Looking Good Info About Financial Leverage Interpretation Cash Flow Under Direct Method

Financial leverage refers to using borrowed amount for purchasing assets to build capital and expand a business, with an expectation of earning or reaping gains, which would be.

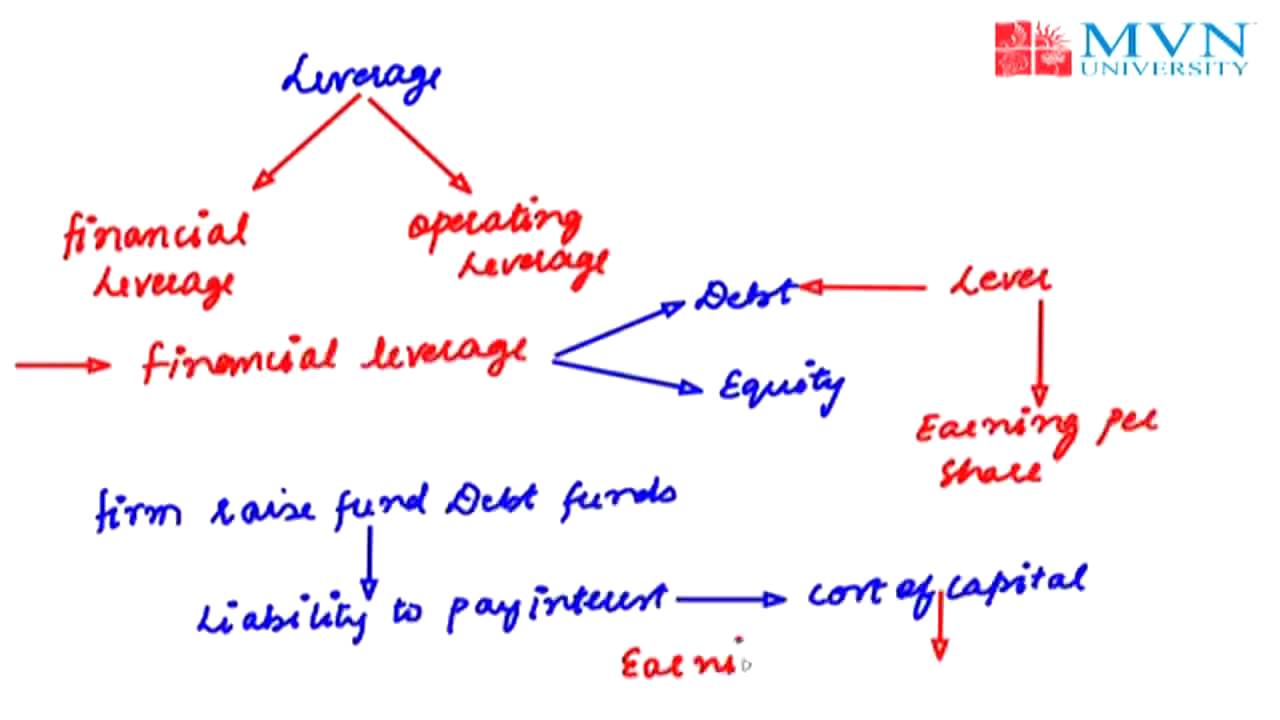

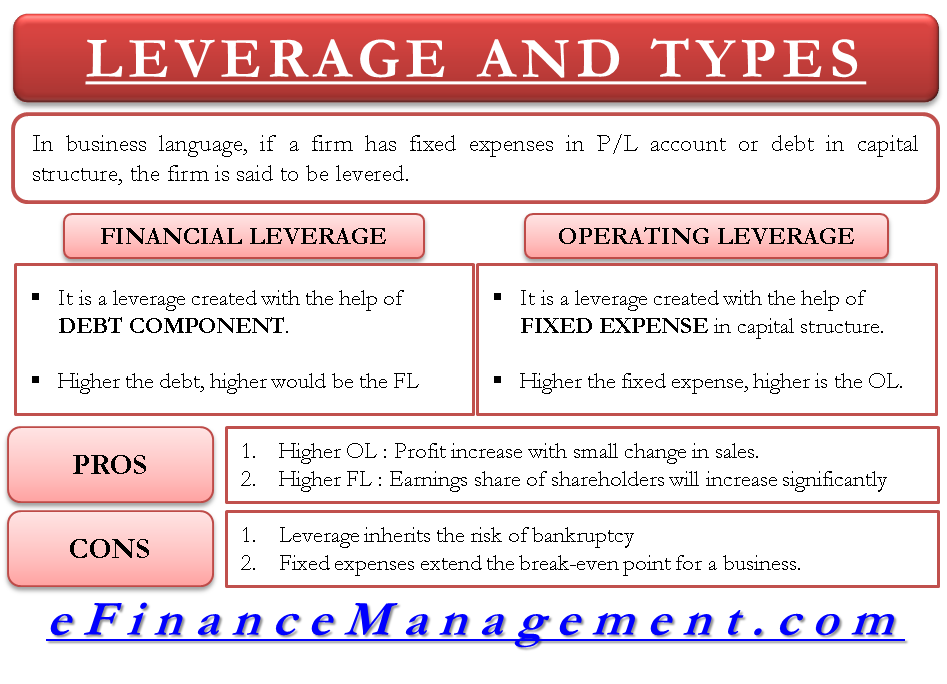

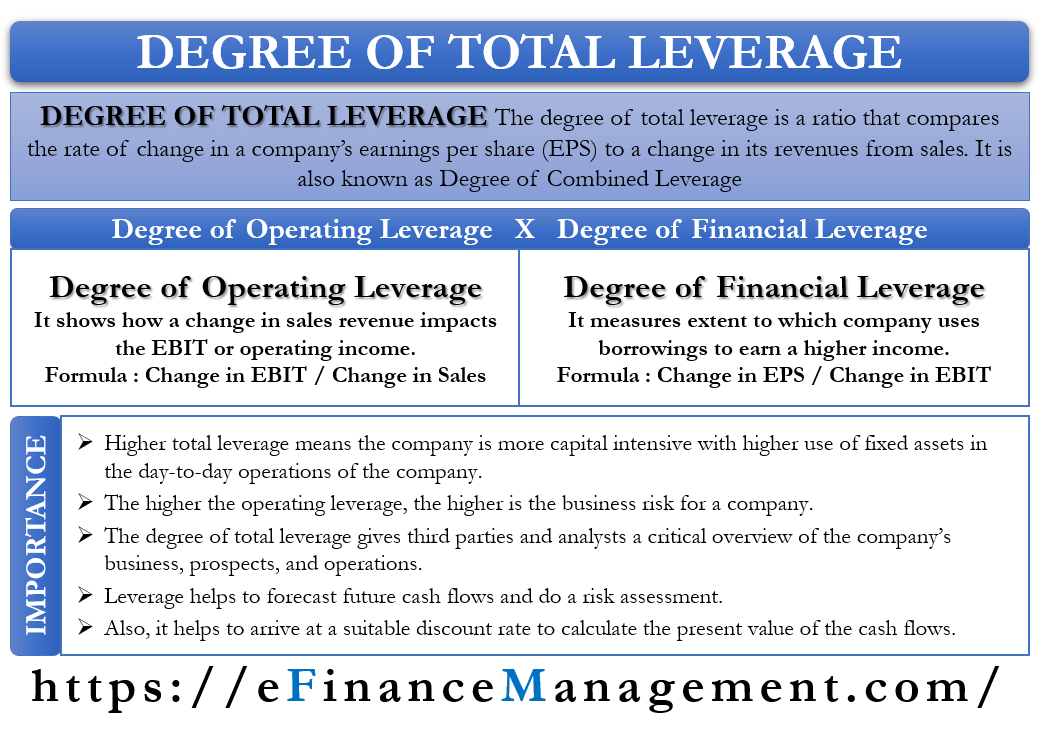

