Unbelievable Info About Are Balance Sheets Monthly Or Yearly Interest Expense On Statement Of Cash Flows

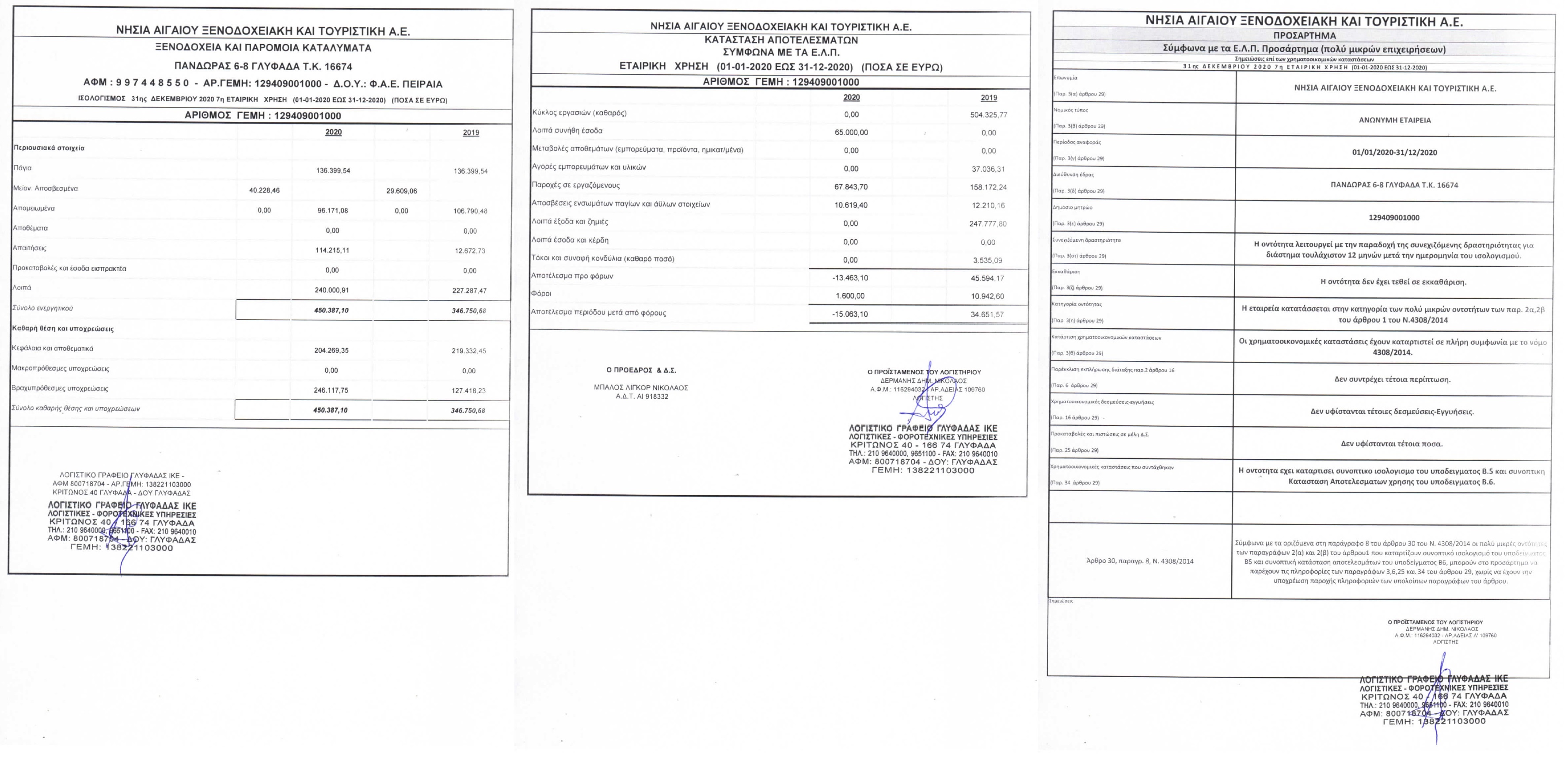

