Sensational Info About Salary Expense Appears On Which Financial Statement Luxottica Statements

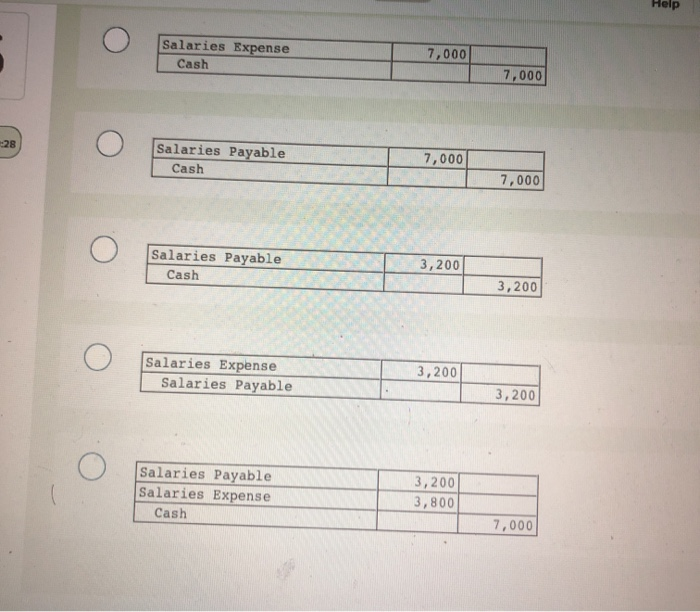

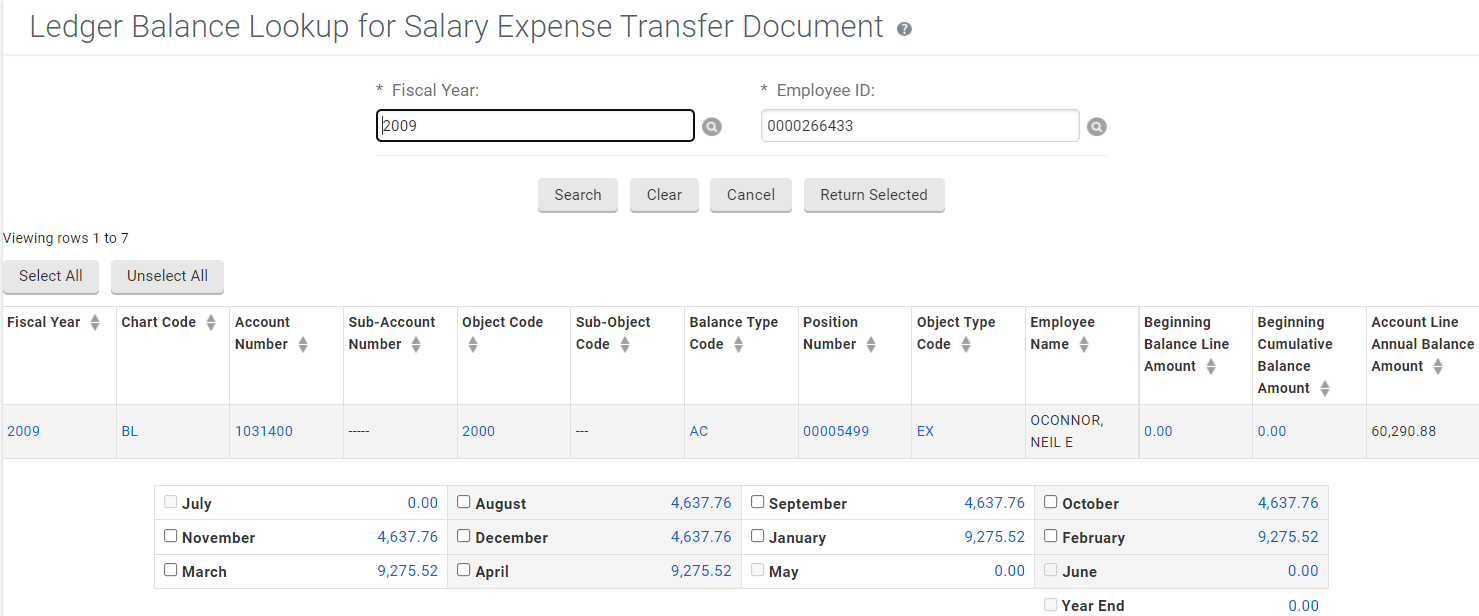

