Fun Info About Inventory Is Reported In The Financial Statements At Statement Ifrs

With the lifo figures reported by safeway, $1,886 million (beginning inventory) was added in arriving at this expense and then $1,740 million (ending inventory) was.

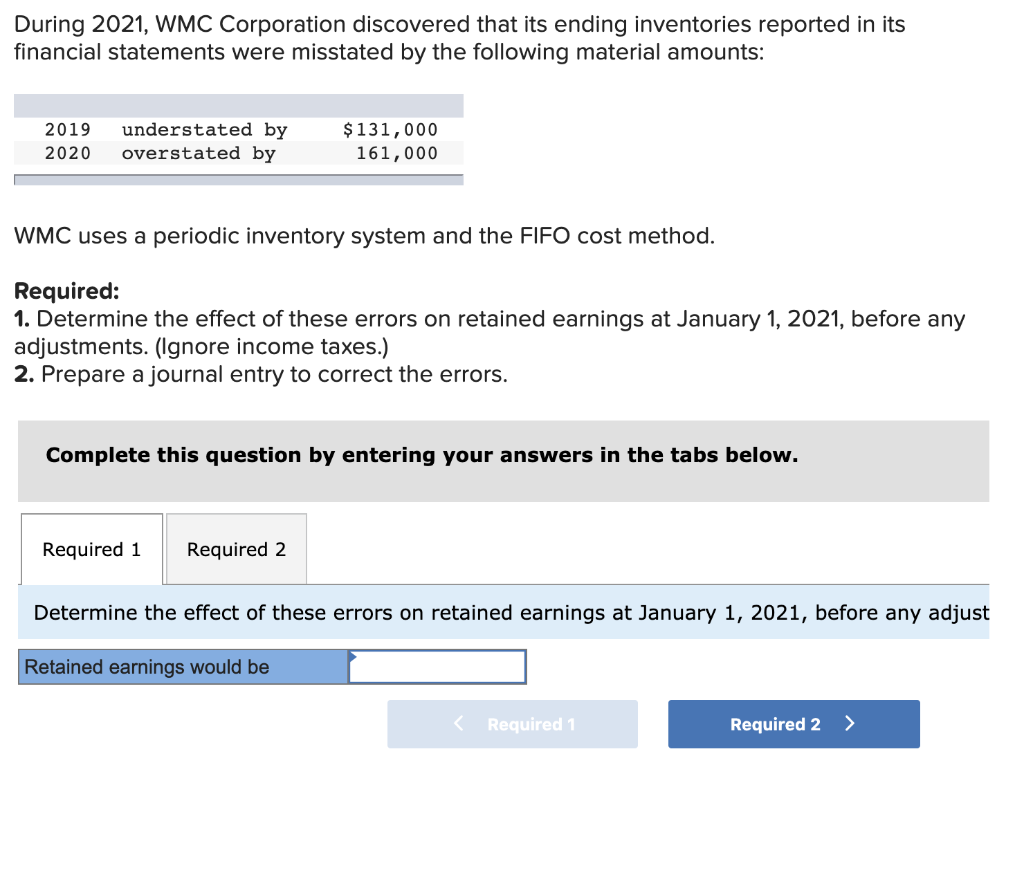

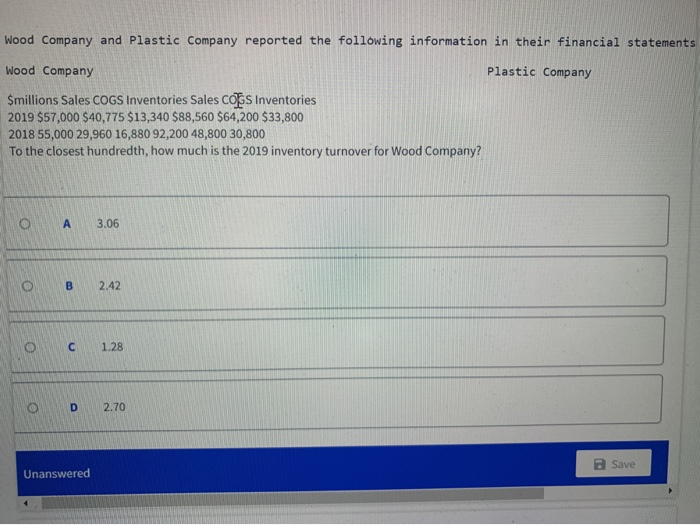

