Amazing Tips About Net Cash Used By Financing Activities Balance Sheet And Trial Difference

![[Solved] Stormer Company reports the following amounts on its statement](https://media.cheggcdn.com/study/439/439c6b99-c9d7-4d3d-a846-f060c1454fd6/image)

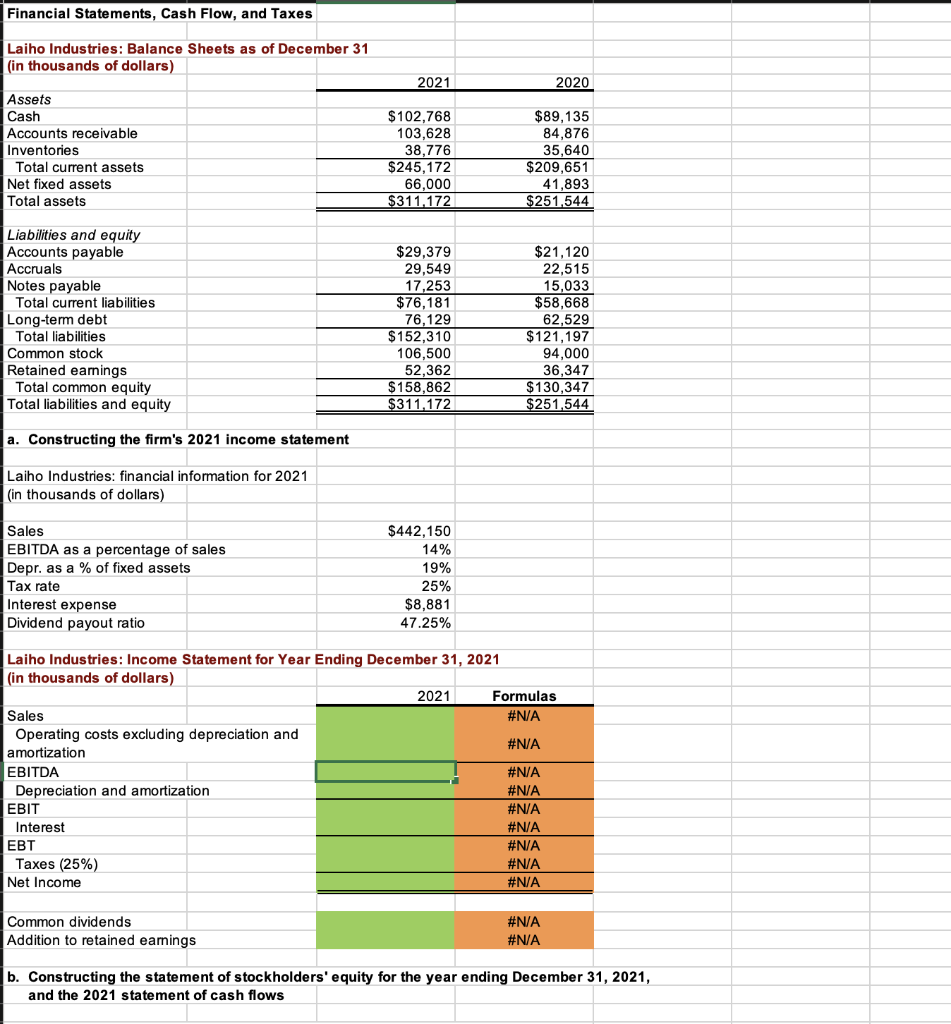

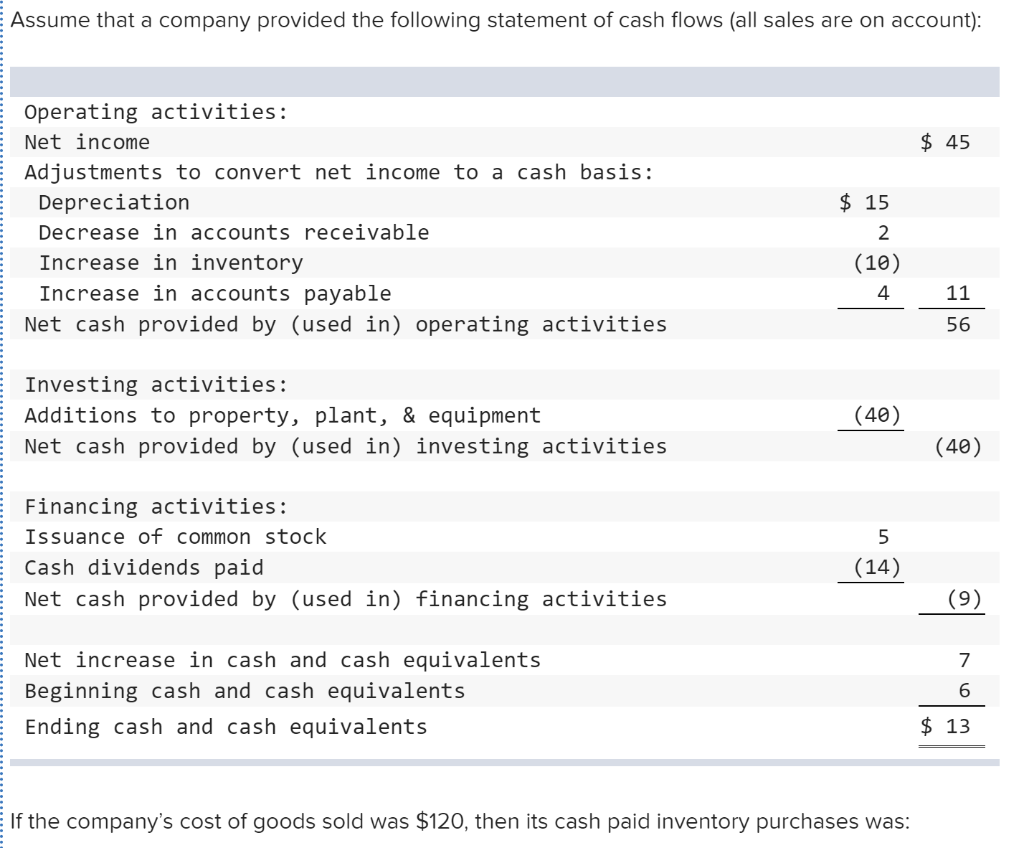