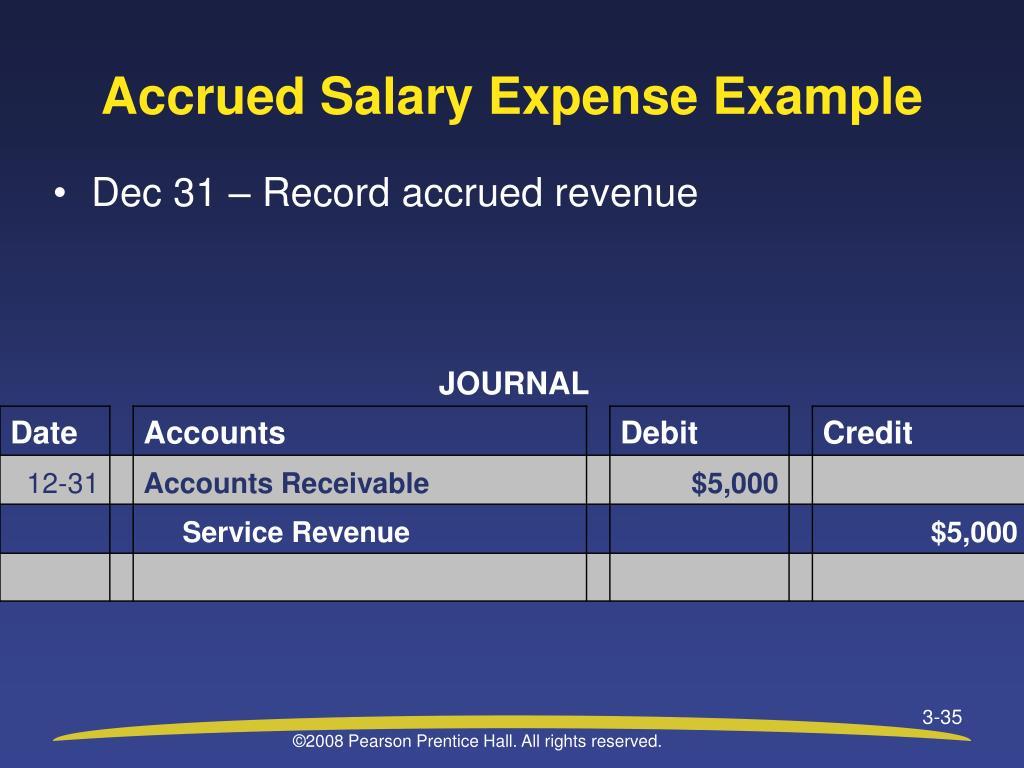

Study with quizlet and memorize flashcards containing terms like if a company recognizes an accrued salary expense in year 1 and pays its employees in year 2, which financial.

