Brilliant Tips About Summarized Income Statement Components Of P&l

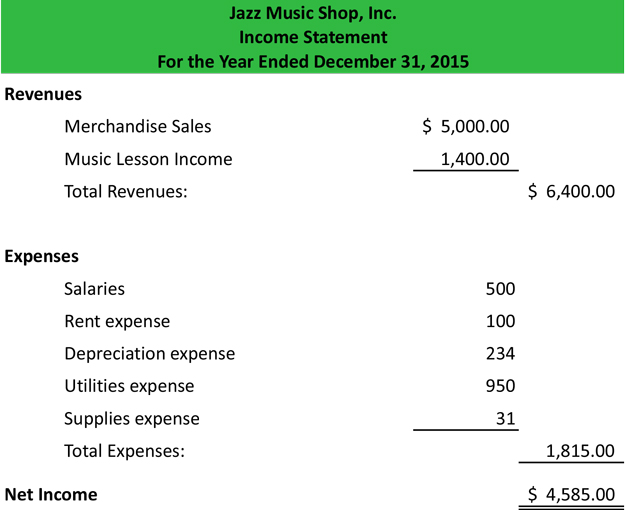

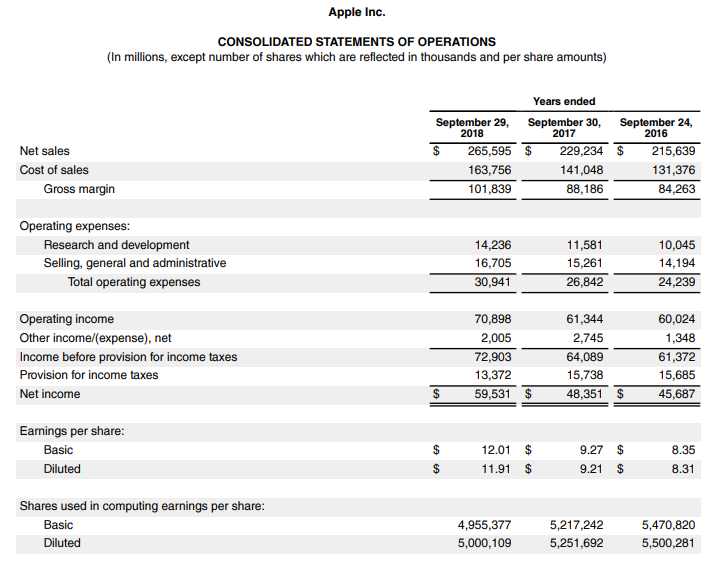

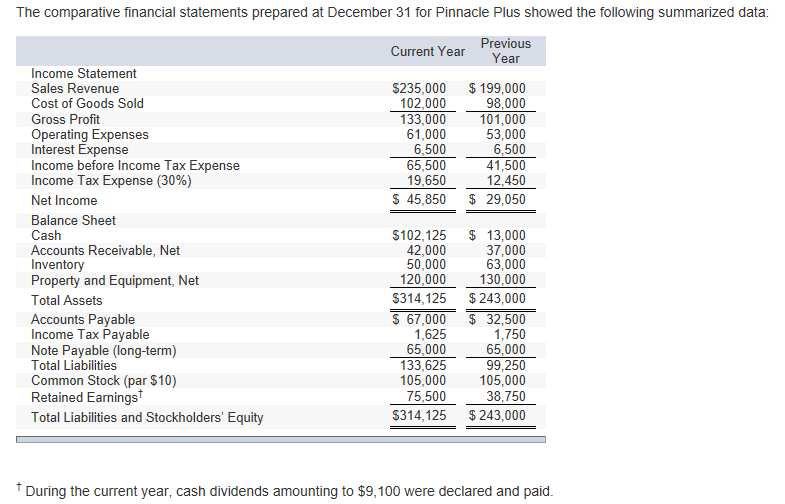

An income statement (also called a profit and loss statement, or p&l) summarizes your financial transactions, then shows you how much you earned and how much you spent for a specific reporting period.