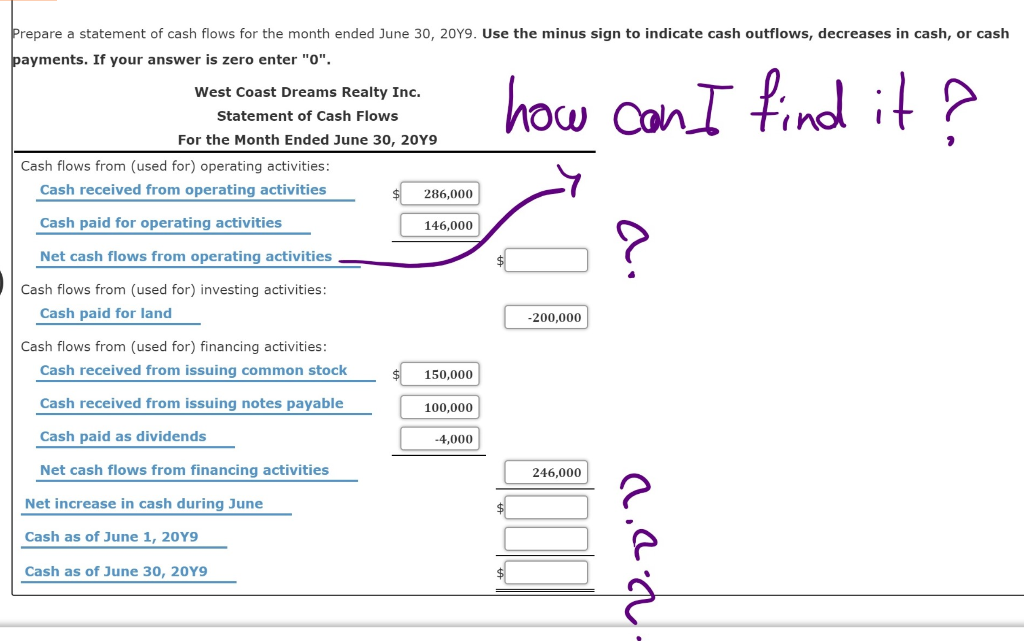

Net cash flow from financing activities refers to the total amount of money coming in or going out of a company as a result of financing activities, such as equity capital administration, sale and repurchase of the company’s stock, and debt management.

