Here’s A Quick Way To Solve A Info About Estimated Balance Sheet For Bank Loan Three Important Financial Statements

A deposit is a liability on a bank's balance sheet.

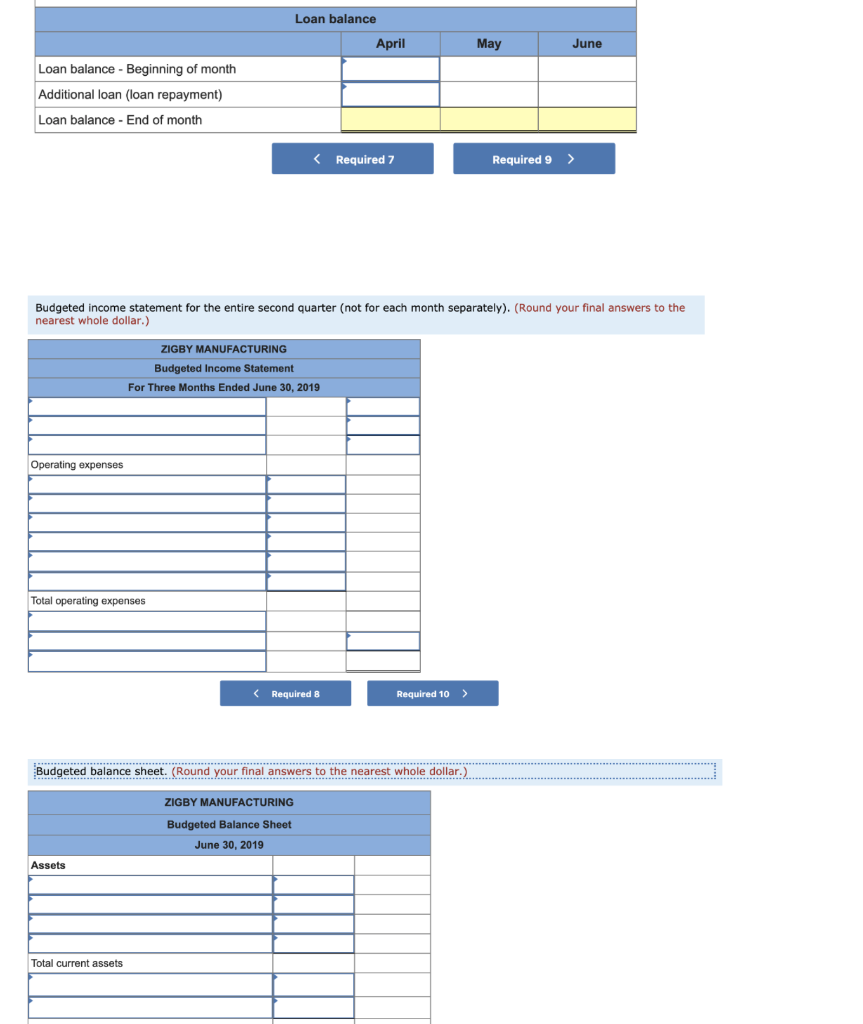

Estimated balance sheet for bank loan. Project cost estimation: The balance sheet is based on the fundamental equation: Using the inputs, the calculator will produce ratios that are important for the analysis of a bank’s balance sheet.