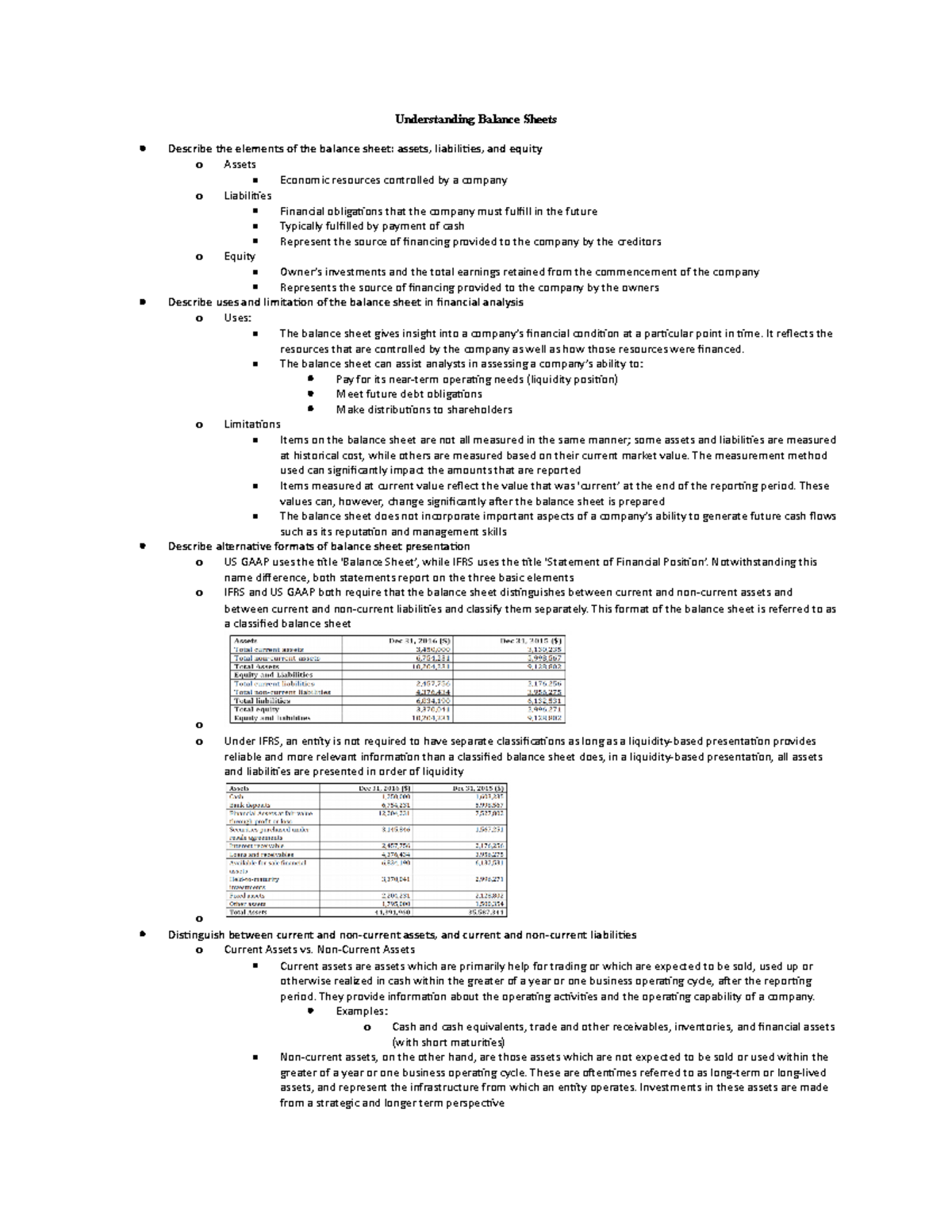

Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business's calendar year.

