Inspirating Info About Cost Of Goods Manufactured Income Statement Cash Inflows From Investing Activities Include

Finished goods inventory, beginning $ 50,000:

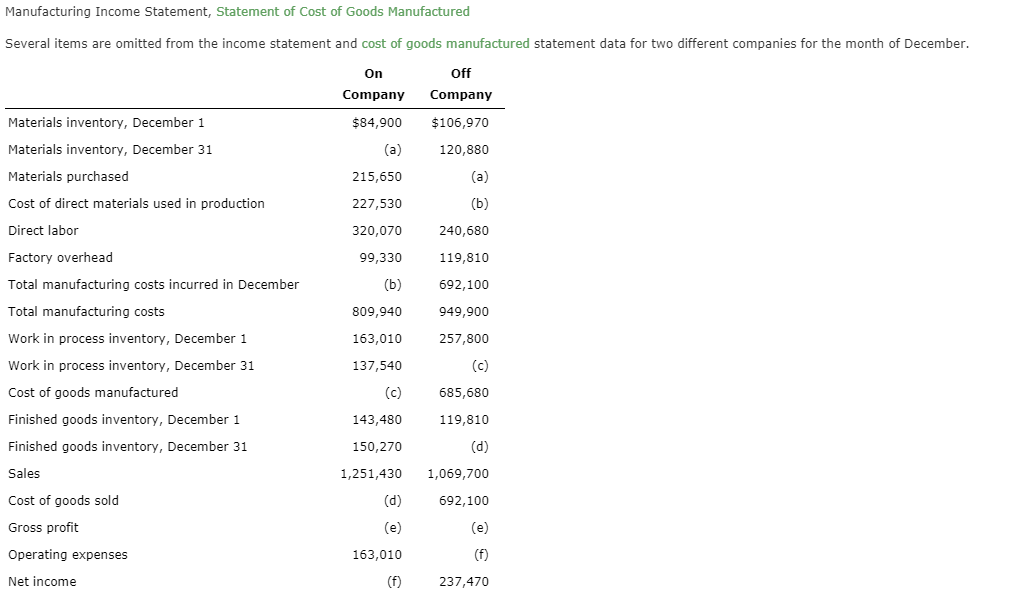

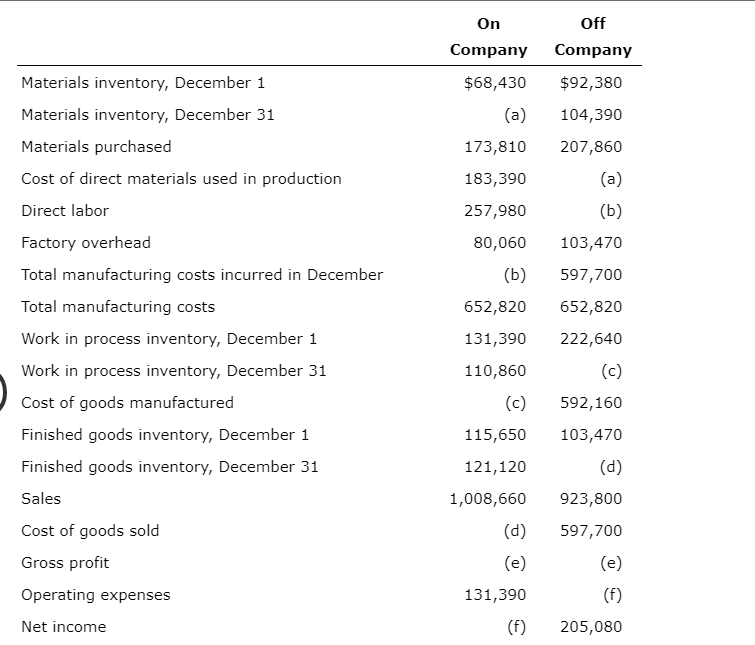

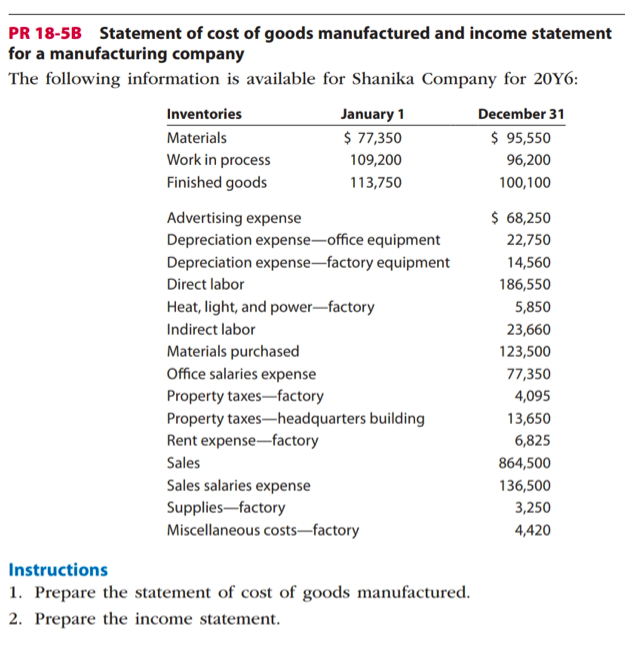

