Brilliant Strategies Of Tips About 1099 Income Statement Monthly And Expenses Spreadsheet

Most states exempt the dividend income derived from a fund’s investments in u.s.

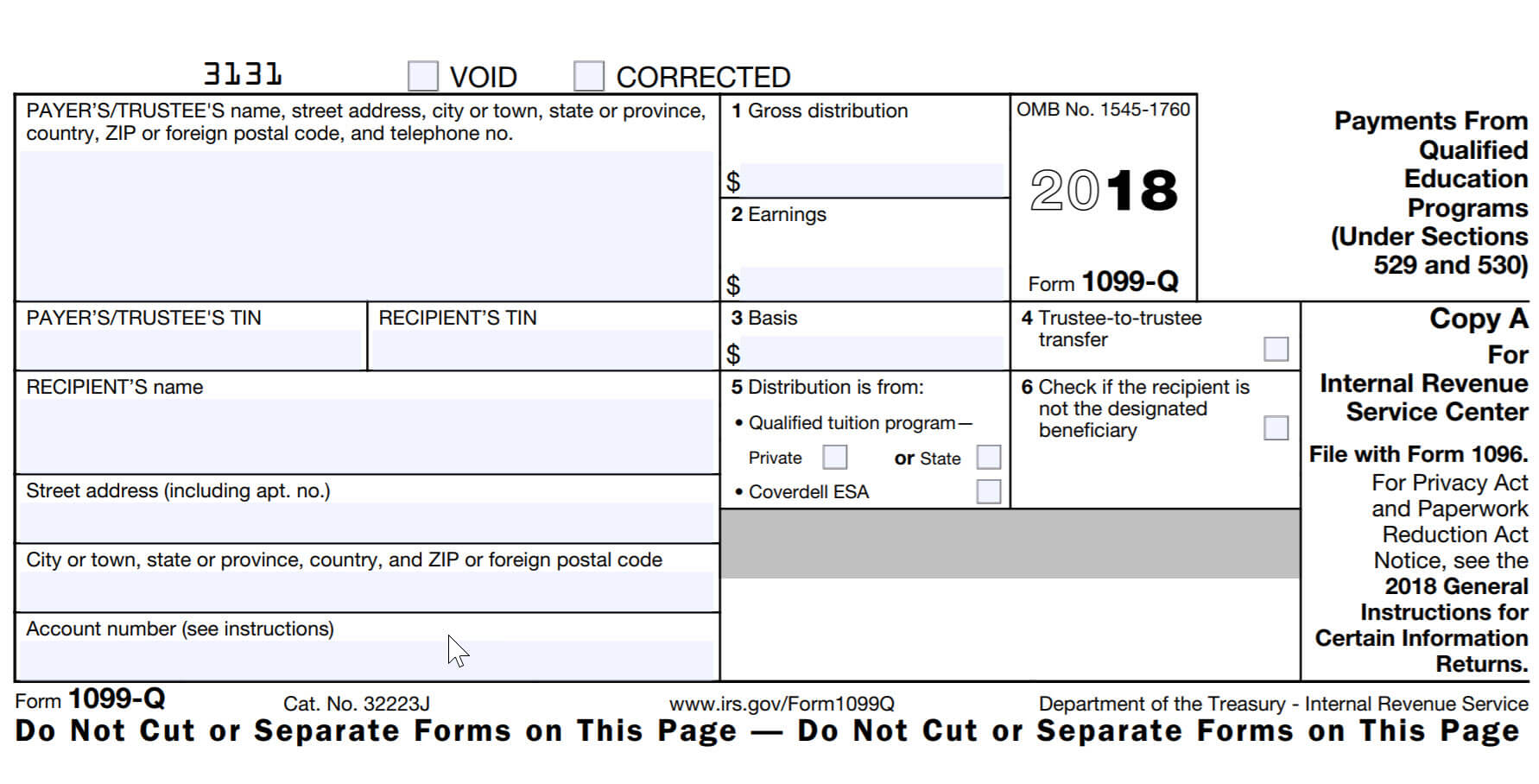

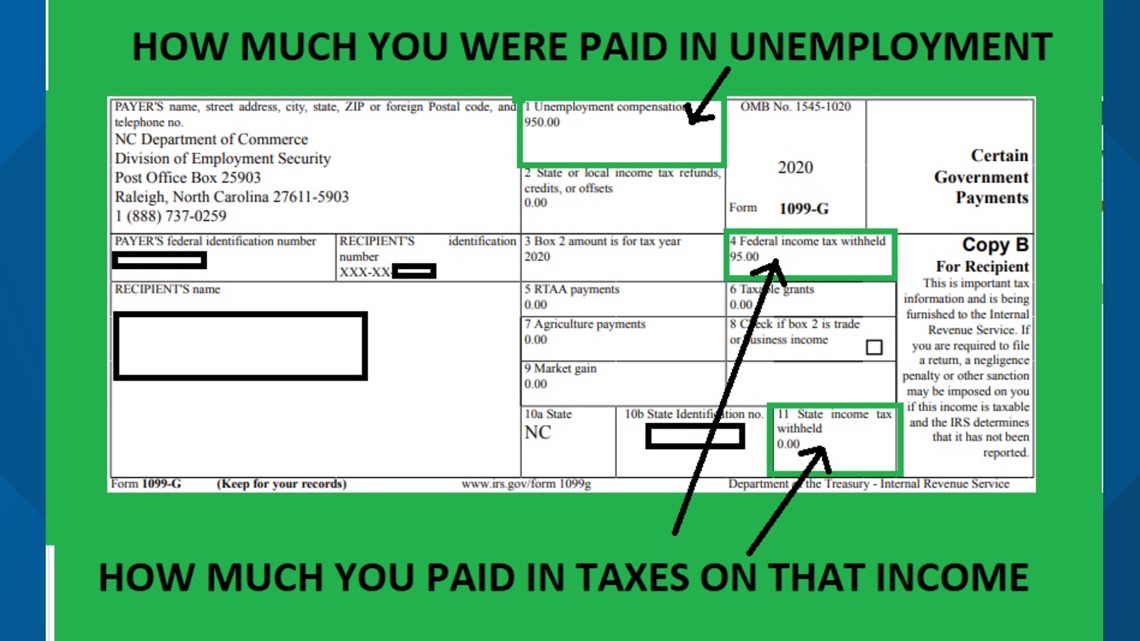