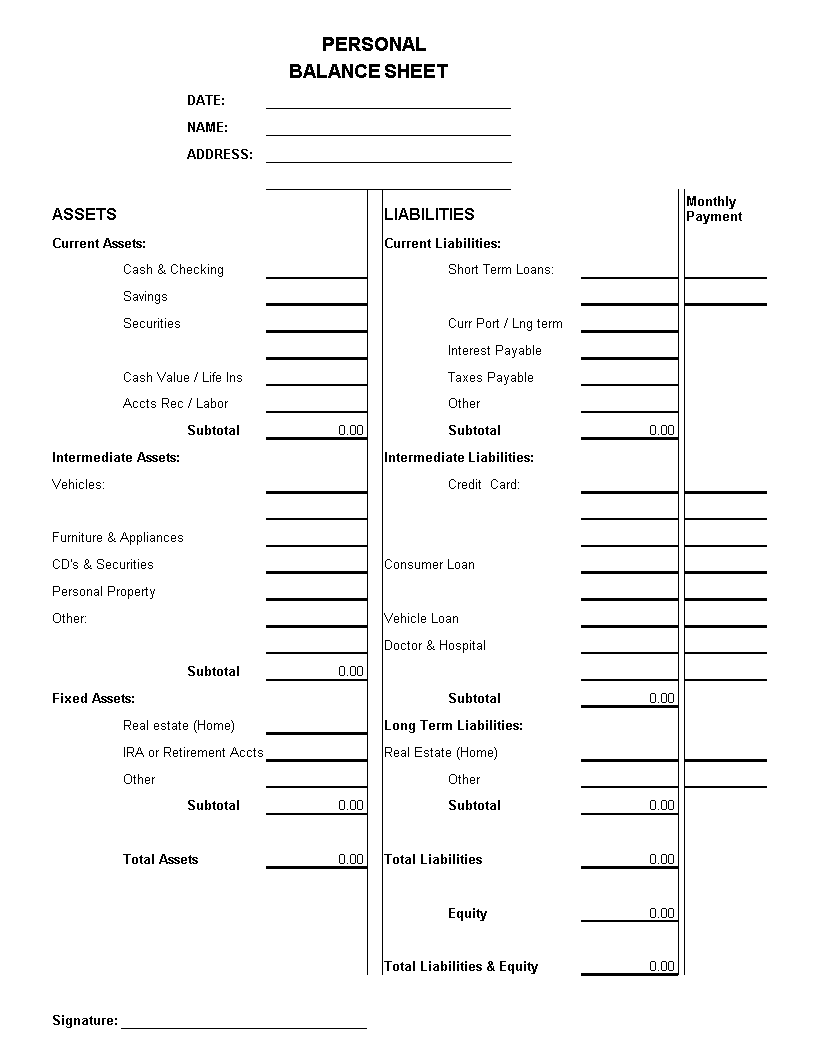

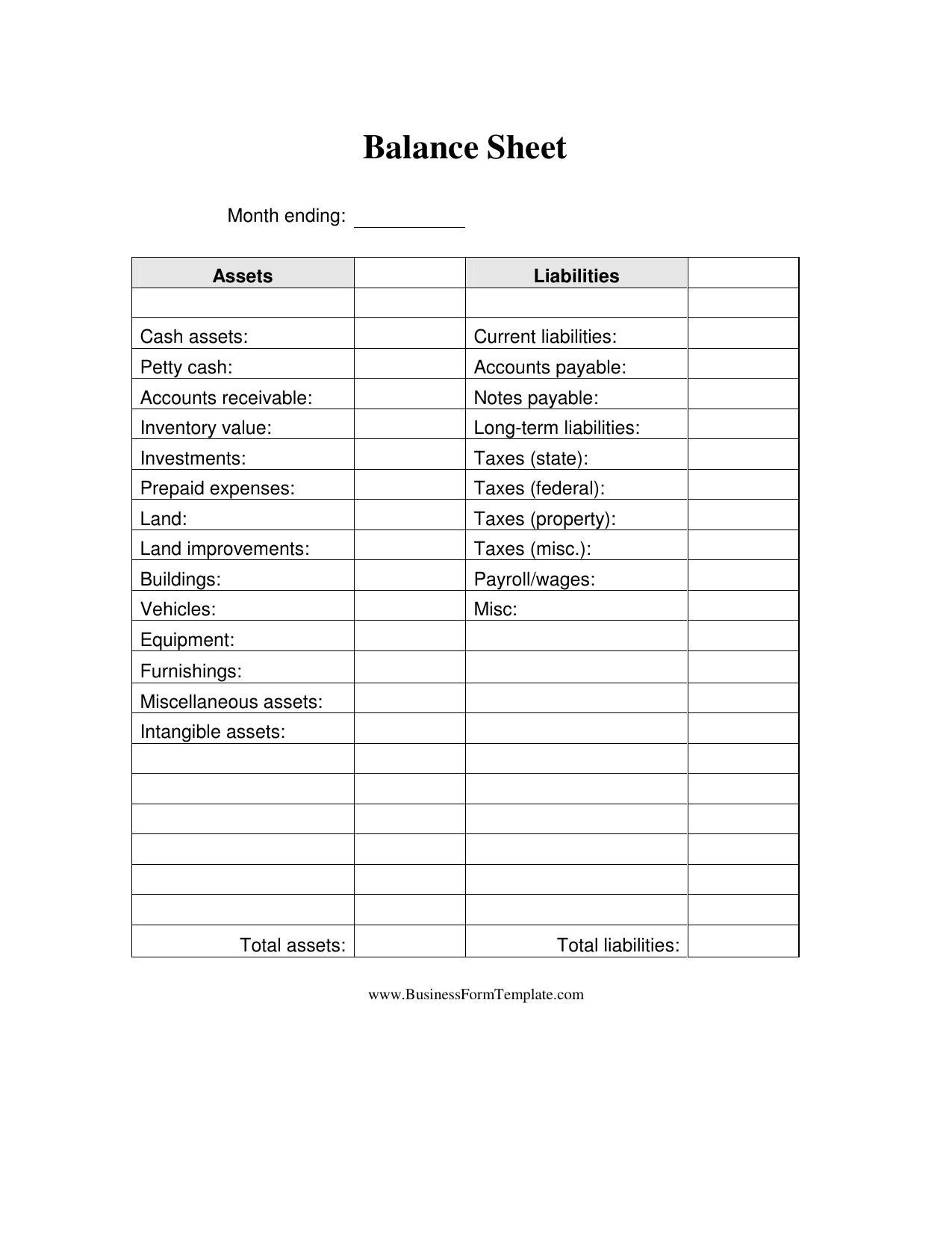

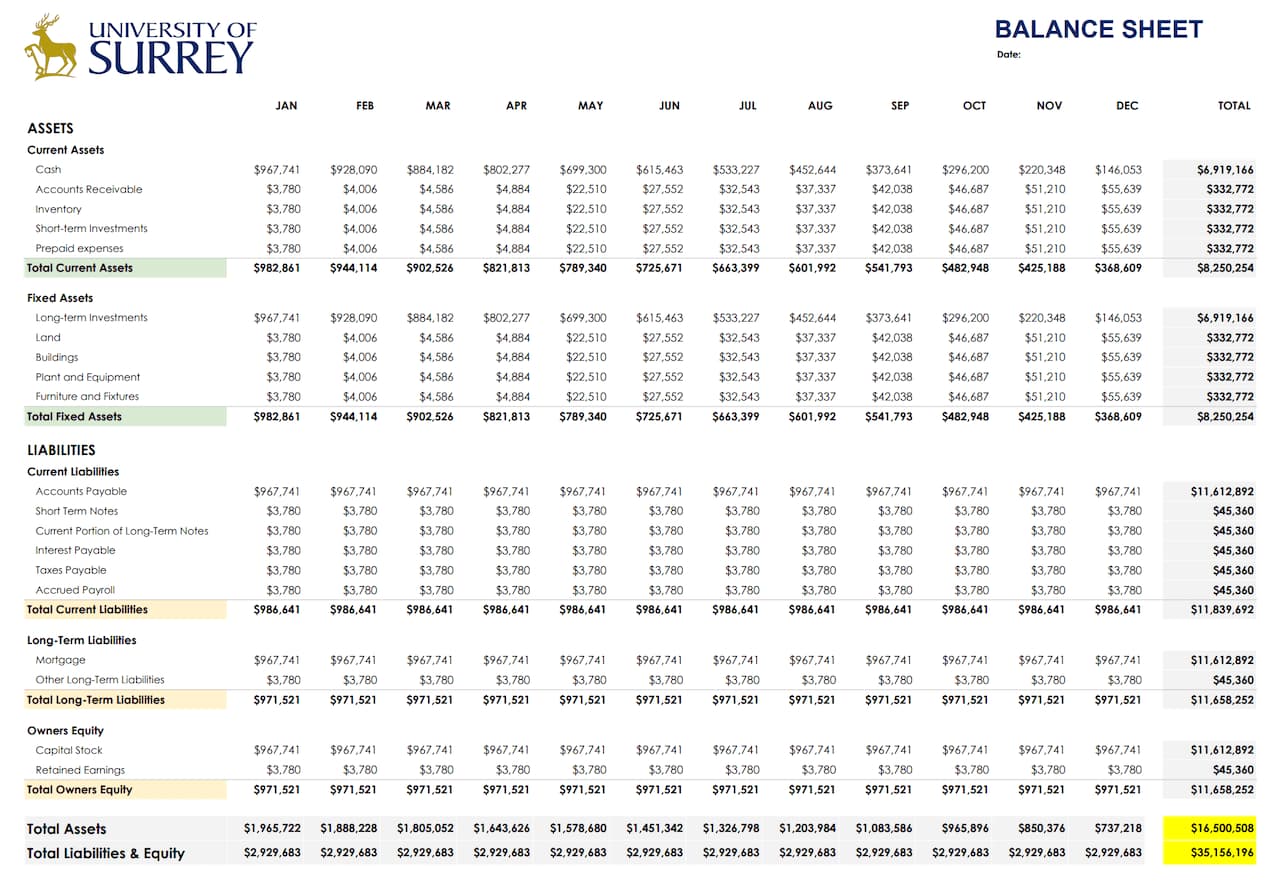

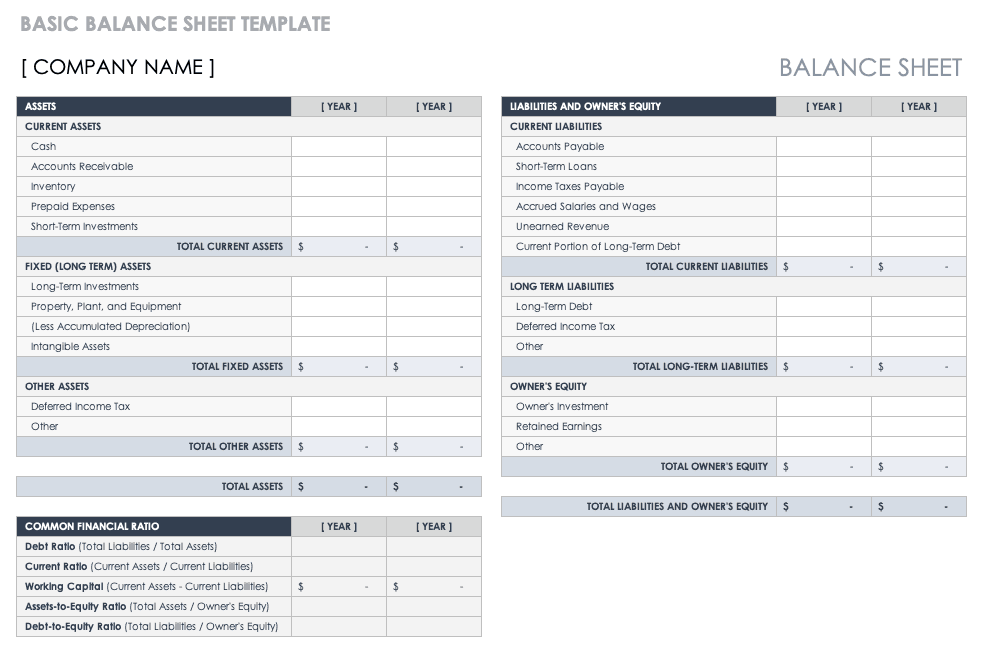

Are balance sheets monthly or yearly. The balance sheet is basically a report version of the accounting equation also called the balance sheet equation where assets always equation liabilities plus shareholder. Why do you need a balance sheet? The balance sheets of utilities, banks, insurance companies, brokerage and investment banking firms, and other specialized businesses are significantly different in account presentation from those.

It allows you to see what resources it has available and how they were financed as of a specific date. Check out our video on the balance sheet below, and subscribe to our youtube channel for more explainer content! The purpose of the balance sheet