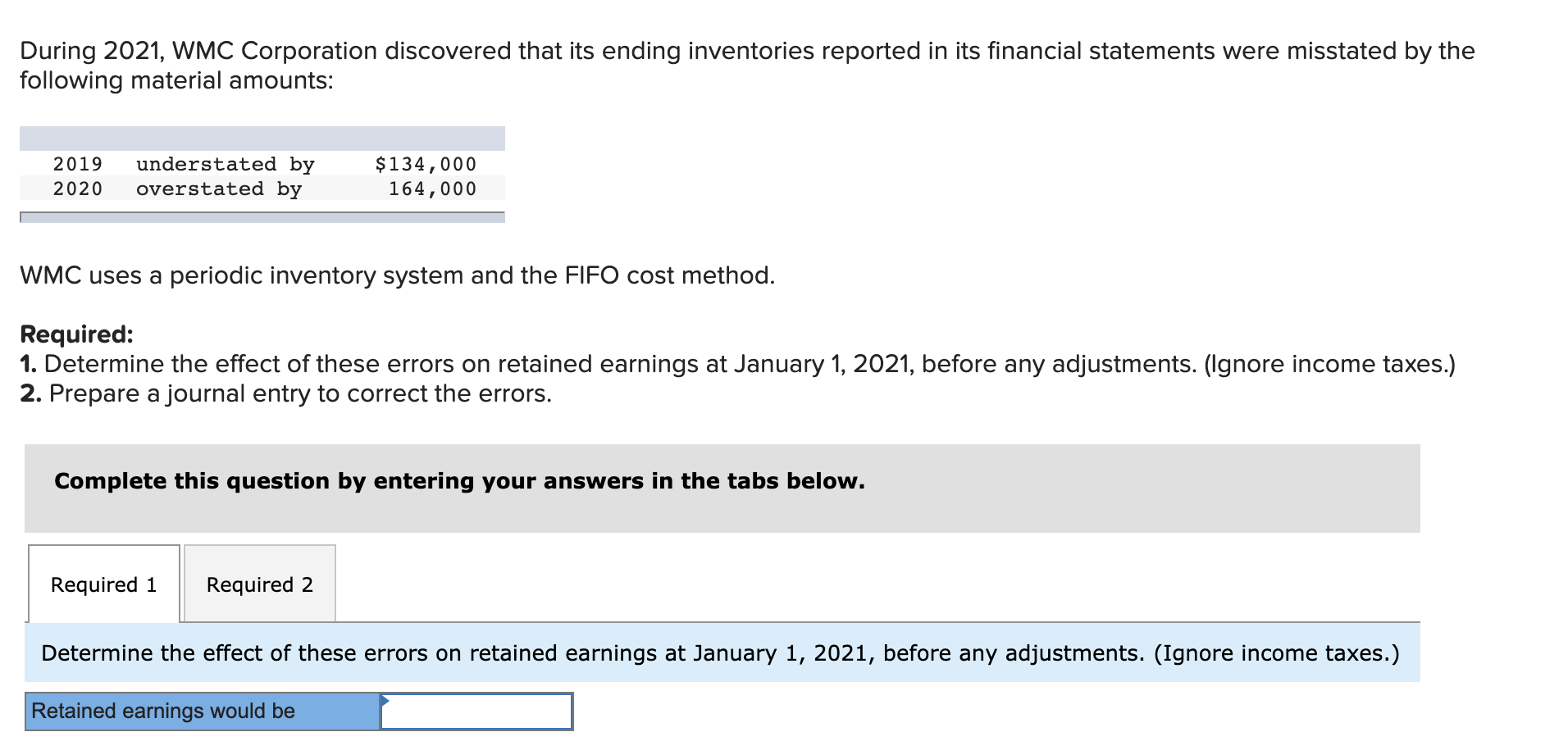

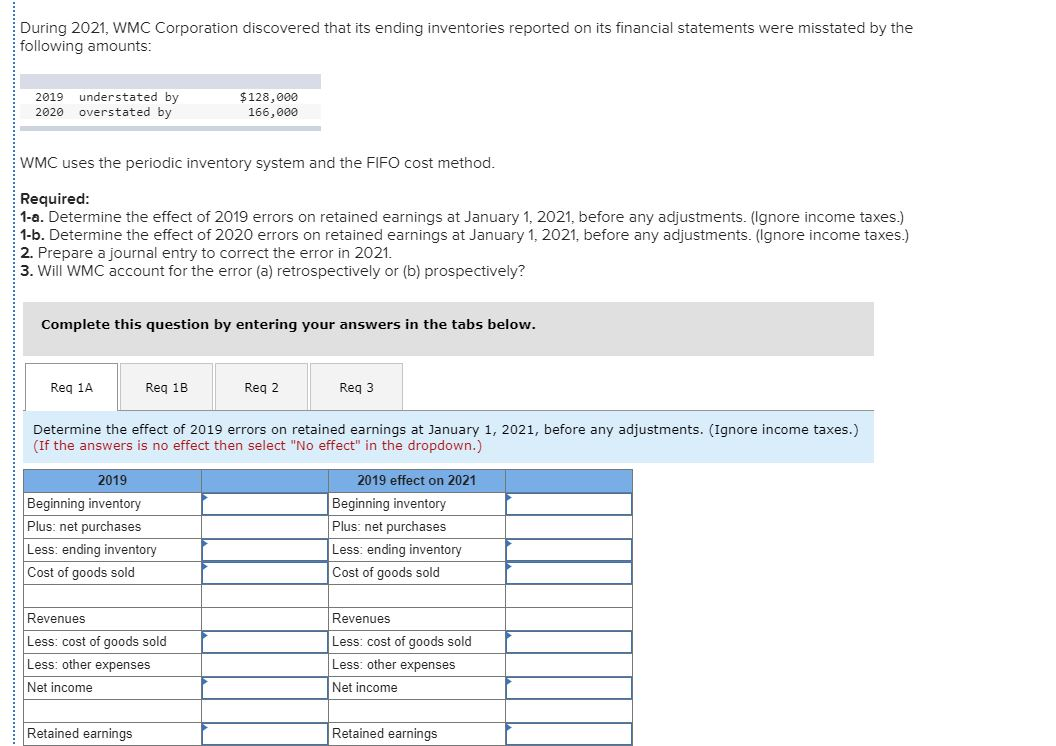

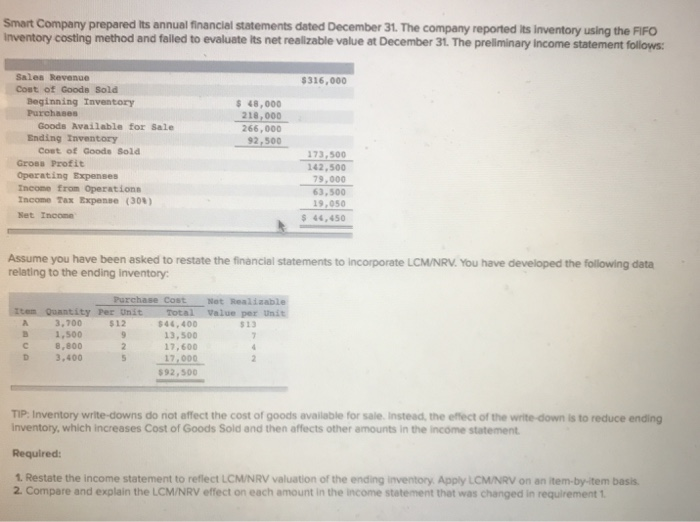

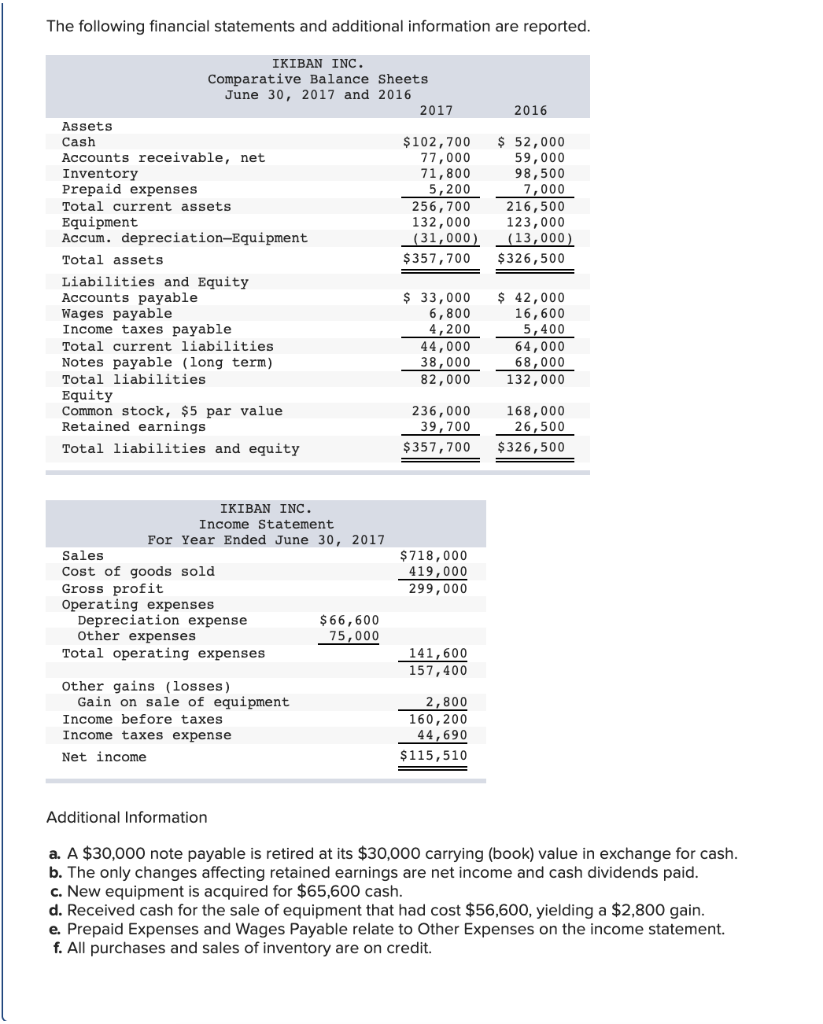

Inventory is reported in the financial statements at. If the ending inventory is overstated, cost of goods sold is understated,. The choice of inventory method affects the financial statements and any financial ratios that are based on them. This ratio compares current assets to current liabilities.

In addition to showing the inventory amount, a business must disclose the. Itreports the annual turnover first, the amount of which is extracted from the salesledger. Should inventories be reported at their cost or at their selling prices?