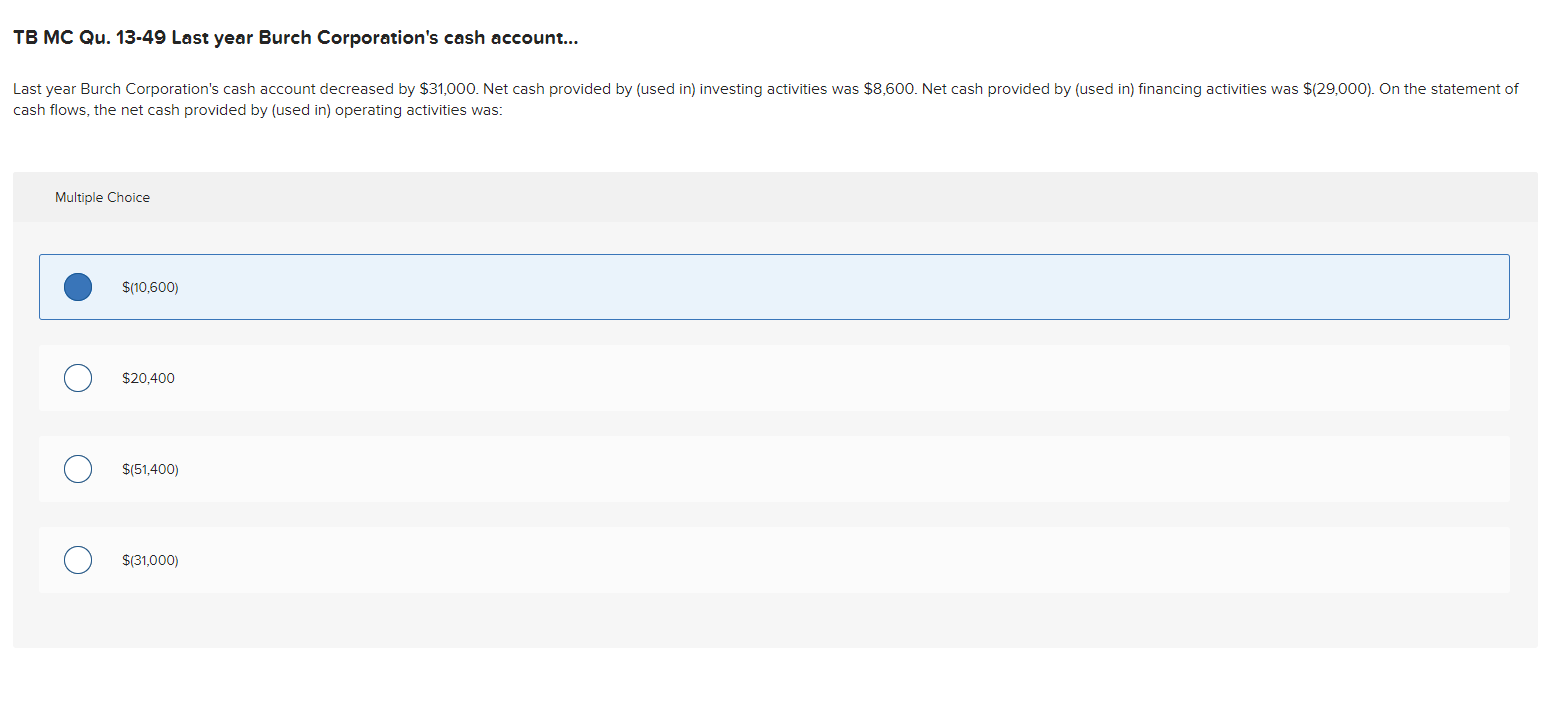

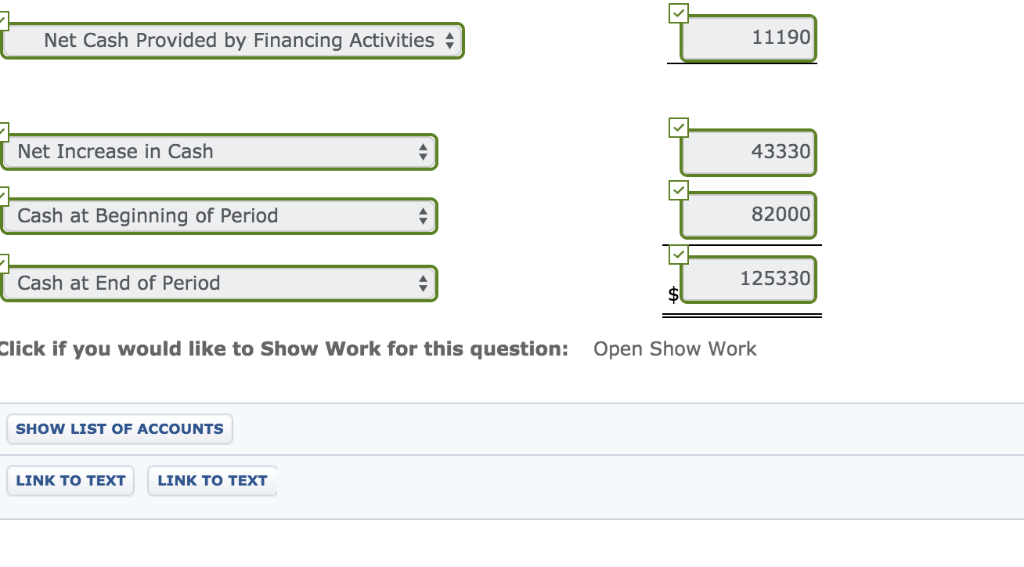

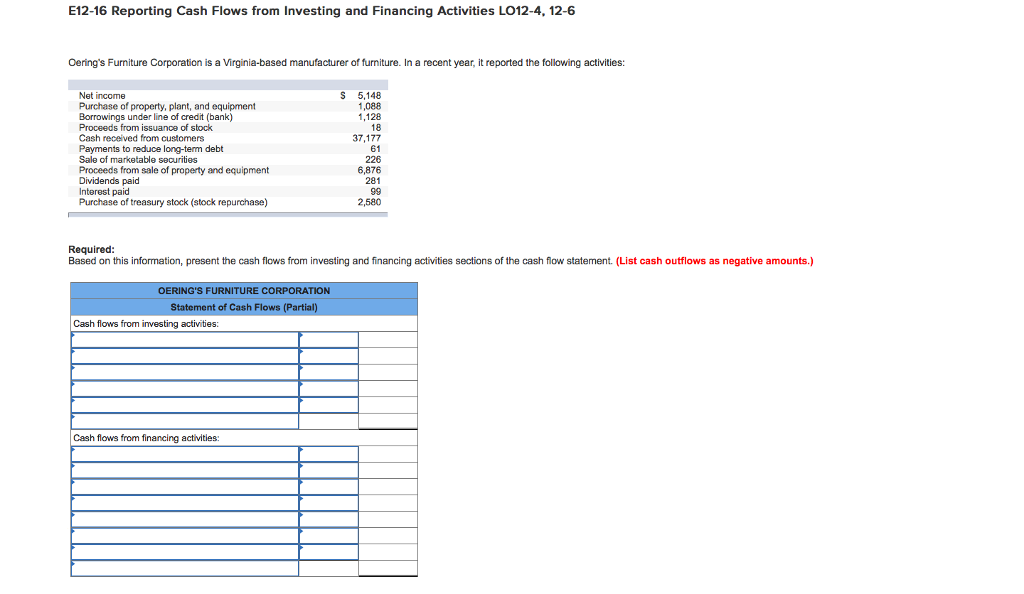

Net cash used by financing activities. See also cash provided by (used in) financing activities, discontinued operations contributions from noncontrolling interests Net cash flow from financing activities $3,000,000. Calculate net cash flows used for financing activities amount by deducting cash outflows from cash inflows.

The net cash impact of raising capital from equity/debt issuances, net of cash used for share buybacks, and debt repayments — with the outflow from the payout of dividends to shareholders also taken into account. Here’s a look inside donald trump’s $355 million civil fraud verdict. Net cash is commonly used in evaluating a company's cash flow , and can refer to the amount of.