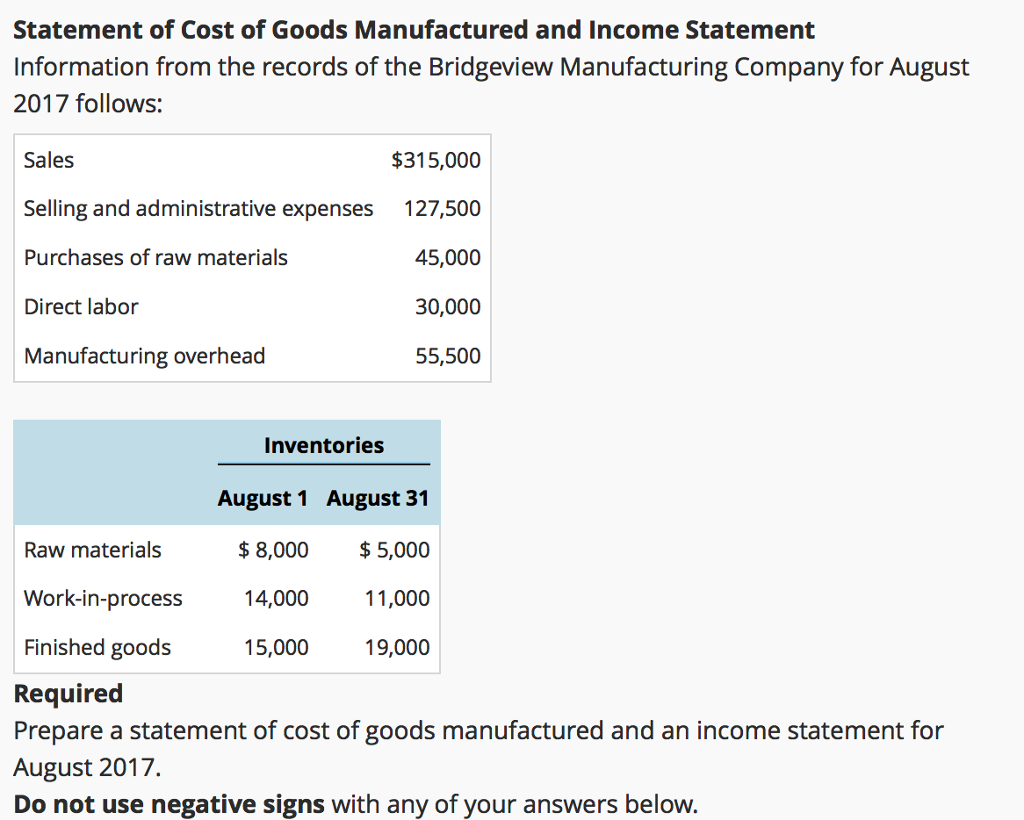

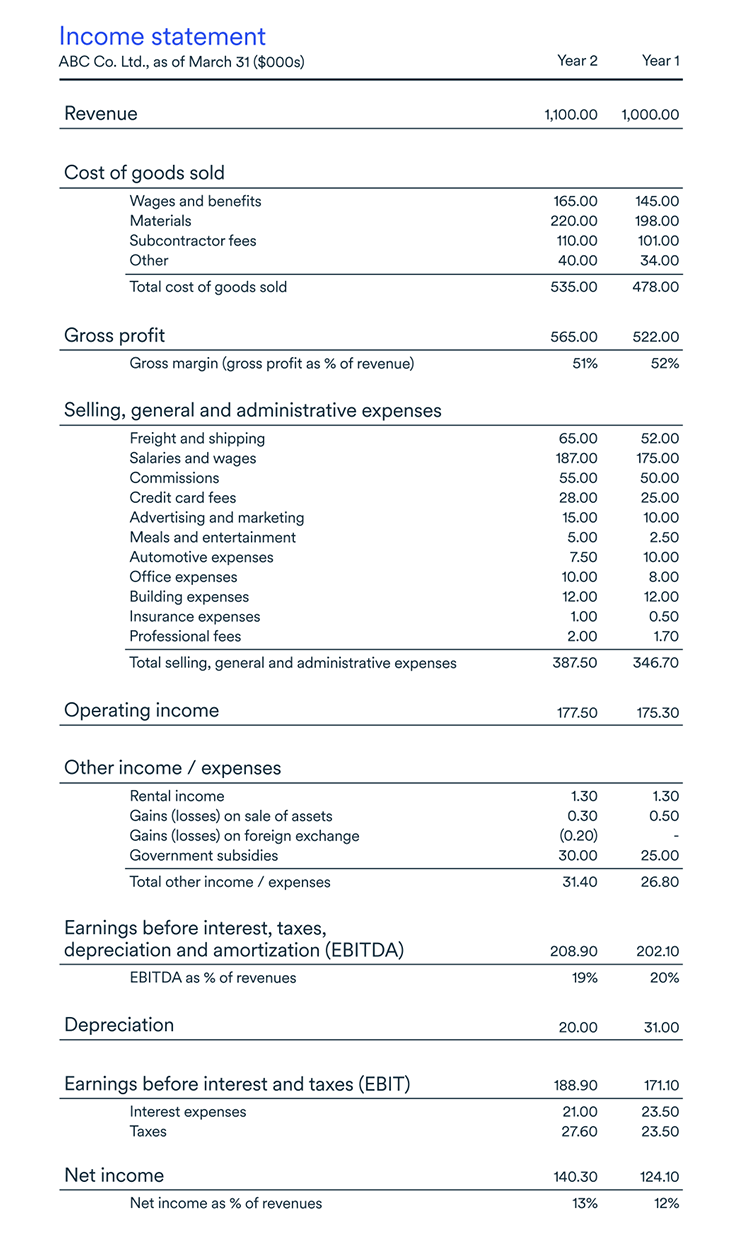

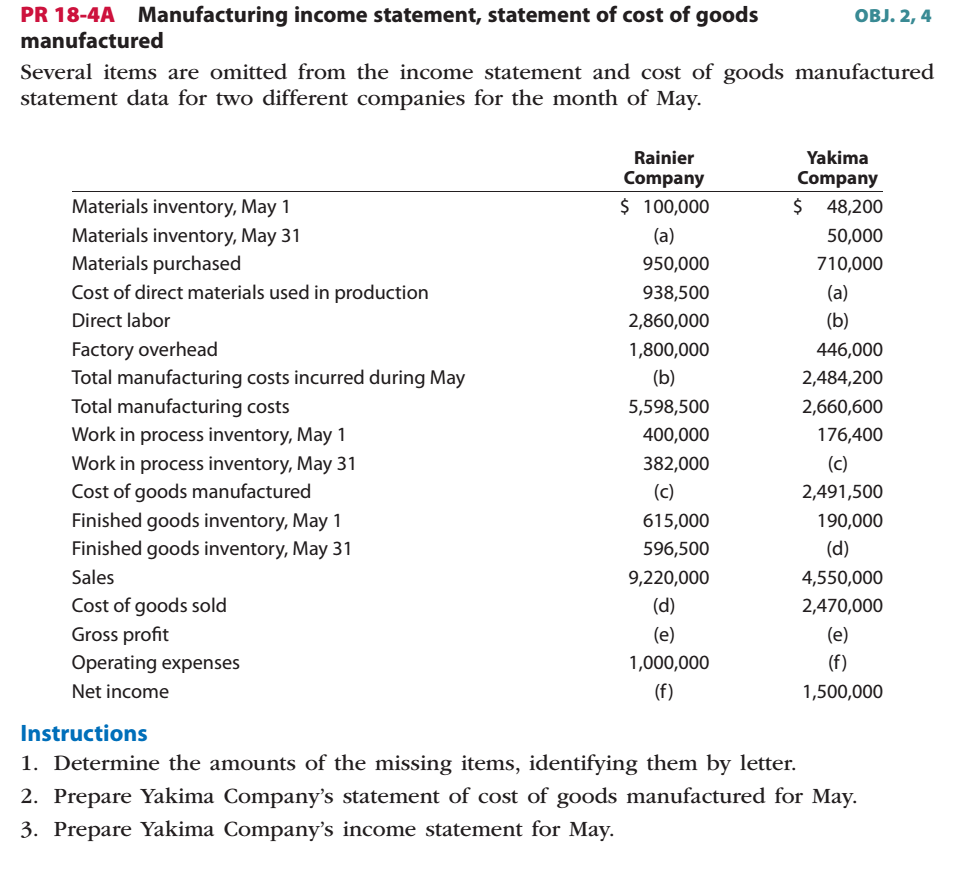

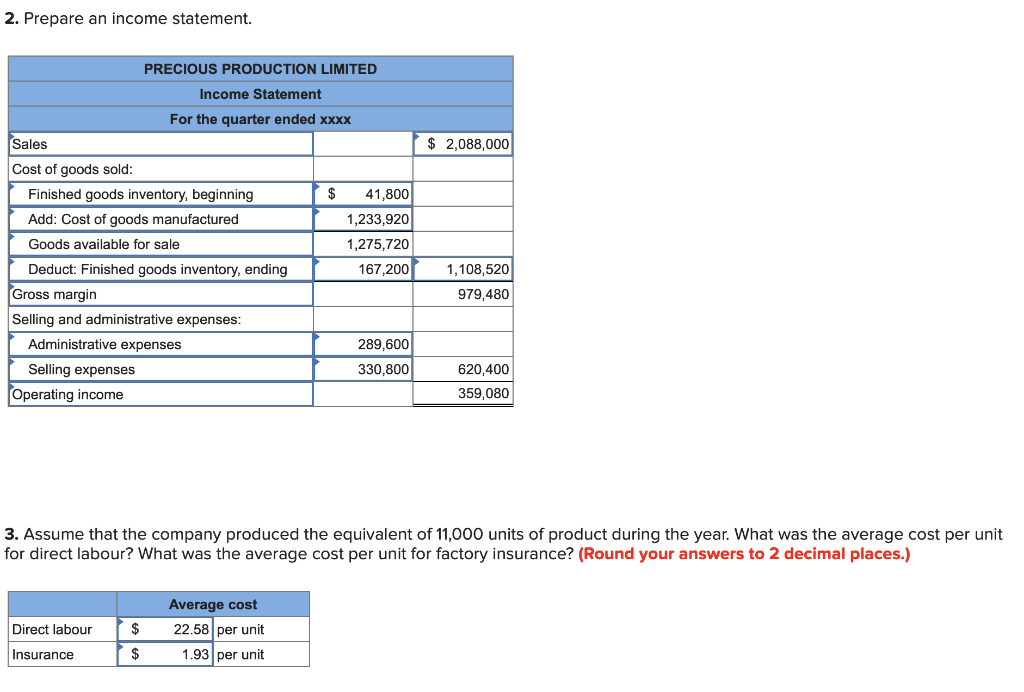

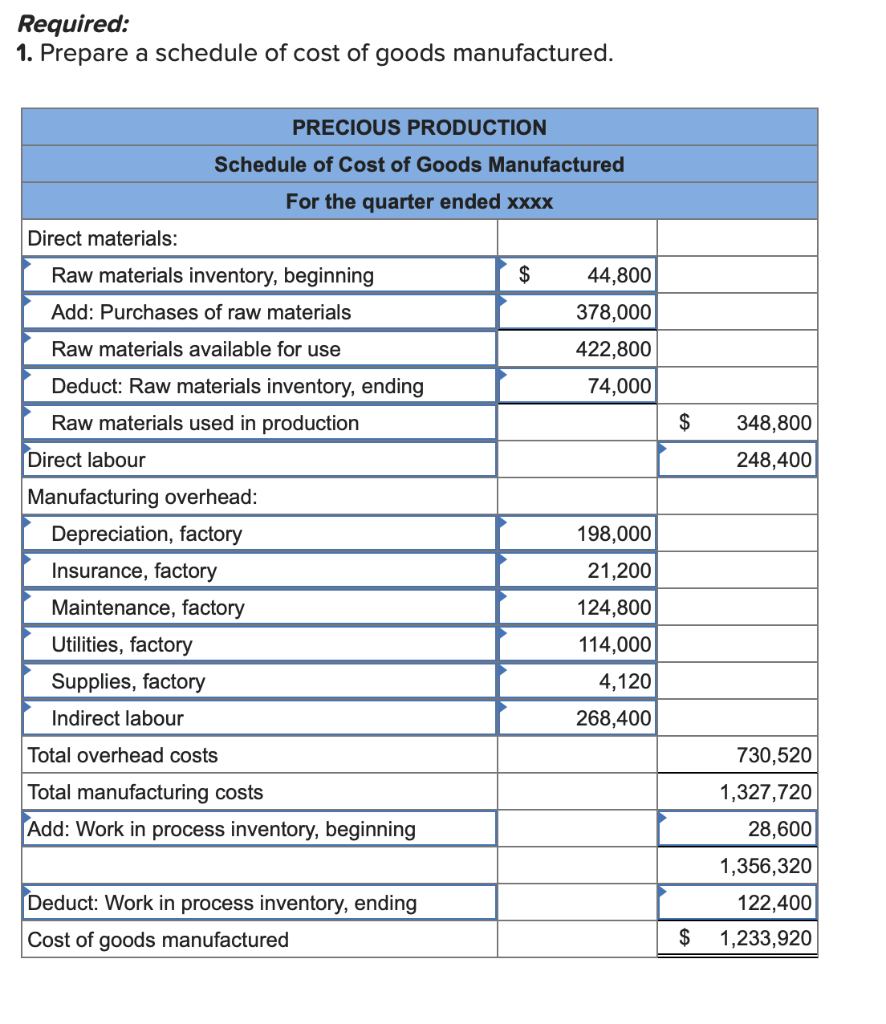

Cost of goods manufactured income statement. The cost of goods manufactured (cogm) itself doesn't directly appear on a company’s income statement. The cost of goods manufactured (cogm) itself doesn't directly appear on a company’s income statement. The statement of cost of goods manufactured summarizes the total production costs incurred by a manufacturing.

If we enter those inputs into our wip formula, we arrive at $44 million as the cost. Manufacturing companies transform raw material into finished goods through the use of. The two most important numbers on this statement are the total.

