Lessons I Learned From Info About Interest Revenue Account Fund Flow Statement Adjustments

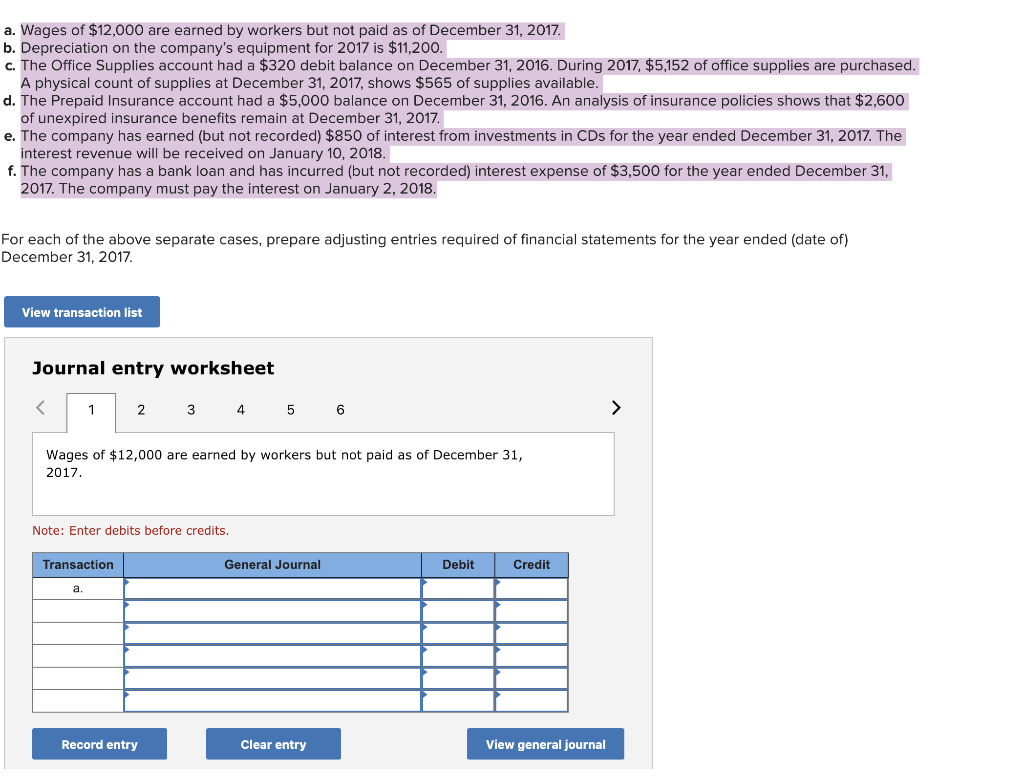

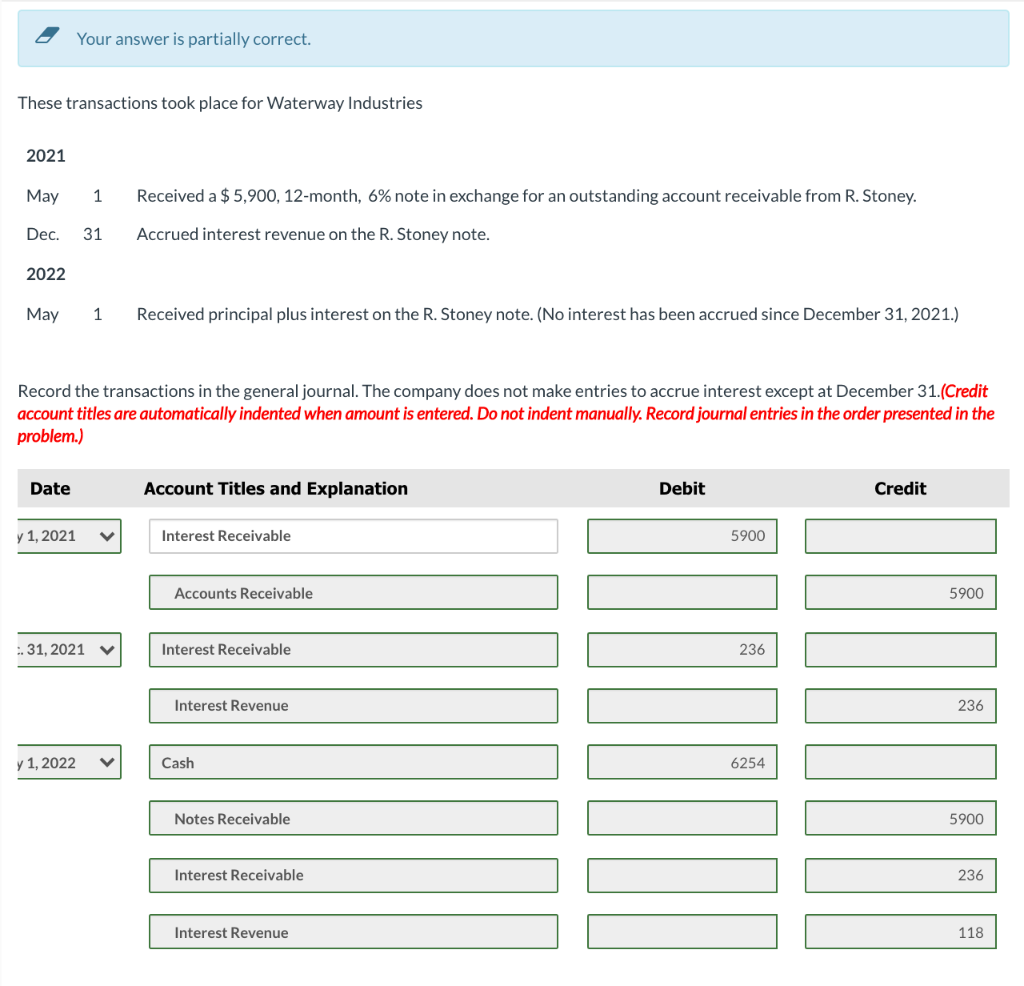

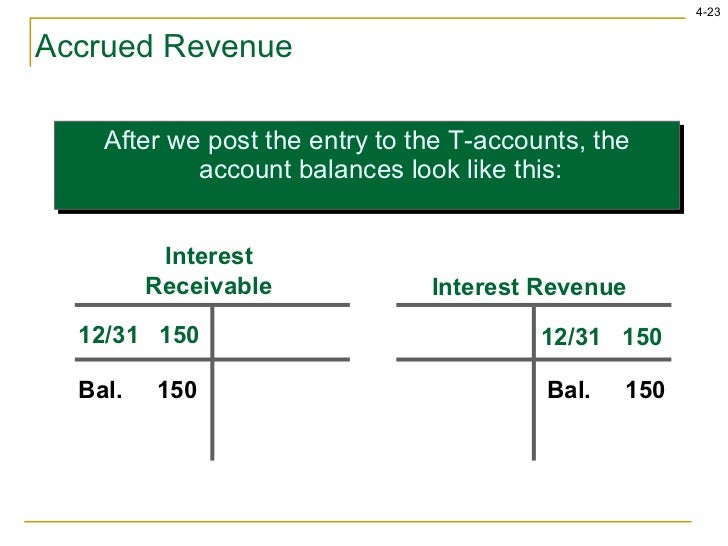