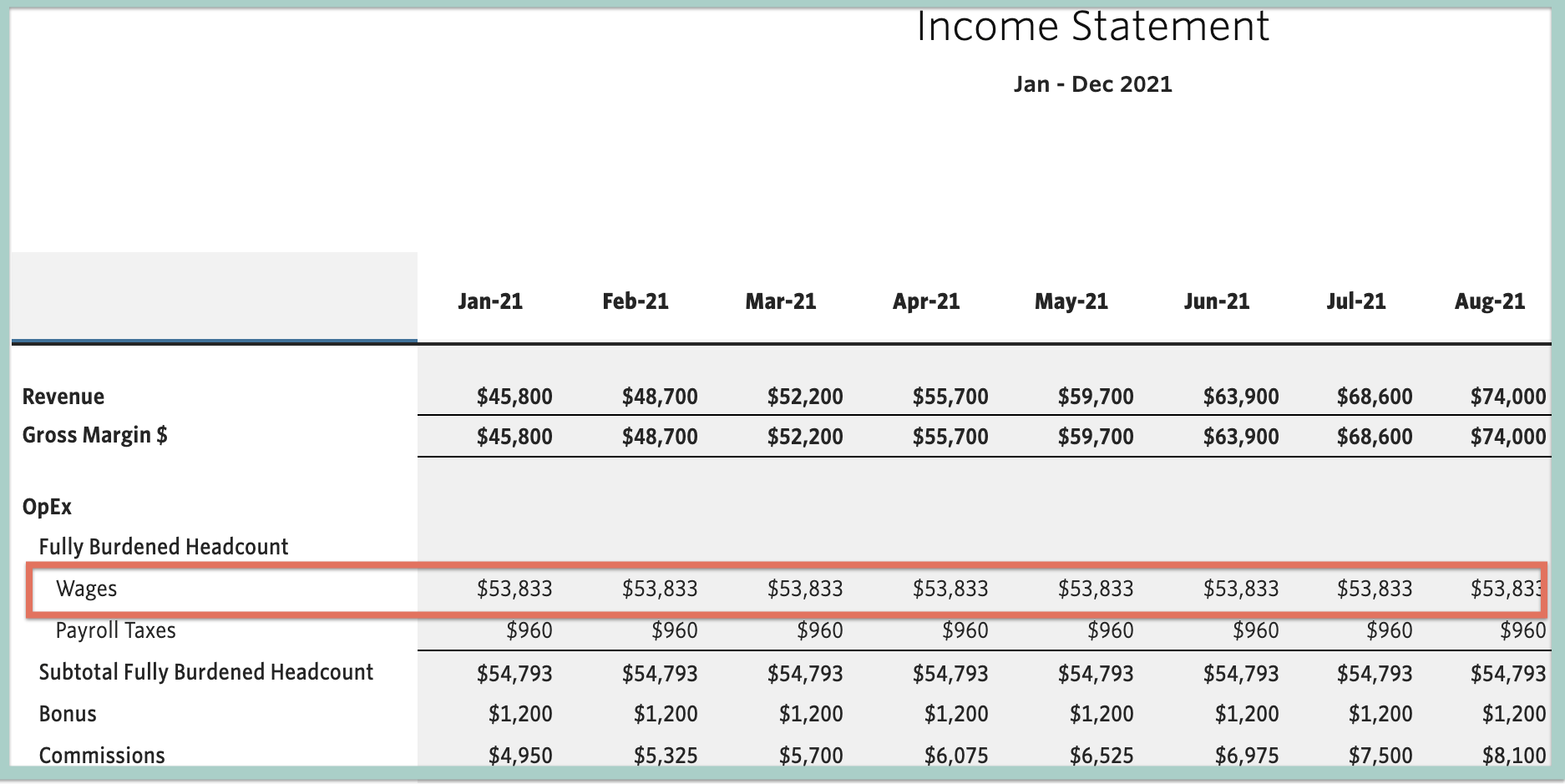

Salary expense appears on which financial statement. It refers to the amount of money paid out in salaries and wages. Lawn mowing revenue, gas expense, advertising expense, depreciation expense (equipment), supplies expense, and salaries expense. Salary expense is a type of expense that appears on a company’s financial statements.

