Unique Info About Income Statement Accounts And Balance Sheet Credit Side Of Trial

During the period close process, all temporary accounts are closed to the income summary account, which is.

Income statement accounts and balance sheet accounts. The balance sheet is one of the three core financial statements that are used. The key balance sheet accounts include: Balance sheet, statement of retained earnings, or income statement.

If the company reports profits worth. This includes cash, buildings, land, tools, equipment, vehicles, and. Unless you went to business school—or at least took an accounting or finance course—you’ve probably never given much thought to financial statements such as balance sheets, income statements, or statements of cash flow, right?but now you’ve got some money to invest, you’re looking at a few companies and trying to figure out whether.

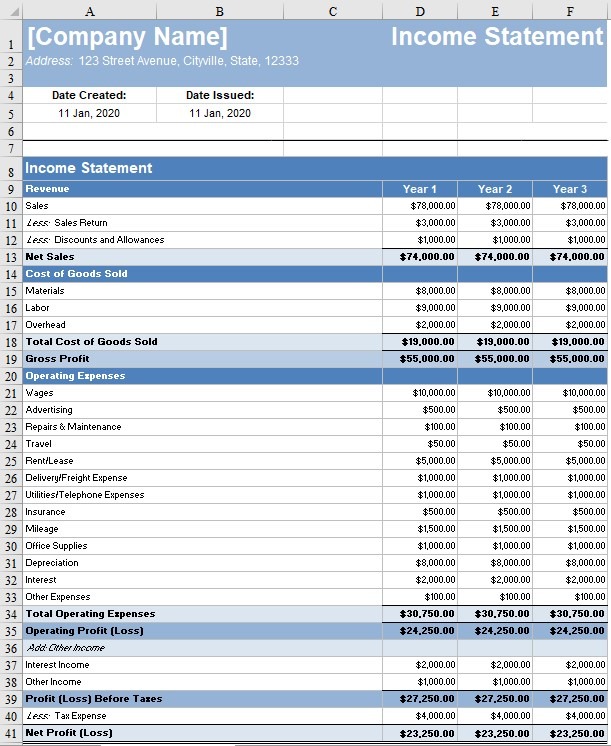

In accounting and bookkeeping there is a separate financial statement known as the income statement that reports the revenues, expenses, gains, and losses that are recorded in income statement accounts. 2.3 prepare an income statement, statement of owner’s equity, and balance sheet highlights one of the key factors for success for those beginning the study of accounting is to understand how the elements of the financial. Income statement accounts are one of two types of general ledger accounts.

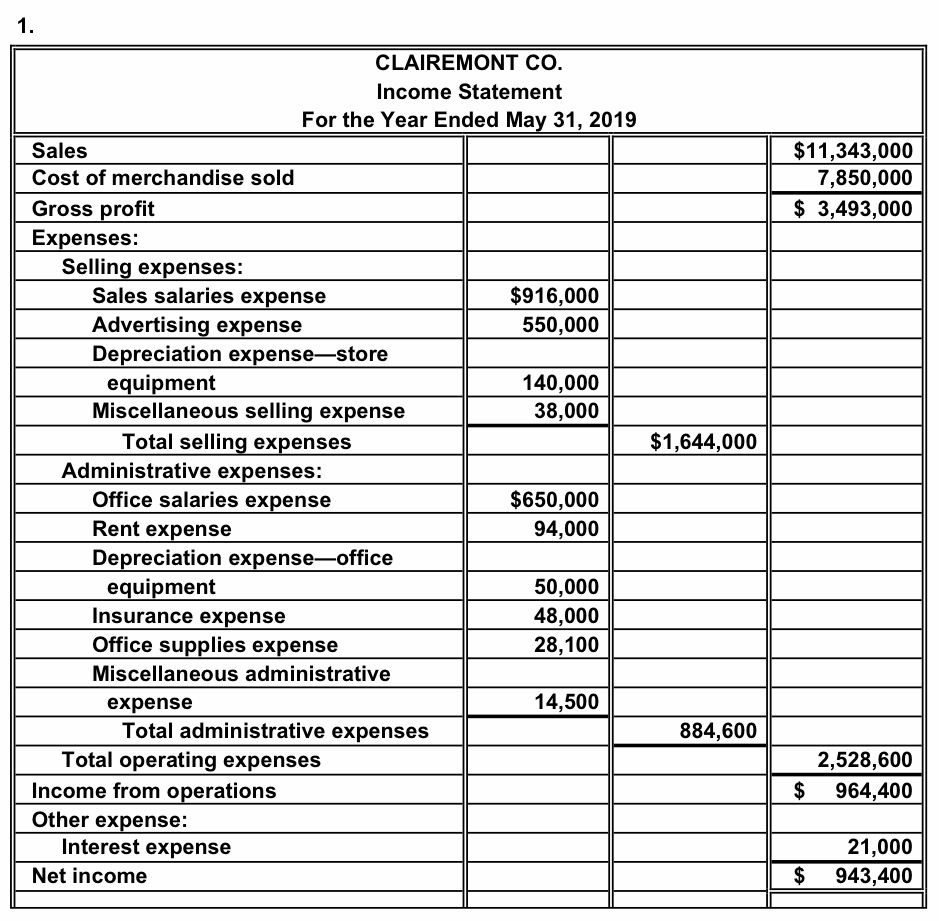

The income statement gives you a summary of all transactions during a particular period of time, usually a month, a quarter, or a year. The core statements used in financial modeling are the same core statements used in accounting. A balance sheet lists assets and liabilities of the organization as of a specific moment in time, i.e.

Definition of income statement accounts. (the other three financial statements report amounts for a period of time such as a year, quarter, month, etc.) Balance sheets and income statements are both financial statements that provide information about the company’s finances, but they are not the same.

Income statement cash flow statement statement of stockholders' equity the balance sheet reports a company's assets, liabilities, and stockholders' equity as of a moment in time. Click below to download a free sample template of each of these important financial statements. When the company earns money and keeps it, it gets added to the balance sheet.

The income statement, the balance sheet, and the cash flow statement. The income statement and balance sheet follow the same accounting cycle, with the balance sheet created right after the income statement. Balance sheet accounts (assets, liabilities, and equity) and income statement accounts (revenue and expenses).

On the other hand, the income statement reports a company’s financial performance and has two primary components: The balance sheet provides a snapshot of a company’s financial position and consists of three main elements: The income statement was first since net income (or loss) is a required figure in preparing the balance sheet.

Prepare the retained earnings column of a statement of stockholders' equity. Everything the business owns in order to operate successfully is considered an asset. Review the following statements and select the ones that are correct regarding sorting accounts from the adjusted trial balance columns of a worksheet to the income statement and balance sheet columns in order to prepare for our last step of completing the worksheet.

Your bank balance is the sum of all the deposits and withdrawals you have made. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. The income statement was first since net income (or loss) is a required figure in preparing the balance sheet.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)