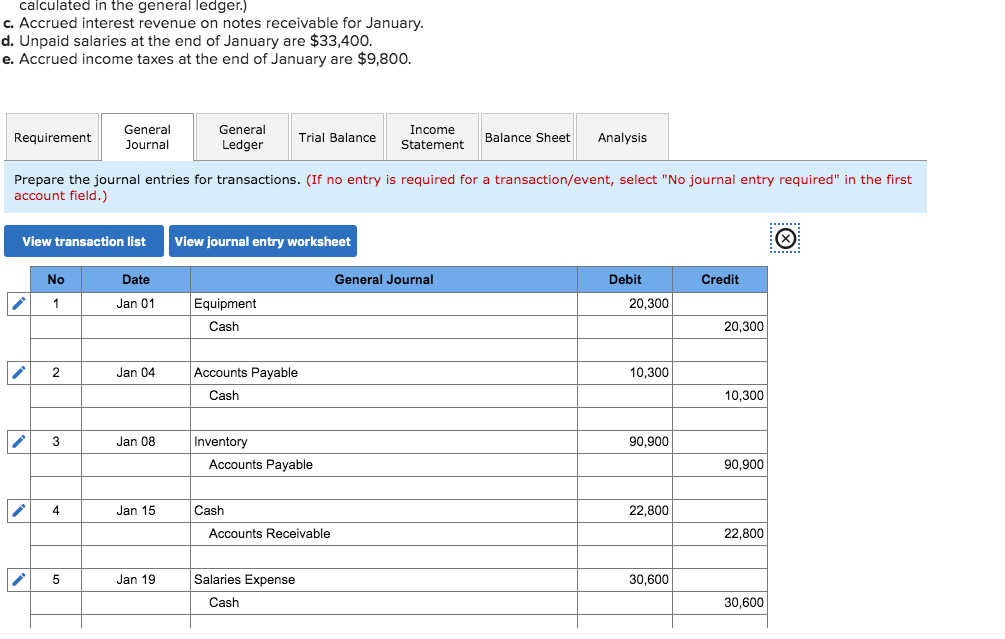

That interest can be categorized as either interest receivable or interest revenue. these accounting terms have slightly different meanings.