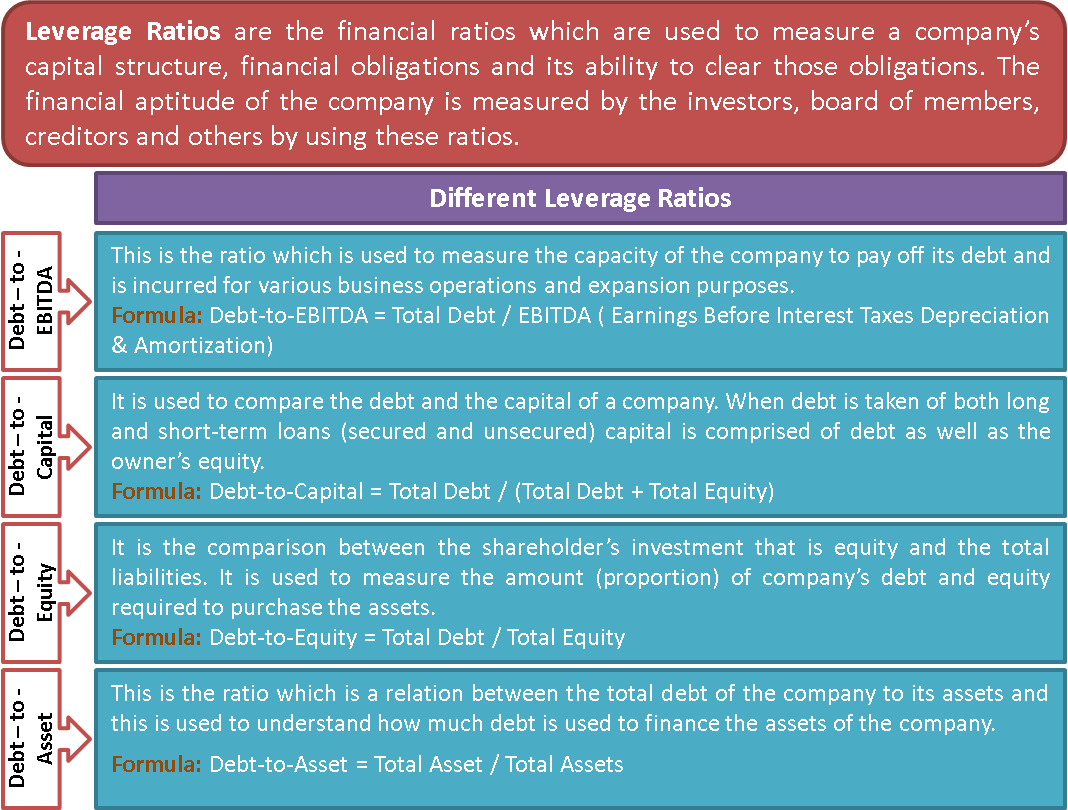

Financial leverage interpretation. Leverage is the use of fixed costs in a company’s cost structure. Fixed costs that are operating costs (such as depreciation or rent) create operating leverage. Financial leverage ratios are essential metrics that provide insights into a company’s capital structure and its ability to meet its financial obligations.

Financial leverage is a process where businesses or individuals use loans to fund projects or acquire extra assets for the business. The use of debt, also known as leverage, can be a positive indicator of a company's health when future benefits are expected to compensate for the current debt. Here, the questions answered are, “what.

