Unbelievable Tips About Sample Profit And Loss Statement For Nonprofit Organization Of Comprehensive Income Question Answer

The entire guide for examples.

Sample profit and loss statement for nonprofit organization. A nonprofit statement of cash flows is a financial report that shows how cash moves in and out of an organization on a regular basis. In this guide we explore the do's, don'ts and requirements of financial statements for. Nonprofits also have a primary task to their donations when filing or exchange these financial statements.

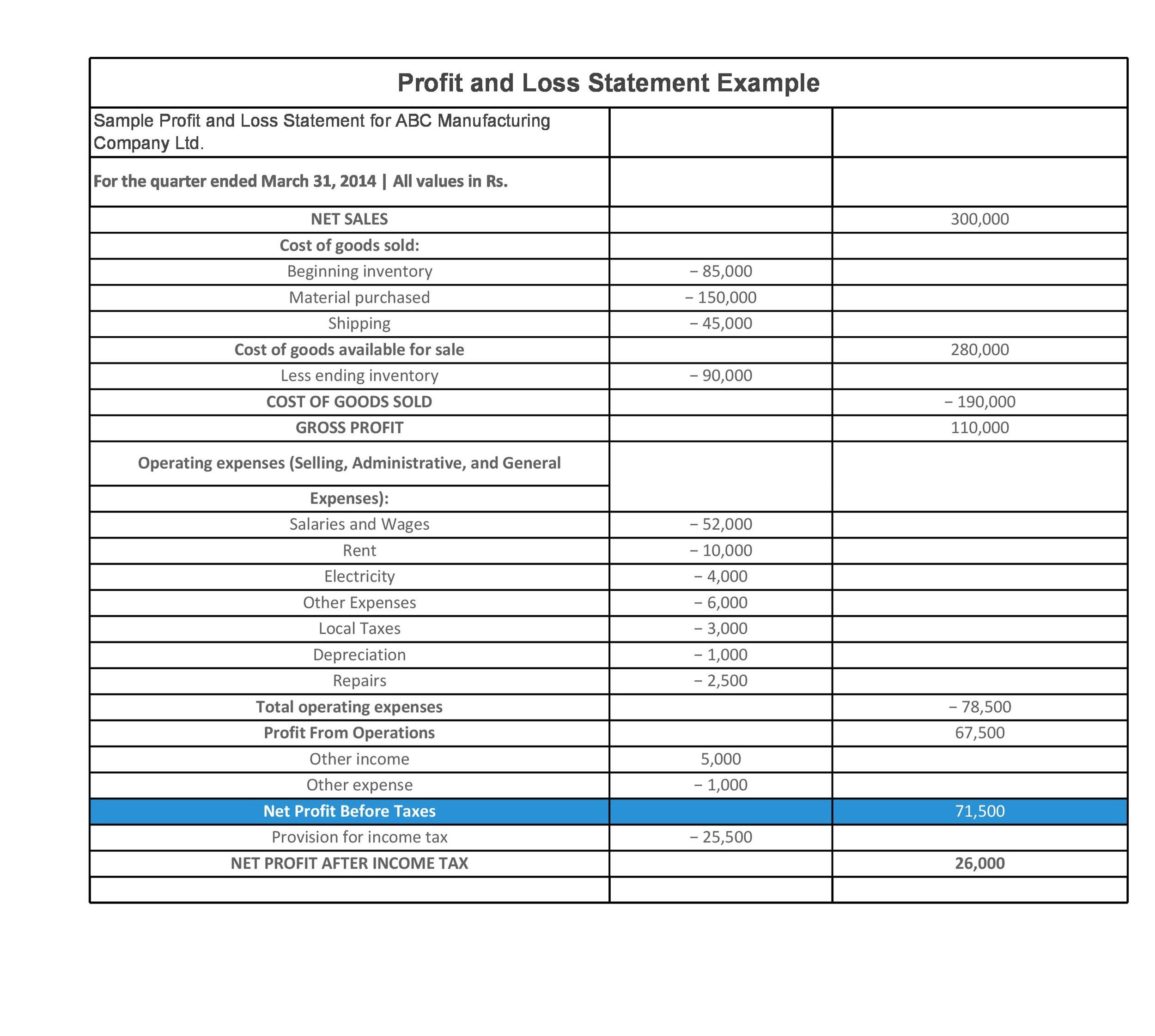

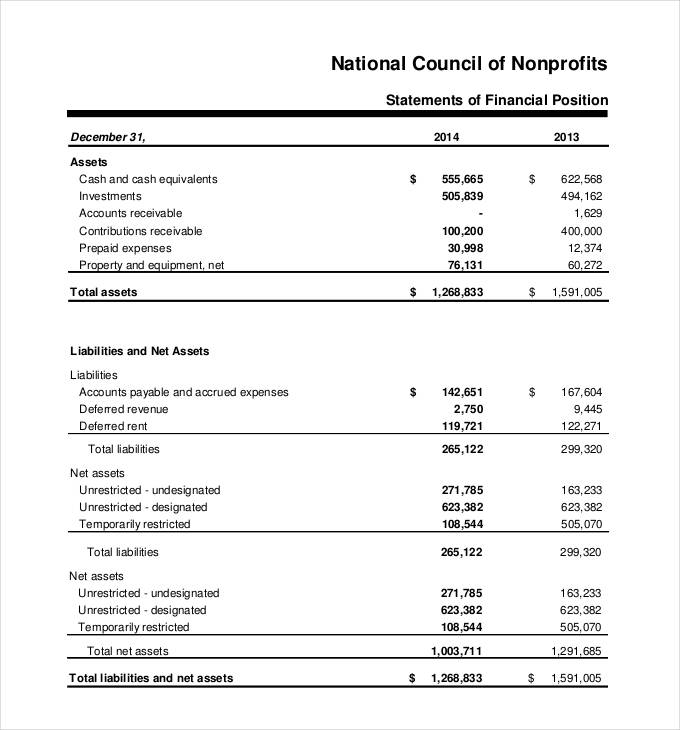

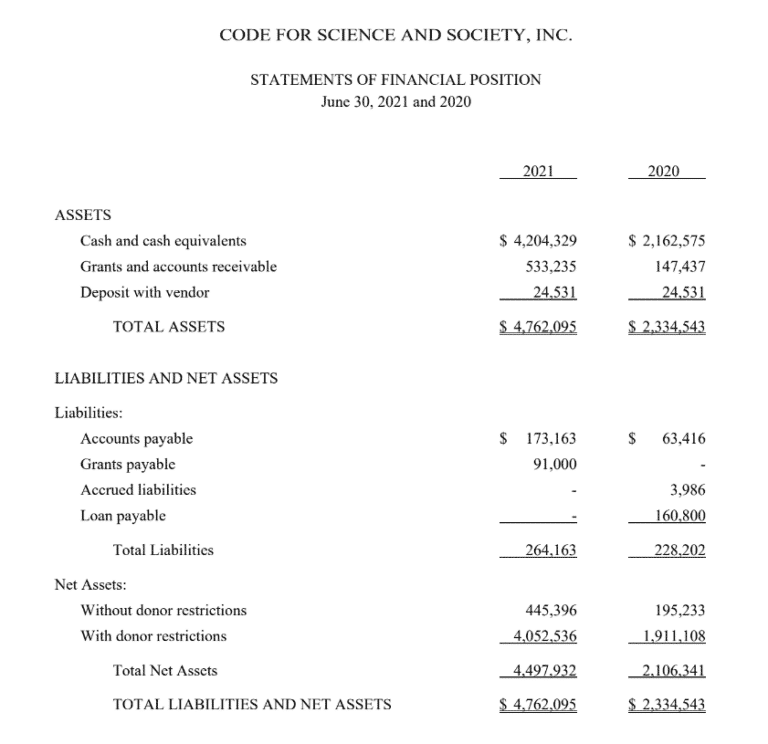

Mastery of financial statements helps ensure compliance with these regulations, avoiding potential penalties or loss of nonprofit status. A nonprofit's statement of financial position (similar to a business's balance sheet) reports the organization's assets and liabilities in some order of when the assets will turn to cash and when the liabilities need to be paid. The soa report shows a nonprofit organization’s income, expenses, and net income for a specific period of time, all or part of a fiscal year.

Keeping in mind the net costs for every department, you can check out sample financial statement templates to get a better idea of what should such. Our core values (national council of nonprofits) statement of core values (north carolina center for nonprofits) code of ethics (charles stewart mott foundation) equity statement (nonprofit association of oregon) (a nonprofit corporation) as of june 30, 20x7 and 20x6, and the related statements of activities, functional expenses, and cash flows for the years then ended, in accordance with statements on standards for accounting and review services issued by the ameri.

As shown in the sample statement below, the cash flow starts with the. These sections include the cash flows from: It’s one of the core financial statements that all nonprofits need.