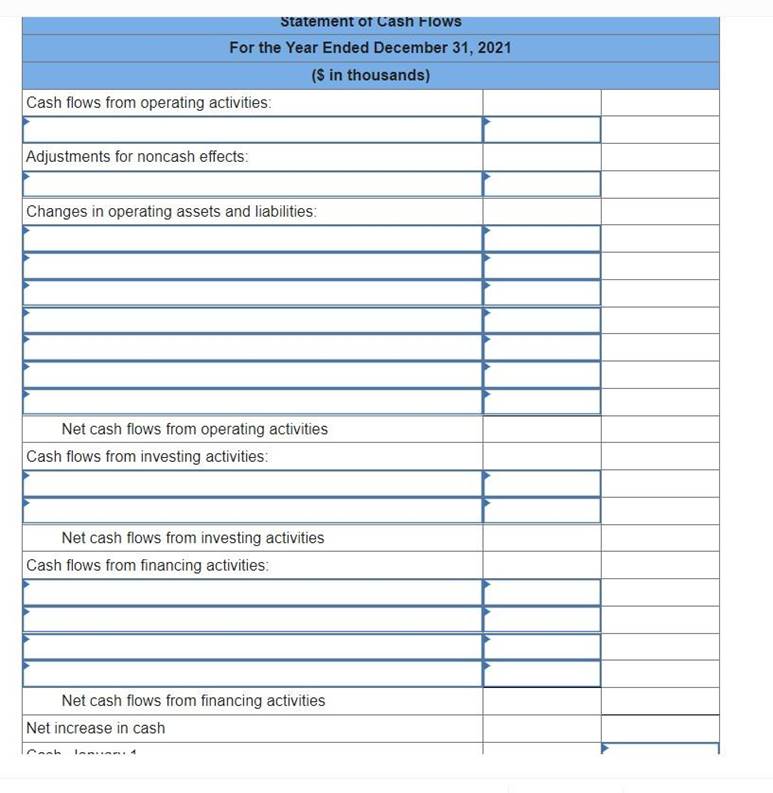

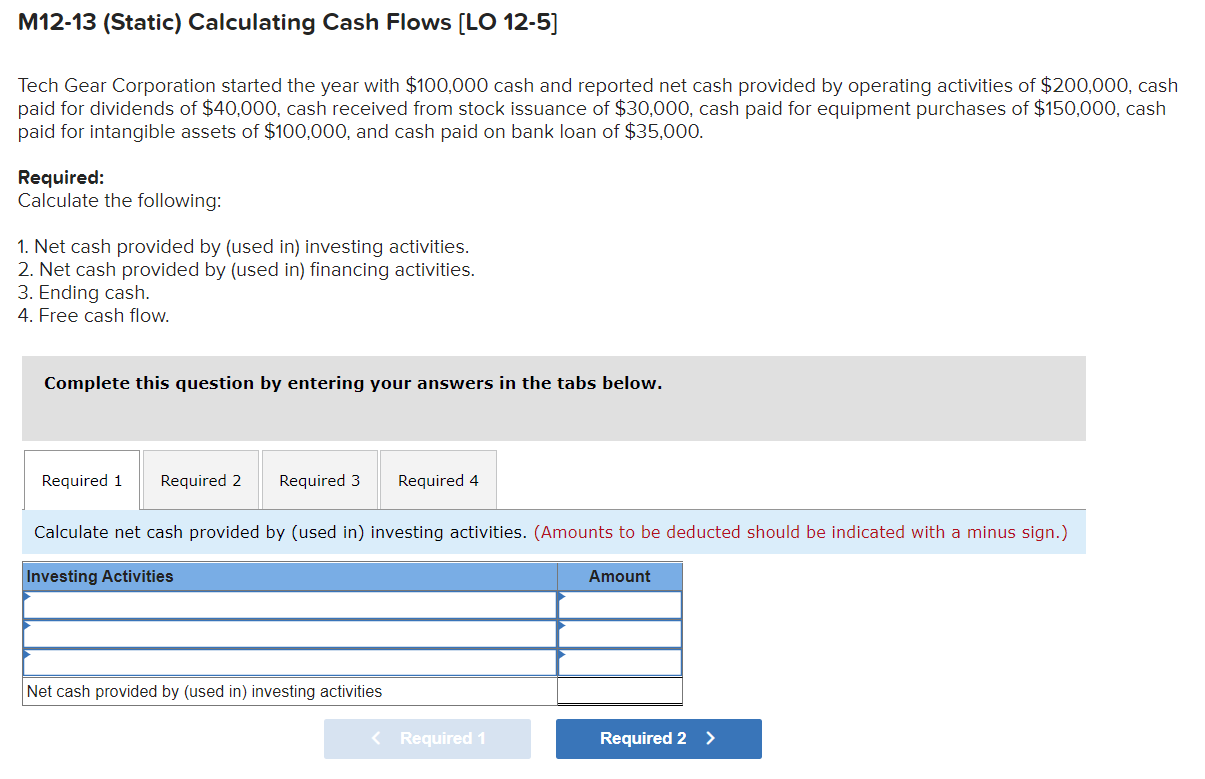

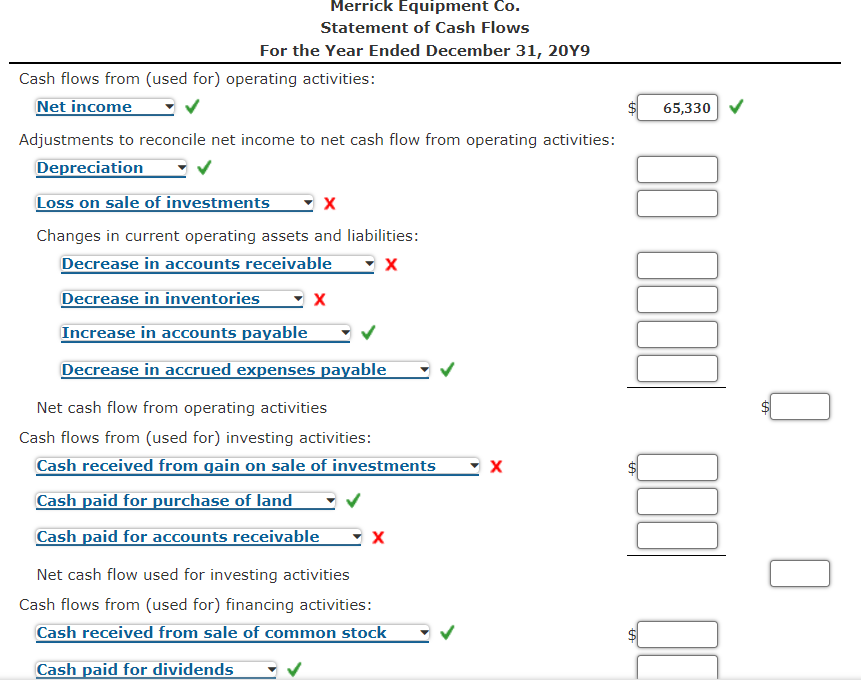

The net cash formula can be somewhat limited depending on the complexity of the business. Cash flows from financing activities: Net cash used in investing activities:

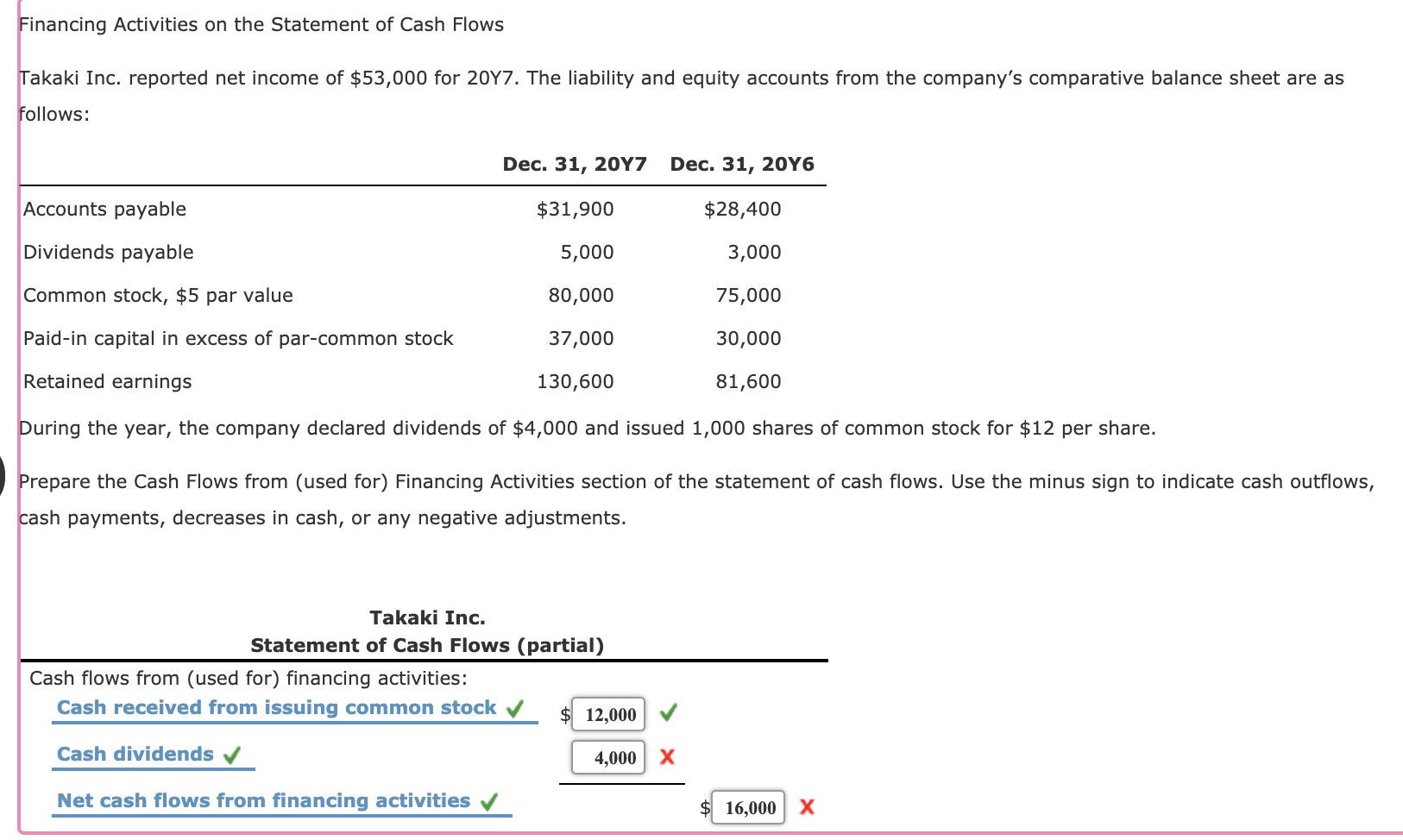

Finance activities include the issuance and repayment of equity, payment of dividends, issuance and repayment of debt, and capital lease obligations. The mortgage repayment is a financing activity. Cash flows from financing activities:

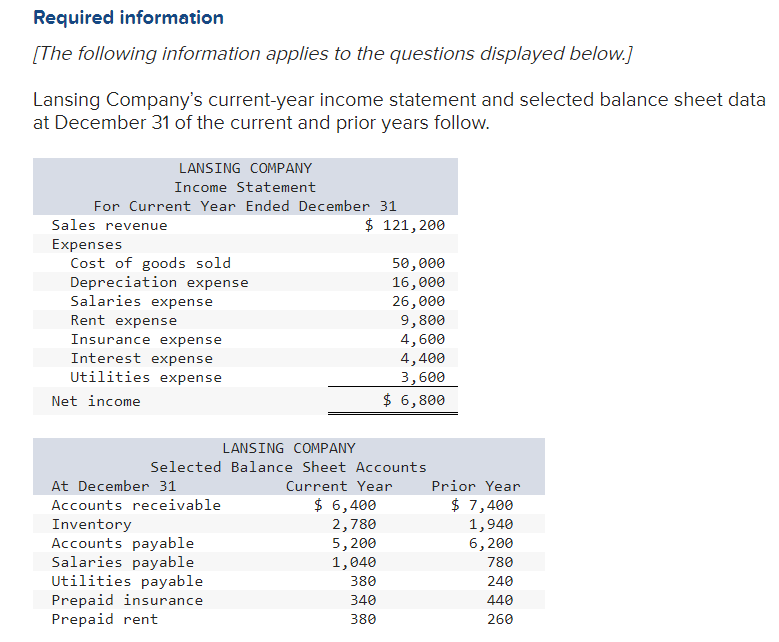

Within a cash flow statement, financing activities are related to company investors and creditors like banks. Net cash provided by operating activities is a financial metric that measures the amount of cash generated or used by a company's normal business operations, such as sales and expenses. Net cash flow from operating activities is a financial metric that indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a service.