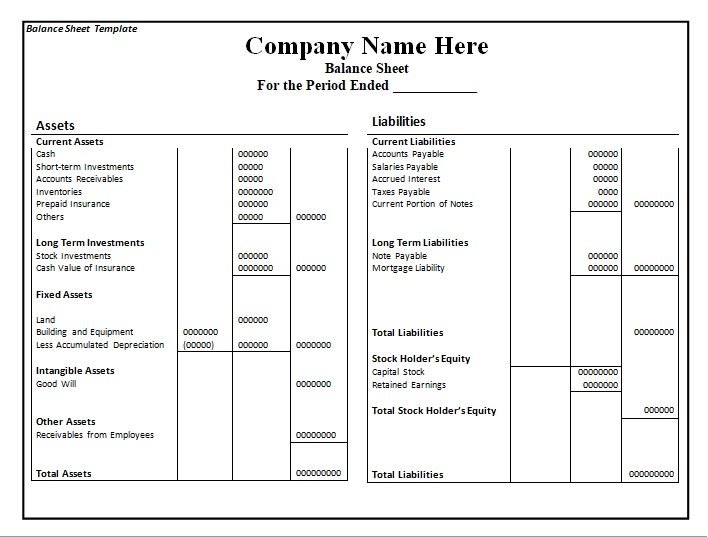

On the other hand, private companies do not need to appeal to shareholders. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. It can also be referred to as a statement of net worth or a statement of financial position.

The balance sheet is based on the fundamental equation: It lists the current and fixed assets on the left. How to read a balance sheet.