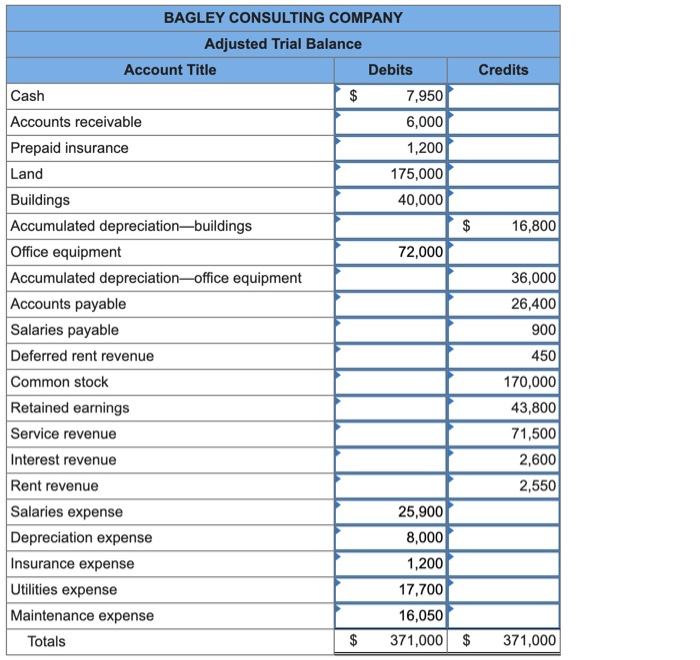

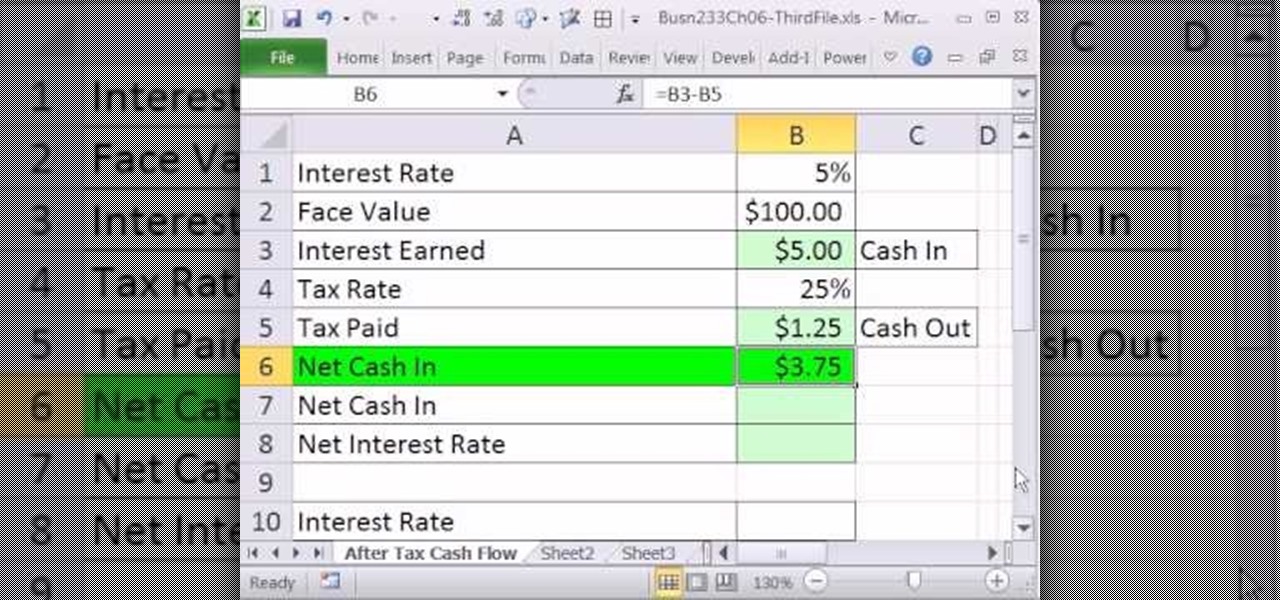

Interest revenue account. Deposited a sum of $ 500,000 in the bank account on december 01, 2018. It is presented on the organization’s income statement, showing the interest earned for the reporting period in. Under the accrual basis of accounting, the interest revenues account reports the interest earned by a company during the time period indicated in.

