Exemplary Info About The Statement Of Cash Flow Is Financing Activities Section Flows

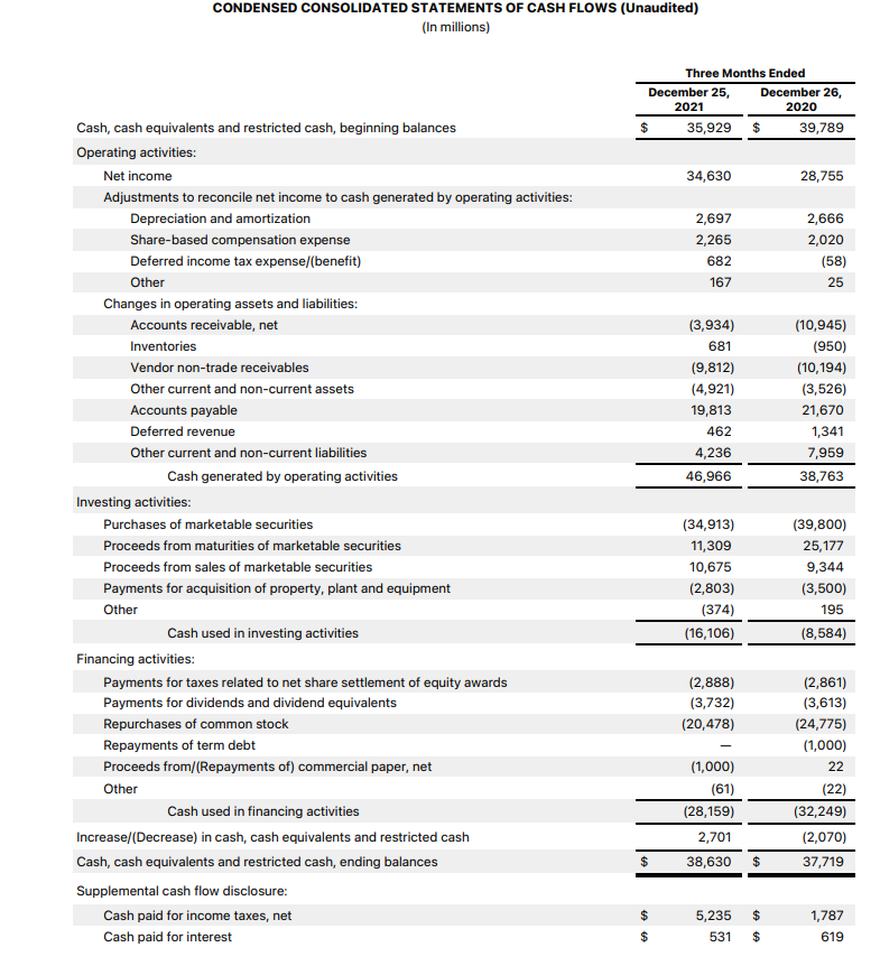

The statement of cash flows acts as a bridge between the income statement and balance sheet by.

