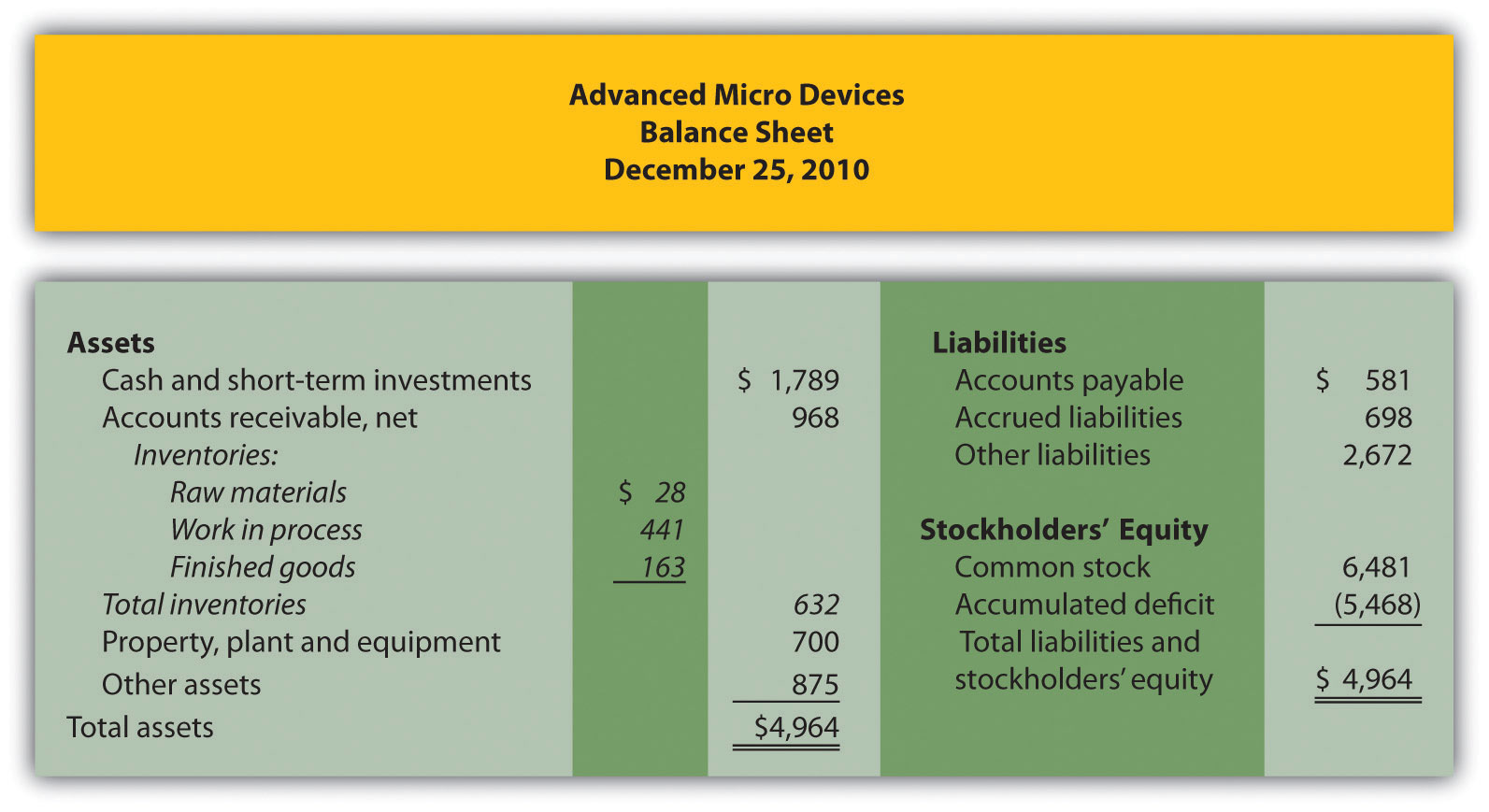

Knowing the cost of goods sold can help you calculate. Fact checked by yarilet perez companies will often list on their balance sheets cost of goods sold (cogs) or cost of sales (and sometimes both), leading to. Balance sheet shows the balance of goods not yet sold, which is known as.

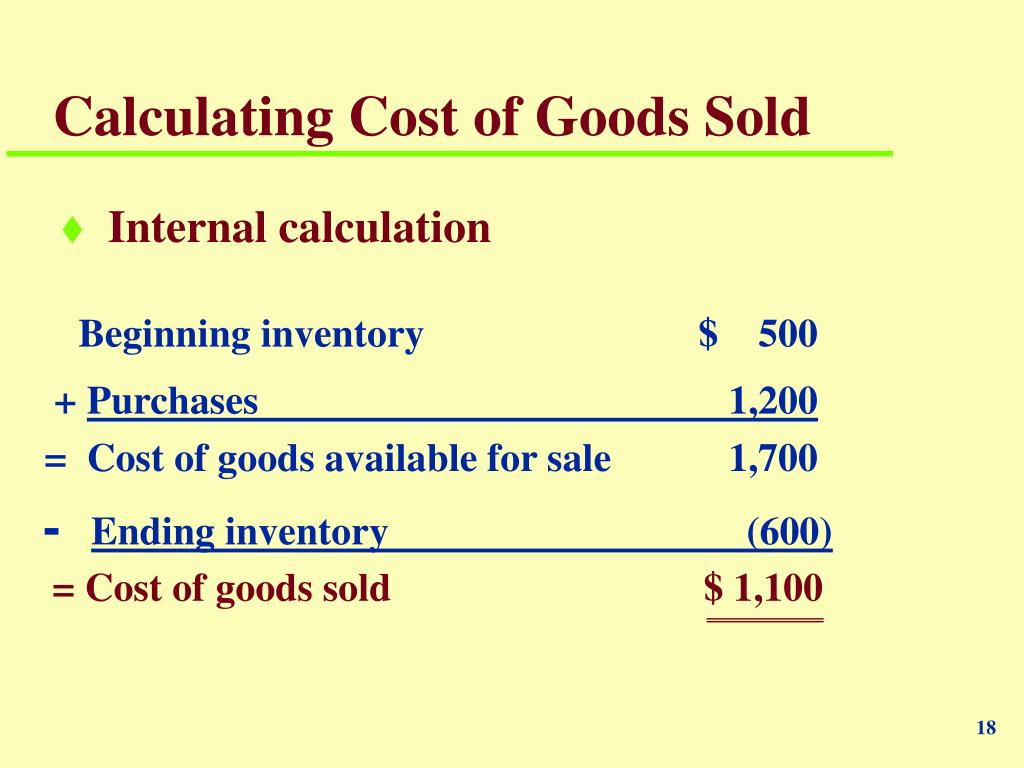

How to calculate the cost of goods sold (cogs) every accountant worth her spreadsheet should be able to rattle off the basic cogs formula in her sleep. Cost of goods sold represents the amount a company paid for the manufactured items that it sold. The cost of goods sold is calculated by the following formula.

Cost of goods sold refers to the total expenses incurred on the goods sold during a period. Cost of goods sold is matched with sales on the first.

![[Solved] MOSS COMPANY Statement For Year Ended Dec](https://media.cheggcdn.com/media/c50/c50cca1f-cfa5-4c81-a37f-2810754a3a83/phpTzrprB)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)