If the balance remains unpaid on july 1, you’ve earned $10 of interest. Accrued interest is a term used in accrual accounting that disregards cash flows and reports interest that has been earned but not collected. A borrower incurs interest expense;

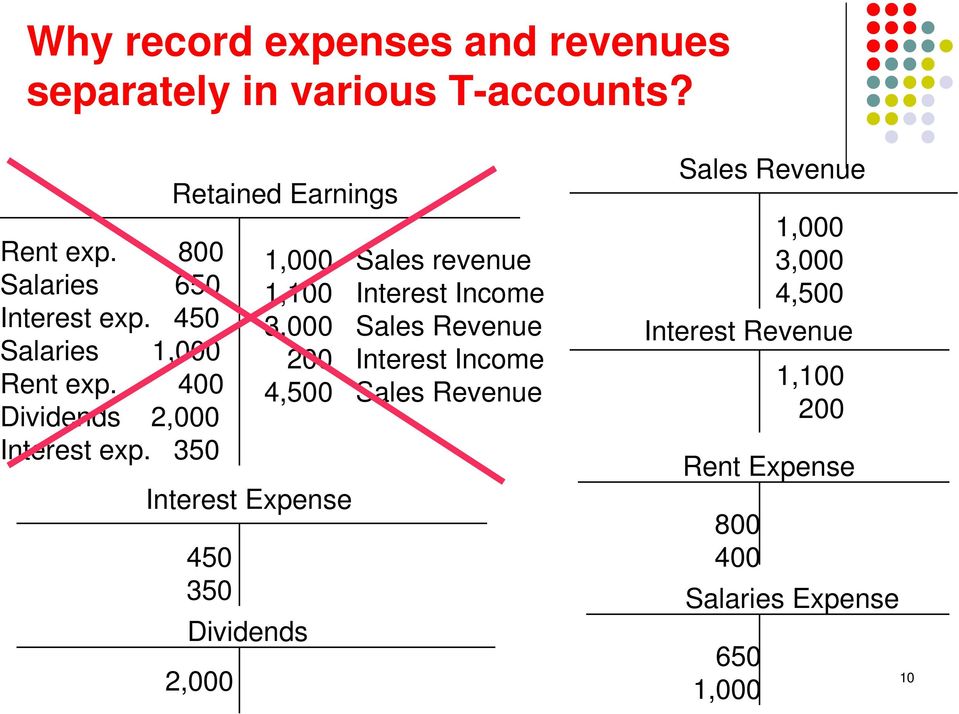

List of revenue accounts 1. Other account titles may be used depending on the industry of the business, such as. How to succeed in an era of volatility.