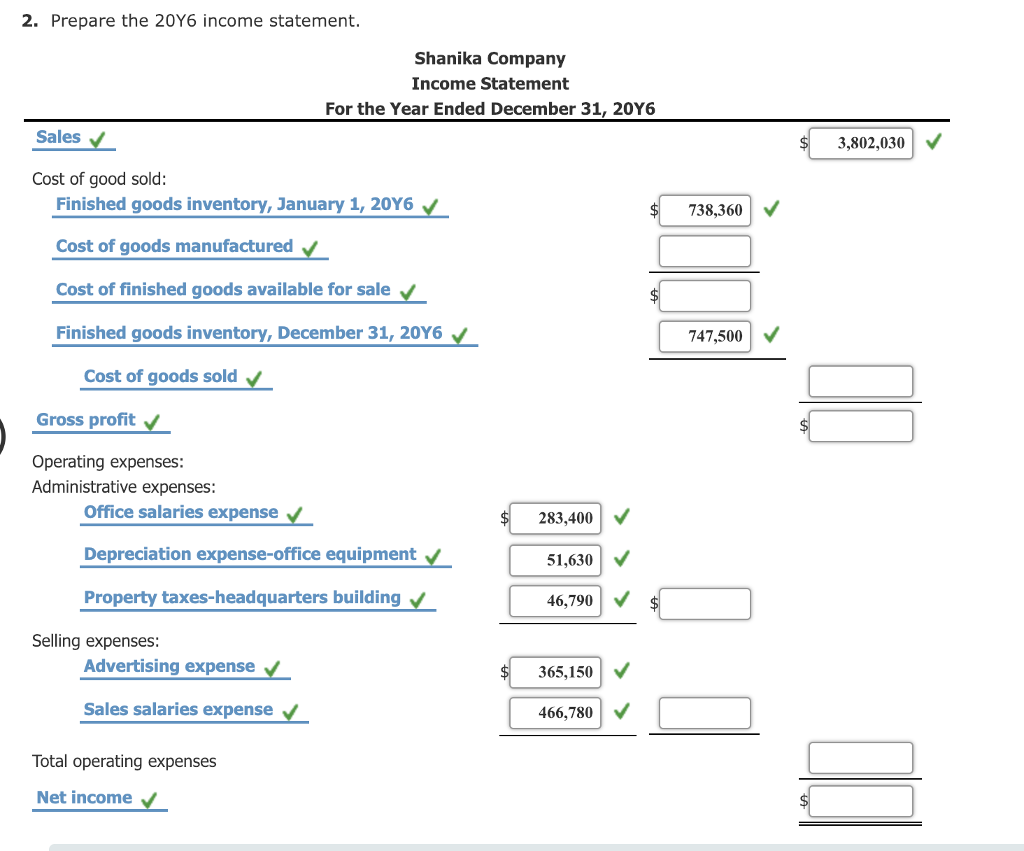

Coral reef furniture calculates its cost of goods manufactured for the year as: Once you have completed these calculations, the income statement for a manufacturing company is exactly the same at the income statement for a. Instead, components of the cogm, such as the cost of.

