Casual Info About Accounting For Prepaid Insurance Disney Income Statement 2018

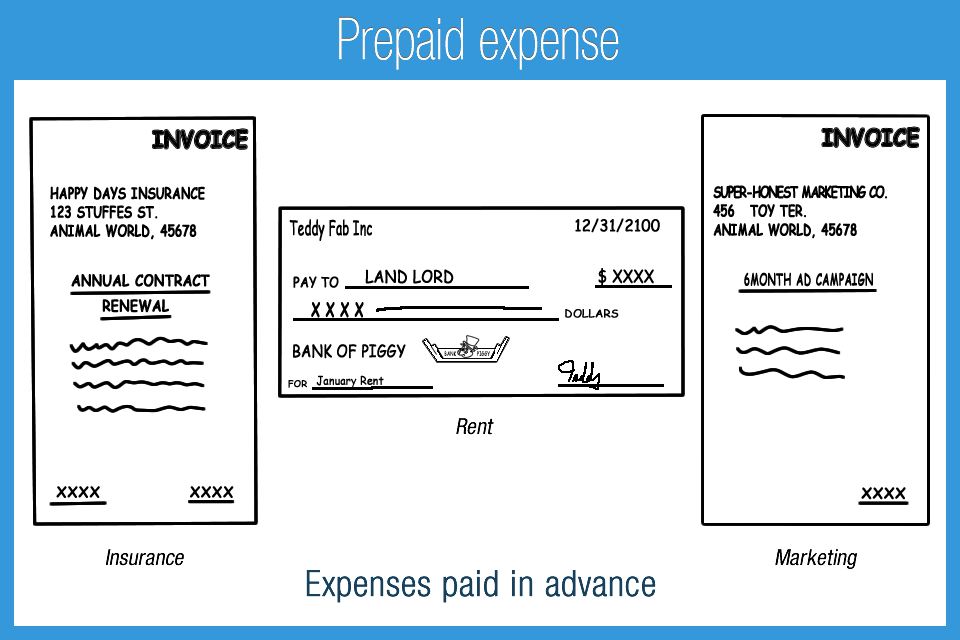

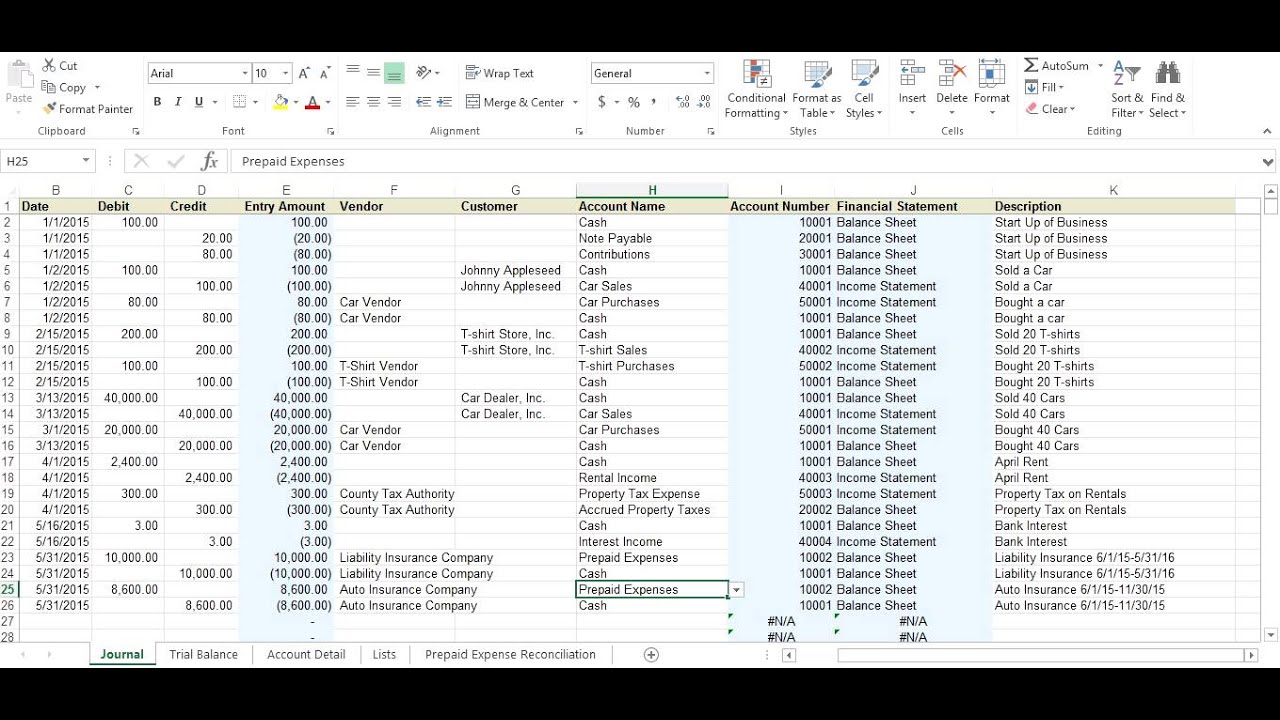