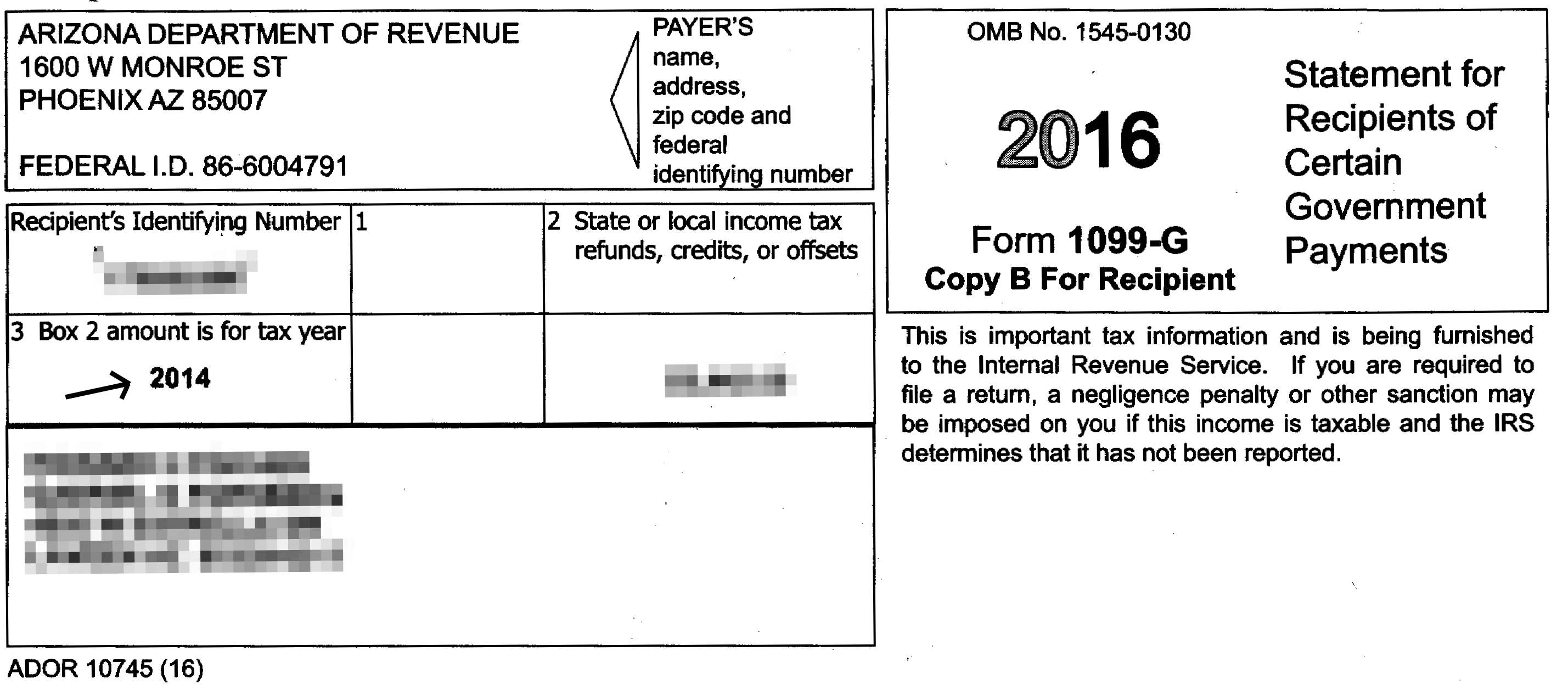

1099 income statement. Everything you need to know a 1099 form is put out by the internal revenue service (irs) that reports other income received. You will need to file a return for the 2024 tax year: This can include various types of income, such.