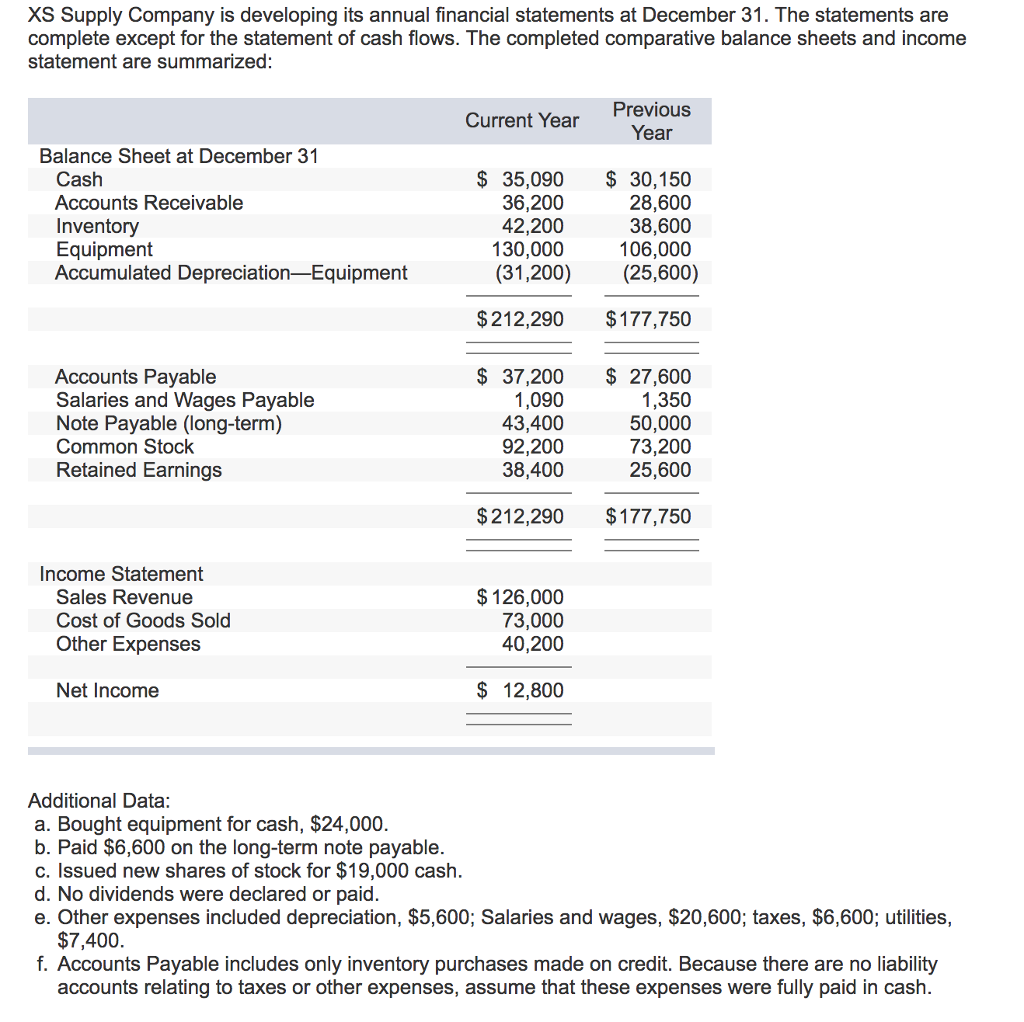

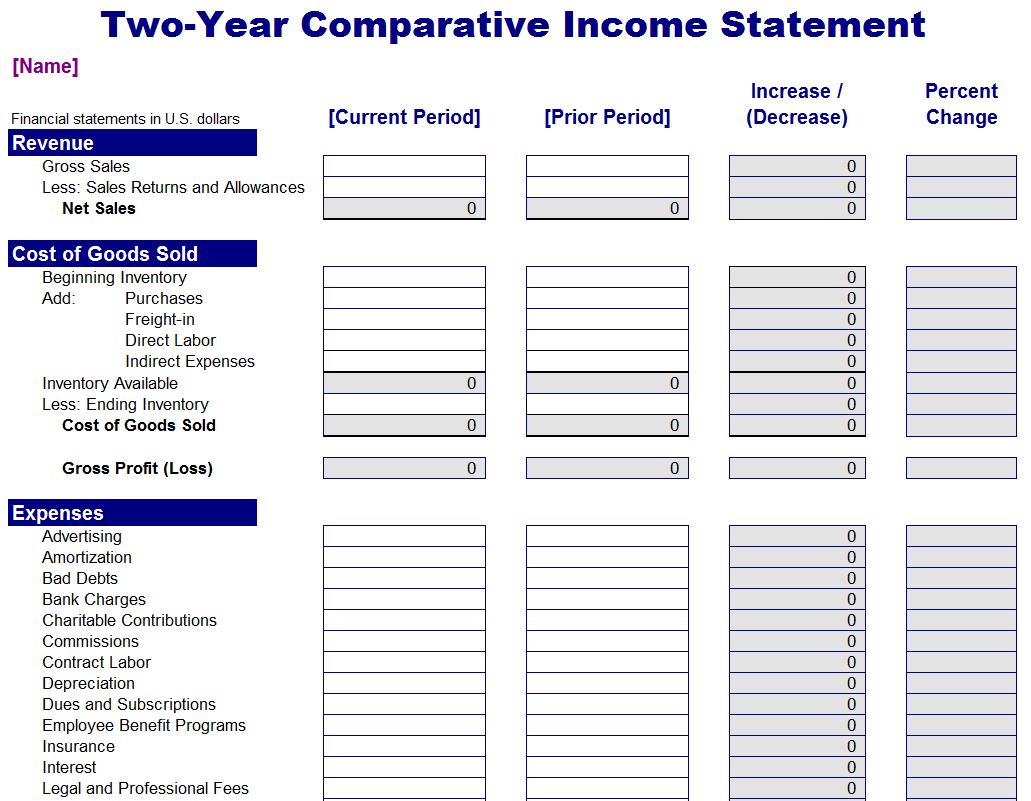

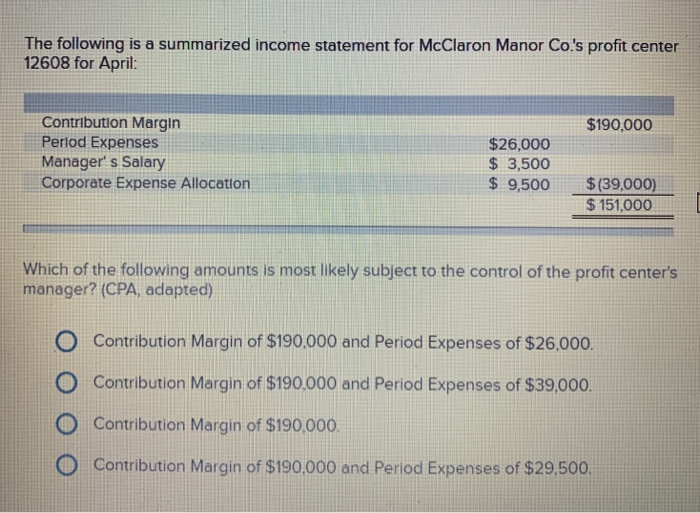

Summarized income statement. Each step down the ladder in an income statement involves the deduction of. Income summary, on the other hand, is for closing records of expenses and revenues for a given accounting period. Most companies prepare monthly income statements for management and quarterly and annual statements for use by investors, creditors, and other outsiders.

