Have A Tips About Journal Entry For Net Profit Income Statement Template Google Sheets

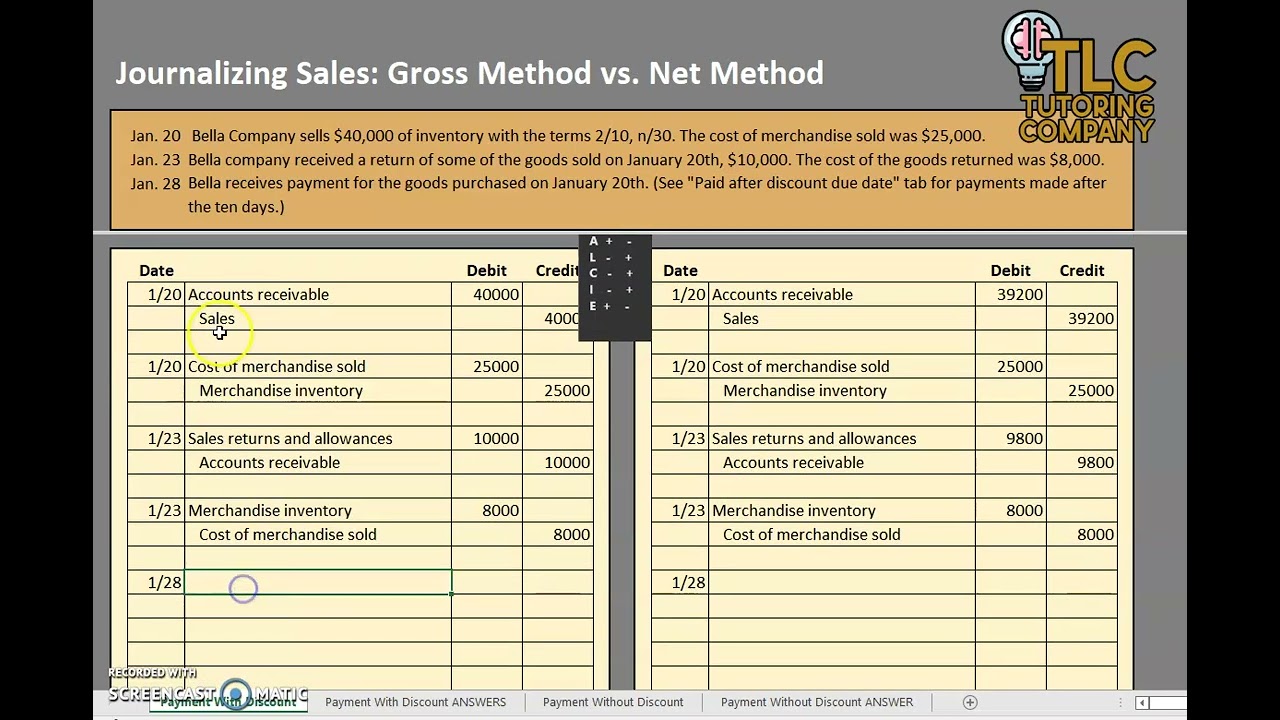

In the sales cycle with [δcash from sale + δinventory] 2.