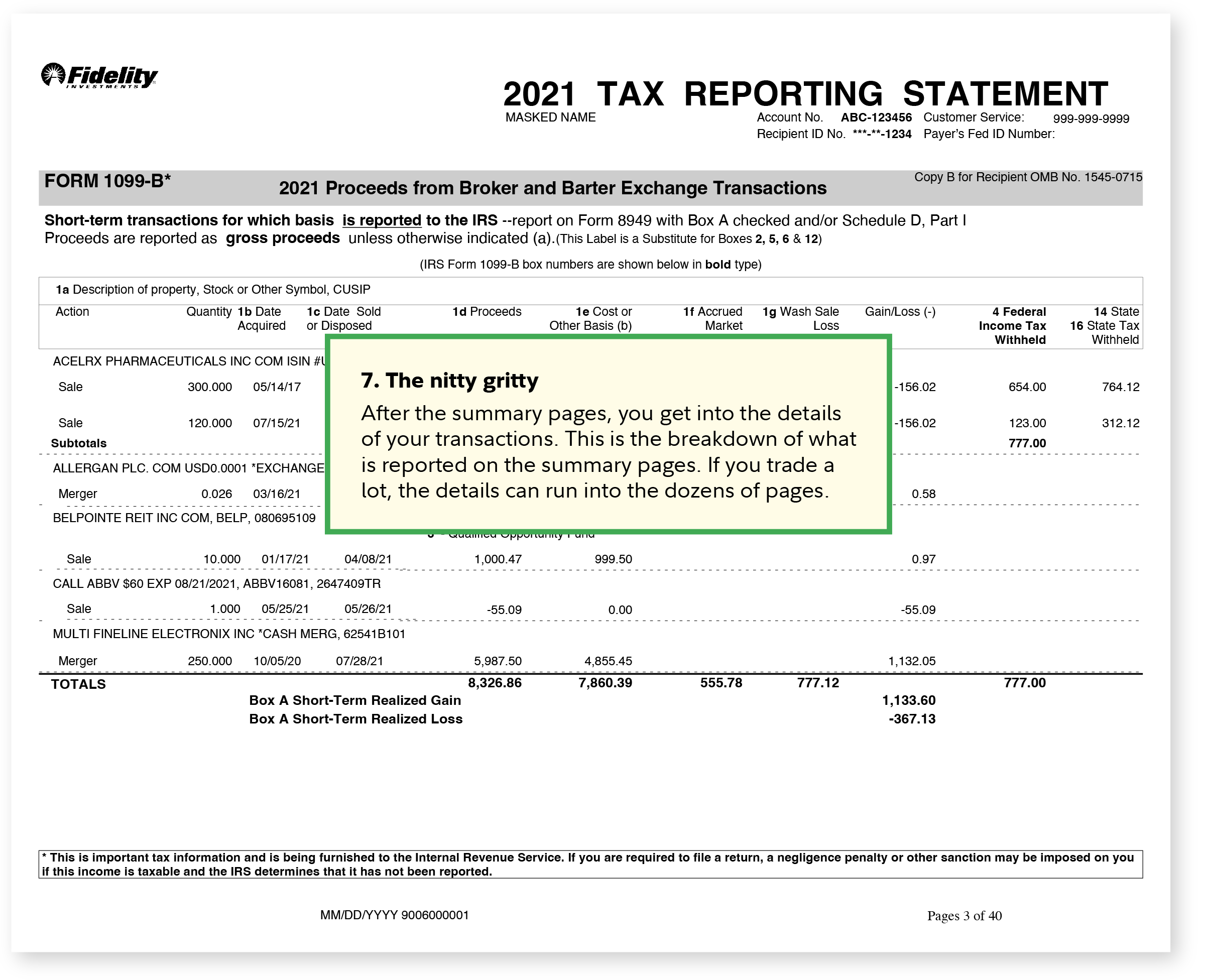

Take $300,000 divided by 60 months equals $5,000 per month of income. Investors can download investment income forms from their brokerage firm: Calculating 1099 income for a mortgage involves the following steps:

Exempt from your state’s income or investment tax. Made a payment if, as part of your trade or business, you made any of the following types of payments, use the link to be directed to information on filing the. If you are an unmarried senior at least 65 years old and your gross income is more than $14,700.

Information returns are used by the irs to. If you earned $10 or more in interest from a bank, brokerage or other. A 1099 form is a tax record that an entity or person — not your employer — gave or paid you money.

Key takeaways form 1099 is a collection of forms used to report payments that typically aren't from an employer. (noncitizens living outside the us receive. This means income and employment are left.

Your 2023 tax form will be. A 1099 is a tax document that reports income you receive from sources other than an employer. See how various types of irs form 1099 work.

Let’s say you received three 1099 forms with income amounts of. It shows the total amount of benefits you. There are a variety of incomes reported on a 1099.

Table of contents whats a 1099:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)