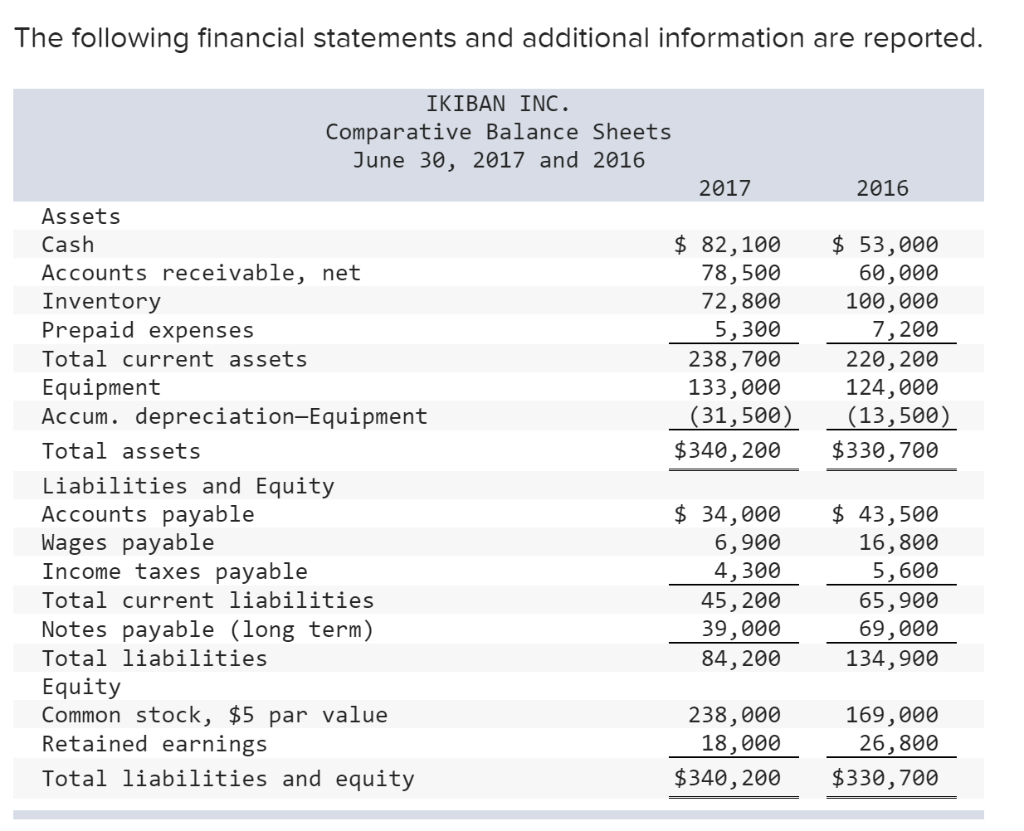

Reporting of inventory on financial statements inventory is an asset and its ending balance is reported in the current asset section of a company's balance sheet. If any general and administrative costs are charged to inventory, state in a note to the financial statements the aggregate amount of the general and administrative costs. In the current assets section the.

Describe how inventories are reported on balance sheets and income statements all businesses that sell a product or goods have inventory. Inventory is reported in the financial statements at: As inventory plays a key role in working capital, it also affects the current ratio.