Statement of financial position, statement of activities, statement of cash flows, and statement of functional expenses. Simply, it reports your organization’s revenue and expenses during a specific period and the difference between them. We have reviewed the accompanying statements of financial position of habitat house, inc.

Operating activities investing activities financing activities In the midst of it all, these financial statements may seem like just another administrative burden. Sharing financial statements with donors is one of the best ways to ensure transparency and build trust.

Donors want to know their contributions are being used wisely. In nonprofit accounting, there are four required financial statements that organizations must produce, and we will touch on each of these in this guide. In this article, we’ll explain more about each financial statement, why and when nonprofits need financial statements and share examples of how organizations have used them in their annual reports.

This statement categorizes all income and expense, showing net surplus or net deficit. You may also hear it referred to as a profit and loss statement or income and expense report. Infodocs profit and loss statement for the year ended december 31, 2023;

The statement of activities (soa) is the correct nonprofit term for the report we may commonly have called the income statement, budget report, profit & loss, income and expense report, etc. In this article, we’ll explain. This statement shows the inflow and outflow of cash within the organization.

The four required financial statements are: How to create a non profit financial statements [11+ templates to download] a financial statement is a sheet that shows the income and expenditure of an organization throughout a financial year. Updated july 27, 2021 reviewed by andy smith while many investors have at least some understanding of typical financial statements like the balance sheet, income statement and cash flow.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Rental-Property-Profit-and-Loss-Statement-Template-TemplateLab.com_-scaled.jpg)