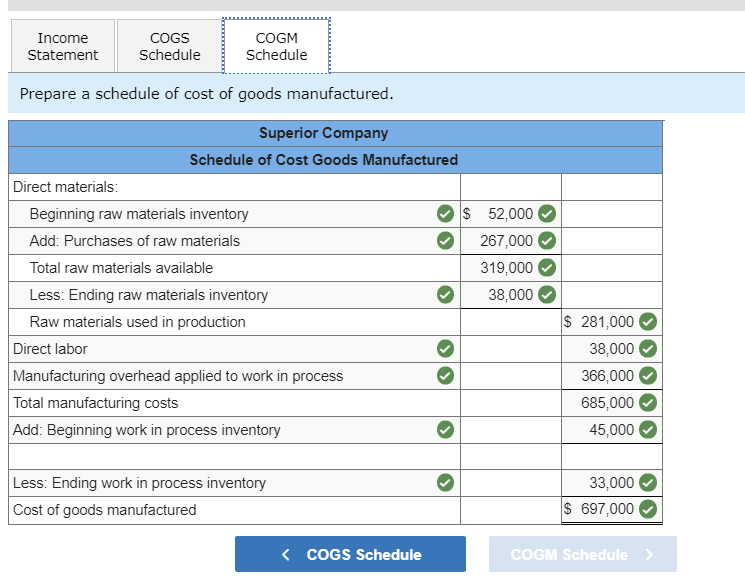

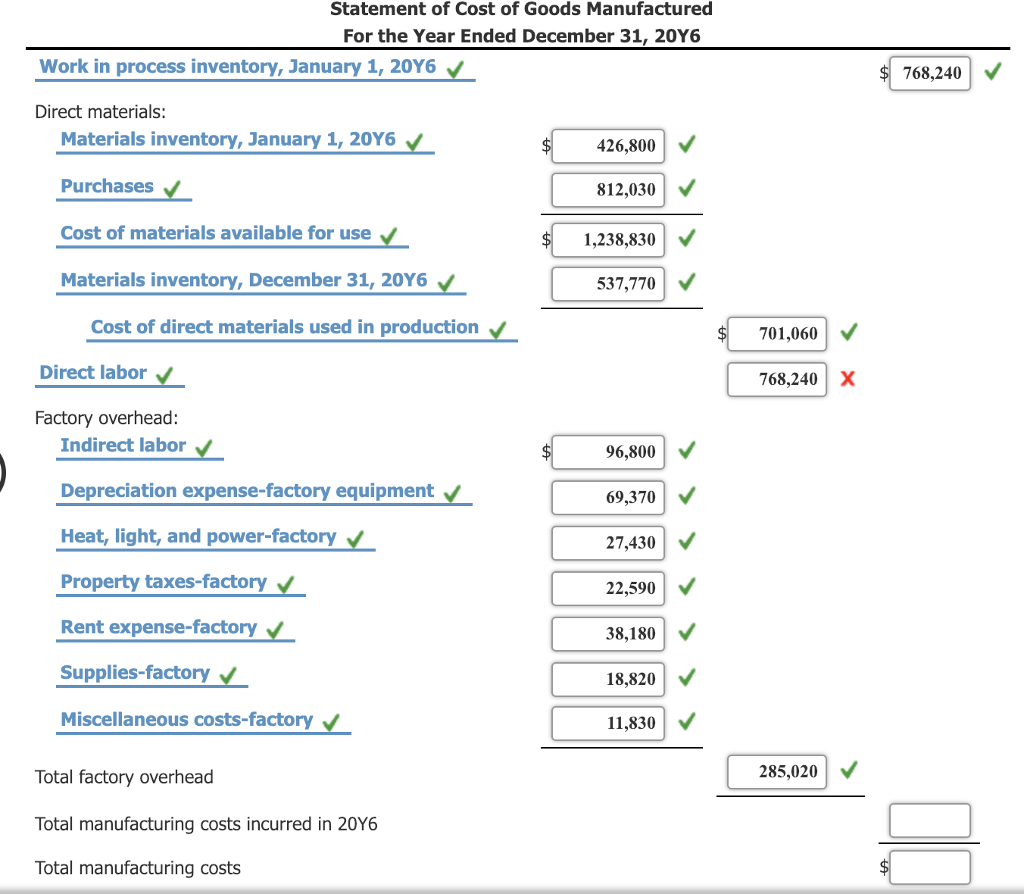

Statement of cost of goods manufactured. Raw materials inventory, january 1: Schedule of cost of goods sold;

Merchandise inventory, beginning $ 25,000: The two most important numbers on this. Material cost = 491,250 x 100 = 49,125,000.

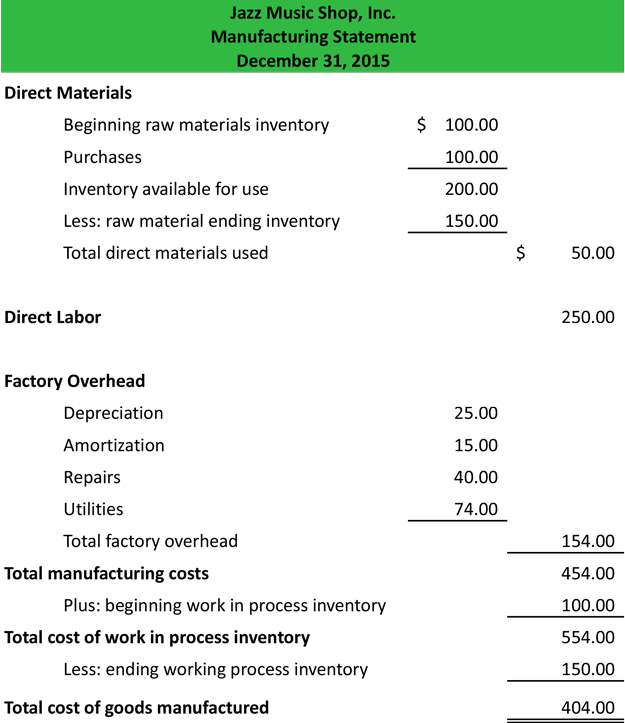

This cost of goods manufactured template lays out a schedule of cogm using the amount of direct materials, direct labor, manufacturing overhead and work in process inventory. Therefore, the calculation of the cost of goods manufactured is as follows, =. = cost of goods sold.

The statement of cost of goods manufactured supports the cost of goods sold figure on the income statement. Manufacturing costs = $50 million. Cost of goods manufactured is the total cost of goods completed during the period.

Schedule of cost of goods manufactured; Ending work in progress (wip) = $46 million. The income statement for merchandising and manufacturing companies differs in the reporting of the cost of the merchandise (goods) available for sale and sold.

The cost of goods manufactured amount is transferred to. To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring. Labor cost = 378,000 x 100 = 37,800,000.

+ cost of goods manufactured. Statement of cost of goods manufactured for the year ended december 31 direct materials used: The cost of goods sold then.