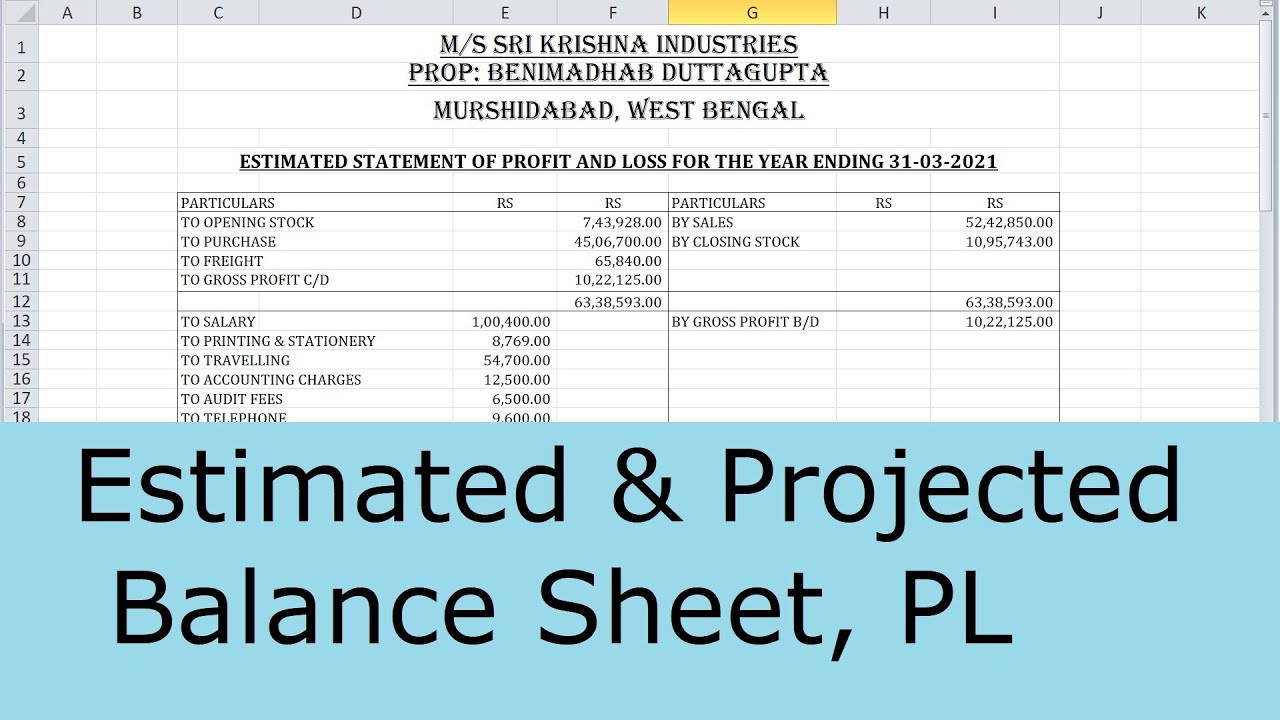

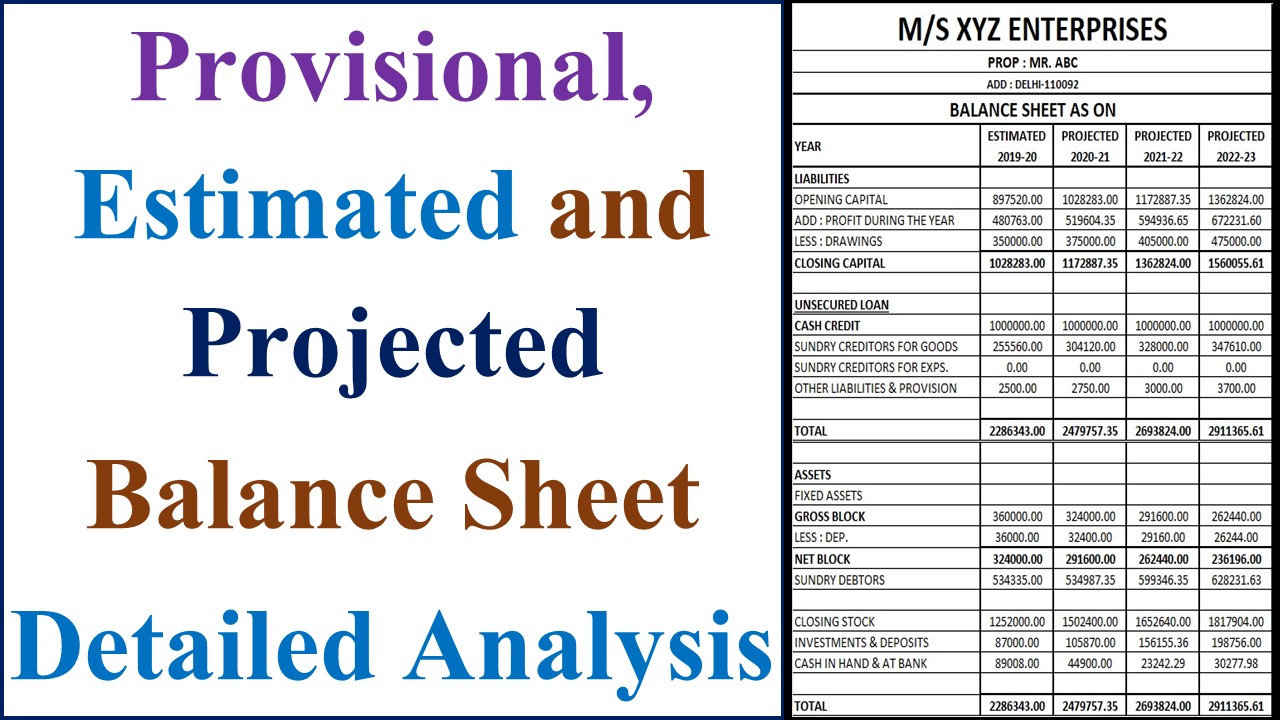

The left side of the balance sheet outlines all of a company’s assets. Accounting for a bank loan under frs 102. This video is for those who want to make estimated balance sheet and profit and loss.