In the formula, the cash balance is used to describe all cash the company holds plus highly liquid assets. Positive net cash flow generally indicates adequate cash flow margins exist to provide continuity or ensure survival of the company. Cash flow from financing activities (cff):

In simpler terms, it shows how much cash a company has received from loans, investments, and other financing sources, or how much it has paid out in dividends, debt repayments, and other financing. What's net cash provided by financing activities? The net cash flow from financing activities provides valuable insight into a company's financial health.

Net cash flows from financial activities: Cash flow from financing activities is the net amount of funding a company generates in a given time period. So, any transactions associated with debt, dividends or equity will fall under this category, which is listed as a line item on the cash flow statement.

Knowledge base net cash provided by (used in) financing activities net cash provided by (used in) financing activities the net cash inflow or outflow from financing activity for the period. If we add these figures up, we get a net change in cash and cash. In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock and the payment of dividends.

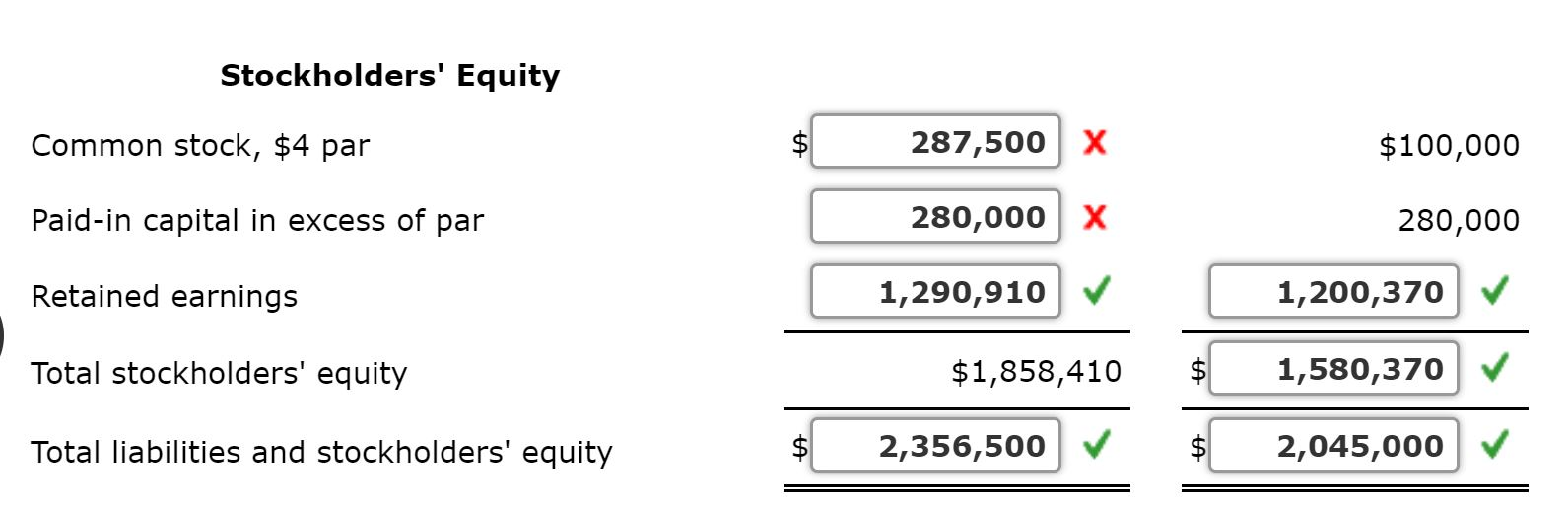

Positive and negative cash flow from financing activities. Proceeds from issuance of common stock: In this example, the company has a positive cash flow in the given period, which can be used for its other financial obligations.