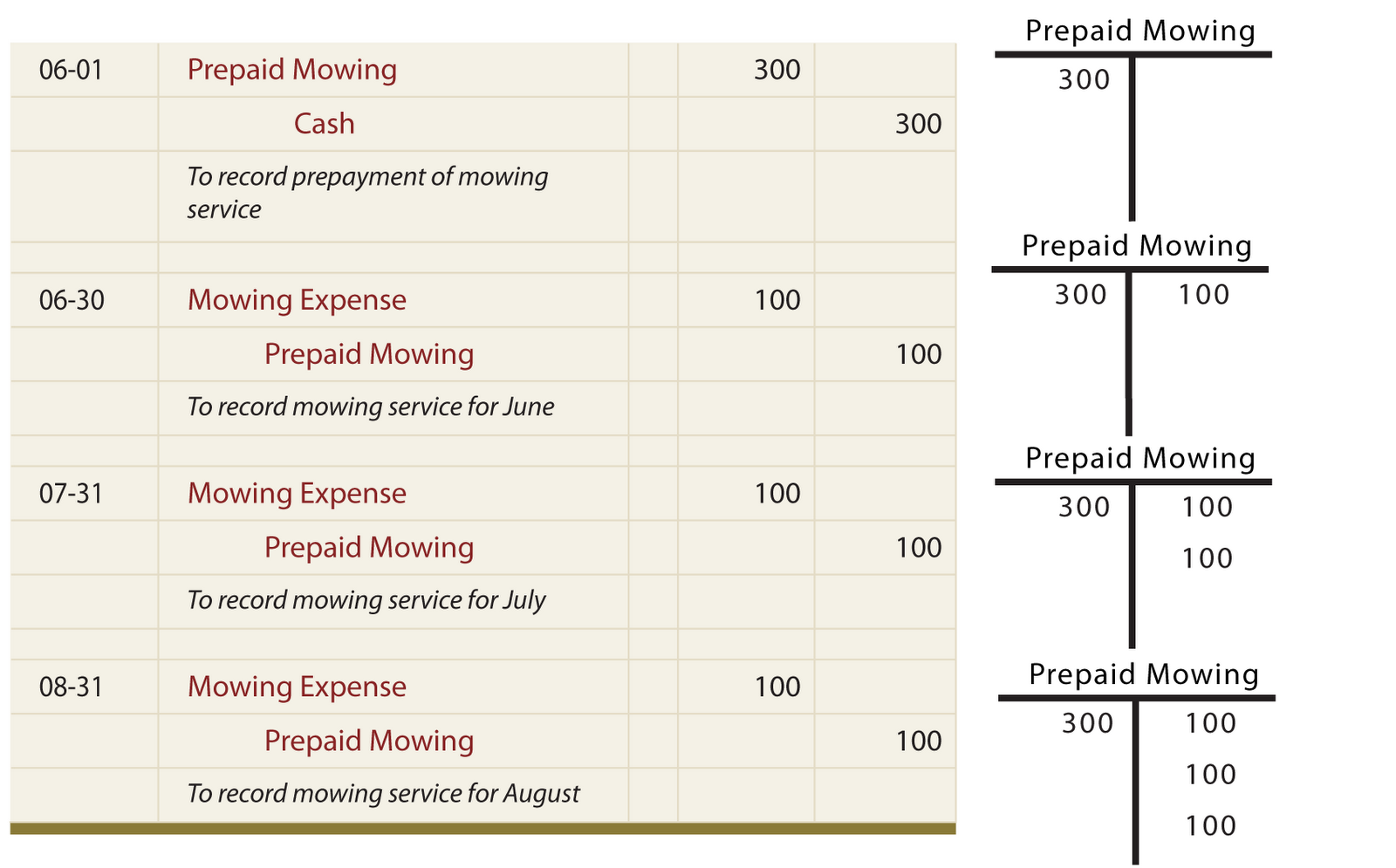

The initial journal entry for a prepaid expense does not affect a company’s financial statements.

