Unbelievable Tips About Simple Cash Flow Example Gst Expenses In Profit And Loss Statement

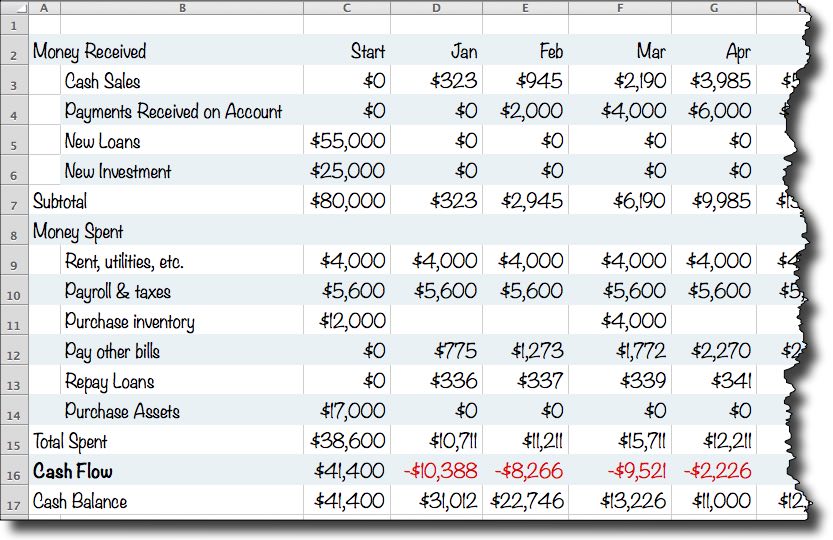

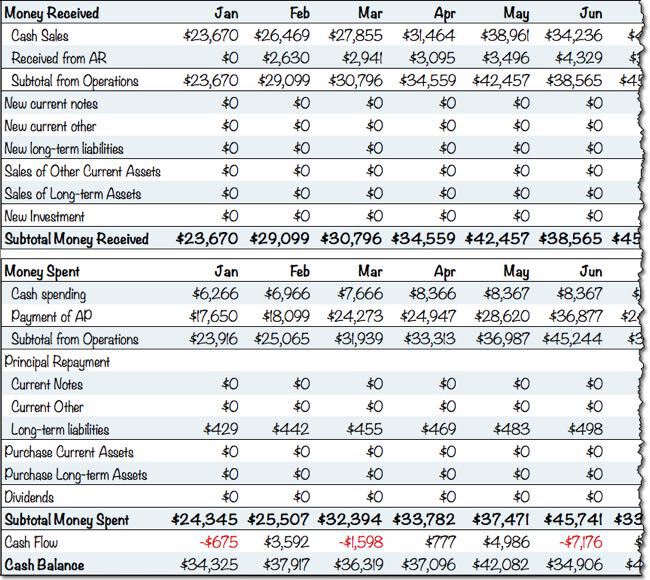

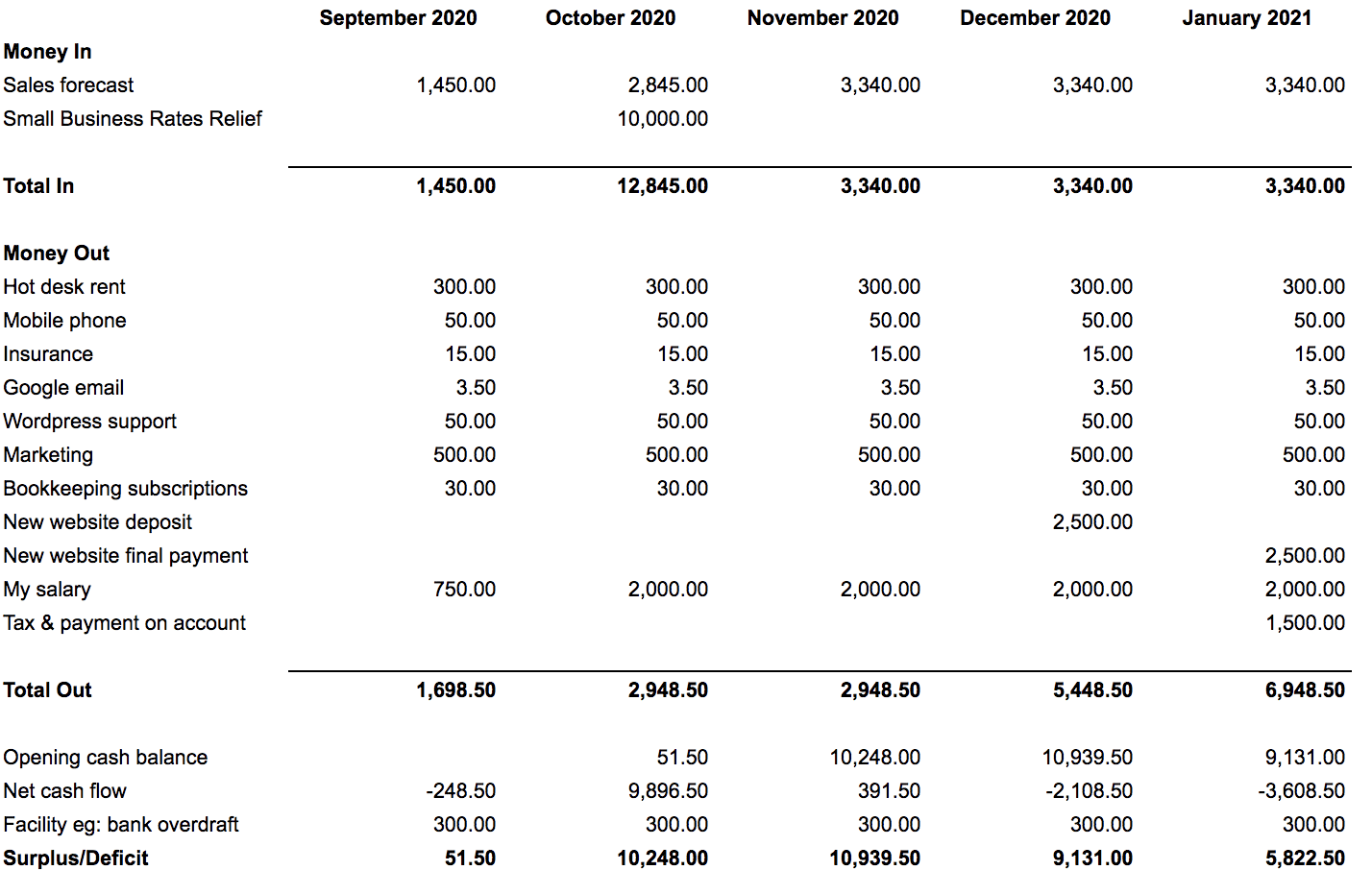

Enter your beginning balance for the first month, start your projection with the actual amount of cash your business will have in your bank account.

Simple cash flow example. Assets = liabilities + equity). Download a statement of cash flows template for microsoft excel® | updated 9/30/2021. For the year ended december 31, 2021 cash flow from operating activities:

Cash flow statement example. Financing cash flow: Learn how to analyze a statement of cash flows in cfi’s financial analysis fundamentals course.

Each company also reported a net income of $225,000 for 2007. Four simple rules to remember as you create your cash flow statement: Transactions that show a decrease in assets result in an increase in cash flow.

It’s essential because it mirrors your financial health and is the lifeblood that sustains your operations. Examples of cash flow include: 24th january 2024 finances a cash flow forecast shows you how much money is coming into your business, where it is being spent and whether you have enough money in the bank to pay your bills (and pay yourself ).

To do this, the cash flow statement combines information from your: Statement of cash flows example. What is a cash flow example?

How to create a simple cash flow forecast (+ template & example) published: Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and financing activities. $30m + $18m = $48m.

A cash flow statement shows how much money you have to spend, and where that money comes from. Statement of cash flows: The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid).

Be sure to test yourself on how to compile a cash flow statement by trying the cash flow statement practice example below as well as the cash flow statement mini quiz at the end of the lesson. Cash flow is the heartbeat of your small business, reflecting the movement of money in and out. Cash flow from investing activities:

In the last video, using the accrual basis for accounting, we had $200 of income in month two. Think of it as the vital fluid that keeps your business’s heart pumping, allowing you to cover expenses, pay employees, and invest in growth. $ 146,000 cash paid for expenses (81,000) cash paid to suppliers (47,500) $ 17,500:

But for year 1, the retained earnings balance is equal to the prior year’s balance plus net income. Transactions that show an increase in assets result in a decrease in cash flow. Example of a simple statement of cash flows:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)