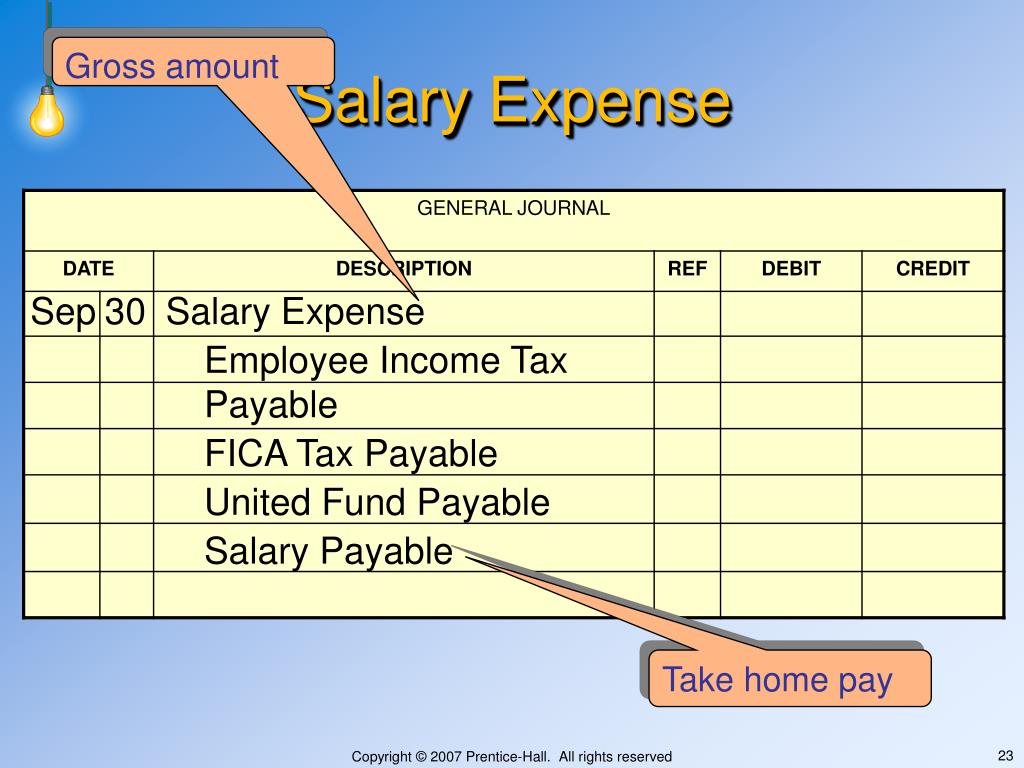

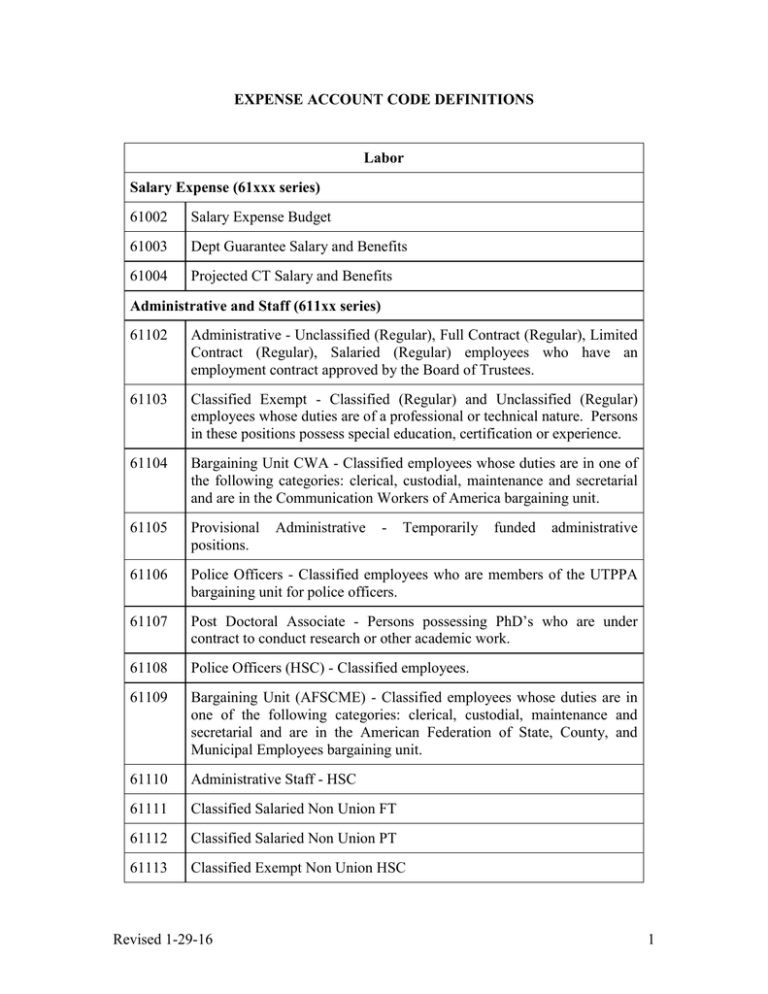

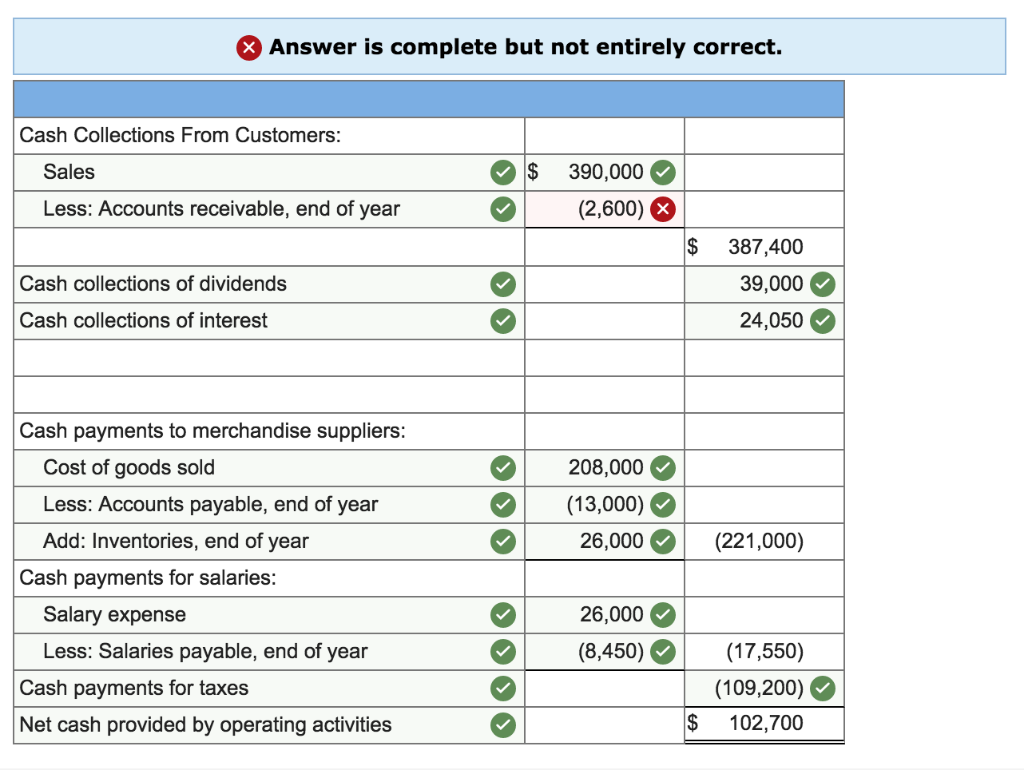

There are three main types of wage expenses: A wage expense is the cost incurred by a business to pay hourly employees and is recorded as a line item that may also include payroll tax and benefits expenses. Salaries expense appears in the _____ and cash dividends are found in the _____ section of the cash flow statement.

The cost of goods sold is deducted from your gross receipts to figure the. It is frequently subdivided into a. Selling, general administration, etc.) are part of the expenses reported on the company's income.

A new york judge ordered. Updated 5:14 pm pst, february 16, 2024. Balance sheets function like a snapshot of the financial state of the company at a given point in time.

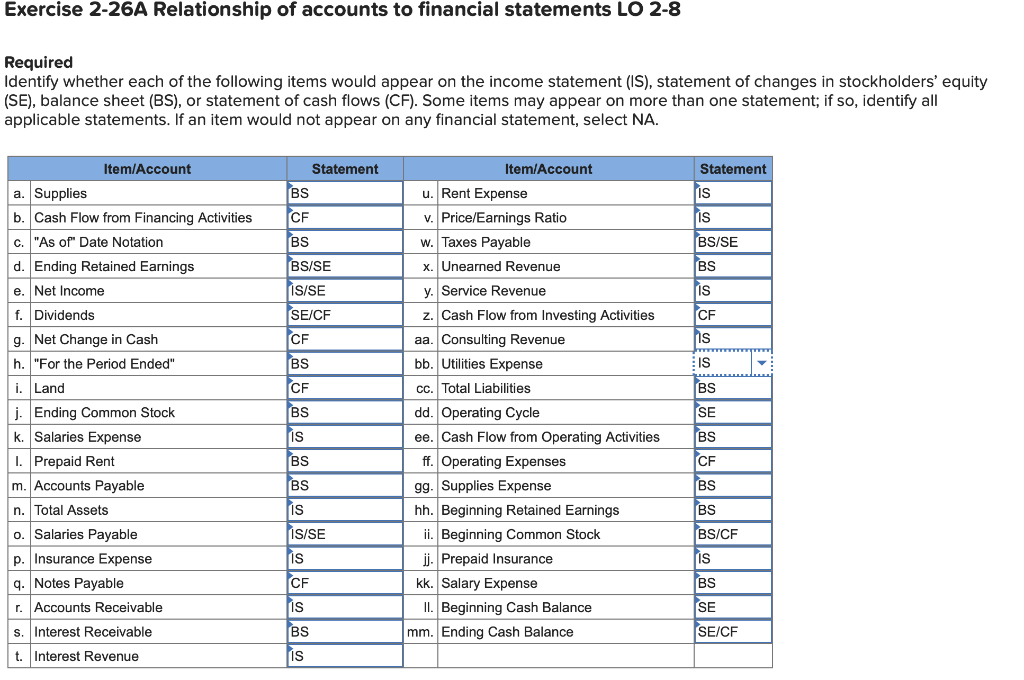

The balance sheet, the income statement and the cash flow statement. Salaries do not appear directly on a balance sheet,. Taxes appear in some form in all three of the major financial statements:

Salaries, wages, and benefits expenses include the payroll cost of permanent and temporary employees of an organization for their services during an accounting period. (1) times wages, (2) piece wages, and (3) contract wages.

Salaries expense is the fixed pay earned by employees. The cost of goods sold is included in part 1 income as part of the calculation of gross profit. These amounts affect the bottom line of your income statement, which affects the assets and.

The financial statement that reflects a company’s profitability is the income statement. Under the accrual method of accounting, the account salaries expense reports the salaries that employees have earned during the period indicated in. Your balance sheet shows salaries, wages and expenses indirectly.

The income statement shows the financial results of a. The statement of owner’s equity —also called the statement of retained earnings —shows. When an expense is recorded, it most obviously appears within a line item in the income statement.