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to. Revenue from interest remains consistent, but the overall report allows a company to monitor the source of its income. The interest revenue account, which is ultimately reflected on company income statements, includes all interest income earned regardless of whether it's paid or.

Revenue in the dairy products & eggs market for different segments united states from 2018 to 2028 (in billion u.s. For most businesses, the majority of its revenue is derived from sales. They state that ifrs 7.b5 (e) requires an entity to disclose whether net gains or net losses on financial instruments measured at fvpl include interest or dividend.

How fast should your company really grow? Not all wells fargo accounts offer standard interest and annual percentage yield, and the accounts that do offer as low as 0.01%, which is lower than the national. To the maker of the note, or borrower, interest is an expense;

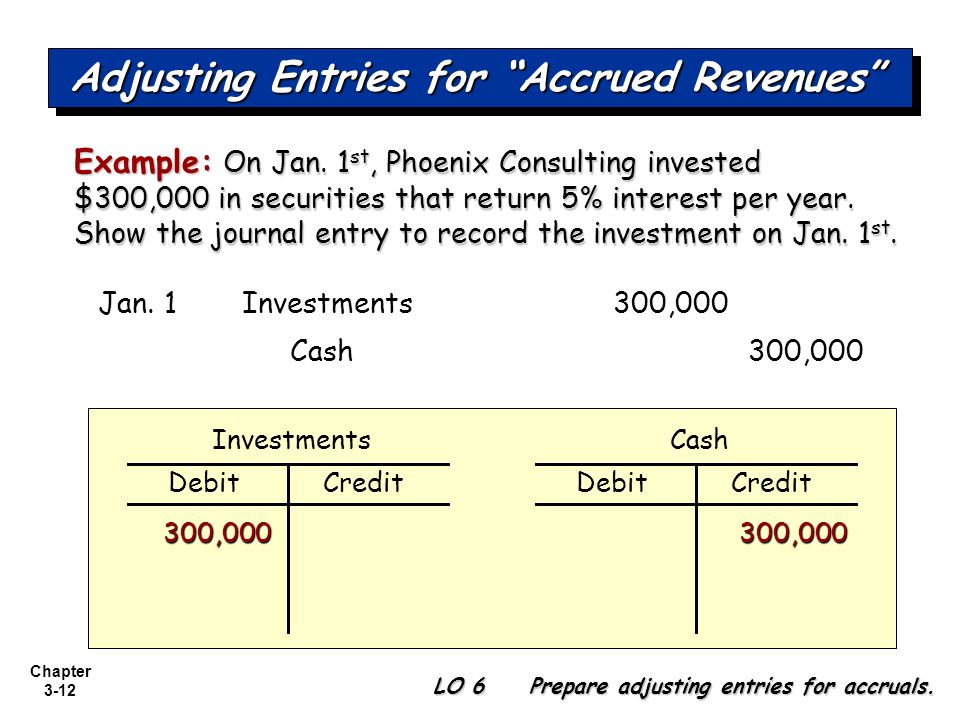

Interest revenue is calculated and recorded separately of interest receivable. Interest revenue is the earnings that an entity receives from any investments it makes, or on debt it owns. For example, a bank can earn.

Ias 18 outlines the accounting requirements for when to recognise revenue from the sale of goods, rendering of services and for interest, royalties and dividends. At the end of a period,. Until the interest is paid, or written off as uncollectible, the $10 is included in the interest.

Generating revenue from interest on your customers’. A note generally creates interest income even though the interest has yet to. Create a system to grow consistently.

What is interest revenue? Below are the examples of interest receivable journal entries. Dollars) [graph], statista market insights, july.