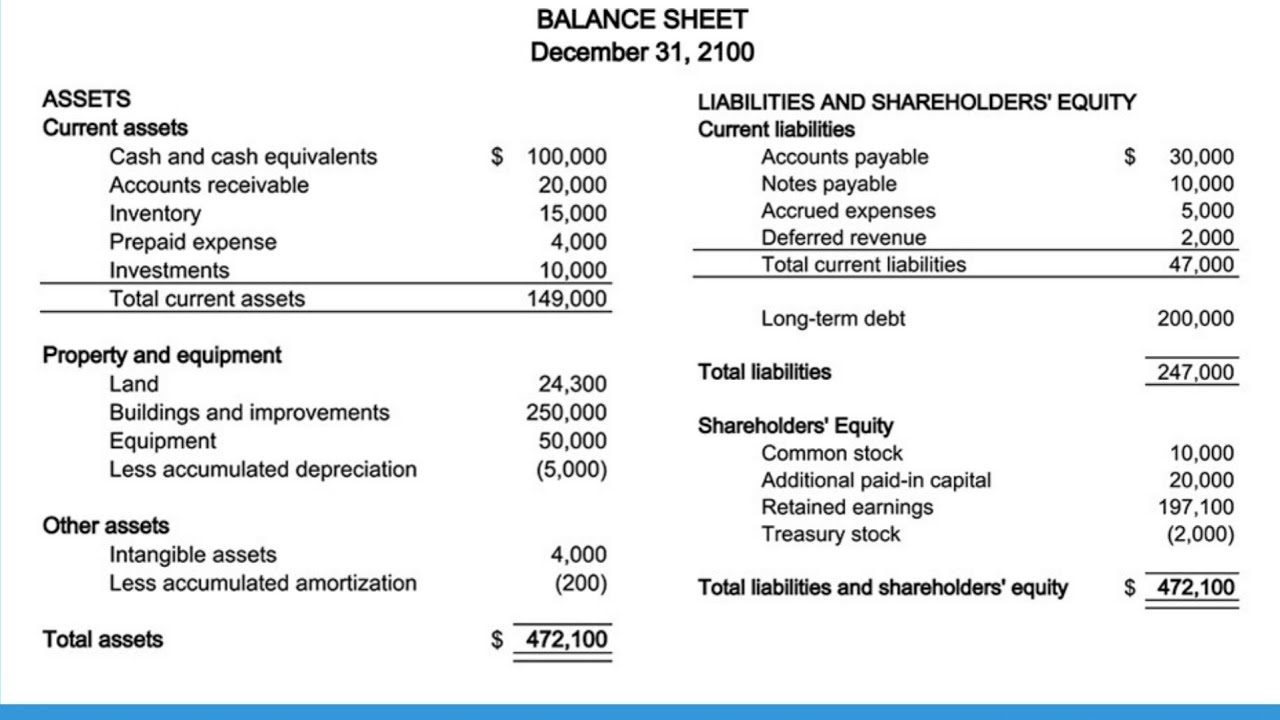

Other tabs are self explanatory, if you have any doubt, leave a comment, i will guide on usage. The typical structure of a balance sheet for a bank is: Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections).

You can check also the available balance at the bank. Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new. Assets property trading assets loans to customers deposits to the central bank liabilities loans from the central bank deposits from customers trading liabilities misc.