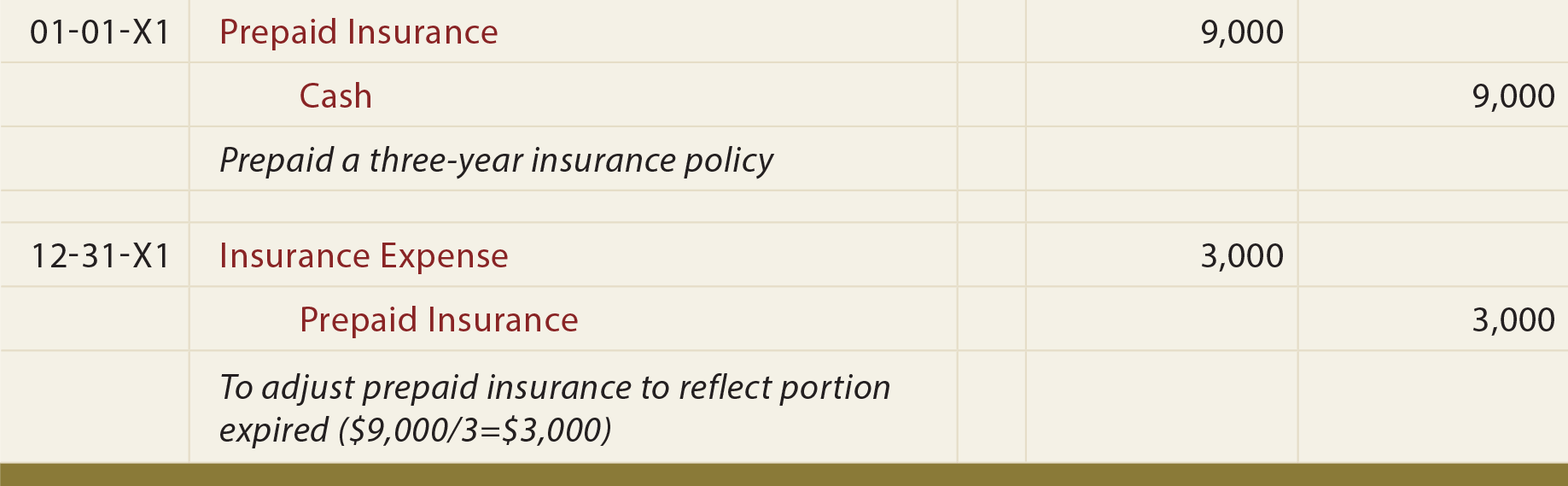

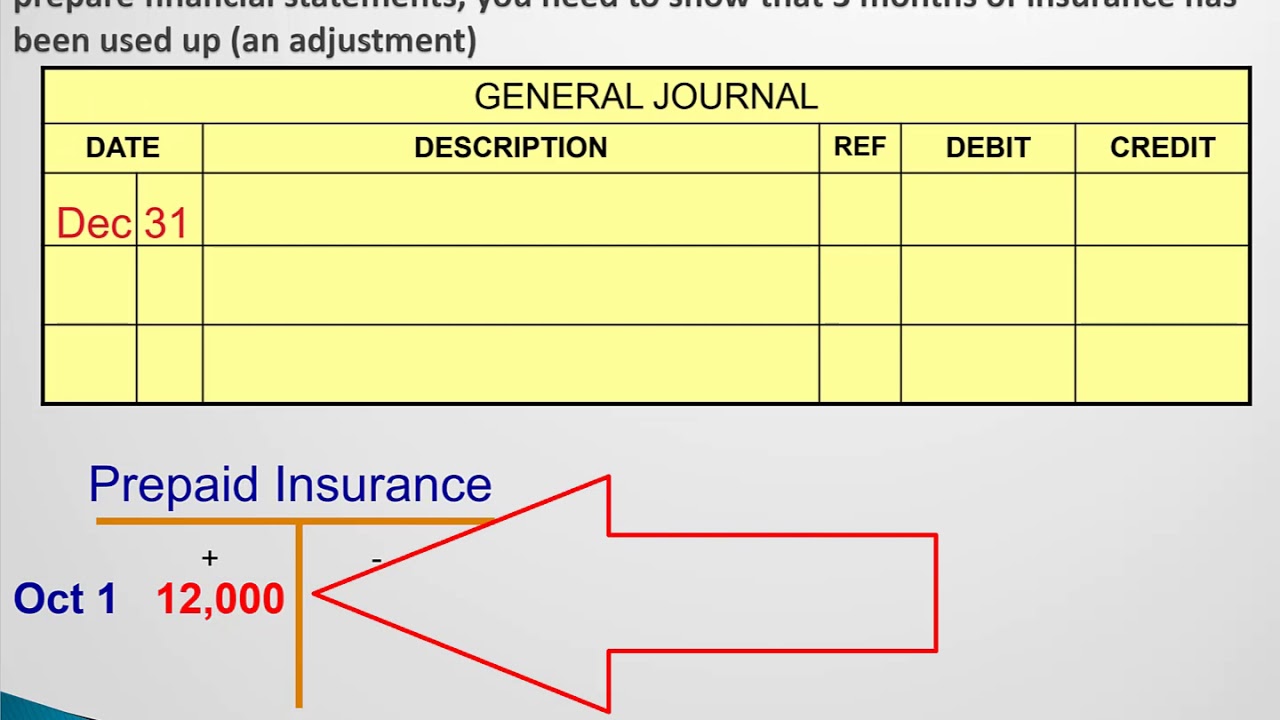

Accounting for prepaid insurance. Prepaid insurance is the portion of an insurance premium that has been paid in advance and has not expired as. The adjusting entry for prepaid expense depends upon the journal entry made when it was. What is prepaid insurance?