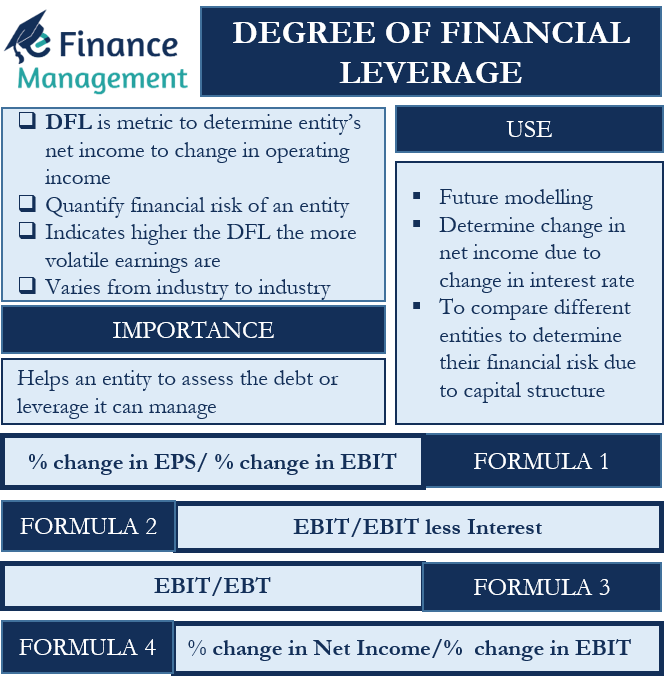

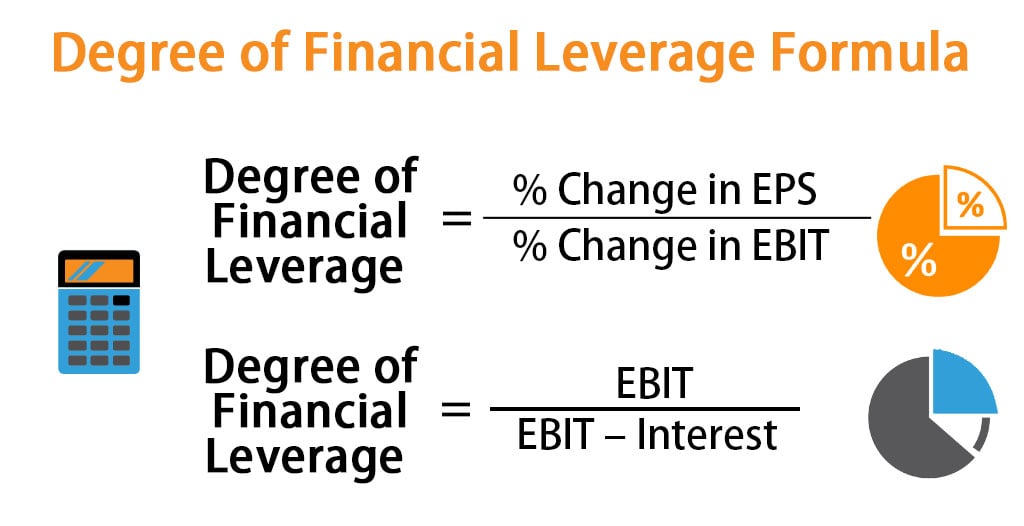

Financial leverage results from using borrowed capital as a funding source when investing to expand the firm's asset base and. The degree of financial leverage is a financial ratio that measures the sensitivity in fluctuations of a company’s overall profitability to the volatility of its operating income. Simple leverage ratio:

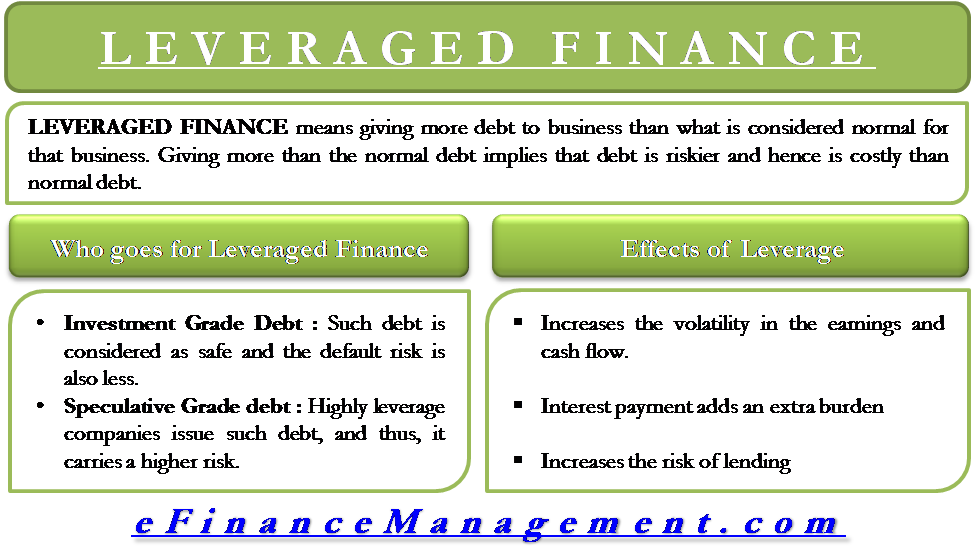

A leverage ratio is any kind of financial ratio that indicates the level of debt incurred by a business entity against several other accounts in its balance sheet, income statement, or. A high ratio means the firm is highly levered (using a large amount of debt to. The financial leverage ratio is an indicator of how much debt a company is using to finance its assets.

Financial leverage refers to a corporation borrowing capital from lenders to meet its recurring, operational spending needs and capital expenditures (capex). The financial leverage of a company is the proportion of debt in the capital structure of a company as opposed to equity. The degree of financial leverage (dfl) is a financial metric that measures the sensitivity of the net income (or earnings per share, eps) of a company to.

Financial leverage is the borrowing of money to acquire a particular asset that promises a higher return than the interest on the loan. Interpreting this ratio, we can conclude that for every dollar of equity, the company has $0.2 of debt. This ratio shows how much a company.

Financial leverage ratio = $1,000,000 / $5,000,000 = 0.2. After the project or asset. In other words, financial leverage can be referred as the degree to which net operating assets are financed by borrowing with net financial obligations or by equity.

:max_bytes(150000):strip_icc()/What_Is_Financial_Leverage-2e972f832d4749c9aa5302353cdec52f.jpg)

![Financial Leverage [PDF Inside] Example, Calculation, Strategies](https://educationleaves.com/wp-content/uploads/2023/03/FINANCIAL-LEVERAGE.png)