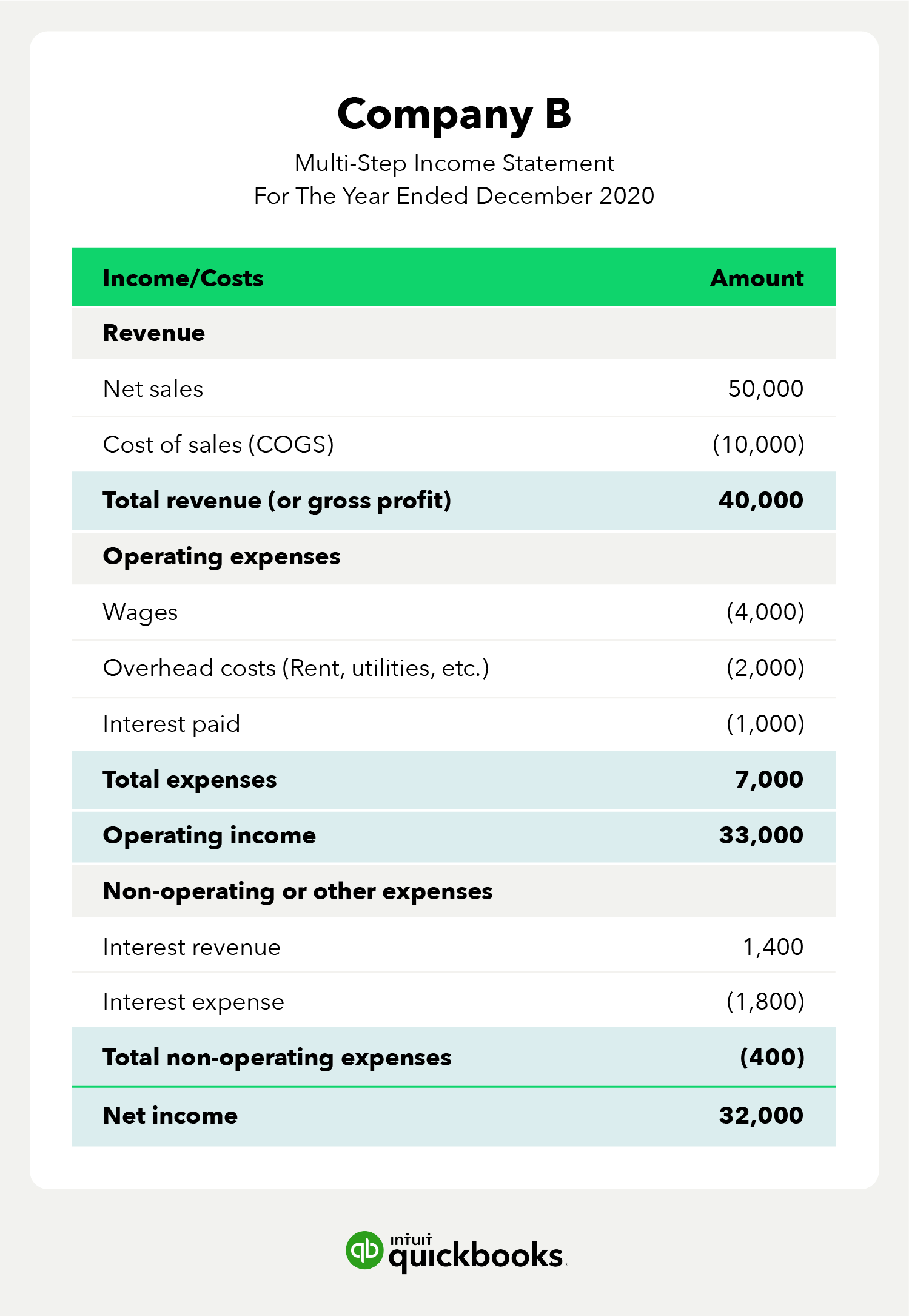

Profit & loss account or income statement; The three main elements of income statement include. The income statement summarizes the firm’s revenues and expenses and shows its total profit or loss over a period of time.

The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Once expenses are subtracted from revenues, the statement produces a company's profit. An income summary is a temporary account that consolidates temporary accounts, indicating profit or loss at the end of an accounting period.

This example financial report is designed for you to read from the top line (sales revenue) and proceed down to the bottom line (net income). An income statement, also known as the trading and p&l account or revenue and expense summary, reveals the performance of your business entity within a specific accounting period. What is the income statement?

This is similar to the outcome of a particular game—the team either won or lost. The income statement reports how the business performed financially each month—the firm earned either net income or net loss. The income statement presents information on the financial results of a company’s business activities over a period of time.

The income statement (also known as a balance sheet, a profit and loss statement, or a statement of revenue and expense), provides information about the financial health of a company and its profitability. In this guide we’ll use annual reports as examples, but you can prepare income statements quarterly or monthly as well. Income summary closes revenue and expense accounts, transferring their balances to a single value, and showcasing financial performance.

An income statement reports a company’s revenue, expenses and profit or loss during a specific accounting period. In the horizontal form of a p&l account, gross profit or gross loss, whatever is determined from the trading account, is transferred accordingly. Sales on credit) or cash vs.

The income statement focuses on four key items: The income statement is one of the most important financial statements because it details a company’s income and expenses over a specific period. When closing the accounts in the income statement, accountants can choose to close them directly.

In the budgeted income statement example above, we can see that the actual profit for the period is about $8,500 less than what was planned for. This document communicates a wealth of information to those reading it—from key executives and stakeholders to investors and employees. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions.

Income statements or profit and loss accounts are financial statements used to calculate the financial health of the company. Income statements are often shared as quarterly and annual reports, showing financial trends and comparisons over time. Income statements are also known as statements of earnings, statements of income, net income statements, profit and loss statements or simply “p&ls,” among other names.

![[Solved] Required information P11 (Algo) Preparing an In](https://media.cheggcdn.com/study/dd5/dd5264e0-1ff5-4634-b685-ba2014524300/image)