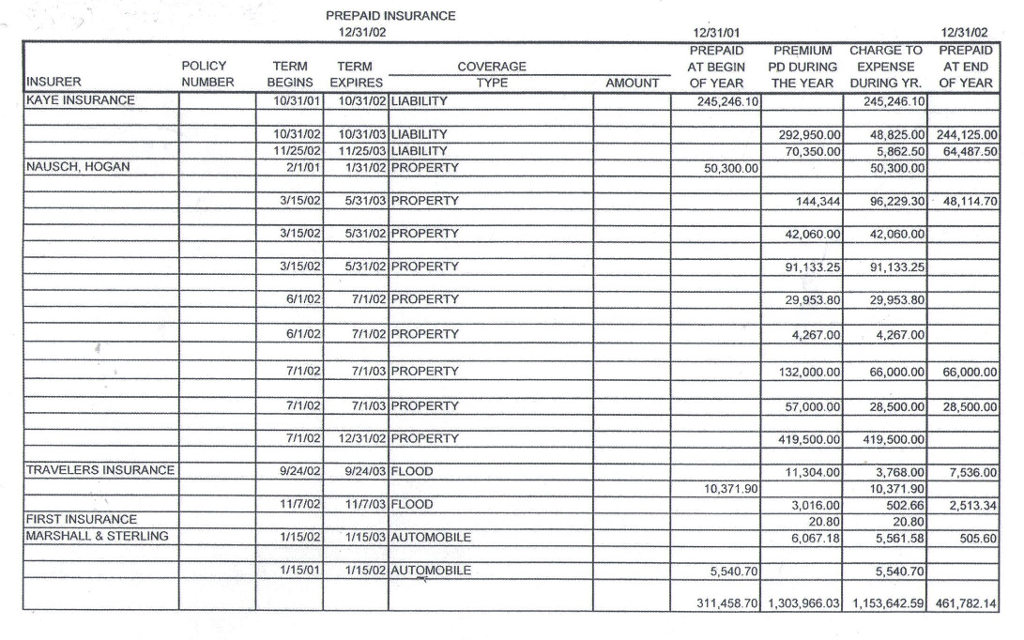

The prepaid insurance will be allocated to the insurance expense base on the coverage time. Once the journal entry for prepaid expenses has been posted they are then arranged appropriately in the final accounts. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet.