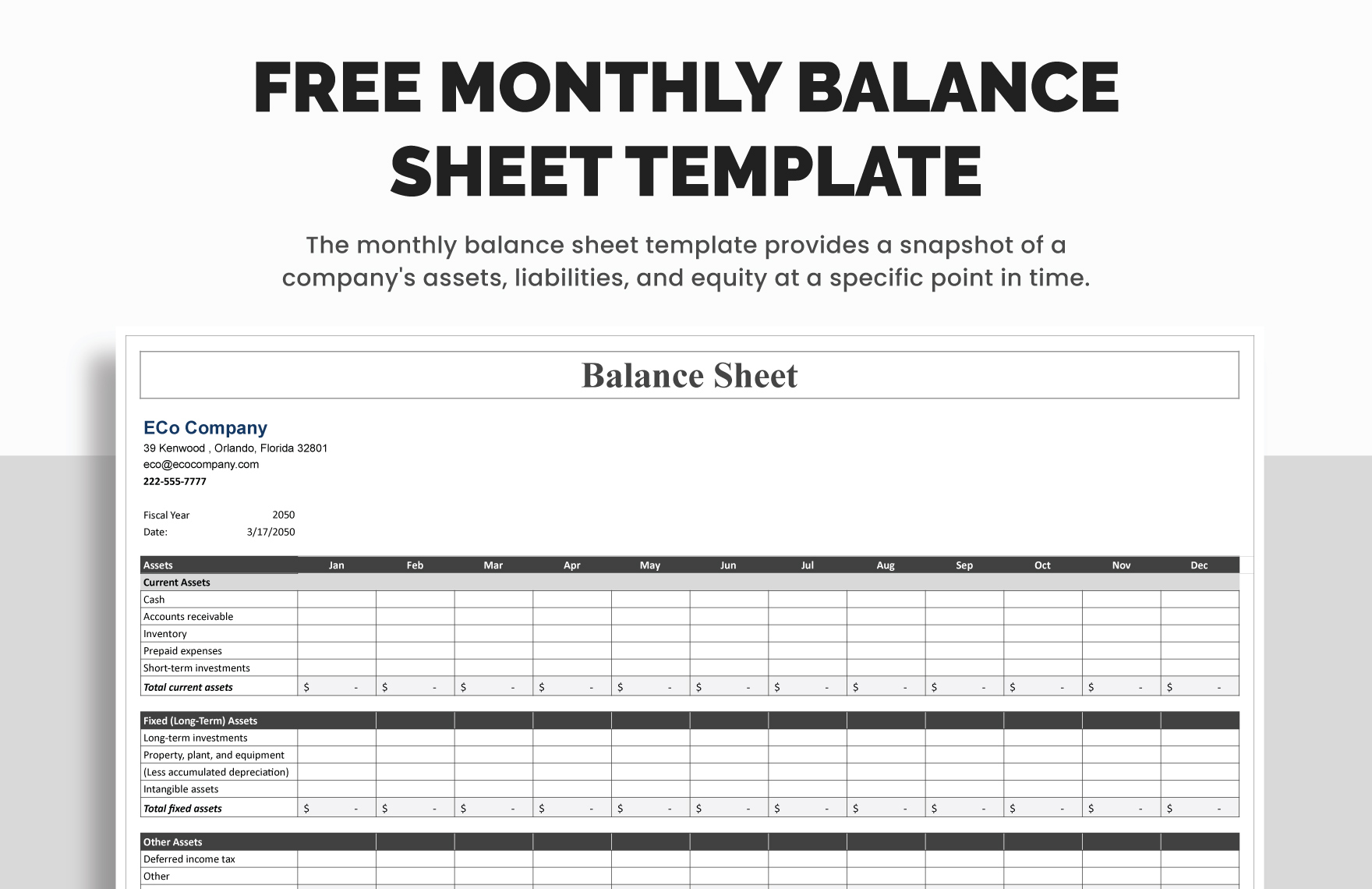

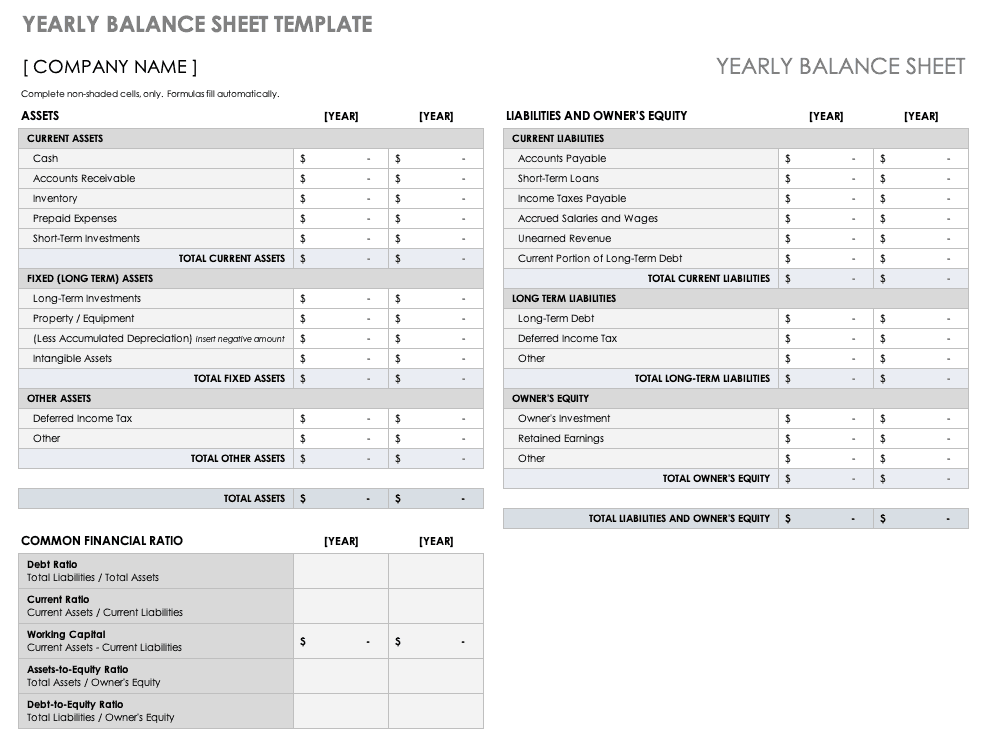

Updated january 31, 2024 reviewed by margaret james what is a balance sheet? Balance sheets are typically prepared at the end of set periods (e.g., annually, every quarter). A company’s balance sheet is one of the most important financial statements it produces—typically on a quarterly or even monthly basis (depending on the frequency of reporting).

A balance sheet is often described as a snapshot of a company's financial condition. A balance sheet also serves as a company or organization’s financial position over specified time, such as daily, monthly, quarterly, or yearly. Reporting what is a monthly balance sheet with prior month and last year comparisons ?

Businesses typically prepare and distribute their balance sheet at the end of a reporting period, such as monthly, quarterly or annually. Typically, a balance sheet will be prepared and distributed on a quarterly or monthly basis, depending on the frequency of reporting as determined by law or company policy. There is no mandatory frequency to generate balance sheets;

Public companies are required to have a periodic financial statement available to the public. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders). Why do a monthly balance sheet analysis?

It also tracks owner and shareholder investments (equity), but that’s less important for most small businesses to keep an extremely close eye on. For your balance sheet to be properly balanced, the total of your assets must equal the combined total of liabilities and equity. A balance sheet is one of the financial statements of a business that shows its financial position.

Is a balance sheet monthly or yearly? Specific information can be accumulated by the. Balance sheets are typically prepared monthly, quarterly and annually, but you can prepare one at any time to show your firm's position.