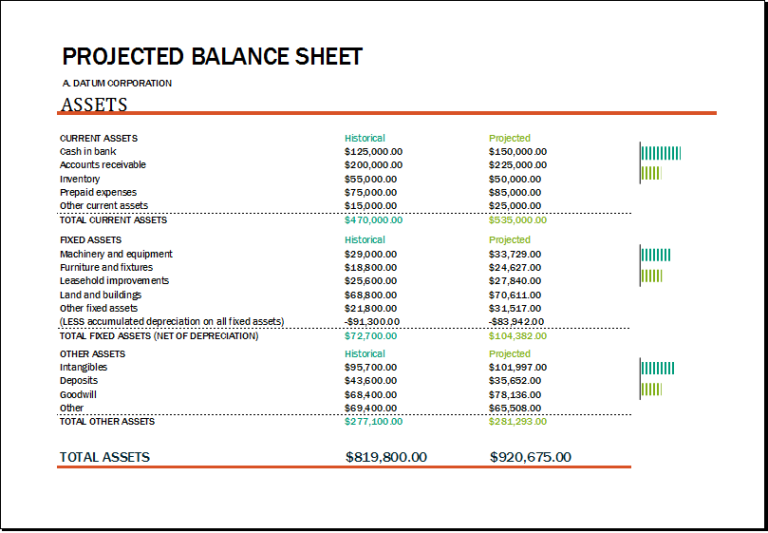

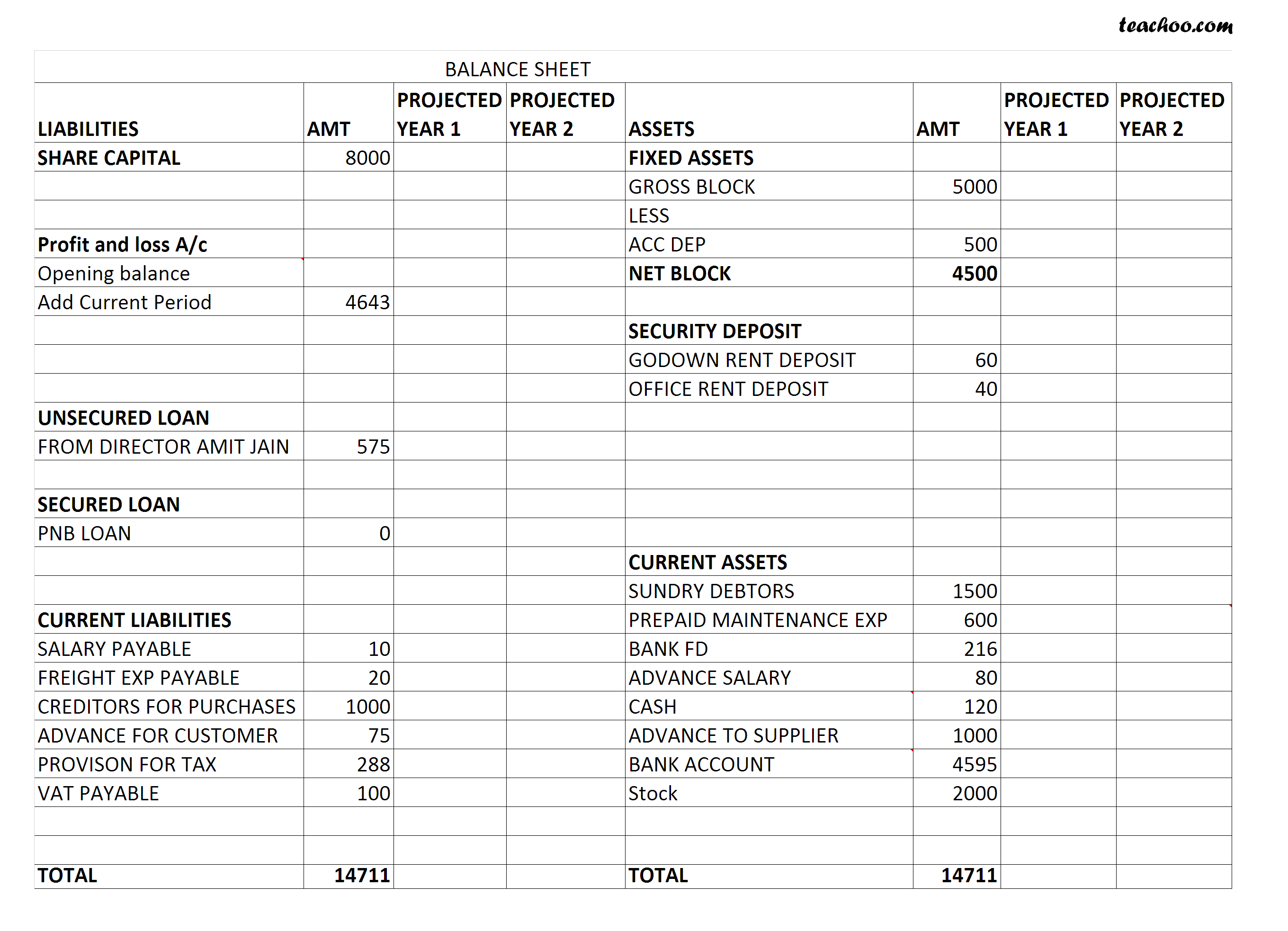

In this article, we define projected balance sheets, explain why they're important, share the steps involved in creating one and provide an example of a projected balance sheet. This template includes the following ratios: We now have around 14 to 15% share of loans on the stock of our balance sheet as against to 10 to 11% of deposits,” jagdishan said.