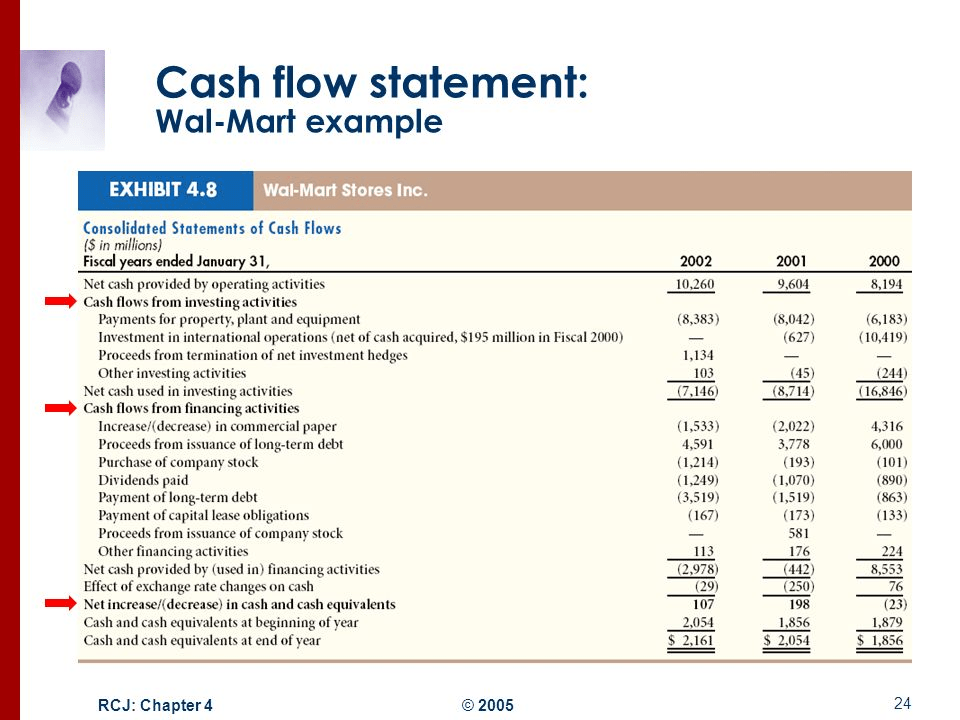

The statement of cash flow is. Looking over a cash flow statement is one of the best ways to find areas to cut back so you can maximize your business's profits. Cash flow statements provide details about all the cash coming into and exiting a. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period.

This is not a market in which the company has previously operated. The cash flow statement is a financial statement. Free cash flow eur 423 million;

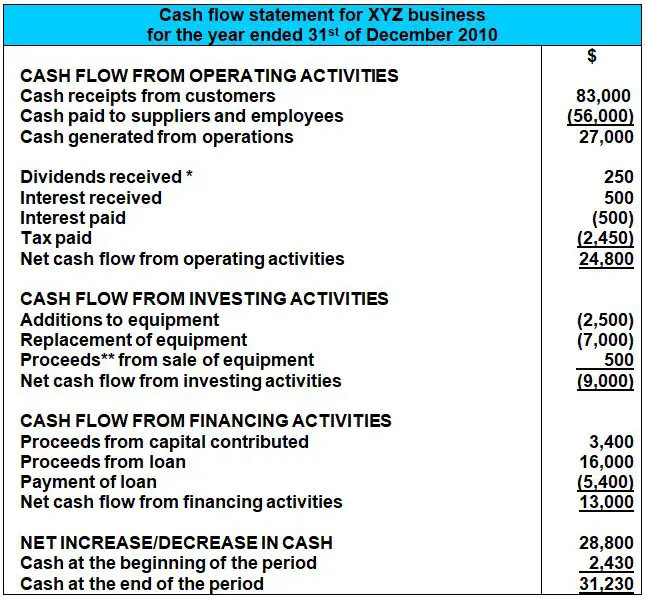

The statement of cash flows is a financial statement listing the cash inflows and cash outflows for the business for a period of time. Cash received signifies inflows, and cash spent is outflows. From the above example, we can see that the computed cash flow for fy 2018 was $ 2,528,000.

A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. A statement of cash flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. Cash flow kings 100 etf ( flow), which debuted last july, features an approach that’s similar to what’s found with the aforementioned cowz.

Innovation rate increased to 20%; A cash flow statement is one of three key documents used to determine a company's financial health. Is the below cash flow statement correct for the example case scenario?

Cash coming in and out of a business is referred to as cash flows, and accountants use these statements to record, track, and report these transactions. A cash flow statement is the best way to see how much money you're making and losing over any given time period—anywhere from two weeks to a month, a year, or five years. The statement of cash flows tracks the firm’s cash receipts and cash payments.

The company established a niche counting loose change at the exits of supermarkets and other. It gives financial managers and analysts a way to identify cash flow problems and assess the firm’s financial viability. Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the gdp of all but two.

The cash flow statement, also called the statement of cash flows, is a financial statement showing how cash flows in and out of a company over a specific period of time. Add back noncash expenses, such as depreciation, amortization, and depletion. The statement of cash flows enables users of the financial statements to determine how well a company’s income.

The statement of cash flows is a financial statement listing the cash inflows and cash outflows for the business for a period of time. A cash flow statement is a financial statement that shows how cash entered and exited a company during an accounting period. We will use these names interchangeably throughout our explanation, practice quiz, and other materials.

Exhibit 14.7 coinstar is a cash cow—literally. A cash flow statement tells you how much cash is entering and leaving your business in a given period. Cash flow represents the cash receipts and cash disbursements as a result of business activity.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)