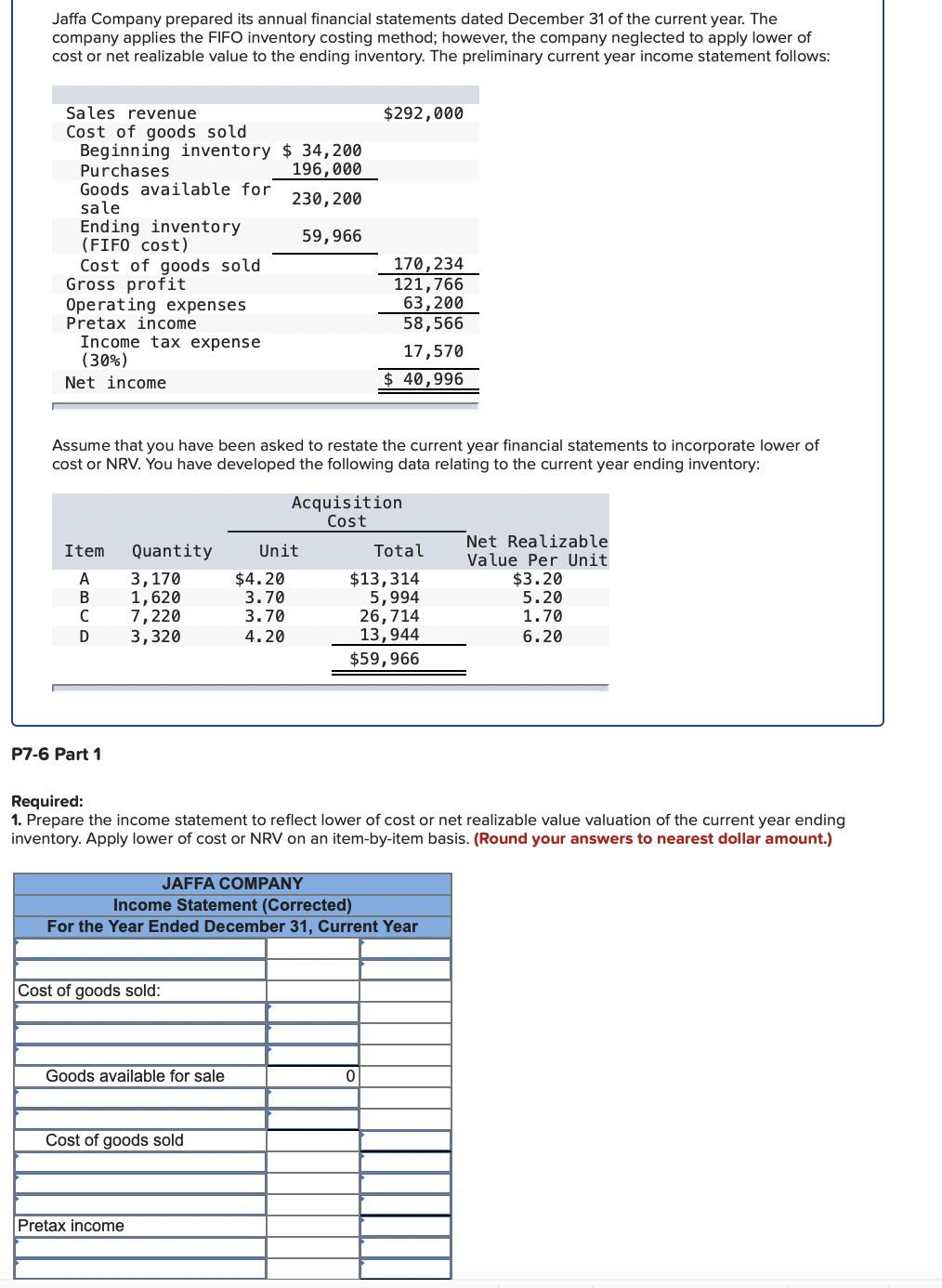

Use net realizable value to estimate the market value of unsold inventory at the end of the. It tells us how well a company. Inventories are required to be stated at the lower of cost and net realisable value (nrv).

Definition of inventory cost inventories are reported at cost, not at selling prices. [ias 2.9] measurement of inventories cost should include all: Inventory is the raw materials,.

A retailer's inventory cost is. When replacement cost for inventory drops below the amount paid, the lower (more conservative) figure is reported on the balance sheet and the related loss is recognized. Inventory is reported as a current asset and is often listed after receivables on a balance sheet.

As a consequence, the analyst must carefully consider. Hence the cost of goods sold is deducted from the. Inventory refers to units of.

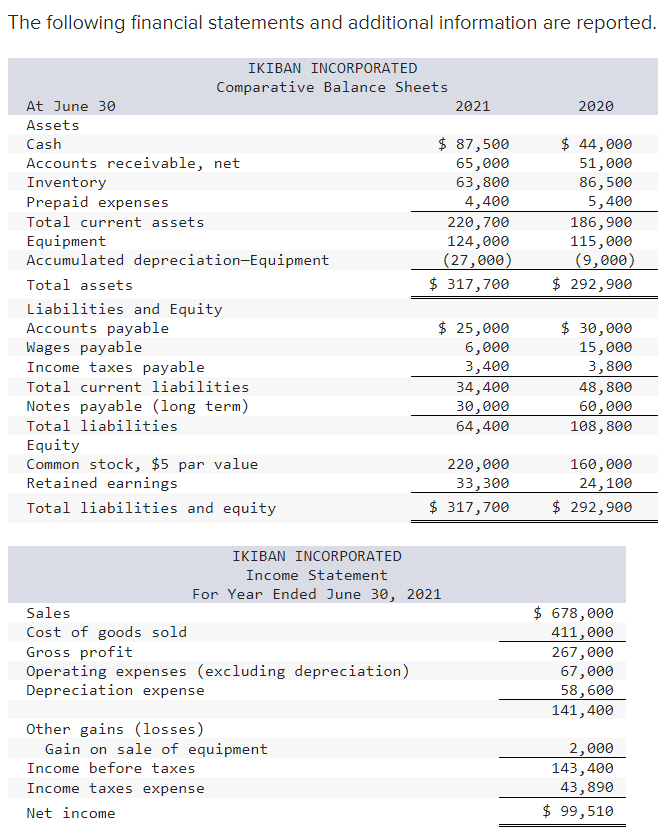

As per ias 01, gross and net profit shall be distinctly reported. Changes in inventories and incorrect inventory balances affect your balance sheet, the financial statement that is a snapshot of your company’s worth based. A manufacturer's inventory will be reported in the current assets section of the balance sheet and in the notes to the financial statements.

The reporting of inventory shrinkage in financial statements involves considerations in the balance sheet, income statement, and statement of cash flows. Newly released federal trade commission data show that consumers reported losing more than $10 billion to fraud in 2023, marking the first time that fraud. Learn the basics of inventory accounting and how to report inventory in your balance sheet and income statement.

![[Solved] Graffiti Advertising, Incorporated, repor SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2023/02/63ecce4a155f1_1676463689443.png)

![[Solved] The following financial statements and additional](https://media.cheggcdn.com/study/4e4/4e4bcb34-d117-4898-9c37-429b2f22b0a0/image)

![[Solved] The following financial statements and ad SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2021/02/60225803e72ed_1612863490510.jpg)