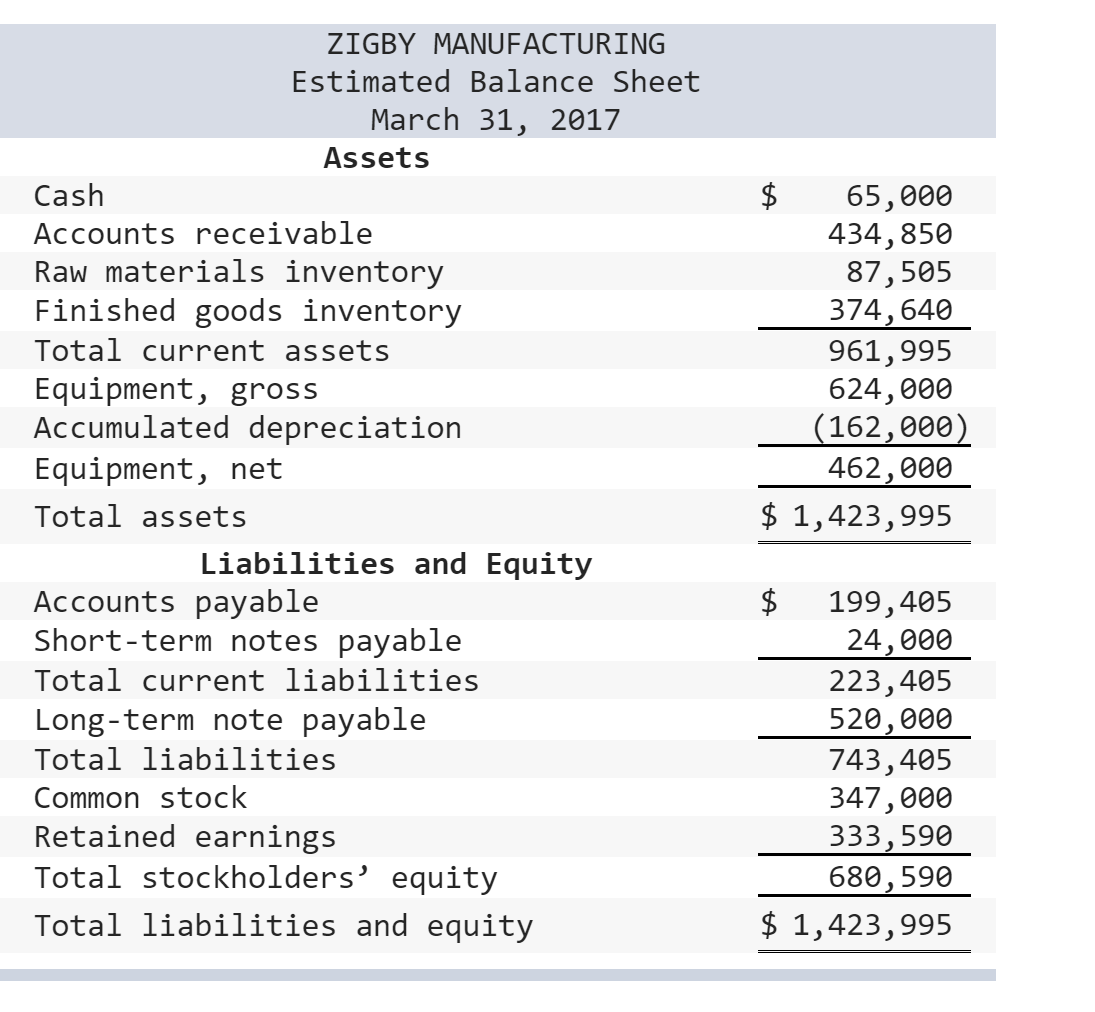

Usually businesses tend to prepare projected balance sheet in order to make strategic decisions. Project report for mudra loan, cash credit or od, working capital. Commercial and consumer loans represent the largest asset on bank balance sheets, and the application of fair value accounting to bank loan assets has been a continuing trend in the industry.

This is because money lending and interest generation through money loaned out are major sources of a bank’s income. Calculate cash in hand and cash at the bank. A confluence of factors has led to increased focus on the measurement and analysis of bank loan portfolios.

By kate christobek. A projected balance sheet indicates the expected future changes in the financial statements by considering the future investments, equity financing and the remaining liabilities. Example suppose, for cc limit extension or taking fresh loans, bank demands financial statements of current year i.e.

Debt equity common and preferred shares recall from cfi’s balance sheet guide that assets = liabilities + equity. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. A projected balance sheet shows the estimated changes to a company’s financial status, including assets, liabilities, investments, and financing for equity.

These are very useful for bank loan purpose. Forecasting your business’s balance sheet involves estimating your company’s assets and liabilities for a future date. Balance sheets provide the basis for.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)