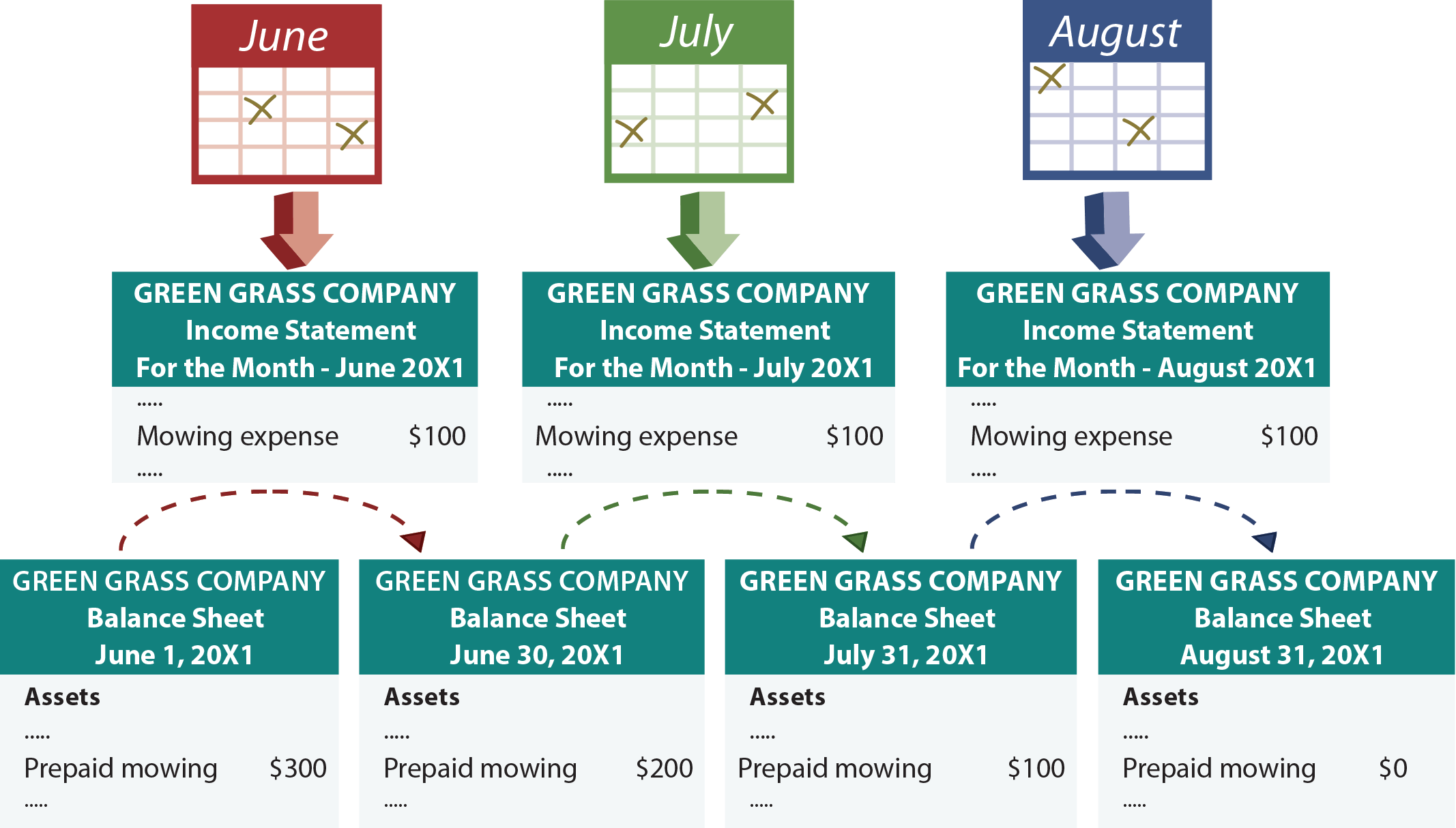

An accounting period can be a month, a quarter, or a full. In this case, on 30. The national center for education.

For example, refer to the first example of prepaid rent. So, prepaid expenses are payments for purchases that will be consumed throughout two or more accounting periods. This requires proper calculation and amortization of prepaid expenditures such as insurance, software subscriptions, and leases.

As prepaid insurance is an asset that will expire through the passage of time, the cost of expiration will need to be recognized as an expense during the period. Prepaid expenses refers to payments made in advance and part of the amount will become an expense in a future accounting period. Treatment of prepaid expenses in financial statements.

Prepaid insurance is not considered an expense and it is treated in the accounting records as a current asset. A prepaid expense is an expense that has been paid for in advance but not yet incurred. Prepaid insurance is a future expense, which you must pay upfront and receive its benefits over time.

Prepaid insurance represents the portion of the insurance premium paid in advance for future coverage. The balance will be reversed from prepaid insurance to expense on. Prepaid insurance is a key component of business accounting, whereby advance payments are made for insurance coverage.

Prepaid insurance is treated in the accounting records as an asset, which is gradually charged to expense over the period covered by the related insurance contract. The basic accounting for a prepaid expense follows these steps: The average annual net price of the universities in this ranking amounts to about $17,500.

Prepaid expenses may need to be adjusted at the end of the accounting period. Cost of an online accounting degree. Prepaid expense accounting.

Instead of posting the $1,200 to expense, you post it to prepaid insurance,. However, it must be noted that this charge is then gradually. Upon the initial recordation of a supplier invoice in the accounting system, verify that the item.

/GettyImages-1164110433-e2aecbe76b334a4383498c78c2d11082.jpg)