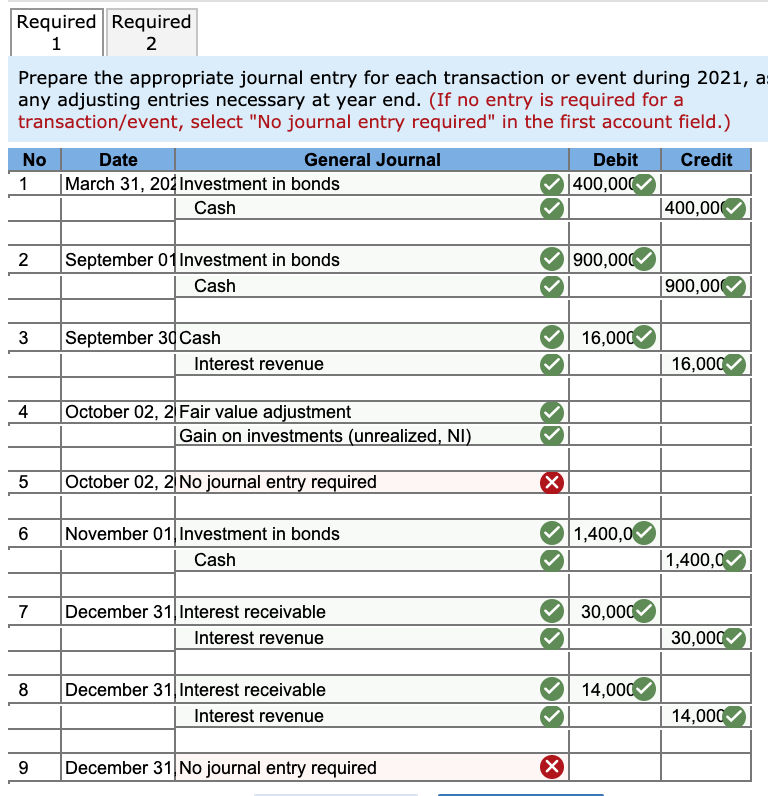

Journal entry for net profit. The journal entry is debiting a net income $ 100,000 and a credit partner account $ 100,000. For transfer of net profit: These entries often include payroll, reclassification of.

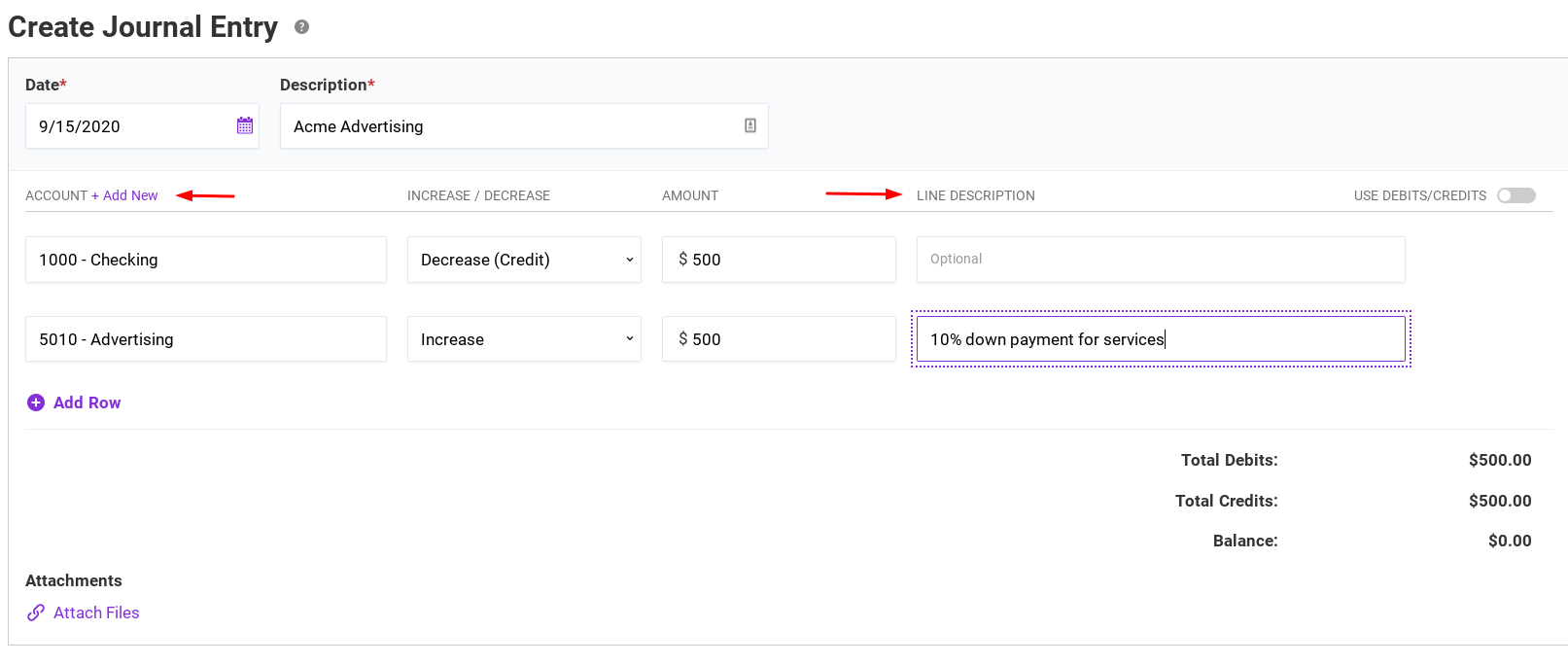

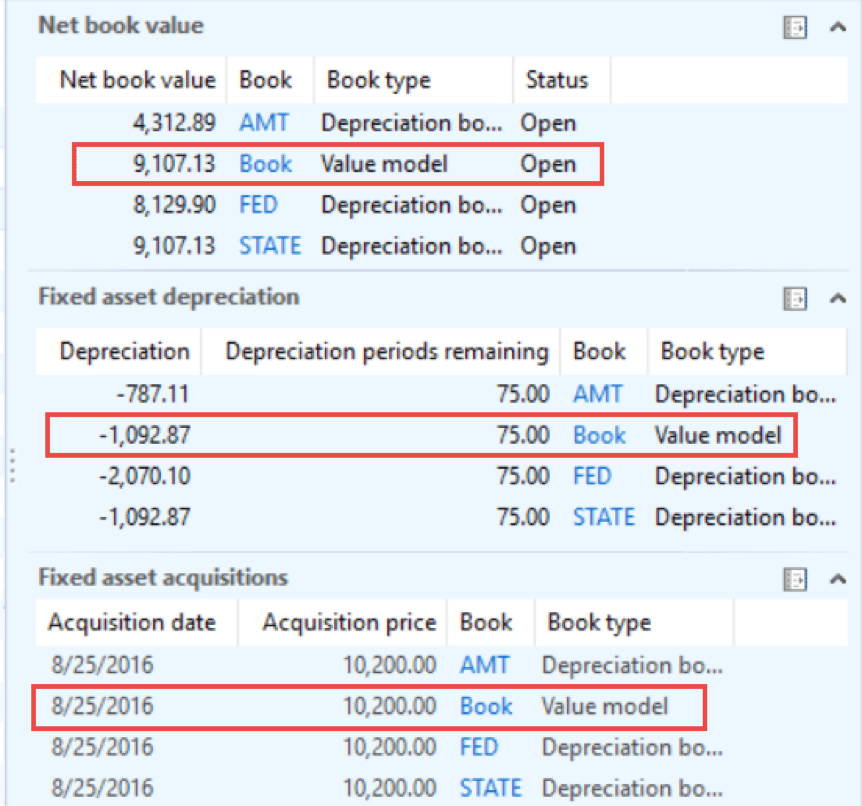

Fill in the date that relates to the end of the period for which you are reporting your net profit; In accounting, the company usually makes the journal entry for retained earnings when it makes the closing entry after transferring net income or net loss to the income summary. Since the asset had a net book value of 3,000 the profit on disposal is calculated as follows.

6 types of journal entries. Therefore, the net profits or losses are ultimately transferred to the capital account. Journal entries relating to profit and loss appropriation account:

Gather information from your books before recording your cogs journal. After charging $3 on account of partner salary and $6 million on account of interest on partner's capital accounts we are. Fill in the amount with your.

Follow the steps below to record cogs as a journal entry: While we prepare profit and loss account to ascertain the net profit/ net loss. The japanese carmaker said thursday that net profit fell 42% from a year earlier to 29.14 billion yen ($196.7 million) for the three months ended dec.

In the expenses cycle [δcash for expense] 3. The lawsuit alleges that from 2011 to 2021, donald trump and his organization created more than 200 false valuations to inflate his net worth by billions of dollars with. In the investing cycle [δcurrent depreciation] 4.

While there are other methods for tracking net assets. We say that the profit and loss a/c is closed by. This amount varies depending on.

Net profit can be determined by deducting business expenses from the gross profit and adding other incomes obtained. The net profit belongs to the ownership of the business which is represented by the capital account. $ 100,000 x 30% = $ 30,000 partner b:

Net profit/ net loss we prepare trading account to ascertain the gross profit/ gross loss. The net profit from profit and loss a/c is transferred to profit. Net profit is the amount of money remaining after deducting a company's total expenses from its total revenue for a given accounting period.

$ 100,000 x 30% = $ 30,000. Create journal entries to adjust inventory to nrv. The announcement came one day after a new york judge ordered trump and the.